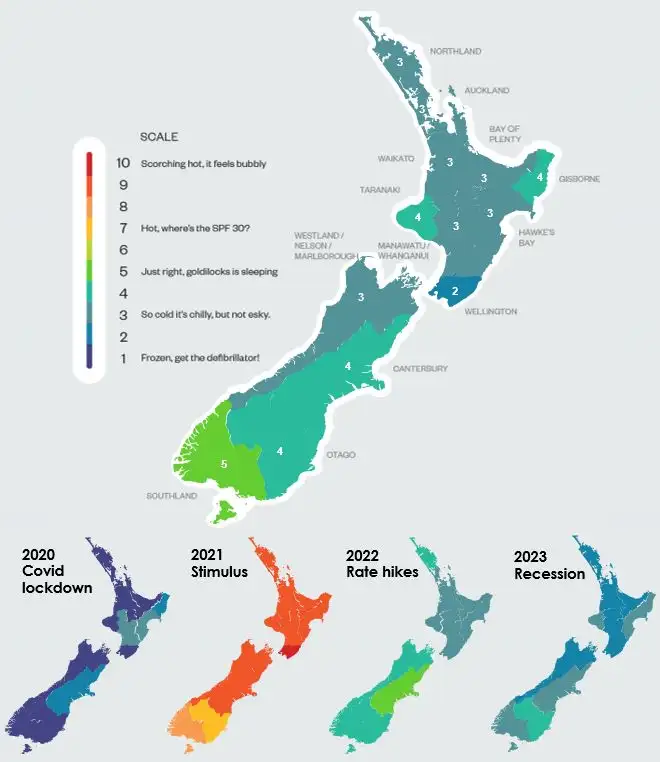

- Economic activity has improved across the motu – but only just. Our regional heatmap has gone from flashing mostly 2s out of 10 to a scattering of 3s, 4s, and a single shining 5. The economic scores are still soft, but it’s an improvement nonetheless.

- Southland is the top performing region, with activity boosted by a building boom. Auckland’s activity is still weak, despite strong population growth. And it’s feeling bitterly cold in Windy Wellington, with a Jack Frost score of just 2, the same as last year. The bright spots, hidden beneath the surface, reflect the recovery in tourism. Otago is a strong performer.

- Looking ahead, inflation is easing, interest rates will fall, and business confidence should strengthen. Spring is coming, and most regions will defrost.

It feels better than it did last year, but it's still toughCaitlin Osmond, Commercial Manager, Wellington.

That sums up perfectly our latest look into the regions.

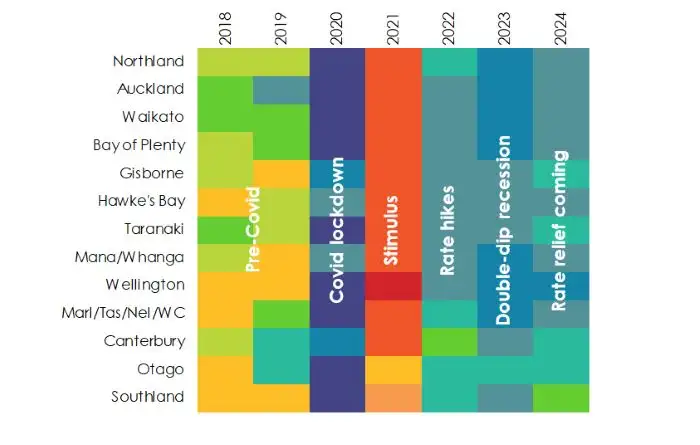

Without a doubt, 2023 was a rough year. Activity levels were dire, with most regions recording frost-bitten scores of between 1.7 and 3 out of 10. The ‘on the ground’ sentiment scores were no less gloomy. We are still in a recession… it started in 2022, and we’re still recording declines. However, 2024 is shaping up to be a better year – just. Economic scores have started defrosting across the motu. Our regional heatmap is now flashing mostly 3s out of 10, with an encouraging share recording 4s as well as a single shining 5. The regions are performing better than last year, but are not at their best. It’s still a tough gig navigating the current economic environment. But next year should be an even better year. Because rate cuts are coming, and will breathe new life into a rather deflated economy.

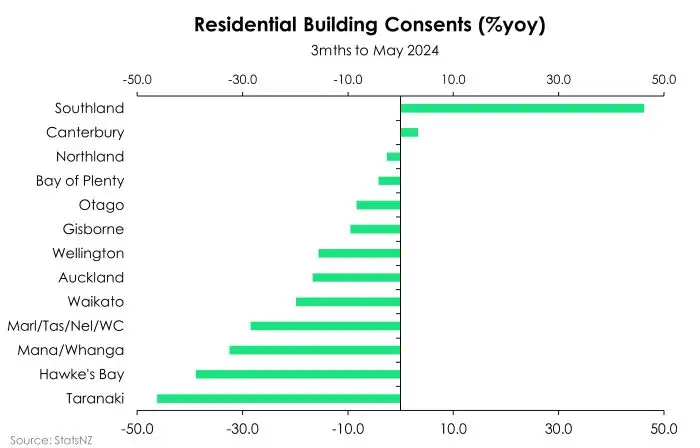

The South Island is faring better than the North, with Southland leading the way. Murihiku (or Southland) may be the “tail end of the land”, but it is at the top of the leaderboard with the highest score of 5. As building activity in the rest of the country has slowed down, Southland has ramped up. New dwelling consents are growing at pace, supporting construction and housing activity in the region. Otago is another top performer (4/10), thanks to the ongoing recovery in tourism. Queenstown just feels better. The recovery continues to support employment and the housing market in the region. Progress, however, could be better. Because short-term visitor arrivals into New Zealand are still running 20% below pre-pandemic levels. Canterbury’s score also improved to a 4, as the post-earthquake rebuild underpins activity. However, drought conditions have continued into the winter, making it tough for farmers and growers in the region.

Scores for Northland, Waikato, the Bay of Plenty and Hawke’s Bay have all lifted to a 3 out of 10. It’s an improvement from the average score of just 2.1 last year, but still signalling subdued activity. Indeed, the unrounded scores for the Bay of Plenty and Hawke’s Bay are sitting at 2.7 and 2.8, respectively. Employment growth in the BoP underperformed from last year and the HB recorded the second deepest slide in building consents.

Of all regions, Auckland’s performance has been the most disappointing. Not because it has the lowest score – Wellington takes that crown. But because activity indicators across employment, dwelling consents, and housing in the City of Sails are tracking largely in line with national averages – despite benefitting the most from the 2023 migration boom.

All regions recorded an improved score, bar one – Wellington. Down in the Capital, the score is unchanged at an icy 2. Reductions in Government spending and headcount will be a significant drag on activity throughout the region. Businesses are no doubt bracing themselves for tougher times over the coming year.

Looking over the past few years, it’s been a nauseating rollercoaster ride for the Kiwi economy. The pre-Covid period saw the economy humming with regional scores of between 5 and 7.5. Then Covid hit in 2020, and the score cards came in icy cold, between 0.9 and 2.8. Unprecedented fiscal and monetary policy followed and lit a fire under the economy. Regions flashed red-hot scores of between 8 and 10 in 2021. But as inflation spiked, fast and furious rate hikes poured cold water on households and businesses. Scores plunged, and the economy recorded a double-dip recession. It’s now 2024 and activity is beginning to thaw as rate relief nears.

Ultimately, it’s all about inflation. And inflation is set to fall back within the RBNZ’s 1-3% target band by year-end. It has become a ‘sure bet’ that the RBNZ will cut interest rates sooner than they anticipated (second half of 2025). Rate cuts will lower the cost of leverage, and bolster investment intentions. Business confidence will return. Household stress will ease. And investors will step back into the housing market, with improving rental yields. We expect to see economic scores improve across all regions next year.

Hiring slowdown snowballs

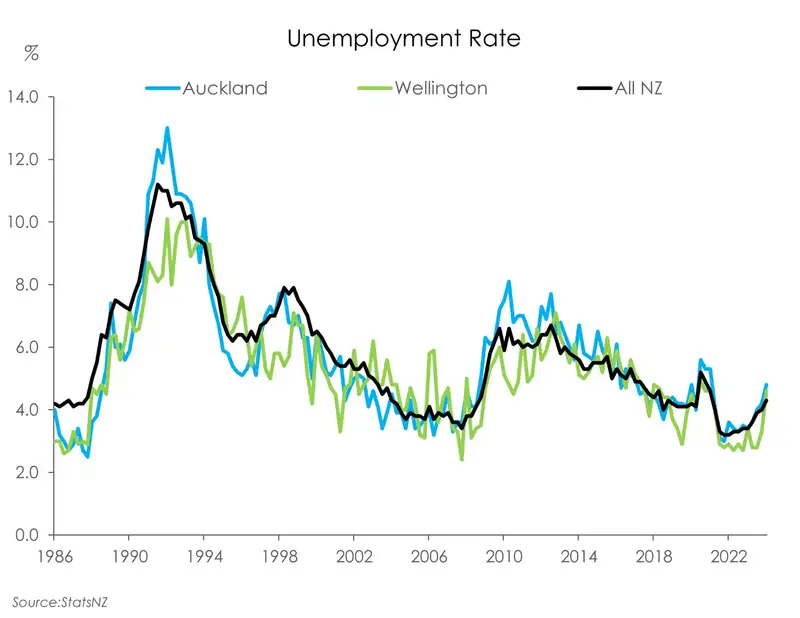

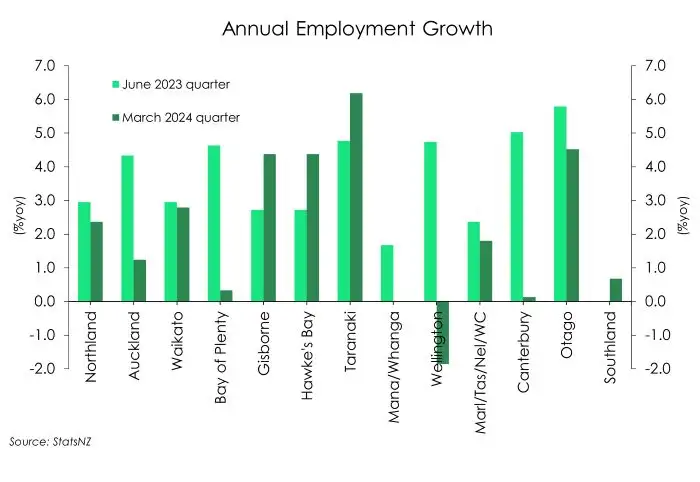

Heat is beginning to leave the labour market because of a cooling in labour demand – quicker in some regions than others. The Kiwi economy fell into recession last year, and the weak undercurrents are beginning to catch up with the labour market. Firms are pumping out less output. And with less output, there’s less demand for workers. It’s snowballing. We’re seeing it in the data, and we’re hearing it from our clients.

Businesses are looking at reducing head count or have done so already. This is a mixture of not replacing those that leave or retire. Some have let underperforming staff go. Others that rely on contractors have vastly reduced their headcount.Phil Whittle, Commercial Growth Manager, Auckland.

When quizzed today, our Kiwibankers scored the labour market an average of 4. It’s just shy of the goldilocks score of a 5, where “work is there for those that are keen”. So, it doesn’t seem too bad – for now. The problem is that the labour market is set to weaken further. A rise in unemployment lags economic activity by about 9 months. So, more layoffs are likely. We expect to see a move towards a score reflecting higher unemployment if surveyed in 6-9 months’ time. All regions have recorded a downtrend in online job ads. Demand for labour is softening.

In terms of actual employment levels, most regions have recorded slower growth than last year but to varying degrees. Employment growth in Wellington stands out amongst the regions. Unlike the rest of the country, employment growth has run backwards in the Capital, with a 2% annual decline. Given the concentration of public sector job cuts in Wellington, the result comes as no surprise. We expect further contraction in employment levels over the coming year. As of March 2024, Wellington’s unemployment rate is sitting at 4.6%, higher than the national rate of 4.3% but below Auckland’s 4.8%. Looking back at peak unemployment during the 2008 GFC, Auckland suffered a much higher rate of unemployment than the national equivalent, and higher still than the Capital. Of course, things may unfold differently this time.

In Auckland, annual employment growth has slowed from 4.5% to just 1.2% - keeping largely in line with the national rate. In the Bay of Plenty, Canterbury and the Manuwatu/Whanganui regions, employment is barely registering growth.

In contrast, annual employment growth in Taranaki accelerated to 6.2% from 4.8% last year. It seems a diversification in its economy and the return of tourism has supported employment in the area. Meanwhile Gisborne and Hawke's Bay are benefiting from ongoing repairs and rebuilding efforts, particularly through the Transport Rebuild East Coast (TREC) initiative, which contributed to the 4.4% rise in employment in both regions.

"Taranaki's economy has traditionally depended on the rural and energy sectors. Recently, however, key industries such as manufacturing, construction, and health care have driven employment growth, creating a more buoyant outlook as the region aims to diversify its economic base." - Jayden Devonshire, Asset Finance Manager, Taranaki.

"TREC remains a big opportunity for the region with a number of businesses awaiting this to get going to drive economic activity…There is still massive amounts of infrastructure work (roading/bridges/fencing etc) required around Gisborne/Hawkes Bay areas post cyclone Gabrielle." Karl Trafford, Commercial Growth Manager, Gisborne/Hawkes Bay.

The return of the Investor

Holding our breaths, waiting for the opportune moment - some first home buyers are still active, seeing the value in buying while the prices are lower.Nadine Davison - Mobile Mortgage Manager, Wellington

"Additionally, some investors have the same thinking, particularly with the pending changes to interest deductibility and the bright line tax circling back around to be in the investors favour. However, for the most part it is still very quiet out there." - Nadine Davison - Mobile Mortgage Manager, Wellington

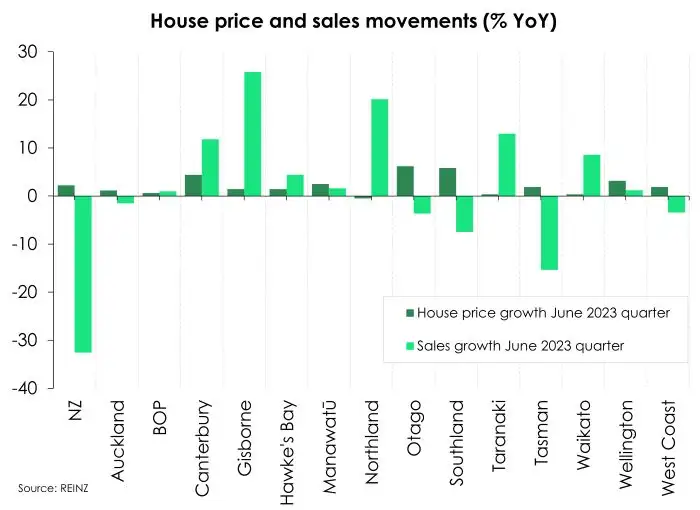

Regional housing markets are lying dormant, for now. Monthly house price moves have been modest, and sales activity is lacking. Since stabilising in early 2023, house prices are up just 1.7% at the national level. The market has also been flooded by new listings which is keeping price growth under pressure.

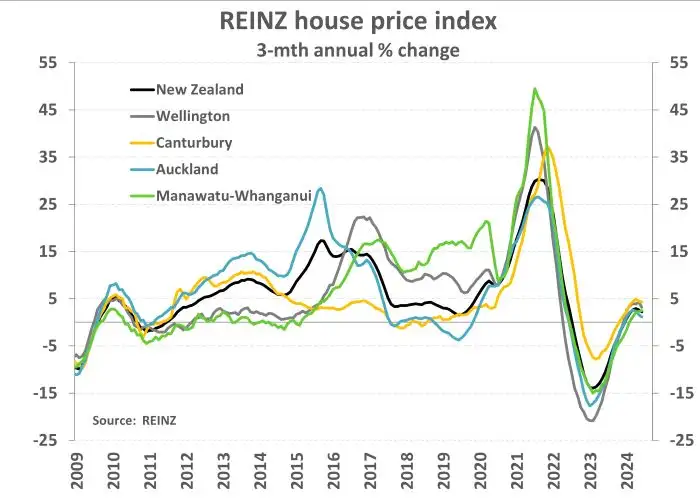

House prices in the two capitals, Auckland and Wellington, suffered the deepest decline during the downturn, with price falls of about 23% and 25% respectively. While regions like Canterbury posted a materially shallower decline of 7.8%. Now in the slow recovery, regional divergences are clear. House prices across Aotearoa have recovered 1.7% since the trough last year. Auckland’s recovery is more sluggish, with house prices up just 1.3% from the bottom. While Canterbury has a bit more bounce in its step, with prices up 4.1% from the trough. Wellington house prices too have lifted near 3% from the bottom, but context is key. For the Windy Capital, house prices are still over 20% below the late-2021 peak. House prices in the Garden City, however, have clawed back to be just 4.7% below peak levels.

In the year ahead though, Wellingtonians will likely be weighing up the impact of layoffs in the public sector. That will have flow-on effects, possibly stalling Wellington’s recovery. Meanwhile, as the biggest beneficiary of the migration boom, Aucklanders will have to deal with a worsening housing shortage. But come rate cuts, the influx of migrants and rapid population growth might well see a faster recovery for the Auckland housing market.

An experience shared by Kiwibankers across the regions is the level of enquiry they are fielding from first home buyers. Whether in Auckland or Otago, the Hawkes’ Bay or Wellington, first home buyers are well represented in the market.

"Steady. We are definitely not looking at 2021 levels of enquiry, however first home buyers appear to be the majority coming across my desk. More so than they have been over the past year or so. I think a lot of buyers within Wellington are starting see house prices stabilise." - Chelsea Ladbrook, Mobile Mortgage Manager, Wellington.

"I like it right now; prices seem a bit more normal than the crazy highs we've seen over the last 2-3 years. It's a great time to be a first home buyer so I hope more of them start looking for bargains in the spring.”- Donna Neville, Mobile Mortgage Manager, Auckland.

The Kiwi housing market is in need of rate relief. The good news is that it’s coming. Interest rates are the key driver of the housing market. And once lowered, we expect to see a more convincing lift in activity and engagement. Regulatory changes should also spark investor interest. The (partial) restoration of interest deductibility and the reduction in the Brightline test favours investors. Come spring, we should see investors return to market with greater confidence.

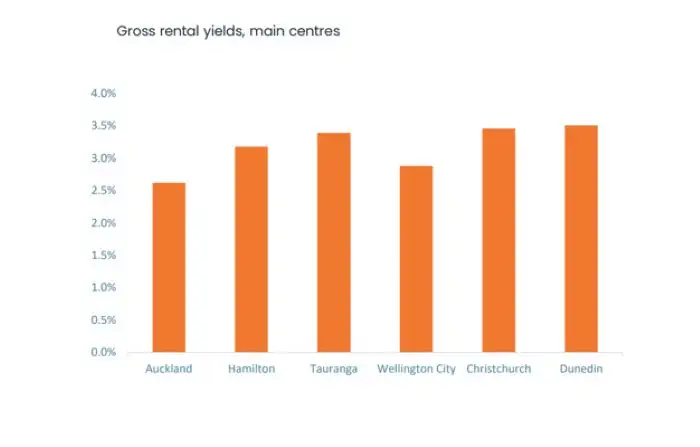

An improvement in rental yields should also pull investors off the sidelines. Rental yields hit a trough of 2.6% in 2022. But the rise in rents has seen yields creep higher. Nationally, gross rental yields are climbing back to pre-pandemic rates, sitting at 3.2% in June. Across the regions, however, the spectrum is wide. Auckland yields are at the lower end of town, at just 2.6%. While rental properties in Christchurch and Dunedin are yielding the highest return of 3.5%. While yields are climbing, they remain historically low.

Rental property is still yielding less than the income returns on some other asset classes, including term deposits. Indeed, rental yields need to better compensate for high mortgage rates (interest deductibility certainly helps). The attraction toward rental property however will strengthen once interest rates have been cut.

Turning to supply, falling house prices combined with building costs blowouts, and a lack of infrastructure have put off many from building. It follows the strong building boom over 2021/22. Now, building consents in most regions remain in a downtrend. Barring Southland and Canterbury, all regions recorded a decline in residential building consents in the three months to May 2024. New dwelling consents fell over 10% in both Auckland and Wellington. Taranaki saw the largest decline with a 46% drop. The South Island fared better with a 46% increase in Southland and 3% rise in Canterbury.

Rough ride for retail

No matter the region, we’ve really felt for retailers over the past couple of years. From the closure of shops during lockdown to an overwhelming surge in demand for goods as online shopping took off. Quickly met with massive delays in stock as an array of supply chain disruptions —droughts, oil price spikes, pirate skirmishes, you name it—left stockrooms sparse. In response, we saw retailers switch from a “just in time” inventory strategy to a “just in case” approach. Only to be met with hoards of stock as the cost-of-living crisis and rampant interest rate hikes quickly took effect. Crashing consumer confidence, depleted disposable incomes, and dwindling demand has led to a total collapse in the industry. It’s hard to find the words for it. But it’s truly been a shocker. Adjusting for inflation, retail sales across the country contracted by 2.6% in the year ending March 2024, marking the sixth consecutive annual decline.

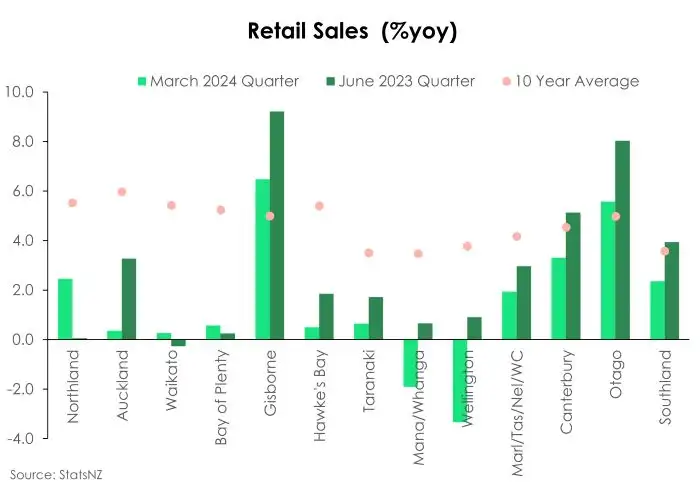

By no surprise, retail spending has been rather dire across the regions. Besides a few outliers, most regions saw consumers tightening their belts another notch from an already constricted waistline. Although, a modest improvement in Kiwi exports and a stabilisation in dairy prices did seem to cause a return in consumer confidence for the Waikato, Northland, and the Bay of plenty as retail sales performed ever so slightly better than last year. Still, it’s no cause for celebration as retail sales in these regions – much like the rest of the country – remain substantially below their average levels over the past decade.

Taking the cake for the worst performing retail sales “growth” is Wellington. Over the year to March, the value of retail sales in Wellington contracted by a significant 3.3%. Unsurprising public sector job cuts are weighing on job security, and in turn, household consumption. Similarly, the Manawatu and Whanganui remain deep in the trenches with the value of retail sales down 1.9% over the year.

Looking to the silver lining however, both Gisborne and Otago have seen stronger than average growth in retail sales. Over the year, the value of retail sales was up 6.5% and 5.6% for Gisborne and Otago respectively. And while this is a slowdown from last year’s levels, it’s likely that some disinflation is contributing to the decline in values. In Gisborne, increased spending on rebuilding, replacing, and refurbishing after Cyclone Gabrielle has helped boost retail sales. Similarly in Otago, the return of international tourists continues to support retail and hospitality. But the slowdown in retail values from last year compared to now will also be in part due to the easing of inflation, as the labour supply has stabilized in the area.

Along with weak demand, a cooling in inflation pressure is another key driver behind the slowdown in retail sales this year. We’re comparing the value of retail sales from year to year. And over the year inflation has gone from running in the 6’s to now in the 3’s. So, with prices for goods decreasing, that’s likely helped contribute to a reduction in total retail spending.

Looking ahead the outlook for retail across the regions is for a rocky road back to recovery. The worst should nearly be over. Upcoming rate cuts and falling inflation should provide some relief to households and their wallets. But a loosening in the labour market and an uptick in unemployment may see retail sales growth depressed for some time longer.

The feel good (or bad) factor

We asked our Kiwibank business banking and mortgage manager colleagues, as well as our friends from NZ Home Loans, for the word on the street. Here’s what they said:

(3/10) And the feeling’s mutual in the Winterless North

“Mixed. There is more cashflow pressure evident, some just working to get through this period, and some customers are reasonably well positioned & looking to engage in projects or expand. – Geoff Yendell, Commercial Manager.

“Certain sectors difficult (no surprises). Construction a concern. Weak pipeline ahead for many with resi construction and infrastructure being slow. Some landmark projects ending CRL, Convention centre or halted (KO/MOE) and there will be a lag for new fast track projects starting. Many have come into the slowdown in a good position though so have a balance sheet or off balance sheet assets to provide support. Tourism businesses have performed well on their core business but asset disposals are tough.” - Matt Smith, Asset Finance Manager.

(3/10) But Auckland feels a warmer 4

“Revenue challenges are currently a significant concern for firms, leading them to diversify revenue streams, hire additional sales representatives, lower prices, or, in the worst case, cut costs and staff. Downsizing has become common. However, staple industries such as supermarkets, certain educational sectors, and exporters are stable and performing well. Labour hire firms are struggling due to an excess of labour compared to available work. Additionally, there is a lack of institutional capital interest in New Zealand, complicating larger business sales. I am hopeful that current DTI rules will enable rate reductions without fear of a housing boom and that any resulting increase in confidence can be channelled into productive business activities, thereby enhancing productivity and GDP per capita.” – Rudi Bansal, Regional Manager.

“It is very mixed I have a number of customers who are doing at least 'Ok' (they tend to be medium/large and well established. Current issues are primarily with the smaller entities particularly - retail & property development. 2 customers in the food industry (one a supplier and one a freight haulage company) have commented on lower levels of activity with the super markets.”- Bryan Davies Commercial Manager

“Businesses are finding it slow going, largely attributed to a fall in business confidence because of high interest rates and the change in government. Businesses who are carrying too much debt, revenues are falling or are experiencing higher costs (often a combination of the above) have significant pressure on their working capital. Tight cashflow leaves little room for investing in P&E or to provision for unforeseen costs.” – Ryan Davidson, Commercial Manager.

“Cautious and reserved. There is a lot of positive activity being undertaken and when that involves bank lending, it is competitive. On the other side of the coin, a lot of businesses are feeling the heat of inflation and delaying CAPEX, reducing staff count and managing lower turnover levels.”- Henry Wright, Commercial Growth Manager.

“Businesses are feeling the pain of higher interest rates and consumers putting their wallets away to focus on being able to meet their higher mortgage payments. Industries can be patchy, with some really struggling and others in the exact same industry still going well.” – Ben Gillies, Commercial Growth Manager.

“It is pretty tough going. We have a higher than usual number of clients that can't make their repayment commitments. We also see an increase for temporary overdraft facilities. However, there are some companies that are doing well, civil engineering companies, earthworks companies that have benefitted from the good weather we had so far this year. Construction, especially small developers, are doing it though at the moment.”- Roeland Jongbloed, Commercial Associate.

(3/10) The Waikato feels a mightier 4

“Dead Flat, high interest rates are impacting heavily across our customer portfolio. New projects have stalled, presales market has gone, developers' confidence has dried up.” – Stephen Edge, Senior Manager, Property Finance.

“Mixed. Construction down, manufacturing solid, retail terrible, food industry unchanged, hospitality dire.”- Eddie Stocks, Commercial Growth Manager.

(3/10) And the feeling’s mixed in the Bay of Plenty

“It’s a mixed bag out there. Some businesses continue to perform well and have used the downturn to reposition and seek new opportunities. Businesses dependant on discretionary spend are still seeing downward pressure as interest rate hikes hit the back pocket. The new home market is still slow, however players in this industry are reporting signs of life through increased enquiry now. There is an underlying feeling that we have seen the worst of the downturn, with optimism for the future now making up more of the conversation.” – Mat Luijken, Commercial Manager.

“Slow - declining sales increased listings and reducing prices. Until interest rates fall combined with lower prices, I see no change to current sales levels. Then DTI may also effect affordability for First home buyers. – Murray Nelmes, Mobile Mortgage Manager.

“Definitely some bargains to be had, property taking a long time to sell and auction rooms clearing approx. 15-20%. I like it right now, prices seem a bit more normal than the crazy highs we've seen over the last 2-3 years. It's a great time to be a first home buyer so I hope more of them start looking for bargains in the spring.” – Donna Neville, Mobile Mortgage Manager.

(4/10) But weather-beaten Gizzy feels a cooler 3

“Continued weather events affecting the region is affecting primary sectors (Mutton/Lamb/beef prices all down. Forestry prices/appetite continue to be volatile with a number of small to medium operators under financial pressure). TREC remains a big opportunity for the region with a number of businesses awaiting this to get going to drive economic activity. The key here will be hopefully they use local contractors. Residential construction remains a strong performer post cyclone especially compared to nationwide. Transport operator’s margins getting squeezed with longer trips out of region due to poor roading etc post cyclone.” – Karl Trafford, Commercial Growth Manager.

(3/10) The Hawke’s Bay feels the same

“Professional services firms (accountants/Lawyers) continue to find it hard to fill vacancies. Continued delays with TREC/Council cyclone recovery work is having a major impact on contracting/civil companies in that space especially for the businesses that borrowed heavily in 2023 to gear up for projects that been delayed/stalled (causing cashflow issues) . There is still massive amounts of infrastructure work (roading/bridges/fencing etc) required around Gisborne/Hawkes Bay areas post cyclone Gabrielle. Tax arrears (customers on arrangements with IRD) remains a big issue for a number of customers. Hawkes bay grape harvest down over 40% in 2024. Housing market remains flat with a number of properties being withdrawn from market not meeting sellers price expectations” – Karl Trafford, Commercial Growth Manager.

“Big variance- some businesses are doing very well but others are struggling. Many people are definitely starting to feel the pinch. More TR requests, IRD arrears etc.” - Lara McRae- Commercial Manager

“The market is definitely much slower. Investor interest has increased with the hope they will secure bargains. First home buyers have also been steady over the first part of this year with vendors appearing to be more motivated to sell/accept offers.” -Dianne Jones, Mobile Mortgage Manager.

(4/10) And Taranaki feels it

“Much like the All Blacks' reliance on at least one Barrett brother, Taranaki's economy has traditionally depended on the rural and energy sectors. Recently, however, key industries such as manufacturing, construction, and health care have driven employment growth, creating a more buoyant outlook as the region aims to diversify its economic base. Events like the Matchbox Twenty show in March and the annual Festival of Lights over the Christmas/New Year period have attracted tourists, bolstering the local economy to levels not seen since pre-COVID times. This trend is expected to continue with an increasing number of cruise ships scheduled for the summer. While cautious optimism prevails around the Taranaki Maunga, there is a sense that the region is starting to rebound. – Jayden Devonshire, Asset Finance Manager.

(3/10) But feels more like a 5 in Manawatū/ Whanganui

“The Manawatu mainstays of; Agriculture, Logistics, Health, and Defence continue to forge ahead and provide certainty for the region. Headwinds facing the tertiary education and service sectors are denting confidence in the community. Within this tepid environment there remain opportunities for businesses to expand their reach in spite of historically high business lending rates.” – Will Warren, Commercial Associate

(2/10) And Wellington feels the icy chill at 3

“Businesses are doing it tough - from a lack of government contracts and work for construction and civil operators to hospitality having less people through their doors, couple that with increasing OPEX and high interest rates. It feels better than it did last year but it's still tough!” – Caitlin Osmond, Commercial Manager

“The business climate is tough. Public sector job cuts & the construction industry is slow.” - Matt Dravitzk, Commercial Associate.

“Frozen, get the defibrillator. Hospo, retail, trucking haulage, property developers are really suffering right now.”- Brett Cunningham, Commercial Manager.

(4/10) Canterbury’s feel-good score is just right at 5

“Business sentiment seems more positive than other parts of the country. Deal flow is increasing with stronger financially positioned businesses going to market with their banking requirements, with strict expectations around low interest rate margins and minimal fees to refinance. Very thorough and drawn out due diligence is being undertaken for any acquisitions.” – Alicia Vickery - Client Director, Corporate Banking.

“Business climate has slowed, things are tighter when it comes to servicing debt but the clients who can make it work in particular to commercial property can find good deals..” – Scott Owen-Burke, Commercial Associate.

“Climate is fairly positive with business that have struggled last several years now starting to recover and see tick up in new opportunities.” - Mark Thompson, Commercial Growth Manager.

(4/10) Tourism has turned up the heat to a 5 in Otago

“While Dunedin Cities overall economic activity fell marginally over the last 12 months, employment rose. Consumer spending was despite a large number of retail vacancies with currently 39 vacant retail shop sites in the main street of the CBD. Accommodation guest nights have steadied to pre covid levels but with a drop off in domestic replaced with increased International. House values up 5% and increased turnover of properties. New residential consents have reduced. Non-residential consents significantly increased in the last 12 months with a large number of construction projects underway.” – Martin Hannagan, Commercial Growth Manager.

“Dunedin appears to be holding steady. And it will continue to improve. First home buyers are well represented in the market and out of town investors are looking to Dunedin as an affordable, lower risk option.” – Leanne Hannah, Mobile Mortgage Manager.

Kiwibank’s Regional Score

Kiwibank’s Regional Score summarises seven economic indicators in 13 regions (see map on the front page). Included in the scores are: population growth, retail sales, employment, house price index, house sales, building consents, and international tourism electronic card transactions. To combine these different measures (e.g., number of people versus values of retail sales) we take annual growth rates of each measure. Growth rates are then standardised relative to their average rate of growth – as some data seem to move to their own beat. We then combine the indicators for each region by taking the average of the various measures. Finally, we convert each average into a score from 1-10 by fitting the data to a normal distribution with a mean of 0.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.