- Another MPR, and another hold. As expected, the RBNZ kept the OCR unchanged at 5.50%. But importantly we finally got a noticeable softening in tone. It was a welcome shift given the total collapse in business confidence last week. Enough is enough.

- The economy is clearly responding to restrictive monetary policy. Economic activity looks likely to contract over Q2 and unemployment is set to rise further. We expect inflation to fall in line, eventually.

- With a softening in language and tone, we, along with all market traders, have grown in confidence that a rate cut should be delivered this year. Market pricing has moved to price in a full 60bps of cuts by November, with the first 25bp cut for October. We agree with the market, but don’t think the RBNZ will deliver as much as priced. Regardless, it’s good news for most businesses and households.

The RBNZ left the cash rate unchanged at 5.5% today, no surprise. But the RBNZ’s language softened, just a touch. And we, along with all market traders, have grown in confidence that a rate cut could be delivered this year – not the end of next year, as the RBNZ forecast in May.

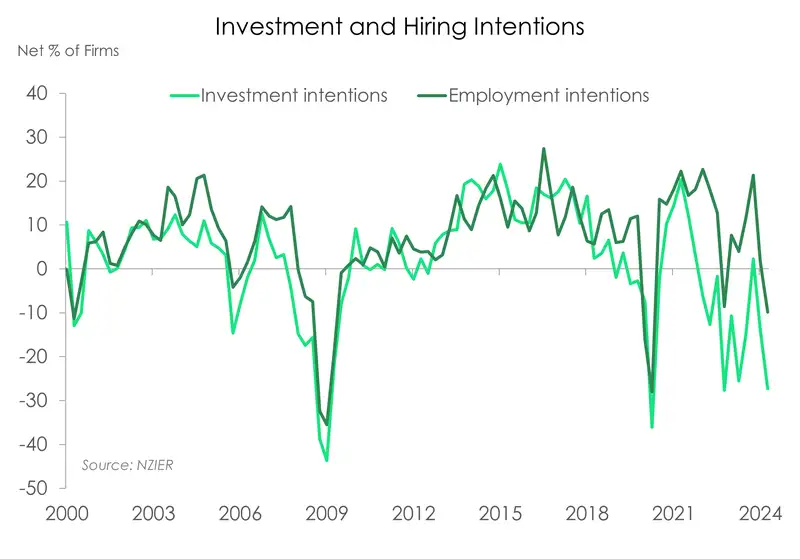

The RBNZ’s softening in tone reflects the collapse in business confidence, and the gallows level of confidence amongst households. The RBNZ referred to firms hiring decisions, with the increase in labour supply, and investment intentions. See our special section on business confidence below.

Another notable change, or tweak, was the reference to inflation piercing below 3%. In the May’24 MPS summary record of meeting - “The Committee noted that annual headline CPI inflation was expected to return to the target band in the December quarter of this year.”

In today’s MPR summary record of meeting – “The Committee is confident that inflation will return to within its 1-3 percent target range over the second half of 2024.”

It doesn’t sound like much, but it opens up the door to rate cuts this year. The change in language reflects (Kiwibank’s forecast of 2.9% in the September quarter) the very high probability that inflation breaks below 3% sooner than their December quarter forecasts. Inflation is falling faster.

This was part of just a 176-word statement. We didn’t know economists could be so succinct…

Moving in the right direction

We’re confident that the next move in rates is down. And we’re growing in conviction that the easing cycle will begin in November – the latest. Because week after week, the data has printed weak. A contraction in June quarter economic activity looks increasingly likely. As several business surveys have shown, downbeat firms are reporting depressed trading activity as high interest rates curb demand. Labour demand indicators have also softened, with firms now looking to decrease headcount. We expect a continued climb in unemployment from here. The economy is clearly responding to restrictive monetary policy. And the longer rates remain restrictive, the greater the economic damage inflicted.

“Members discussed the risk that this may indicate that tight monetary policy is feeding through to domestic demand more strongly than expected.” RBNZ July MPR Summary Record of Meeting

We expect inflation to fall in line, eventually. For now, the persistent strength in domestic price pressures is slowing disinflation. But clear weakness in the economy and a looser labour market should quell services inflation. Amidst soft demand, firms are finding it difficult to raise their prices. A continued cooling in costs pressures, as wage growth weakens, should also reduce the need to raise prices. Taming domestic inflation is key for a successful and sustainable return to 2%.

The stars (data) are aligning for a rate cut before Christmas. The September quarter inflation print will be a decisive one. We currently expect inflation to break below 3% by Q3. And the psychological shift of seeing an inflation rate with a 2%-handle should not be disparaged.

The Q3 inflation print is key for a November cut. But Q2 inflation will determine if the RBNZ will double-down on its dovish-tilt. Two key datapoints to watch in the weeks ahead are:

- June quarter inflation data (17 July): The RBNZ forecasts a fall in the annual inflation rate to 3.6% from 4%. But more important than the headline is what’s driving disinflation. Tradables (imported) inflation has fallen 7.1%pts from its peak to 1.6%. But domestic (non-tradables) inflation is proving a harder nut to crack, falling just 1%pt to 5.8%. The RBNZ expects domestic inflation to ease to 5.3% in Q2. We will finalise our pick later this week.

- June quarter labour market data (07 August): The RBNZ forecasts the unemployment rate rising to 4.6% in Q2 to an eventual peak of 5.1% in 2025. We expect broadly the same. And wage inflation (private sector labour cost index) is expected to fall to 3.6% in the June quarter. An easing in wage growth should see a (needed) slowdown in services inflation.

Volatility on the trading floor

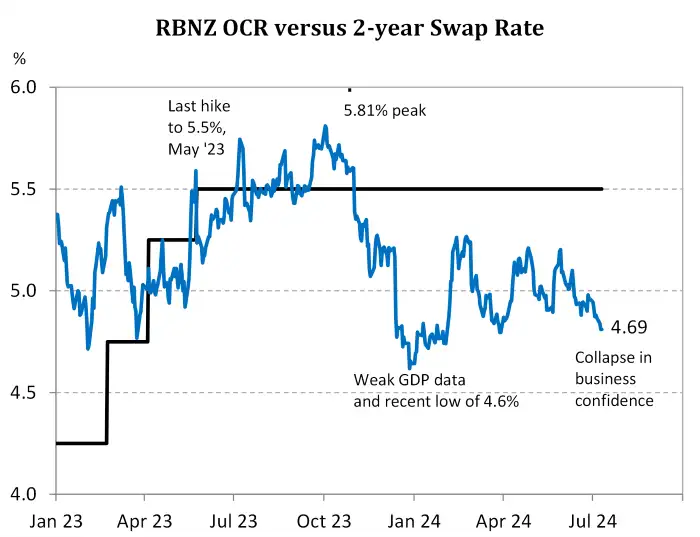

Wholesale interest rates markets remain volatile in anticipation of RBNZ rate cuts. Predicting the exact timing of RBNZ rate cuts is fraught with danger. But we’re confident on direction (down) and magnitude (at least 150bps). And so too are market traders.

The market now has a full 60bp rate cut priced in for November, 4.89%, down from 5.13%, before today’s announcement. That’s a significant move. The pivotal 2-year swap rate, used by banks to hedge 2-year fixed rate mortgage flow, is trading at 4.63% - down 18bps after the RBNZ’s announcement. The 2-year rate is down from the lofty levels of last year, hitting 5.85% in October. The downshift in expectations has pushed the 2-year to a low of 4.60%. And we expect the downdraft to continue into next year, and the next year. As we highlighted in our financial market update: “Soft landing nirvana: “on a plain”. Confidence to cut is key. Interest rates will fall for households and business.” “We forecast the pivotal 2-year swap rate to hold below 5% for the next quarter. And then we expect the 2-year to ease down to 4.0% by year-end. Over 2025, as the RBNZ cuts below 4%, the 2-year will fall towards 3.0%. So we could see a fall in interest rates of around 250bps. Such a move should see similar falls in mortgage and business lending rates, but also term deposit rates. Good news for many, bad news for some.”

We continue to highlight the overly optimistic market pricing for cuts near-term, but the lack of cuts longer-term. We agree with the need for the RBNZ to cut sooner. But we don’t think they will deliver (immediately). What we think they should do, cut in August, and will do, cut in November, are painfully apart. The cash rate, currently 5.5%, is unlikely to be cut before November. We think they need to see the September quarter inflation print (out mid-October). But the market has more a full 50bp cut priced by November. The OIS strip has 4.99% for November – we see 25bps to 5.25%. Further out, the February date has 80bps (4.70%) – down 15bps. We still see 50bps to 5.0% by February. By this time next year, the market has 130bps of cuts priced. Ever so slightly optimistic. Although the economy needs it.

Over the longer term, however, the market is well short of our expectations. The terminal rate is around 3.80%. That’s short of a return to neutral. Neutral is argued to be around 2.5-to-3%. And we expect a move to 3.75% next year, and below 3% in 2026. If we’re right, there’s plenty of room for longer dated interest rates to fall. And fall they will.

In currencies, the RBNZ’s dovish tilt clipped the Kiwi’s wings. The Kiwi dollar has plunged 50pts from 61.30 to around 60.80 at the time of writing. Against the Aussie dollar, the cross has fallen more steeply, from 90.95c before the 2pm decision to ~90.20. The outlook for the Kiwi is still mildly supportive near term, but we expect bigger falls later in the year. We’re picking 0.57c against the greenback. For more on the Kiwi dollar, with commentary from our traders, see: “The Kiwi currency continues to consolidate, with captivating carry.”

Special Topic: Calls for cuts were crystalised by a collapse in confidence. Crikey…

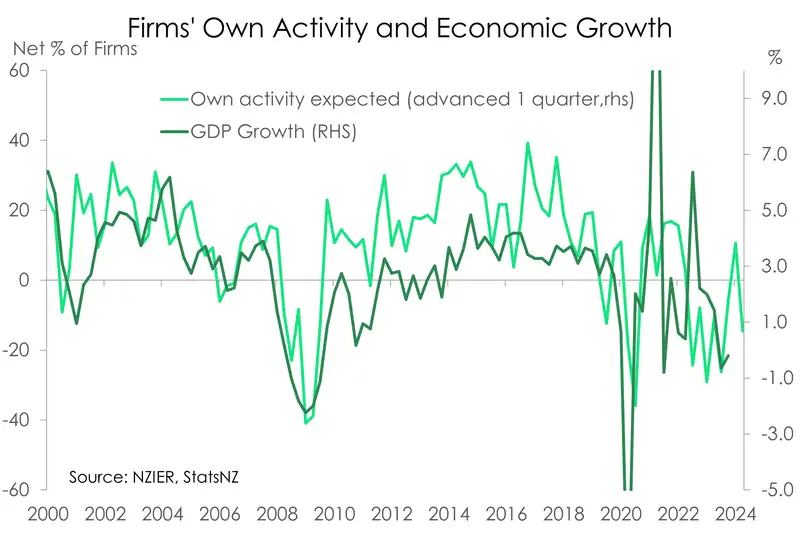

Business confidence deteriorated in the June quarter. High interest rates are weighing on demand, with more businesses seeing a decline in trading activity. Weak-to-miserable growth remains the outlook. Overall, it supports our call for RBNZ rate cuts, sooner rather than later. We’re sticking to our call for cuts to begin in November. Otherwise, we’re likely to see severe economic scarring.

A further deterioration in activity indicators reminds us that we’re not out of the woods yet. A net 25% of firms reported a decline in trading activity, up from 23% last quarter. Given the clear correlation between trading activity and growth, the economy seems to be shaping up for another contraction in the June quarter. Looking ahead, the outlook is not much better, hence our downgraded growth forecasts. As we pointed out in our latest outlook note “Survive ‘til 25: it’s a white-knuckle ride” we now see the economy growing just 0.1% this year. That’s well below the long-term average of 2.5%. The RBNZ has the economy in a chokehold, and the pulse will only strengthen once rates are reduced.

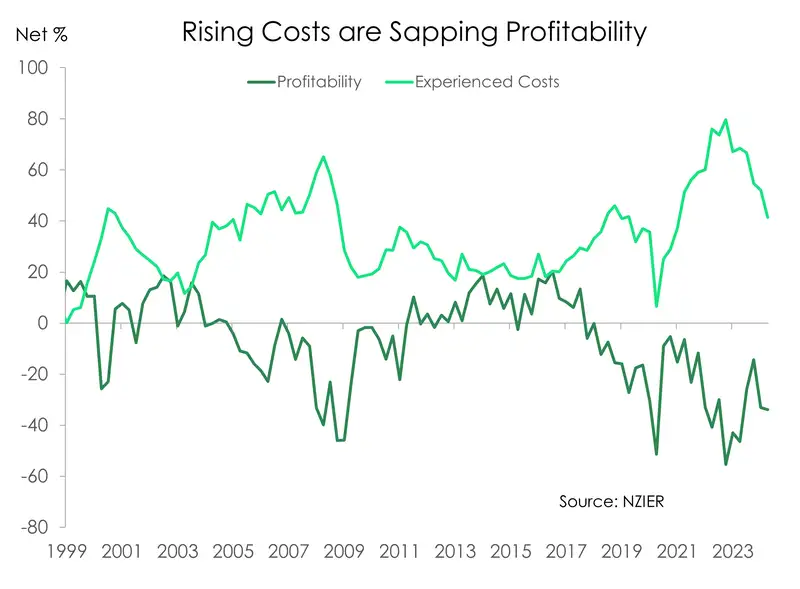

The ”good news” in the report was the fall in experienced ‘costs’. The inflation dragon has been slain, we’re just waiting for it to hit the turf. This is good news for businesses, who have had to deal with rapid inflation in parts. High inflation, coupled with weakening demand, has hurt profitability. And it appears ‘profitability’ is not looking too good. It’s hard to invest for future growth when your profitability is in decline.

When businesses stop investing for the future, that kills growth. When businesses tell us they’re unwilling to invest in more staff, equipment, buildings and all that good stuff that generates growth, well, we take a red pen to our forecasts. Yes, the RBNZ’s actions are designed to rein in business intentions, from the rapid rebound out of Covid. But enough is enough. The risk here is severe economic scarring, from overly restrictive monetary policy.

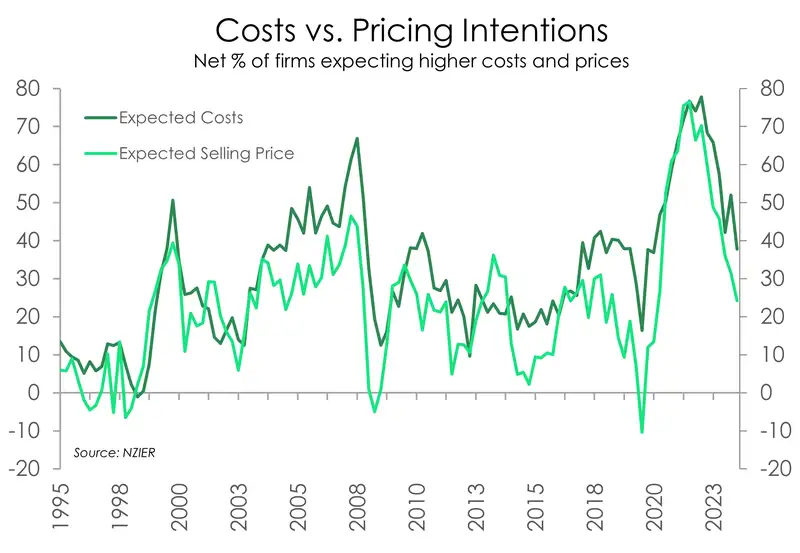

Fewer firms reported increased costs and raised prices over the quarter. A net 42% of firms experienced higher costs, far fewer than the net 49% of firms last quarter and net 70% last year. The improvement is feeding through to an easing in pricing. A net 23% of firms raised prices over the quarter – down from the last print of a net 35%. That’s the lowest since March 2021. And looking ahead, the proportion of firms expecting to raise prices is also shrinking.

RBNZ statement (just 176 words)

“Restrictive monetary policy has significantly reduced consumer price inflation, with the Committee expecting headline inflation to return to within the 1 to 3 percent target range in the second half of this year.

The decline in inflation reflects receding domestic pricing pressures, as well as lower inflation for goods and services imported into New Zealand. Labour market pressures have eased, reflecting cautious hiring decisions by firms and an increased supply of labour. The level of economic activity, including business and consumer investment spending and investment intentions, is consistent with the restrictive monetary stance.

Current and expected government spending will restrain overall spending in the economy. However, the positive impact of the pending tax cuts on private spending is less certain.

Some domestically generated price pressures remain strong. But there are signs inflation persistence will ease in line with the fall in capacity pressures and business pricing intentions.

The Committee agreed that monetary policy will need to remain restrictive. The extent of this restraint will be tempered over time consistent with the expected decline in inflation pressures.”

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.