Scams are getting more sophisticated — but so are we

To meet new scam protection commitments under the Code of Banking Practice, we’re adding extra protection to your digital payments. This is to help you – and us - spot scams before money leaves your account. These commitments are applicable to all New Zealand banks from 30 November 2025.

How it works

Here’s what’s changing, and how these checks can help you keep your payments safer.

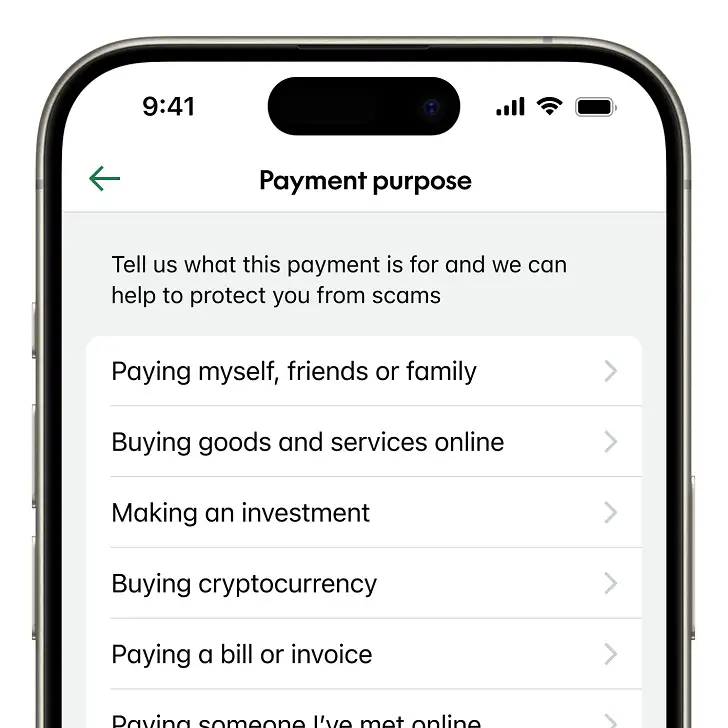

Tell us why you're making the payment

You may be asked what the payment is for, for example paying a friend or a bill.

This helps us show you scam protection tips based on your payment purpose.

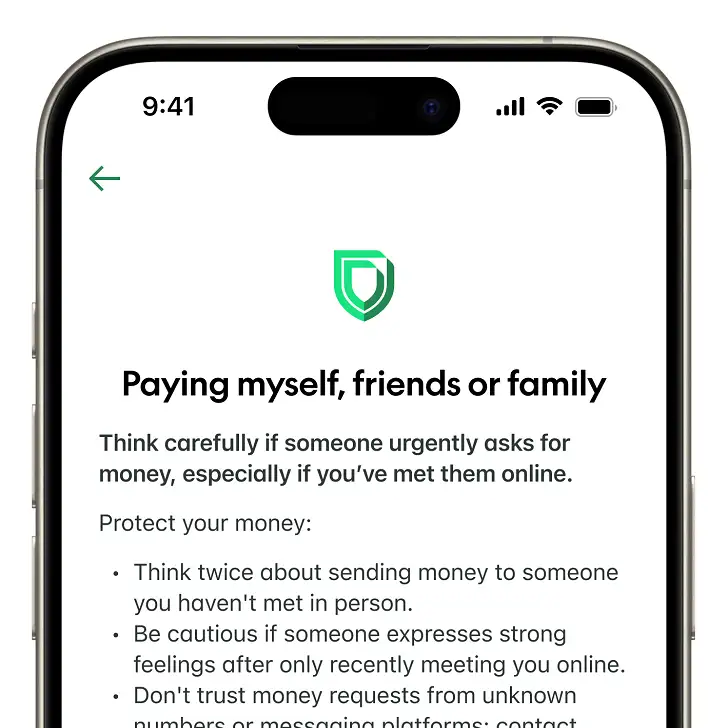

Get scam protection tips

We’ll show you messages and tips to help you decide whether you want to continue with your payment.

If you’re unsure, pause and reach out — we’re here to help.

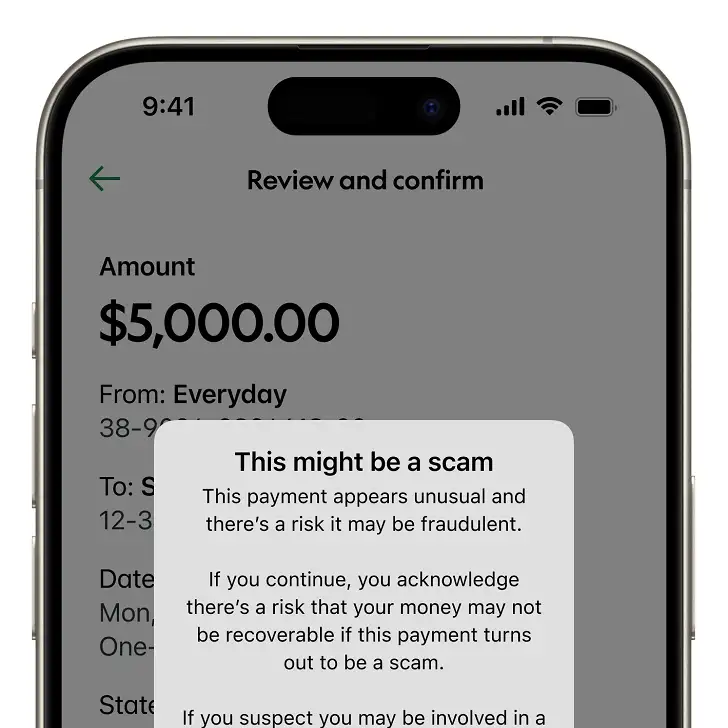

We'll flag potential fraud risks

If we detect something unusual about the payment, we'll let you know there may be a fraud risk. You'll have the option to continue or cancel the payment.

In some cases, we may decline the payment to protect you.

Safer payment checks, however you bank

You'll see these checks mainly when you pay someone online, but you might also be asked to provide a payment purpose when making a payment in a branch, or through our contact centre.

Some payments stay the same

You won't see these extra steps when you're making:

- regular bill payments to registered companies like Spark, Mercury, or IRD

- transfers between your own Kiwibank accounts.

Common questions

No, there isn't an option to opt out. We’re adding extra protection to your digital payments to meet new scam protection commitments under the Code of Banking Practice. These commitments are applicable to all New Zealand banks from 30 November 2025.

We’ll sometimes ask for the purpose of your payment so we can give you scam protection tips. Scams are clever — this step gives you a moment to pause and make sure everything looks right.

It’s a simple step that can make a big difference because money sent to a scammer might not be recoverable. Taking a moment helps prevent fraud before it happens.

The fraud risk message is there to help you pause and think before proceeding with your payment — especially if something doesn’t feel quite right.

You'll have the option to continue or cancel the payment. If you continue and the payment is a scam, the money you send may not be recoverable.

These checks are part of how we help you protect your payments and reduce the chance of fraud.

If in doubt, pause & reach out

Scams are getting harder to spot, if something doesn't feel right or you're unsure, here's what to do:

-

Pause & slow down

Take a moment — don't rush a payment or respond to pressure. Slowing down gives you time to think more clearly and decide whether to continue.

-

24/7 support is available

We're here to help if something seems unusual. Call our fraud and scam support team anytime on 0800 113 355 or +64 4 473 1133 from overseas.

Stay alert about scams

We’re here to help you bank with confidence. Learn more about how we keep your banking secure, and how to spot scams on our fraud and scams hub.