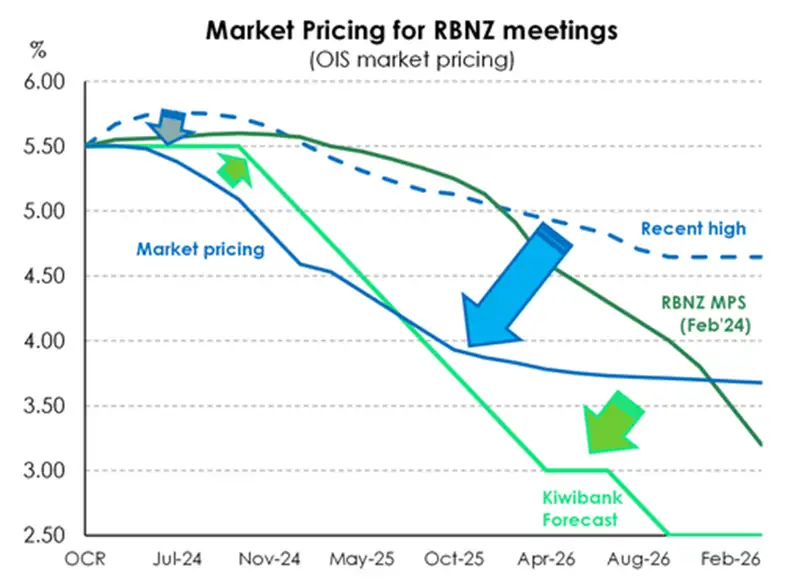

We believe the RBNZ will be in a position to start cutting from November. Financial market traders are betting on more, a lot more, near term. We should all be right on direction, it’s the timing that’s difficult.

Rates markets are factoring in too much, too soon in the near term, but not enough over the medium term. 66bps by November, compares to our 25bps. But the terminal rate around 3.9% in 2026 is well above our expected move to a neutral setting of 2.5-3%.

Soft Landing Nirvana, will we get there?

“It is now time, to make it unclear. To write off lines, that don't make sense.” Nirvana

Soft landing nirvana is a term coined in foreign financial markets. It’s the idea that central banks do just enough, and not too much, to control inflation by nudging the economy back to optimal levels. The state of nirvana would see demand fall back to better match supply, easing price pressures.

Getting inflation back to 2% is seen as the optimal run rate, at least for now. We have seen the heat come out of goods markets and asset markets, like housing. But we need to see a little more heat come out of labour markets, and services. It’s a monumental task. Because using blunt tools to orchestrate a soft landing is not something we see much in history. But it’s one traders are betting on. And our central bank is buying in. Will they get there? We think so. And when they get there, they can unwind restrictive policy, returning to more neutral settings.

We forecast substantial declines in interest rates this year and next. The great unwind of heavy handed hikes will help households and hampered businesses, producing a better outlook. The glass half empty will turn full. 2024 will be a better year than 2023, and 2025 will be better than 2024.

Financial markets are pricing in swift rate cuts. The US Fed is expected to start the rate cutting cycle, followed by the ECB, BoE, BoC, RBA among others, and then the RBNZ. It should be an exciting year. At home, rate cuts will be well received and support asset markets, including housing.

Come as you are, as you were, as inflation fighters

“Take your time, hurry up. Choice is yours, don’t be late. Take a rest, as a friend.” Nirvana

It’s all about inflation and the outlook for central banks. They are inflation fighters through and through. So, at what point will we see a claim of victory? Well, soon. Central banks are growing in confidence.

"We are waiting to become more confident that inflation is moving sustainably to 2%. When we do get that confidence, and we're not far from it, it will be appropriate to begin to dial back the level of restriction so that we don't drive the economy into recession" – Fed Chair J. Powell.

We are making good progress towards our inflation target and we are more confident as a result - but we are not sufficiently confident.Christine Lagarde, ECB President

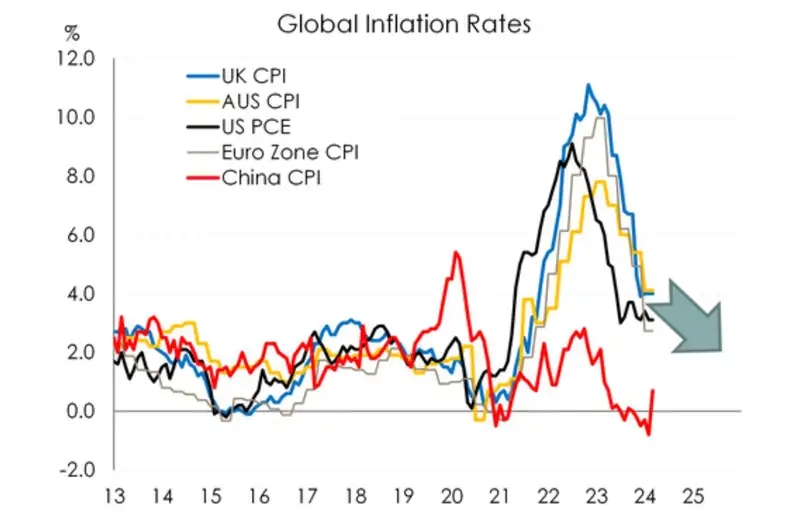

Global growth and inflation rates can be beautifully correlated. So too, are the actions of policymakers. Most in the market follow the Fed, and reflect back to their local central bank. And many central banks, the RBNZ included, will want the Fed to act as icebreaker.

If the Fed leads, then the Kiwi currency should hold up against the greenback, helping to ease imported inflation. We need that sort of help. It is only when the RBNZ comes into action that the Kiwi is likely to depreciate, helping exporters. Indeed, we see the Kiwi holding strong near term, before falling to 57c by year-end.

In bloom: inflation has blossomed, and will wilt

“But he knows not what it means. Knows not what it means. And I say yeah.” Nirvana

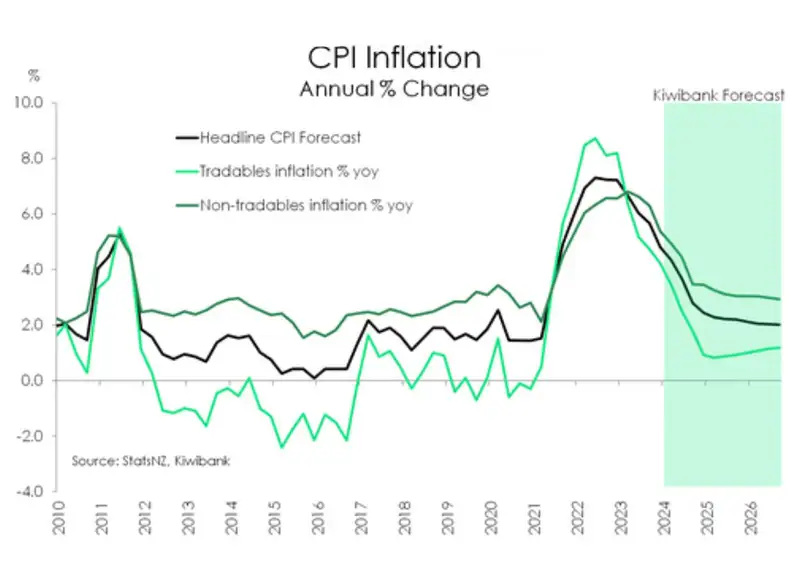

A big part of the disinflationary story stems from offshore. Tradables, or imported, inflation has fallen from a lofty peak of 8.7% in June 2022, to 3%, and we forecast a further fall to under 1% next year. It’s the decline in global inflation rates, especially those in China, that have us gaining confidence.

The complication is in domestically generated inflation. Non-tradable inflation is sticky at 5.9%, down from 6.8%. And the migration boom is having a push-pull effect. More workers, means reduced wage pressure. That helps. But more people also means more strain on creaky infrastructure and more demand for just about everything. Most notably, there has been the lift in rent growth. Rental inflation has risen to 4.5%, high above the circa-3% pre-covid rates. A shortage of housing is to blame.

Ultimately, we forecast inflation falling below 3% this year, and we expect headline to push toward 2% next year. That’s key to any financial market outlook. Effectively, our forecast path for inflation, is a forecast path for policy. And we believe the RBNZ will be in a position to commence cutting in November, not earlier as the market suggests, and possibly later if price pressures persist.

The market is getting ahead of itself near term. But over the medium term, we think the market has more work to do.

Something in the way: cuts are over and underpriced

“And the animals I've trapped have all become my pets.” Nirvana

The animal name calling of central bank officials from bulls to bears, hawks to doves, and maybe a few pigeons, has shifted. Hawks are becoming rarer, and doves more common. It’s a welcome change.

The RBNZ’s decision in February to keep the cash rate unchanged at 5.5%, despite calls from some commentators for hikes,

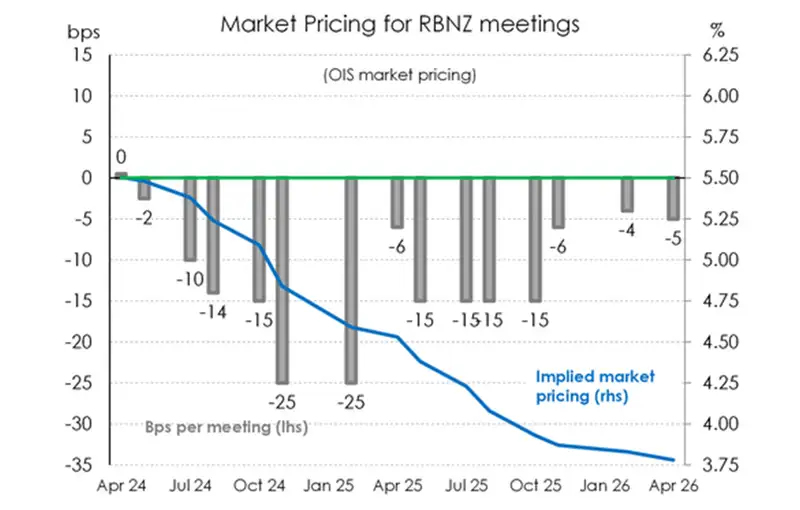

has seen market pricing reverse. Bets on rate hikes have swung to rate cuts. If we look at the OIS (overnight index swap) curve, traders are placing some handsome bets on cuts to come as early as August (-26bps at 5.24%). And there is 66bps of cuts priced by November (at 4.84%). Our call is for the first 25bp cut to come in November, ahead of most commentators, and even we’re surprised at the speed at which cuts are expected.

The chart above plots the basis points per meeting priced out to 2026 (grey bars), alongside the implied cash rate (blue line). Traders have placed 90bps of cuts over the year ahead, to February 2025, implying a cash rate of 4.6%. That’s well ahead of our optimistic estimate of two cuts to 5%, and the RBNZ’s path of unchanged (5.5%). Cuts are expected to continue over 2025 and into 2026. By October next year, there is 156bps priced, with the cash rate going below 4%. Into 2026, expectations flatten off. It’s here we believe there is not enough priced in.

The chart above plots the RBNZ’s OCR track, Kiwibank forecasts, and current market pricing. We, along with the market, are miles ahead of the RBNZ. That’s not unusual. Markets turn much faster than central banks. And market pricing has moved from sitting close to RBNZ estimates, to below our estimates near term (blue arrow). We think the market is getting a little ahead of itself, near term.

The cuts priced into July, and out to February, are likely to be pushed back. If we’re right, (paying) the 6-month to 1-year rates will grind higher, as the RBNZ under-delivers on over-priced cuts. It’s further out where pricing becomes a little light. We forecast 25bp cuts in each meeting from November, until we get back towards neutral – around 2.5-to-3%. From a traders point of view, that’s a front-end flattener. Pay 6-month to receive further out, maybe 3-year.

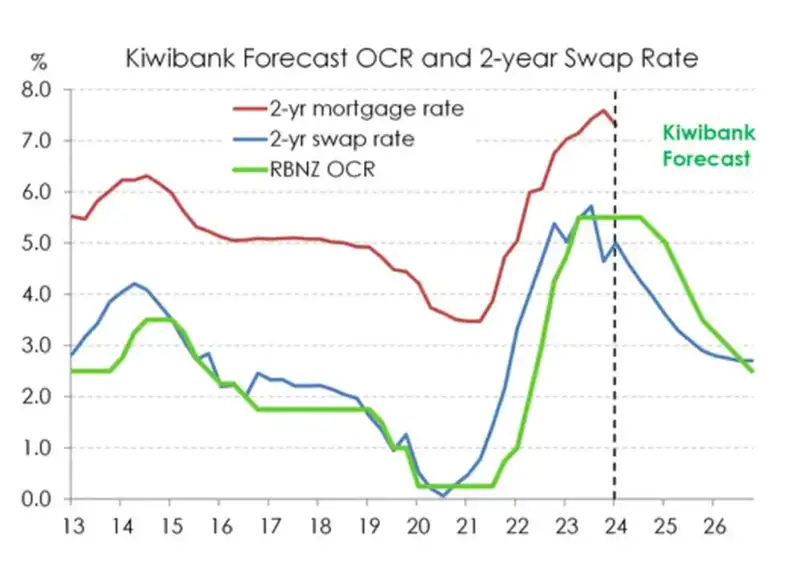

If we’re right, big if, then the interest rate curve should move as follows. We forecast the pivotal 2-year swap rate to hold below 5% for the next quarter. And then we expect the 2-year to ease down to 4.0% by year-end. Over 2025, as the RBNZ cuts below 4%, the 2-year will fall towards 3.0%. So we could see a fall in interest rates of around 250bps. Such a move should see similar falls in mortgage and business lending rates, but also term deposit rates. Good news for many, bad news for some. The lowering of interest rates will provide much needed relief for indebted households and businesses. And it is the expectation of these rate cuts that has us in the more “optimistic” camp when thinking about economic growth, household wellbeing, business expansion, and the recovery of the housing market.

Lounge act: it’s a curve flattener, then steepener

“I can't let you smother me. I'd like to but it couldn't work. Tradin' off and takin' turns, I don't regret a thing.” Nirvana

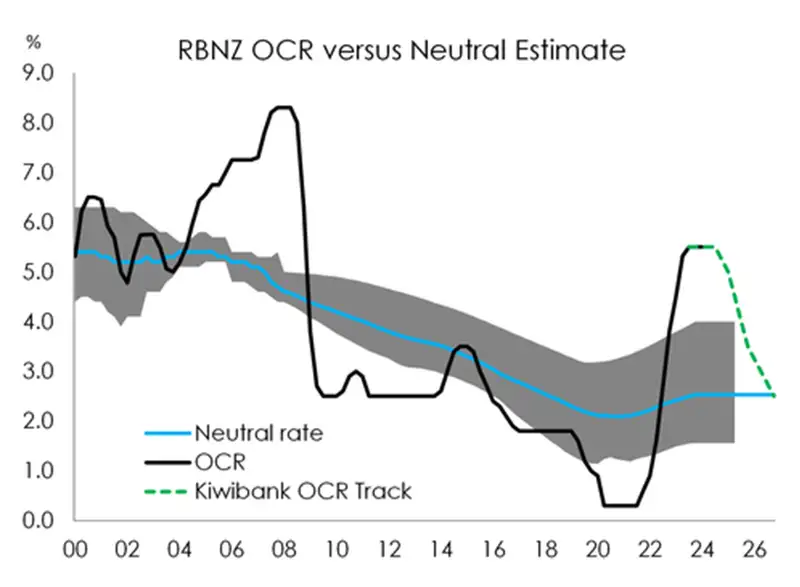

It’s a bit early, but a discussion around the neutral rate will come into focus when the RBNZ actually starts cutting, hopefully later this year. The RBNZ currently have the neutral rate around 3%, and heading back to 2.5% long term. They’ve revised it up from 2.1%. It’s the rate of interest that neither restricts nor stimulates. It’s the goldilocks “just right” rate. And that’s important when considering where the terminal cash rate will (likely) be.

The chart above highlights how restrictive the cash rate is. The heavy-handed hikes into a heated housing market have halted household spending habits. And it hurts. Business lost confidence and investment intentions were deeply negative, until recently. Once the RBNZ starts to cut the cash rate, it’s not just a 25bp decision. It’s a decision to return the cash rate to a more neutral setting. And we think that’s a decision to head back to 3%, probably 2.5%.

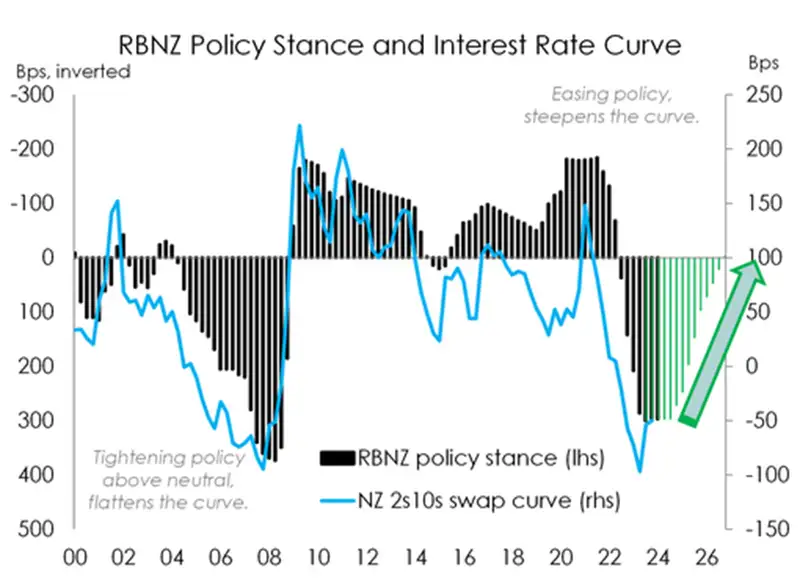

The chart above plots the RBNZ’s (currently restrictive) policy stance, by taking the current cash rate away from the neutral rate (grey bars). The more restrictive monetary policy becomes, the more inverted our wholesale interest rates become. An inverted curve, short term rates rise up above long term rates, points to a significant slowdown in growth, often recession. Historically, an inverted curve forewarns a recession in about 9-to-12 months. Our curve inverted in mid-2022, and the recession started at the end of 2022. And we’re likely to record a double dip contraction in 2023/24.

Cutting the cash rate back to more neutral levels will steepen the yield curve. Short term rates will fall back below long term rates. And these rate cuts will fuel expectations of higher growth to come. That’s the next big move in rates markets. It’s a big bull-steepening.

The fall in wholesale rates has enabled banks to lower lending rates, without an actual cut to the cash rate. Expectations of hikes, turned to cuts, quite rapidly. And these lower wholesale rates, which should continue to fall into 2025 and beyond, will enable further cuts to carded mortgage and business lending rates.

Smells like green spirit: climate change will heat already heated inflation

“With the lights out, it's less dangerous. Here we are now, entertain us.” Nirvana

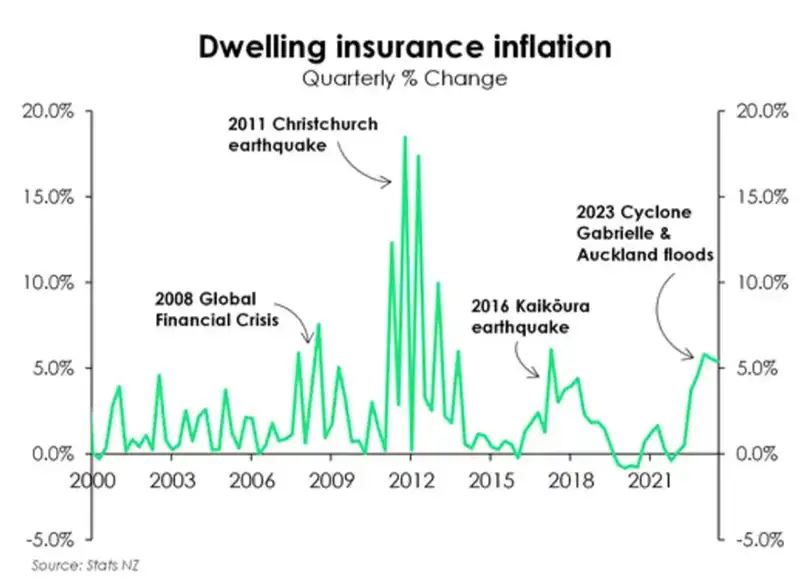

It’s happening now… The impacts of climate change on inflation are multifaceted, and structural. More frequent severe weather events will cause more damage, which will become increasingly expensive to rebuild from and insure against, forcing price hikes in affected industries. The floods and cyclone that ripped through the North Island last year are an unfortunate example. The rebuild cost is estimated at over $13bn, and growing. Lost crops hurt exports by around $1bn, and caused a spike in some food prices (like apples). But there are structural changes. Insurance costs and council rates are being marked higher in response.

Kiwis are paying for decades of underinvestment in key infrastructure. Councils are loaded up to the eyeballs in debt, and the cost of the infrastructure deficit is ballooning. Tackling the Infrastructure NZ guesstimated $200bn in required infrastructure spend, with $100bn in the pipeline, will be inflationary in itself. The more we spend, the more resources we use (from the cost of labour to steel), the more it will cost, and so on.

What’s just as concerning, is the revaluation of insurance. All Kiwis face a sharp increase in insurance premiums due to more frequent, and potentially more devastating climate events. But some will find insurance inhibitive. Properties at risk of rising sea levels, for example, will become uninsurable. Insurers may offer insurance with exclusions, i.e. not for flood. Not helpful. Or insurers will simply refuse to insure some areas. Without insurance, a mortgage may be unattainable. Without the ability to mortgage a property, a devaluation would be inevitable. IAG, the largest insurer, has flagged 20,000 homes at severe risk of flooding. The managed retreat will be both expensive and reduce the stock of housing in a market with a chronic shortage already.

Our point is: what does this mean for monetary policy?

Monetary policy cannot address supply-side problems. And the structural lift in inflation makes targeting 2% in years to come, that much harder. The current war on inflation aside, central banks will have to get a little more creative. Looking through large increases in food prices, insurance premiums, council rates and other costs like (re)building supplies, will prove difficult. We’re (inevitably) going to ask the question, is 2% the right target? No… Targeting 2% in a world of rapidly rising climate related costs, would require a crushing of non-related costs to compensate. Punishing Peter to pay Paul is problematic and painful.

We suspect the conversation will shift towards higher, looser, targets. But not just yet. Because central banks place an appropriately large weight on their credibility. Central banks need to break the inflation beast that reared its ugly head following over-stimulation from Covid. Once the beast is broken, over 2024/25, then we’re going to hear more about climate related inflation into 2026. “Higher for longer” interest rates will make way for “higher for longer” inflation targets.

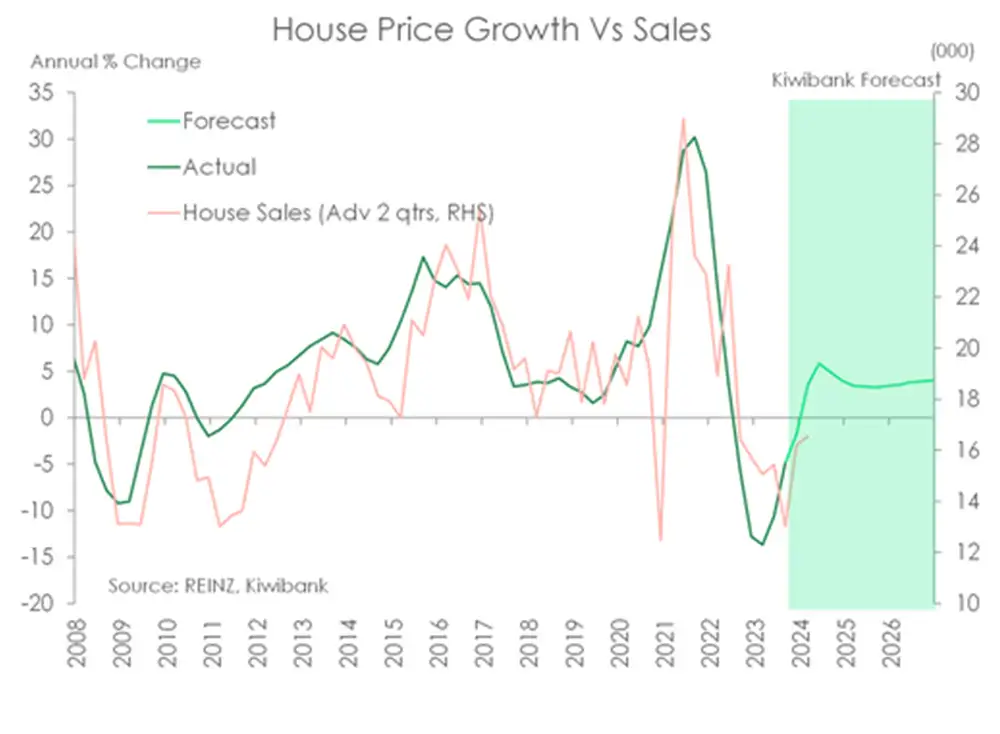

Where did you sleep last night?: the housing market has a chronic shortage

The housing market recorded a bottom around May last year. House prices have lifted, ever so slightly, since. Confidence is improving, with the return of interest deductibility, the shortening of the Brightline test, and the recent reduction in mortgage rates. We expect to see an uplift in activity over the year ahead. And we estimate prices will rise by around 5-to-7%.

There are three drivers of the housing market. Firstly, the outlook for interest rates, with mortgage rates already falling, will support confidence and activity. Secondly, the demand/supply imbalance will worsen. The surge in migration and the loss of dwellings at high risk in climate change will only exacerbate the housing shortage. And finally, residential construction has cooled with the decline in house prices. The number of dwellings coming to market has fallen back from very high levels. The growth in demand, with a migration boom, will once again outstrip supply in coming years. All three drivers point to a strengthening housing market, and price gains.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.