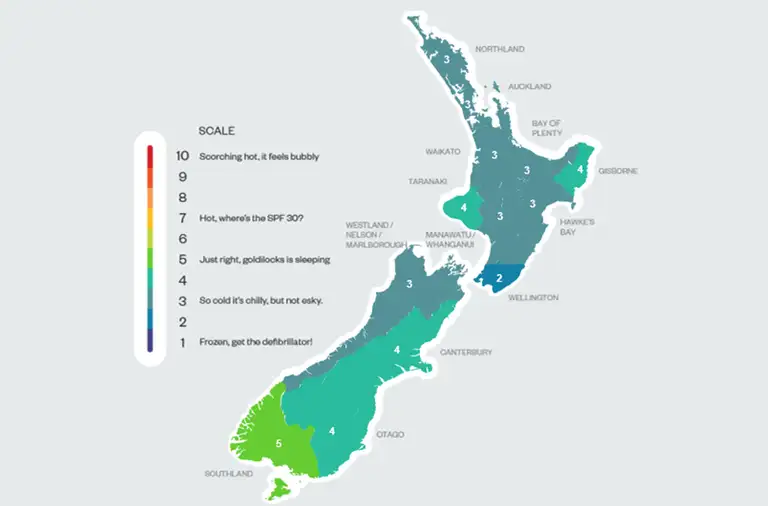

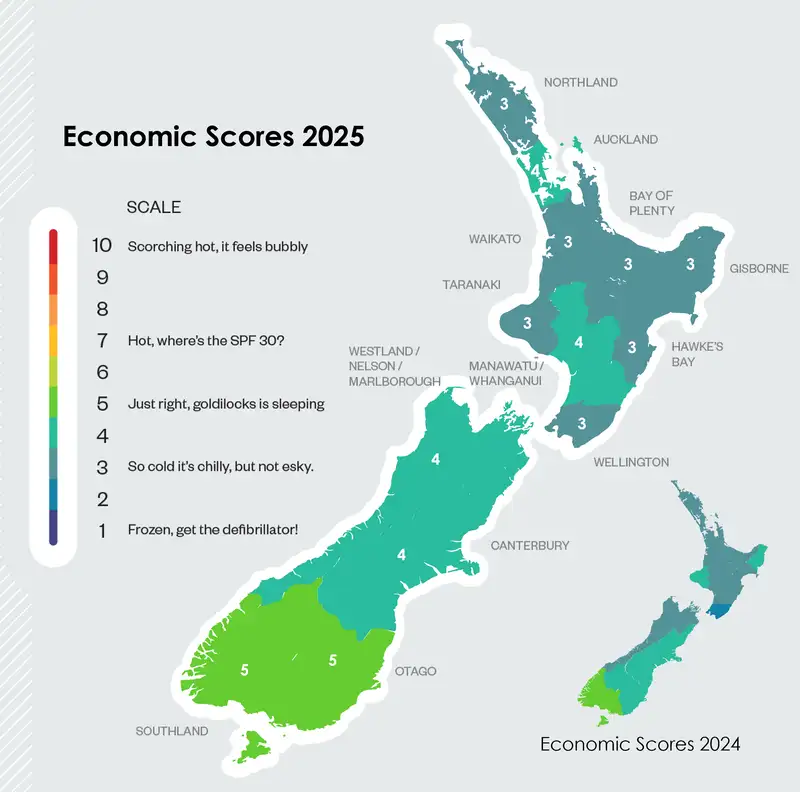

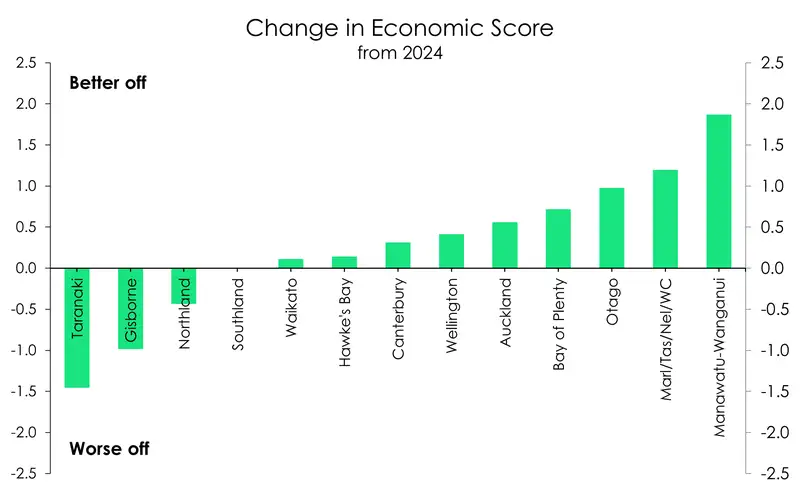

- Economic activity has improved across most of the motu. The average score lifted from a 3 out of 10 to 4. But at the regional level, there was movement in all directions. Most improved, some went backwards, while Southland stayed strong.

- The South Island continues to outperform the North. Otago joins Southland as the top two performing regions, with activity boosted by a bounce back in tourism. Auckland’s activity is still weak, despite strong population growth. For different reasons, economic scores for Northland, Gisborne and Taranaki deteriorated. Meanwhile, Wellington is thawing from its Jack Frost score of just 2 last year.

- Interest rates have fallen a long way, and sentiment has improved. The economic recovery has begun. Better times are ahead. But a highly uncertain and potentially disruptive global backdrop is an added challenge. Spring is coming, and regions should continue defrosting. But we might have to wait until summer for the economy to heat up.

The further south you go the better the business climate seems…Troy Sutherland, General Manager.

That pretty much sums up our latest look into the regions.

On average, economic scores continued to defrost across the motu. Our regional heatmap is still flashing 3s out of 10, with an encouraging share recording 4s, but now two regions share the top spot with a 5 out 10. Most regions are performing better than last year, although far from their best. And the economic scores for three regions actually deteriorated. Without a doubt, it’s still tough for many to navigate the tumultuous economic environment. And there’s now an added challenge of a tariff-induced slowdown in global growth. The good news is that interest rates have fallen a long way from this time last year. There’s a Nazaré-type wave of mortgage refixing due. The move onto lower rates should help improve household disposable incomes, boosting consumption, supporting the housing market and wider business activity. But we may have to wait until summer for things to heat up.

The South Island continues to outperform the North. The average economic score in the South lifted from 4.0 to 4.6. Southland retains its top score of 5 out of 10. A building boom continues to support construction and housing activity in the region. This year, however, Southland shares the podium with Otago, as the region also recorded a 5 out of 10. Otago’s 1pt increase from last year is in large part due to the recovery in tourism. Our friends from across the ditch are lacing up their boots and hitting the ski fields. The few Americans that have a map beyond the USA are exploring the edge of the Earth. And Chinese visitor arrivals are finally recovering. As a tourist mecca, the recovery is supporting regional employment. As employment growth across most of the country has gone backwards, Otago recorded a massive 8% increase. Canterbury’s score improved 0.3pts, and remains at 4 out of 10. The post-earthquake rebuild continues to underpin activity. The housing market also continues to outperform the country. House prices are up 1.5% from last year, compared to the national average of a 0.3% decline. And when we visit the Southern regions, our clients are simply more upbeat, more active, and more fun.

Strong commodity prices and a relatively weak Kiwi dollar are also boosting rural incomes. Although, farmers don’t appear to be in a spending mood just yet. Growth in retail sales in Christchurch is tracking closely to the national average of 1.5%. Like many other households and businesses, crawling out of a recession means rebuilding equity. That’s step 1. Once balance sheets are in better shape, there’s reason to spend. And once demand in the economy strengthens, there’s reason to invest. We’re not quite there yet.

As we make our way North, we may be moving further away from the Antarctic, but our regional heatmap is cooling. The average economic score for the North Island sits at 3 out of 10. Naturally, the average hides movement at the regional level. The Manawatū-Wanganui region can be crowned Most Improved with its score rising almost 2 points off the back of strong employment growth. But just next door, in Taranaki, it’s the complete opposite story. It's somewhat surprising given the region’s economy is largely centred around dairy farming and agricultural manufacturing. But Taranaki recorded the deepest decline in employment across all regions, down 8%. Gisborne dropped to a 3 out of 10, as the only region to record no growth in house sales in the three months to May compared to a year ago. Activity within Northland remains soft, as new dwelling consents posted double digit declines. Northland may be known as the “Winterless North”. But it’s economic score suggests a chilly climate of 2.6 out of 10.

In some good news, the economic scores for our major Northern cities both improved. Auckland is now a 4 out of 10, and still recording the strongest population growth. Meanwhile, Wellington sits at a 3 out of 10, up from its Jack Frost score of 2 last year. Employment is still down in Wellington, but better than last year. And retail sales showed modest growth in the March quarter. The unrounded economic score, however, reveals a still-icy 2.7 as house prices declined the most in the Capital.

Given the mixed movement in economic scores across the North Island regions, the average score for Te Ikaroa (North Island) barely budged – lifting from 3.1 to 3.2.

Patchy progress for property

…Regionally, our southern mobile mortgage managers have shown remarkable consistency and resilience during the last few years. Compared with northern areas, the southern market has weathered the slowdown more evenly than others.Shayne Hawtin, Mobile Mortgage Manager - Southern.

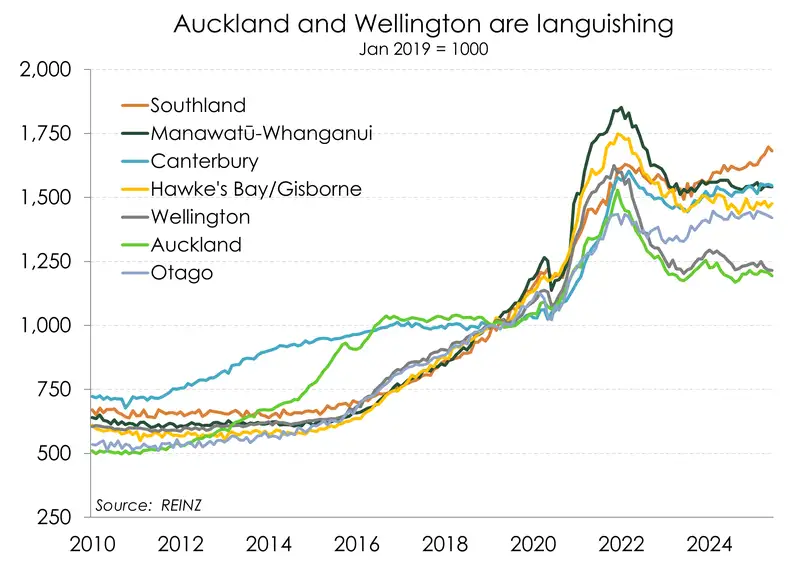

Across the country, the housing market has remained largely locked in lateral moves. Since stabilising in early 2023, national house prices are up just 1.8%. And since the RBNZ’s cutting cycle commenced in August, house prices have lifted by just half a percent. That’s not a market in recovery. It’s a market that is failing to find its footing.

Regions, particularly those in the South, who had shallower price corrections over the 2022-2023 downturn, continue to fair better than those who suffered the deepest declines.

House prices in the two capitals, Auckland and Wellington, suffered the deepest decline during the downturn, with price falls of about 23% and 25% respectively. And today, even with 225bps of rate cuts, prices in Auckland have recovered just 1%. While in Wellington, have recovered by just half a percent.

In contrast, regions like Southland, Otago, and Canterbury, that recorded materially shallower declines, (between 7- 10%), are either above or close to their post Covid highs. House prices in Canterbury remain 4.1% below their early 2022 peak. But have recovered 6.5% from their 10% correction. And in Otago, house prices have hovered around their peak levels over the past couple of years. While prices in Southland are actually up 1% on their post-covid surge.

Still, for an economy that has seen interest rates fall fast, we’d expect more. But heightened job insecurity from a labour market still bleeding out, a surge in housing stock, the continued absence of investors, and rapidly declining net migration are all weighing heavily on the housing market’s recovery. Many of these pressures are themselves by-products of an economy that still needs stimulus.

Across the country, we’ve seen a flood of new listings, anecdote after anecdote of increased enquiries, and a marked increase in sales. All regions, except Gisborne, recorded an increase in sales in the year to May. The strongest growth was seen in Tasman, with sales up over 30% in the three months to May 2025 compared to the same period last year. Followed closely by Manawatū, Northland, and Southland, each posting sales growth of around 23%.

Activity in Gisborne was delayed, but appears to have turned a corner in June. The region ended Q2 on a strong note, with sales up 13.7% on the year to June.

So, activity in the housing market has improved. But prices are yet to follow. Rate cuts to date have not kicked in. Rate cuts to date have not enticed investors. Rate cuts to date are not enough.

We are still seeing slow and measured growth across the housing market, but there are early signs of momentum starting to build-particularly among investors. While enquiry from investors has picked up, it has yet to translate into transactions. That said, the landscape is shifting in a way that suggests investor activity may return when interest rate reduce and there is more certainty around employment ...Shayne Hawtin, Mobile Mortgage Manager - Southern.

"...One consequence of renewed investor activity could be increased competition, particularly affecting first home buyers. To date, first home buyers and movers have been a stabilising force in the slower market, keeping transaction volumes ticking over despite broader headwinds. Their steady presence has been an important part of keeping the wheels turning…"

Getting investors off the sidelines is key to the housing market recovery. The ‘promised’ reintroduction of interest deductibility, shortening the Brightline test, and watering down the CCCFA, have certainly helped calm investors. But alongside building equity in portfolios, rates have not been low enough to entice investors back in. And its investors that will reignite the housing market.

An improvement in rental yields should continue to help draw investors off the sidelines. Nationally, yields have been gradually trending higher since hitting a low of 2.7% in late 2021. According to data from Cotality, the national rental yield now sits at 3.8%, up from 3.2% last year. And that’s despite the rapid cooling in rents.

Rental properties in Dunedin and Christchurch continue to offer the highest rental yields, at 4.3% and 4.1% respectively. Auckland continues to sit at the lower end of the spectrum at just 3.1%. But that’s up from 2.6% last year. Meanwhile, Wellington sits at a more mid-range 3.7%.

So yes, yields are still rising. That’s good news for investors. But depending on location, rental returns are still likely to be lower than the average term deposit rate.

Beyond demand, the most important factor influencing house prices, and affordability, is supply. Right now, there may be an oversupply of stock, driven by the subdued market, and well below-average net migration. But as soon as any of those taps are turned back on, our underlying shortage of affordable housing will become clearer.

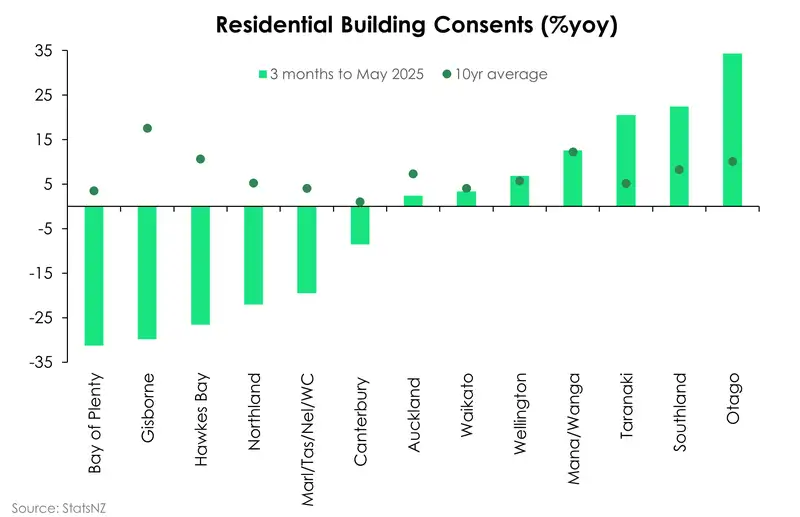

Across the country, we’re still failing to tackle affordability with supply. Around half of our regions are still recording substantial declines in residential building consents. To be fair, it’s a tough one to address when house prices remain depressed, building costs remain high, and infrastructure gaps continue to pose major barriers to progress.

The chart above looks much better than it did last year when all but two regions (Southland and Canterbury), recorded declines. But even now, most regions that have started recording lifts in consents are coming off very low bases.

What’s weighing on wallets?

The Kiwi economy fell into recession last year, and weakness is still being felt in the labour market. Firms are pumping out less output. And with less output, there’s less demand for workers. It’s snowballing. We’re seeing it in the data, and we’re hearing it from our clients.

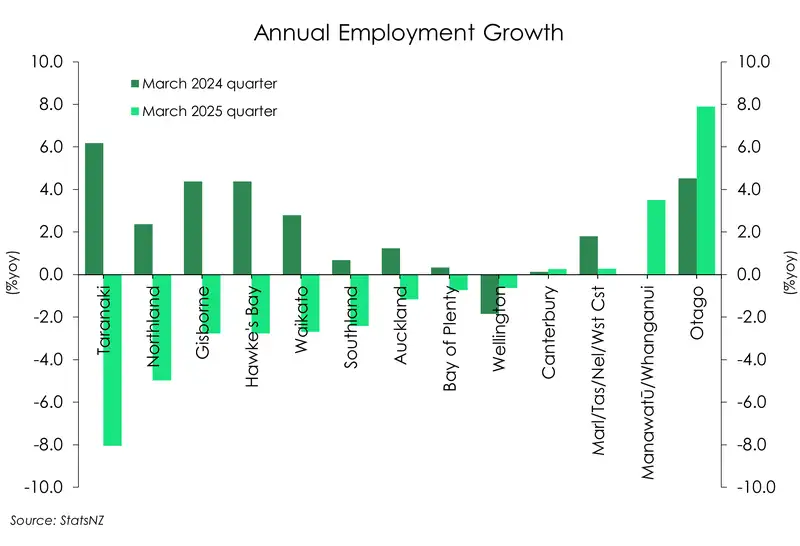

Labour market performance varies across the country. And as with most other economic indicators, the weakest growth is largely concentrated in the Northern regions. In the March quarter, annual employment declined the most in Taranaki, down 8%. Jobs in Northland dropped 5%, while Gisborne, Hawke’s Bay and Waikato posted slides of about 2.5%. Employment in Auckland went from a 1.2% gain to a 1.2% decline. While in Wellington, jobs growth is recovering but remain in the red at -0.6%.

At the other side of the axis, Otago once again recorded the strongest growth at 8%. The tourism industry continues on its road to recovery, with visitor arrivals now around 15% below the pre-Covid peak. And as a key tourist destination, Otago has benefitted, both in terms of employment and consumer spending. Employment within the Manawatū-Whanganui region also outperformed the national average at 3.5% growth.

Employment growth is still far from healthy, and job insecurity is weighing on wallets.

Business optimism wavering with tight actions being put in place - reducing staff numbers, reducing hours, to stay afloat. Business activity a result of customer discretionary spend where cost of living has impacted on that spend for big ticket items and choose to purchase or not.Richard Etti, Transaction Banking Solutions Manager – Central Lower North Island.

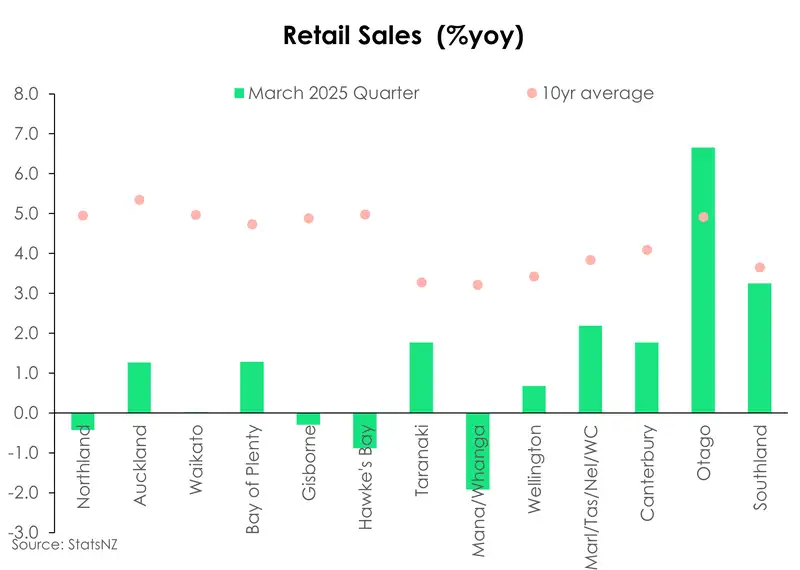

The worst appears to be over for retail, but it’s still a tough time out there. Spending remains muted across most of the country. All regions, bar Otago and Southland, are still seeing well below average retail sales growth. An uplift in tourism, both domestically and internationally, continues to help bolster spending in the South. International card spend was up 5.2% and 1.4% for Southland and Otago respectively. While interestingly, despite the recent stellar performance in Kiwi exports and high dairy prices, spending across the rural economy outside of Southland remains subdued. Retail sales values in the Waikato were unchanged from last year. Meanwhile, Northland, Gisborne, Hawke’s Bay and Manawatū/Whanganui all recorded declines in retail sale values over the year.

The still far from recovered housing market likely continues to play a role on household confidence and spend. Particularly in Auckland and Wellington whose housing market has have been hit the hardest. Retail sales in Auckland and Wellington are up 1.3% and 0.7% respectively. It’s better than a year prior where sales in both regions were still contracting. But both regions still have a long way to go. We expect a more material improvement as the housing market recovers and the labour market stabilises over 2026.

The feel good (or bad) factor

We asked our Kiwibank business bankers and mortgage managers, for the word on the street. Here’s what they said:

(3.0/10) It’s still cold in the Winterless North

“Mixed. Some appear to be in a sound position & looking for opportunities, whereas others are holding in looking for some rebound of activity." – Geoff Yendell, Commercial Manager.

(3.9/10) Strong population growth is not enough for Auckland

“The business climate is showing a mixed bag of results, with some businesses doing well through the downturn whilst others continue to struggle despite falling interest rates. Many of those who'd been banking on lower rates as their ticket out of trouble have found the relief hasn't translated into the turnaround they'd hoped for. While reduced borrowing costs have eased debt servicing pressures, several factors are holding back recovery: many households are keeping their wallets tight despite lower mortgage payments, choosing to save or catch up on deferred essential spending rather than splash out on discretionary purchases. Many struggling businesses remain undercapitalised despite falling interest cost, and with property values still flat, those relying on property equity to access capital for reinvestment into the business are finding themselves stuck. Although there are some encouraging signs emerging, the general feeling amongst business owners is that this downturn is dragging on much longer than anyone expected, creating ongoing uncertainty around investment and business decisions." – Ryan Davidson, Commercial Growth Manager.

“Mixed. A lot of hurt, but a few opportunistic cashed investors looking to purchase assets, be it lower mid-market businesses to property transactions. Construction as normal laggy. Exports going well. A lot of trade delegations at present trying to increase bilateral trade. Defensive sectors, tourism also strong." – Rudi Bansal, Regional Manager.

“Some industries are performing well; food importation, rental businesses, some cafes. However, anything related to construction industry is very challenging. Materially lower sales levels, job cuts, and pressure on margins from competitors. Any improvement appears to be an optimistic 12 months away, but probably 18-24 months away. A few believe it's similar to the 1990-1993 period, which is probably right as it's quite different to 2008-2011.” – Phill Whittle Davidson, Commercial Growth Manager.

“Everyone is being very cautious as they are not sure what is coming next after Covid and an economic downturn. Customers are being careful and ensuring they have reserves in case the slowdown lasts longer than anticipated.” – Ben Gillies, Commercial Growth Manager.

“While Auckland remains the strongest contributor to GDP and may be doing far better than other regions, there is still tightness like housing and large infrastructural projects. While housing market has definitely improved, it has done so only to some extent. The biggest drivers, middle income earners find it difficult to purchase house over 1.1m and unemployment rate is still a factor here. For Major infrastructural projects, I assess this from point of view of major contractors like Downer and Higgins who apart from maintenance and smaller jobs - currently seem to be facing difficulties in securing larger projects.” – Pravesh Singh, Business Advisor Manager.

(4.3/10) It’s not just Dairy that drives the Tron. Waikato

“The building/infrastructure sector continues to be subdued which is impacting on a number of our clients across various manufacturing industries. Customers commenting that this downturn appears to be worse than the GFC with businesses experience sluggish sales in Australasia and overstocked positions. Focus has been on cost cutting and optimisation initiatives. Housing market is tough especially the apartment market with stock difficult to sell quickly even at discounted prices. Non-bank finance sector relating to property funding has been slow with limited opportunities in the market.” – Jyoti Lath, Client Director.

“Businesses have had a tough year. Mainly in retail/hospitality and civil construction. More confidence has started to build up this year with the relief in interest rates and housing market slowly starting to incline." – Rakesh Kumar, Commercial Manager.

“Mixed. Dairy support services doing well, trucking coming back, residential construction......not good.....commercial patchy, but big projects underway. The Ruakura SuperHub will bring in new business." – Eddie Stocks, Commercial Growth Manager.

“In Taupō, tourism and local development projects are providing some momentum.” – Beau Williams, Commercial Growth Manager.

(4.7/10) The winter of wait and see in the Bay of Plenty

“My assessment would be that some businesses are struggling but the majority are holding their own and waiting for market conditions to improve. Are focusing on improving efficiencies to be well placed when the economy starts to grow again.” – Roger Shaw, Commercial Manager.

“Business activity is fairly quiet, with many businesses still feeling the pinch from softer trading conditions. That said, business confidence is starting to lift, helped by lower rates and govt. incentives. Rotorua remains pretty steady with some investment in key sectors, Tourism, Forestry etc. Global uncertainty still causing a bit of hesitation locally. Cautiously optimistic would some it up." – Beau Williams, Commercial Growth Manager.

“The winter of wait and see! The lower interest rates have not contributed to higher market sentiment. Houses are not moving, price expectations are dropping by the day.” – Donna Neville, Mobile Mortgage Manager.

(3.0/10) A patchy sentiment across Gizzy

“The Gisborne economy remains subdued as tough times keep activity restrained. Unemployment is up across the region with lower jobs available across a number of key sectors (ie agriculture, forestry etc). Tourism activity has been mixed with guest nights down but overall tourist spending up. Forestry activity remains slow with lower volumes and less demand from Key market China. Other primary industries (agriculture, Horticulture) have more positive outlooks with higher payouts and volumes respectively.” – Karl Trafford, Commercial Growth Manager.

(3.5/10) Still healing in the Hawke’s Bay

“Although many are still doing it tough, there does seem to be more positivity. We are starting to see an increase in enquiry for things like purchasing a new business and shareholder buyouts, but still not much action in the way of asset purchases and upgrades for existing business owners. Property market still feels quite slow except in the first home buyer space. There is opportunity to be had for those with strong balance sheets and good cashflow.” – Lara McRae- Commercial Manager.

“Business confidence in Hawke’s Bay remains cautious but shows early signs of recovery. While falling interest rates have lifted sentiment slightly, most businesses are still focused on managing costs, preserving cash flow, and delaying major investment decisions.” – Unattributed Business Banker

“The housing market has clearly cooled. Homes are taking longer to sell, and conditional offers — including building inspections, and sale of the buyer’s home are more common.” – Dianne Jones, Mobile Mortgage Manager.

(3.0/10) Tough in Taranaki

“Things are still pretty tough in the Lower North Island. Confidence is low, and even though most businesses expected things would have picked up by now, they really haven’t. 2025 hasn’t been the silver bullet a lot of businesses were hoping for. – Victoria Spring, Regional Manager - Business.

(5.0/10) It feels like a 5 in Manawatū/ Whanganui

“The provinces are buzzing right now—and nowhere is that more evident than in the Manawatū-Whanganui region. We're seeing it firsthand, with job ad growth and business confidence outpacing the rest of New Zealand. After eight long years, the closure of the Manawatū Gorge Road is now behind us. The opening of Te Ahu a Turanga – Manawatū Tararua Highway marks a major milestone in regional connectivity. Meanwhile, the Te Utanganui (Central NZ Distribution Hub) project continues to gain momentum, and local exporters are consistently punching above their weight. Whanganui, in particular, is showing strong signs of growth. The River City—also recognised as a UNESCO City of Design—is forging ahead with housing and commercial developments that promise to boost employment and confidence for years to come. It’s a great time to be in the provinces, and we’re proud to be backing local business owners as they invest and grow.” – Will Warren, Commercial Manager

(3.0/10) Redundancies in the Beehive hurt Wellywood.

“It's not pretty; with a high number of redundancies amongst Government departments last year, mixed in with one the highest falls in property prices in the Country, it feels like we have the lowest confidence nationwide in terms of getting back into the property market. Despite the rates falling and prices having seemingly hit the bottom, buyers are still waiting... refinancers are the biggest movers for the first time in a long time! It can only get better from here, but something has to kickstart buyers' confidence to get back out there.” – Nadine Davison, Mobile Mortgage Manager.

“Redundancies across the capital have had a noticeable impact on the housing market. While supply remains high, demand has not kept pace. First home buyers have maintained a steady presence over the past 12 months, alongside upgraders, which has provided some stability. With interest rates easing and property prices remaining relatively affordable, it appears both groups are beginning to see the advantages of entering the market now. Investor activity has been slower to rebound, however, that was largely anticipated given current conditions. Construction activity has also declined significantly. Despite these challenges, I remain optimistic that the next 12 months will bring a positive shift!" – Chelsea Ladbrook, Mobile Mortgage Manager.

“Stagnant with pockets of green shoots.” – Dean Condon, Commercial Growth Manager.

(5.0/10) Canterbury’s feel-good factor is a firm five

“Reasonably strong with good growth opportunities. Those who have been in difficult times lately appear to be coming through them now with positive signs ahead.” – Mark Thompson, Commercial Growth Manager.

“Some noise from investors. House prices steady. First home buyers still in market. Properties still be sold at auction.” – Blair Milne, Mobile Mortgage Manager.

(3.5/10) Battered by the weather, Tas/Nel//Marl/WC remains under pressure

“With the recent weather events (6 months of rain in 2-3 weeks) hitting the Nelson/Tasman region this has caused widespread considerable damage to infrastructure, properties including businesses and farms. The recovery is estimated to take 2-3 years which will cause significant financial stress to all impacted. With any weather event there are some positive impacts on businesses that are involved, civil construction, contractors, etc. Talking to several civil construction large businesses in the region they are all very busy with the flood recovery work and have had to put some existing jobs on hold. Forestry industry has been impacted with significant damage across the region with an estimated 4,000ha flattened. This will need to be cleared which will result in increase in work for both logging contractors and log cartage companies. Construction picking up slowly but remains subdued in both residential and commercial projects.” – Pauline Pellowe- Commercial Manager

(7.0/10) It’s feels far more fabulous in the tourist meccas of Otago…

“Certainly good activity. I say that as I am not seeing requests for financial relief and there is still a lot of opportunity.” – Andrew Voss, Commercial Growth Manager.

“Feels steady in a balanced market. Higher value properties seemingly taking longer to sell but some good interest with investors looking for a well-priced property and a good return.” – Leanne Hannah, Mobile Mortgage Manager.

(7.0/10) And likewise in Southland

“Good and steady as she goes.” – Martin Hannagan, Commercial Growth Manager.

Kiwibank’s Regional Score

Kiwibank’s Regional Score summarises seven economic indicators in 13 regions (see map on the front page). Included in the scores are: population growth, retail sales, employment, house price index, house sales, building consents, and international tourism electronic card transactions. To combine these different measures (e.g., number of people versus values of retail sales) we take annual growth rates of each measure. Growth rates are then standardised relative to their average rate of growth – as some data seem to move to their own beat. We then combine the indicators for each region by taking the average of the various measures. Finally, we convert each average into a score from 1-10 by fitting the data to a normal distribution with a mean of 0.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.