Tips to start saving

If you’ve got something you want to save up for – a trip, a car, a wedding or a fancy new TV – put a plan in place to make it happen. Take a look at your spending habits, set some goals and start saving for the future you want.

-

1Tahi

Look at your spending

Before you can start saving, take stock of what money’s coming in and what’s going out. Once you’ve done this, you can create a budget and work out how much spare cash you could be saving. Make sure you're realistic and allow some spending money for fun things, otherwise you might not stick to it.

-

2Rua

Set a deadline

Rather than just aimlessly popping money aside, set yourself a goal and a deadline to reach it. Get an idea of what your goal will cost and work backwards from there, working out how much you can afford to save each pay and how long it'll take to reach your target. Goal Tracker can help you track your progress.

-

3Toru

Make a plan

As the saying goes, it won’t happen overnight, but it will happen. Write down your plan and spell out the steps you'll need to take. For example, if you want to go on holiday, it might be: clear your debt, build up an emergency fund, set a savings goal, go on holiday.

-

4Whā

Pay yourself first

Rather than save what’s left at the end of the month, set your savings aside as soon as you’re paid. Treat your savings as a bill that has to be paid, so you’re not tempted to skip it. Set up a direct debit or automatic payment to divert money to a savings account straight after pay day.

-

5Rima

Every little bit counts

Don’t be put off if you can only afford to save a few dollars a month. Set up a separate savings account, consider one that doesn't allow instant access to your money or no minimum balance required to open an account or earn interest.

-

6Ono

Stay on track

It’s worth reviewing how you’re going every few months. If you’re slipping off the wagon, take a look at why, you might need to take a fresh look at your budget and adjust how much you're spending or saving. It's better to tweak things than give up completely.

Accounts to consider

Tips for financial peace of mind

Building up a financial buffer can stop you from having to dip into debt if life throws you a curve ball. Putting aside money to help you cope with hard times or unexpected expenses is a big step on the road to financial peace of mind.

-

1Tahi

Work out how much you need

Three months’ worth of expenses is considered a good rule of thumb, but the size of your emergency fund will depend on your circumstances.

-

2Rua

Separate your savings

Consider setting up a separate bank account that isn’t linked to your EFTPOS or debit card so it’s harder to dip into. You could also set up a direct debit or automatic payment from your pay into a savings account.

-

3Toru

Don't be daunted

It might sound like a big number, but don’t be put off. You don't need to build up your rainy day fund overnight, you just need to get started. It’s easy to fritter away money on small things that don’t seem like a big deal, but quick daily treats can add up to fairly decent sums of money.

-

4Whā

Define 'emergency'

You need to be clear about what constitutes a financial emergency for you – that way you’ll be less tempted to dip into your emergency savings to pay for a holiday, a new gadget or an outfit. It might be job loss, car repairs, replacing a broken fridge or washing machine or facing a larger than normal power bill.

-

5Rima

Choose the right account

Find a savings account, term deposit or a Managed Fund that suits your needs and circumstances. Online Call gives interest for no minimum balance. Notice Saver doesn’t give you instant access to your money – removing easy access and temptation to spend.

-

6Ono

Consider insurance

The kind of insurances you have will also impact how much you need in a rainy-day account. Take a look at our insurance cover options if you don't already have it. If you're already insured, review your policies to make sure they're still enough for your circumstances.

Accounts to consider

Tips to get you on the road (or in the air)

Whether you’re heading off on a holiday of a lifetime, or you’re chasing some winter sun, you need to budget for your trip and plan how you’re going to pay for things while you’re away.

-

1Tahi

Start saving

A concrete goal, like a trip and a deadline of when you want to go can be great motivation when it comes to saving. Once you know how much a trip is likely to cost and when you want to go, set up Goal Tracker to help you visualise your progress.

-

2Rua

Get your budget right

Whether you’re backpacking or going five-star, it could add up to more than you expect, so make sure you’re being realistic about how much things will cost. Work out a budget, make sure you include as many costs as you can think of – flights, insurance, accommodation, food, drinks, entertainment, public transport, shopping, or taxis.

-

3Toru

Choose the right accounts

If your trip is coming up soon, then instant access to your money might be most important to you, so take a look at our Online Call account. If you don’t need to withdraw your money instantly, Notice Saver or a Term Deposit might work for you. Compare our savings accounts.

-

4Whā

Let us know your plans

It’s important that we know when and where you’ll be travelling, so we can keep an eye on your cards and accounts. If we don’t know you’re overseas, we might think your card has been stolen and block it when international transactions start showing up.

-

5Rima

Before you go

Stay safe and check out travel advisories for the countries you’re travelling to. Make sure you have the right travel insurance for your trip. If you have a Platinum Visa or Air New Zealand Airpoints™ Platinum Visa credit card, you may be eligible for built-in travel insurance.

-

6Ono

Manage your money from afar

Manage your accounts while you're away with internet banking or our mobile app. Keep an eye on your balances and transactions, transfer money if you need to and make sure that any payments you've set up have gone through.

Accounts to consider

Laying the groundwork for your kids

It can be tough watching your children struggle with steep student loans or battle to get a big enough house deposit. See what you can do to give your kids a financial head start.

Make sure you’re secure

The first thing you need to do is make sure that helping out your kids isn’t going to leave you in a financial lurch. Get independent financial advice before you commit to any major decisions and always make sure you understand what you’re signing up for and the potential consequences.

For example, guaranteeing a loan means that you'll be responsible for repayments if your children default on their payments. You might think ‘my child would never do that’ but it does happen – life has a habit of throwing curve balls, whether it’s job loss, illness or just bad luck, so make sure you consider how you’d cope with worst-case scenarios.

Teach them young

If your children are still young, then lay the groundwork while they’re still little and think you’re the fountain of all knowledge. Talk about money when you’re shopping or paying the bills and encourage them to save for stuff they want.

Most of all, set a good example. Your children will listen to what you’re saying, but they also watch what you’re doing. You could tell them all the right things they should be doing, but undo all that good work if you’re not being careful with your own money. Our Online Call account can help children save with no transaction fees and good returns.

Save for the future

If you’ve got young children and are able to put aside money for them, then look at setting up savings accounts, term deposits or even a KiwiSaver account in their name. If your child has access to savings accounts or term deposits and you want control over what happens to the money, you could set up a two to sign authorisation on every account withdrawal made. This means you'll need to approve any withdrawal from the account. Alternatively you can open these accounts in your name. For more information about setting up savings accounts for your child, get in touch or visit your nearest branch.

Term Deposits could be a good option, with options to lock in competitive interest rates anywhere from 30 days to five years. Notice Saver is another possibility, if you’re after competitive interest rates and don’t need immediate access to your money. Read more about savings accounts and term deposits.

Start investing

Managed Funds could also be worth looking at, and they’re not nearly as daunting as you might think. With Fisher Funds Managed Funds, you can make regular investments in addition to, or instead of, a lump sum payment. The minimum regular investment is $100 per month.

With Fisher Funds you can open an account on behalf of your child, in their name, in which case once they turn 18, they’ll have authority over the account and can make withdrawals when they like. Or you can open an account in your name, in which case you’ll always be in charge of what happens to the money. Find out more at fisherfunds.co.nz.

Living at home

To help your children transition into adulthood, you could encourage them to stay at home while they're studying or saving for a house. You could have a chat with them about what it may be like flatting and the expenses they may face.

You can also help them choose the best bank accounts for their age and stage.

Onto the property ladder

If you want to help your children into their first home, there are a few ways you could go about it. You might set up a KiwiSaver account for your child, which they could access for their deposit. You could also gift or lend them a deposit (or part of a deposit), guarantee their loan, or, if you have an investment property, you could use some of the equity you’ve built up in that property.

If you do want to help them out, talk to one of our home loan specialists about your options. It’s also important that you get independent advice, so you know exactly what you’re getting into and whether it’s the right option for you.

Accounts to consider

Create a financially comfortable retirement

New Zealand has a universal retirement pension that's paid to eligible Kiwis when they reach 65. While the pension provides a safety net, if you’re wanting a few creature comforts in your dotage, then you’ll have to save up a nest egg to supplement these payments.

How much you'll need

The amount of money you need to save to be comfortable in retirement will vary from person to person – what lifestyle you want, where you live, if you rent or own your home and if you’re single or coupled up. Although there’s no set magic number to work towards, there are ballpark figures out there to give you an idea.

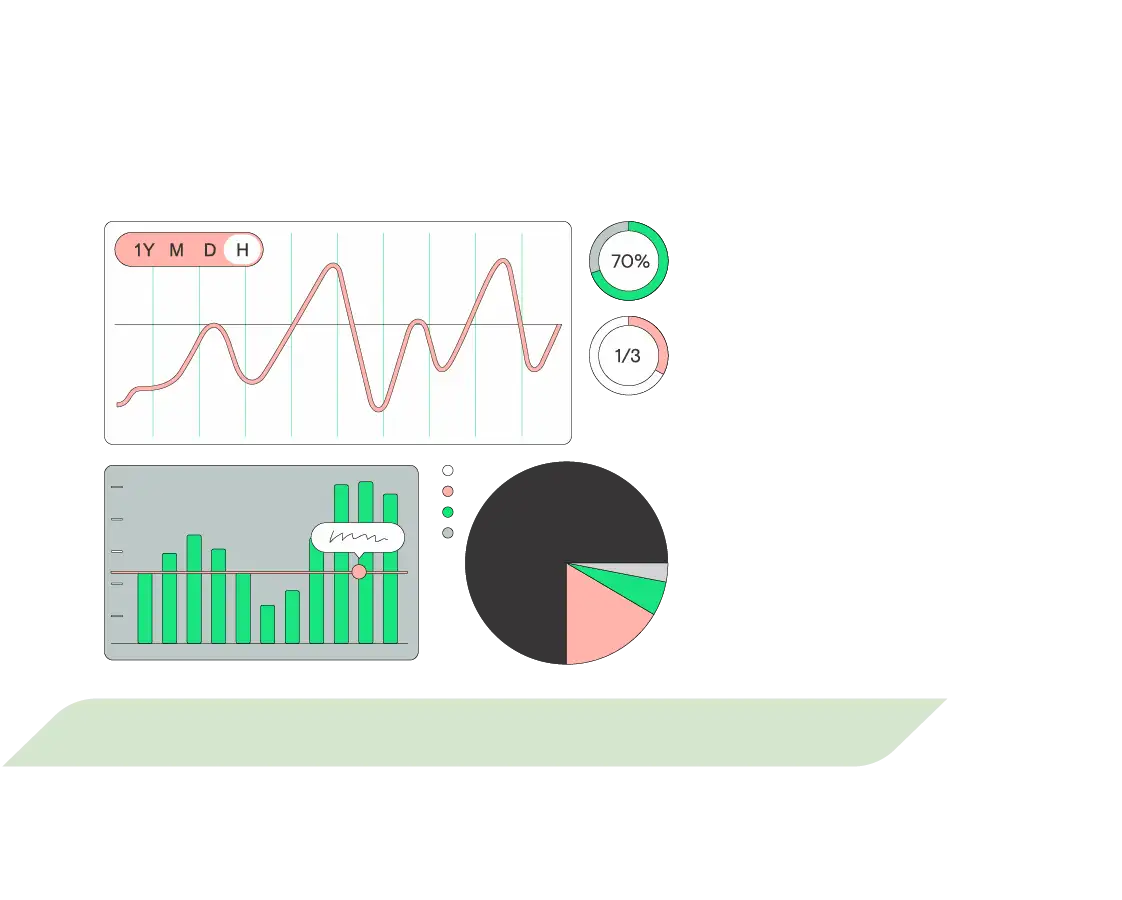

Understanding KiwiSaver

One way to help build up healthy retirement savings is KiwiSaver, a voluntary, work-based savings initiative. With KiwiSaver, your money is usually locked in until you turn 65, the idea is that you won’t be tempted to dip into it for things other than retirement.

Term Deposits

If you don’t want to have all of your money locked in until you’re 65, you can also save and invest outside of KiwiSaver. If you like the idea of a steady, reliable way to grow your savings, then consider Term Deposits. You can enjoy a fixed return on terms ranging from 30 days to five years. Your money is locked in for a set amount of time and your interest rate is fixed for that period.

Managed Funds

Investing isn’t just for the wealthy. With a managed fund your investment is diversified across different assets, such as cash, fixed interest and international shares, depending on the fund. There is no fixed rate of return, you can choose how long you invest for and can access your investment when you need to without penalties. Start investing with as little as $2,000 or $100 per month.

Get insured

Even if you’re on track with your savings and investments, your retirement plans could be thrown off track if something unexpected happens – like an accident, job loss, or serious illness. Make sure you have insurance in place to financially protect yourself, your loved ones and your future if life doesn’t go to plan.

Get rid of debt

Another important step towards a financially comfortable retirement, is paying down debt before you give up work. If you own your house, then aim to be mortgage-free by the time you retire.

Accounts to consider

Open & manage an investment

Whether you’re a seasoned pro, or a new investor, we’ve got savings accounts, term deposits and investment options to suit your financial goals.

Planning for future wealth podcast

Simran Kaur, Founder of Girls that Invest, is on a journey to empower women globally with financial literacy. Get a glimpse into the motivation, mindset and resilience of this remarkable wahine and learn from her wisdom and experience to help improve your own financial health. Listen to her full story on Spotify or Apple Podcasts.

Modal to play video

Tune into our award-winning This is Kiwi podcast series where real Kiwi provide insights and actionable learnings from their life journey and experiences with money to help make Kiwi better off. This is knowledge for better.

Important information

This page provides general information and isn't intended as regulated financial advice. To review your specific situation and financial requirements please talk to one of our Kiwibank Representatives or your Financial Adviser.

Interest rates and rates of return are subject to change.

Kiwibank investments

Kiwibank PIE Online Call Fund, Kiwibank PIE Term Deposit Fund and Kiwibank Notice Saver are funds within a Portfolio Investment Entity (PIE). Units in Kiwibank PIE Online Call Fund, Kiwibank PIE Term Deposit Fund and Kiwibank Notice Saver are distributed by Kiwibank Limited and are issued by Kiwibank Investment Management Limited. Download Kiwibank investment terms and conditions or pick up copies from your nearest Kiwibank.

Fisher Funds KiwiSaver Plan

Fisher Funds Management Limited is the issuer and manager of the Fisher Funds KiwiSaver Plan (Plan). Download the Product Disclosure Statement for the Plan by visiting fisherfunds.co.nz.

Kiwibank Limited (Kiwibank) refers Kiwi to the Plan for fulfilment of their wealth needs. Kiwibank may receive a payment from Fisher Funds if you join the Plan.

Investment in the Plan does not represent a bank deposit or other liability of Kiwibank. Investment in the Plan is subject to investment risk including possible decrease in value as the value of the investment can go up and down. No person, including the Crown or Kiwibank, guarantees the repayment of investments in the Plan or the payment of any returns on investment in the Plan.

Fisher Funds Managed Funds

Fisher Funds Management Limited is the issuer and manager of the Fisher Funds Managed Funds (Funds). Download the product disclosure statement for the Funds by visiting fisherfunds.co.nz.

Kiwibank Limited (Kiwibank) refers Kiwi to the Funds for fulfilment of their wealth needs. Kiwibank may receive a payment from a Fisher Funds group entity if you join the Funds. Investment in the Funds does not represent a bank deposit or other liability of Kiwibank.

Investment in the Funds is subject to investment risk including possible decrease in value as the value of investments can go up and down. No person, including Kiwibank, guarantees the repayment of investments in the Funds or the payment of any returns on investment in the Funds.