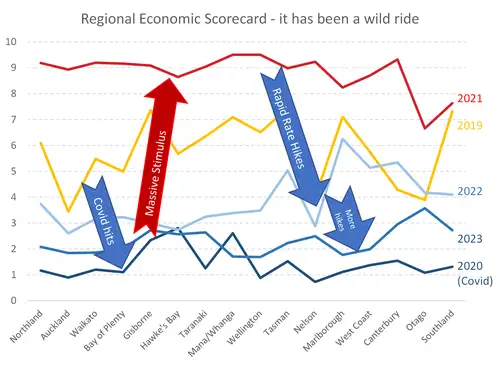

It has been a wild ride in recent years. Activity was crushed during the Covid lockdowns, only to rebound much faster than anyone could have imagined. That rebound caused inflation. And inflation is an evil policymakers are hell-bent on crushing, at any cost. And we can see that cost.

The bright spots, somewhat hidden beneath the surface, are shining with a resurgence in tourist activity. After years of Covid border restrictions, tourists are back. And they’re back in droves.

Looking ahead, the economy is rebalancing, inflation pressures are easing, interest rates are likely to fall next year, and business confidence should strengthen. There is light at the end of the tunnel.

Whilst winter and pre-election are always slower periods, this feels slower than usual. Enquiry slow, general market activity slow, BUT a number of clients in the past week or two have mentioned a noticeable pickup in sales enquiry / activity. Outlook is positive for the Garden CityGreg Bramley - Senior Property Finance Manager, South Island

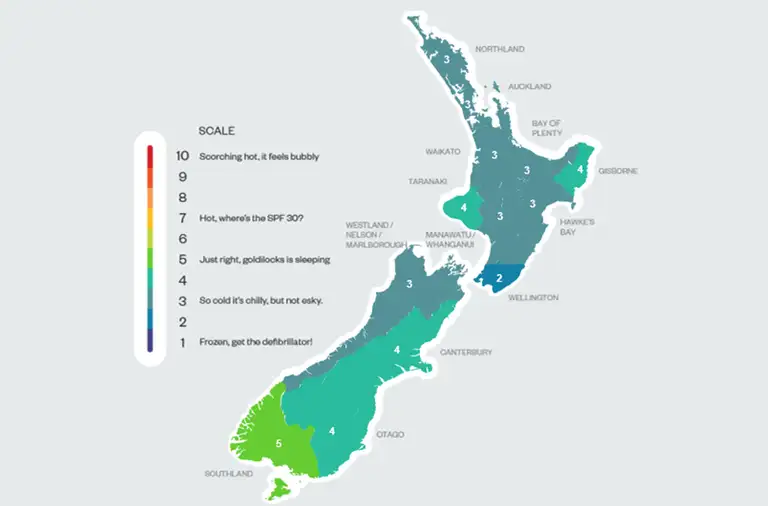

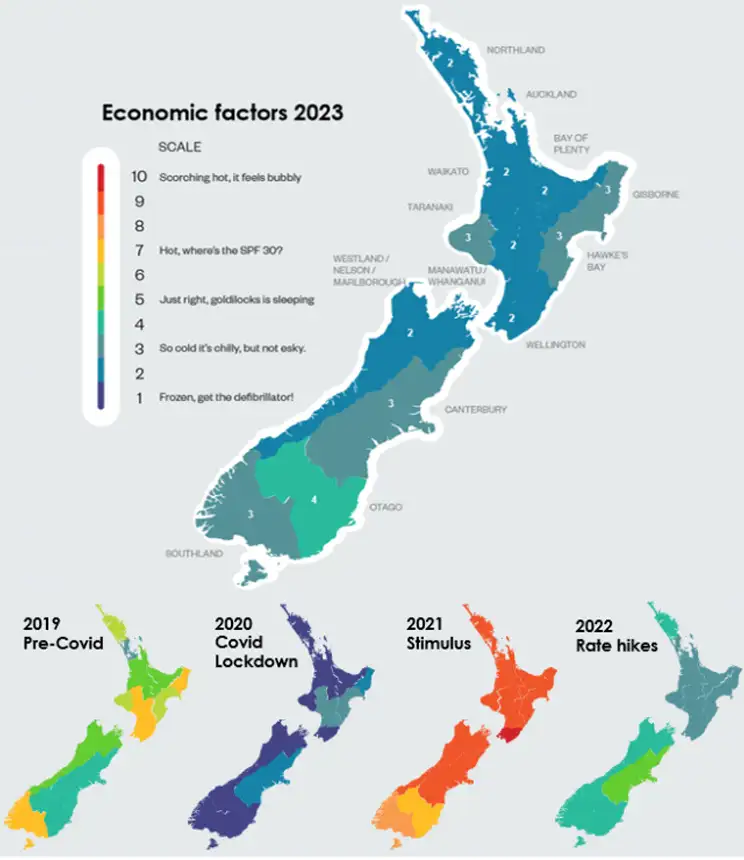

We have seen a sharp slowdown in economic activity across the country. What started out in the major cities has swiftly spread throughout the regions. The slowdown began last year, with well below average readings. And the deceleration deepened this year. Activity across many of the regions has dropped to a score of just 2 out of 10. Most of the country scored between 1.7 and 3, with just a lonely high of 3.6 in Otago. And that 3.6 was inflated by a resurgence of tourist activity in Queenstown. Outside Otago, the South Island fared better than most of the North Island. However, the southern regions experienced the most drastic slowdown. On average, activity went from ‘Just right’ (5/10) in 2022 to a chilly 2 today. Strong building activity supported the regions last year, with Marlborough scoring a solid 6.2. A 24%yoy fall in residential consents however has dragged the wine-country’s score to 1.8.

The performance in the farming regions too has become rather lacklustre. Canterbury’s score has fallen 2.4pts to 3 out of 10, and Waikato is down 1.3pts to 1.9. No doubt our falling export prices, from such lofty heights, explains the slowdown. Global economic growth is weakening under the weight of rising interest rates and a stalling Chinese economy. Dairy prices are falling. The recent weakness in the NZ dollar is providing some relief. But softening demand for our key agricultural exports is hurting local farmers.

It has been a wild ride in recent years. The pre-Covid period saw the economy humming with scores between 5 and 7.5. Covid hit in 2020, and the economic score cards came in icy cold, between 0.9 and 2.8. So while we are not quite as bad as 2020, we’ve been frost bitten nonetheless.

The regions are recording between what we describe as “Frozen, get the defibrillator” (1) and “So cold it’s chilly, but not esky” (3). These readings are consistent with recession. The recession that started late last year, is likely to continue into next year. This is by RBNZ design. The RBNZ deliberately engineered a recession to coax the inflation genie back into the bottle. And they have used a heavy hand.

Ultimately, it’s all about inflation. And inflation has peaked. The sooner we see inflation fall back towards 2%, the sooner we will see the RBNZ shift into reverse. We are expecting inflation to hit 4% by year end 2023, and further falls below 3% by mid-2024. We expect rate cuts (not hikes) in 2024. Rate cuts will lower the cost of leverage, and bolster investment intentions. Business confidence will return. And if realised, we would expect to see the economic scores across all regions improve next year.

Looser labour markets

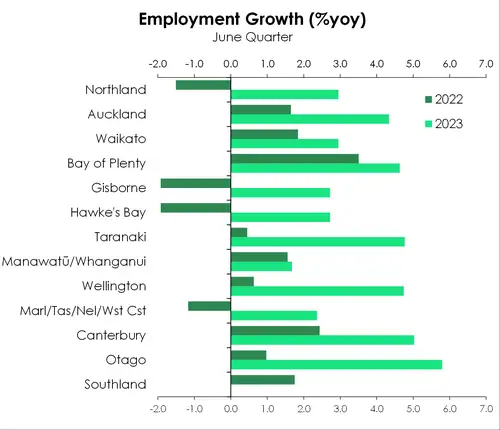

Last year, several KB Business Bankers pointed to labour being hard to find across Aotearoa. From the top of the North Island to the bottom of the South, 8/10 was the average score across all respondents. Hiring eased, and not for a want of workers. Firms could not fill vacancies.

Fast forward to 2023, and NZ’s working age population has grown by 91k. The spike coincides with a surge in net migration of over 80k.

When quizzed today, the average score among KiwiBankers has improved to 6/10. It’s still an above-average score, but the labour shortages have improved. Although for some the search continues.

“Labour availability remains an issue with several business becoming accredited employers to bring in staff from overseas.” – Karl Trafford, Commercial Manager, Hawke’s Bay.

Employment expanded a whopping 4% over the year, with tourism the main beneficiary. Tourism-related employment has now returned to pre-covid levels. The Otago region – boosted by Queenstown – recorded the strongest growth (5.8%). The top 10 occupations of those coming to our shores are concentrated in the services sector, specifically hospitality. Food trade workers

– think chefs and butchers – have climbed to the top spot, from fourth place in 2015 (previous migration boom). For the same reasons, the Bay of Plenty recorded a solid 4.6% annual lift in employment.

“Parts of the local economy are showing signs of recovery and improvement, i.e. Tourism, Arts and recreational services and Professional services.” – Lloyd Upston, Commercial Manager, Rotorua/Taupo.

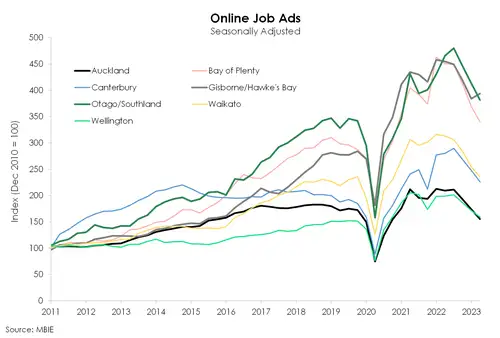

Our bigger cities have also benefited from the return of work-ready migrants. In Auckland, Wellington and Canterbury, employment jumped between 4% and 5%. MBIE job ads peaked in June last year and have fallen 22% since. Of the 10 regional groups, eight recorded a +20% decline from their respective peaks. Auckland posted the steepest descent of 27%, back to 2019 levels.

The fall in job ads is an indication that labour shortages are being resolved. It is also a sign that the demand for labour is softening. We still expect a significant slowdown later this year. The forecast recession should see slack emerge. As consumer demand cools, so too will labour demand. If firms are expecting to pump out less output, they will try to do so with less labour. We are already hearing of firms downsizing their workforce.

“Many businesses are right sizing as best they can.” – Rudi Bansal, Regional Manager, Auckland.

Those anecdotes will continue to stack up. We expect to see unemployment rise to a peak of ~5.5% late in 2024.

Housing markets spring to life

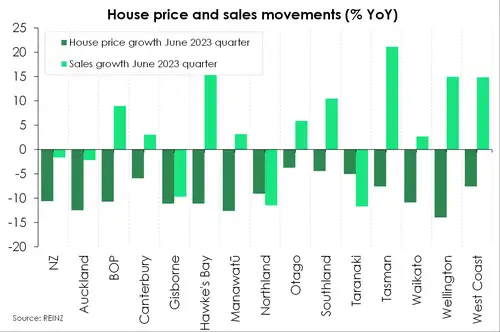

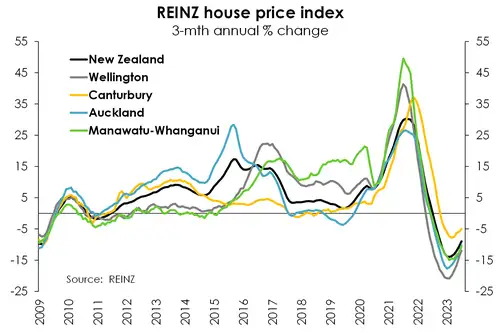

Regional housing markets are springing to life in spring. For much of the past two years, the NZ housing market has capitulated under the pressure of tightening credit conditions (CCCFA), rapidly rising mortgage rates, investor tax policy changes and stretched affordability. The correction, however, appears to have run its course. According to REINZ data, house prices stopped falling in March. And house prices have been increasing since April – albeit modestly. Sales activity is also picking up pace. Nationally, the number of sales was up 2% in the year to June. Where sales go, prices follow. The market is primed for a recovery, across the regions.

Auckland recorded a gain of 1.1% in June, following some hefty falls over the last two years. House prices in the Capital have increased at an average monthly run rate of 0.8% since April. And the number of sales was up 15% on last year. Beyond the big cities, the regions play catch up.

House prices in Northland only hit a peak in January last year, and remains in a downtrend. Down South, Canterbury’s housing market has experienced much more of a soft landing compared to the sharp correction in other markets across the Motu. House prices in the Garden City have fallen just 8.5% from the peak, far shallower than the national 18% peak-to-trough slide. There are mixed gains and losses across the regions, but greenshoots are emerging. And our team on the ground can confirm:

"It appears to be picking up steadily, and with low stock on the market this is likely to push prices up again as demand continues to rise." - Nadine Davison, Mobile Mortgage Manager, Wellington

"Feels like it's starting to pick up with there being more 'bang for your buck' out there. Looks like there is some really good buyer demand and Dunedin is starting to stabilise. There is a good window for buyers to get out there and buy but it hasn't yet flowed through to value." - Leanne Hannah, Mobile Mortgage Manager, Dunedin.

“I think the post-election period will see a flurry of activity again - it will be spring, and people and people keen to move before Xmas. Summer brings people into this region which almost always creates demand for property from people wanting to move here. I don't see prices falling much unless the labour market tanks.” – Donna Neville, Mobile Mortgage Manager, Bay of Plenty

Turning to supply, residential consents surged as we were freed from covid lockdowns. In May 2022, annual building consents hit a record-high of over 50k. That was great. Because we have a chronic shortage of affordable homes. Unfortunately, it didn’t last. Falling house prices combined with building costs blowouts, and a lack of infrastructure, put many off building. In most regions, building consents are trending lower. In the year ended July 2023, new dwelling consents fell 13.8% in Auckland and close to 20% in Wellington. The South Island experience was not too dissimilar with an 11% drop. The fall is undeniable, and unwanted. New homes consented peaked in early 2022, and fallen 25%. Looking ahead, dwelling consents may soon flatten given signs of recovery in the housing market. But we need a reacceleration if we are to truly address the lack of affordability throughout NZ. And we need many more homes, just to house the surge in migrants. Investors should be encouraged, not dissuaded, from building. There is a need for policy to support new builds. And there is a desperation to improve our infrastructure to allow growth.

Rocky retail

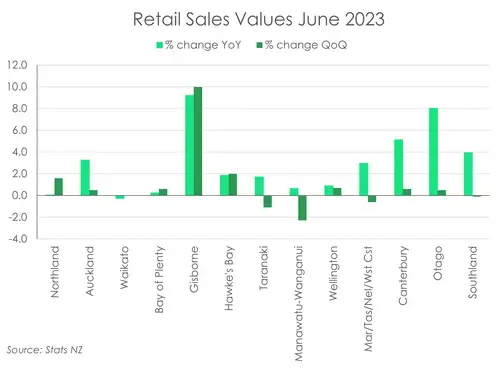

High interest rates on top of a “cost of living crisis” are taking a toll on Kiwi consumers. Spending is weak despite an extravagant surge in migration, and near record low unemployment. Compared to last year, the value of retail spend is up 2.7% nationwide. But it’s largely a story of inflated prices, as retail volumes fell 3.4% from last year. Gisborne experienced an inflated surge of 9.2%, as rebuilds, replacements, and refurnishings followed the devastating cyclone.

Meanwhile a return in tourism has supported retailing in Otago and Canterbury, up 8% and 5.1% respectively. Similar gains were seen in the West Coast, up 8.1%, and Marlborough up 5.1%. But when grouped with Nelson and the Tasman the top of the south only managed a 3% lift, well below average.

Outside these regions, the value of retail sales also tumbled below average growth rates. With high inflation, weak sales values indicates a significant decline in volumes. Waikato was at the bottom of the pack with retail sales down 0.3%. Low dairy prices have shaken consumer confidence. Meanwhile, Northland, Auckland, the Bay of Plenty, Hawkes Bay, Taranaki Whanganui/Manawatu, and Wellington all came in well below average sales growth.

Across the regions, the outlook for retail sales is gloomy. Clean-up related sales from the cyclone and floods is mostly done now. And with 40% of mortgages refixing onto higher rates in coming months, disposable income will be squeezed further. The sands are already shifting. Taranaki, Manawatū, Southland, and the top of the South Island all posted falls in retailing in the June quarter. And we expect more weakness ahead. A cumulative 0.4% contraction in activity across Q3, Q4, and Q1 is likely to coincide with rising unemployment in the year ahead.

Triumphant tourist turnaround

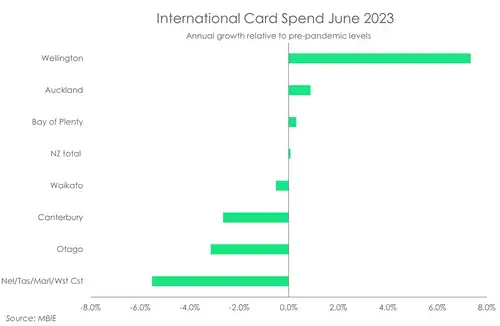

What was once our largest export took a heavy blow during the pandemic. We closed our borders and said goodbye to tourists. And after just a year from re-opening the borders, tourism has bounced back strongly, but is yet to be where it once was. Our tourism industry has been plagued with labour shortages. And a locked-down China over the summer certainly didn’t help. Though more recently, employment in tourism has (finally) returned to pre-covid levels. The return of tourists has supported employment and retailing in travel hot spots like Queenstown. But international tourism card spend remains well below pre-covid growth rates.

In the year to June 2023, total international card spend grew just 0.1%, relative to pre-covid levels. And it’s all inflated prices. The top of the South Island takes bottom place with international card spend down -5.5% relative to pre-Covid levels. But Otago, down 3.2% from pre-covid levels, accounts for 20% of NZ’s international tourism card transactions. That’s massive. Whereas Wellington’s seemingly impressive 7.3% growth above pre-covid levels only accounts for 8% of total spend. Bear in mind, these values are not inflation-adjusted. Adjusting for rapid price rises shows that volumes of spending are well below pre-covid levels. But we think there’s upside to come. The strong return of migrants has helped fill crucial vacancies needed to service demand. Though a global slowdown, and a weak Chinese recovery, does pose some downside risk in tourism posting a full recovery over the next year

The feel good (or bad) factor

We asked our Kiwibank business banking and mortgage manager colleagues, as well as our friends from NZ Home Loans, for the word on the street. Here’s what they said:

(2/10) Northland feels more like a resilient 6

“Whilst it is noticeable that there is some stress in parts of the market in the current climate, there also seems to be an attitude of getting on with things to get through this current period. Some also seem well placed to explore the opportunities this period will bring.” – Geoff Yendell, Commercial Manager.

(2/10) But Auckland feels a warmer 4

“Environment is Middling. At the moment we have seen a slowdown in economic activity from the dizzying heights of six months ago. M&A activity has eased to a more manageable level where buyers and sellers are less frantic, and the FOMO is not there. I think we are in a really good place but the economy needs to hold at the current level, any more fear (and a pending election) could mean we retreat too far and talk ourselves into a (sky is falling) negative vortex. NZ business has much to be positive about and chasing growth is still the best thing for our economy and long-term prosperity of our country.” – Wayne McEntee, Regional Manager.

“Zombie companies are now getting caught out as liquidity dries up and demand falls in a contracting margin environment. That being said there aren't signs of material distress other than overleveraged firms or property investors. Confidence post-election and inflation control should boost decision making. Labour constraints have become a little easier now in select industries however demand can be slower in certain segments. Well-capitalized businesses are looking for acquisitions. Comments from PE / Offshore buyers is that margins in New Zealand are much lower than other countries but some presence can be of use from a diversification point of view. Price increases from firms is still there in certain industries.” – Rudi Bansal, Regional Manager.

“Mixed, opportunities exist. Rate certainty and investment returns are the key drivers for our property finance market - green shoots are starting to emerge as commentary of rates peaking continues.” – Sam Stewart, Head of Property Finance.

“Challenging. High costs of living and debt servicing costs are forcing people to reconsider before spending. The knock-on effect and contagion through sectors is telling. Those looking to invest are holding to see what happens.” – Andrew Mackay, Senior Property Finance Manager.

“We are seeing a slowdown in hospitality (restaurants particularly) and businesses generally resetting their expectations post Covid and implementing cost cutting measures in view of the soft market. Forecasts are being reset to a more conservative and cautious levels especially for businesses exposed to the property sector.” – Jyoti Lath, Relationship Lead, Major Client Group.

(2/10) But the Waikato feels about the same at 3

“In the property space we are busy working on social housing projects, i.e. Kainga Ora buying houses via developers. Presale market is dead, higher interest rates negatively impacting investment market across Resi and commercial” – Stephen Edge, Senior Manager, Property Finance.

(2/10) On the ground the Bay of Plenty is closer to a 4

“General business sentiment among different industry sectors is positive for the region’s future.” – Lloyd Upston, Commercial Manager.

“General apathy given interest rate environment and pre election uncertainty. Localised infrastructure issues in Tauranga namely roading, traffic, public amenities and parking issues have been called out as problems that must be resolved. Tauranga Council Commissioner’s term due to end in mid-2024 with normal mayor and local council governance structure resuming.” – Roger Shaw, Commercial Manager.

“On hold – seeing a reasonable amount of reservation when it comes to carrying out plans for expansion and investment. At the same time we are seeing people start to look for opportunities based on the impression that we are near the bottom of the market.” – Mat Luijken, Commercial Manager.

(3/10) Gisborne feels the same

“We have small businesses in these regions. We see business activity flat, nothing that's out the ordinary. Staffing remains a key challenge and the rebuild in Gisborne etc. House prices in some areas like Hamilton north Rotorua seem to be doing better.” – Rudi Bansal, Regional Manager.

(3/10) The Hawke’s Bay feels more like a 4

“A lot of Horticulture, viticulture and cropping businesses will be unable to operate profitability in the near future and also long-term following cyclone Gabrielle. On the flipside to this, earthworks/contracting/ civil businesses remain extremely busy and forecast to be busy for some time yet (a number have picked up longer terms contracts with Fulton Hogan which has previously been unheard of)-2nd hand machinery market is very strong as a result of high demand for machinery etc. There remains a lot of uncertainty in the local housing market with a number of homes zoned 2-3 following the cyclone which means they are waiting on local government/insurers to make decisions before being able to think about rebuilding/moving etc-once these decisions are made/finalised there could be strong demand for housing for a period. Significant spend on infrastructure still required post cyclone with a number of bridges/roads still requiring major repairs. Hawkes Bay tourism market share fell by 11% post-cyclone. Guest nights remain high as a number of motels still operate as long-term accommodation. A new Quest hotel has opened in Hastings CBD and also another new 5-star hotel earmarked for Napier CBD.” – Karl Trafford, Commercial Growth Manager.

“Hot and Cold depending on what industry due to the recent cyclone. Construction is high due to the rebuild and unemployment is low. Cost of living is hitting families hard that were on the verge before interest rates rose. Those that had surplus cash are riding the wave.” – Dave Reay, NZHL Business Owner.

(3/10) And Taranaki feels it

“On a knife's edge following the recent forecasted drop in dairy prices. It is expected to leave an approximate hole of $1b- $1.2b in a local economy that is already dealing with an environment with higher interest rates and higher costs of living. It's not all doom and gloom though, we have been here before and the province is resilient.” – Jayden Devonshire, Asset Finance Manager.

(2/10) But it’s not all “doom and gloom” and feels more like a 6 in Whanganui/Manawatū

“The business climate Palmerston North/Manawatū is positive. Our region is underpinned by mainstays such as: Defence, Education and Logistics which anchor the economy in good times and bad. Projects like; Te Ahu a Turanga – Manawatū Tararua Highway (Manawatu Gorge Road replacement) and upgrades at RNZAF Ohakea are examples of large government-backed projects that are providing a lot of economic stimulus in the area. There are anecdotal reports of increased enquiry for businesses listed for sale.” – Will Warren, Commercial Associate

“All is not doom and gloom in the Manawatū, with the housing market stabilizing and strong employment numbers. High interest rates and the cost-of-living crisis is biting businesses as well as households. Brokers are indicating higher enquiries from people looking to buy a business despite the high interest rates on lending.” – Al Green, Commercial Manager.

(2/10) And Wellington feels the icy chill at 3

“Businesses are being very cautious still but believe the business climate should improve over the next 6-12 months.” – Brett Cunningham, Commercial Manager.

“Very buoyant particularly with first home buyers. I think they have held off long enough waiting for the drop or the bottom to hit and have saved a bit more in that time and now ready to take the plunge. Other areas such as upgrading owner occupied has ceased particularly with so many government employees in the region some have halted on decision making until post-election.” - Jill Burns, NZHL Business Owner.

(2/10) The top of the south Marlborough, Tasman, Nelson, and the West Coast feel a warmer 6

"It feels like the market is slow at present, property prices dropped but have levelled. Over next 12 months property prices should increase. More stock coming on market. First home buyers will have more opportunities with lower property" - Simon Parle, Mobile Mortgage Manager.

(3/10) Canterbury’s feel-good score is just right at 5

“Confidence is down a little but most business are hunkering down” – Troy Sutherland, Commercial Manager.

“Business is generally just treading water waiting on 1) the election results and 2) stronger indications on when rates will start to drop. A few businesses are carrying more stock than they would like. This as a result of ordering strongly due to delays in shipping and wanting to have enough stock on hand, combine with a slowdown in sales over the first quarter of the year. All are confident of clearing this over time. Generally positive over the longer term with a the feeling a lot of negative sentiment is generated via the media. Most businesses are taking the time to look at their structure and how they can streamline/reduced cost. This is something they have were unable to do over the busy high growth period post covid.” – Grant McIntyre, Commercial Growth Manager.

(4/10) Tourism has turned up the heat to an 8 in Otago

“Strong. Return of International Visitors. Spend up 16% on previous year. Guest nights up 39%. Cruise ship returns injected an estimated $60 million direct into Dunedin business. Non-residential construction remains strong growing 12% to year ended March 2023. Large investments including DCC investment in Central City upgrade approx $100 million and George Street upgrade a further $50 million. New ACC building under construction, accommodating 650 staff expected to cost circa $50 million. Otago University new hall of residence $90 million. $1.6 billion hospital build underway. Commercial arena seeing large development growth including Tuapeka Gold and Kmart. Investment into Centre of Digital Excellence with 25 Studios planned. Professional Scientific and Technical sector now contributing. $575 million into Dunedin economy. As opposed other main centres total retail spending up 1.4% for July 2023 compared previous year. Residential housing market listing.” – Martin Hannagan, Commercial Growth Manager.

“There is a general holding pattern feeling in the region. Businesses have been hit with higher running and material costs and also increased compliance and regulatory changes. Investors are relatively quiet still but seem to be waiting to see what the upcoming election brings. However, there are opportunities for many types of businesses in the current market. Tourism in the area has made a recovery, the Cruise ships were a welcome return for Dunedin retail businesses after a time with the George Street development disrupting many retail shops for a time. The housing market has slowed with listings down and average sale time’s increased with prices lowered also. Some would say there’s been a general equalisation, considering an over inflated market of old housing stock in the region in general.” – Brendon Hunt, NZHL Business Owner.

“Strong - tourism has rebounded in Queenstown & Wanaka. Asian & Chinese visitors are here skiing in large numbers, residential building & commercial construction appear to be still in full swing. Plenty of employment opportunities in service & construction.” – Brent Mitchell, NZHL Business Owner.

Kiwibank’s Regional Score

Kiwibank’s Regional Score summarises seven economic indicators in 13 regions (see map on the front page). Included in the scores are: population growth, retail sales, employment, house price index, house sales, building consents, and international tourism electronic card transactions. To combine these different measures (e.g., number of people versus values of retail sales) we take annual growth rates of each measure. Growth rates are then standardised relative to their average rate of growth – as some data seem to move to their own beat. We then combine the indicators for each region by taking the average of the various measures. Finally, we convert each average into a score from 1-10 by fitting the data to a normal distribution with a mean of 0.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.