- If we had spent the last 3 months deep in the Himalayan mountains, protecting endangered tigers, we would come out oblivious to market moves. If we were given the headlines only… we would have said the NZD should be in the low 50s (not 60s). Why? Well, a global trade war of such magnitude should hammer a (Kiwi) commodity currency. But it hasn’t.

- A soft USD, highly unusual in such an uncertain world, has many talking about a new world order, and the end of the USD as a reserve currency.

- Whilst the strength in the Kiwi (and Aussie) is surprising given the risks to global trade, we have NOT seen a material move out of USDs. We must acknowledge it may be the beginning of the end. Although the end is unlikely in our lifetimes. We have so much to discuss. It’s fascinating and frightening.

We’re facing into many headwinds. But we’re steadfast in our forecast for the Kiwi. We’re sticking with our call for 60c by year end. Yes, given our brave calls of the past and because the Kiwi is basically oscillating around 60c today, it sounds boring. But boring it is not. We expect to see a typically wide trading range around 60c. If downside risks dominate, we could see the Kiwi dip back below 57c. A move less likely with USD weakness. And then there are the upside risks… low in likelihood, but could see the Kiwi pop into the 62-63c range. So, there’s something for importers and exporters… and both will get their chance to play.

Our forecast for 2026 sees a move in the Kiwi up towards 63c, as the global economy recovers (we hope) with further rate cuts delivered. That’s our central scenario. Upside risks could see 65-67c (our 2027 forecast brought into 2026). But many are suggesting we’re entering a very different world. And it’s the beginning of the USD’s end. That’s hard to trade.

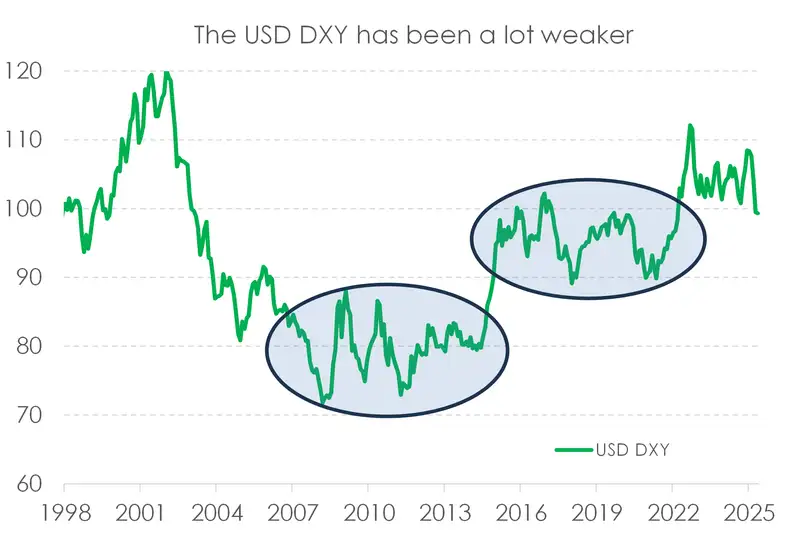

In this new world, searching for safer safe havens, we have seen a rebellious weakening in the USD. But the moves lack conviction. The USD DXY has traded as low as 97.90(ish), taking out the lows of 2023 and ‘24. Is that worrying? Not really. We were much lower over 2020-21, even lower in 2018, and much lower between 2005 and 2014 (averaging close to 80 in the DXY with lows as deep as 70). So, 97 isn’t low. We are not seeing a dumping of dollars. What we are seeing is a mild diversification out of dollars and into assets like gold, currencies like the Euro, and more speculative assets that have the potential to disrupt, namely cryptocurrencies. And it must be said: Trump wants a weaker dollar. MACA: Make America Cheap Again.

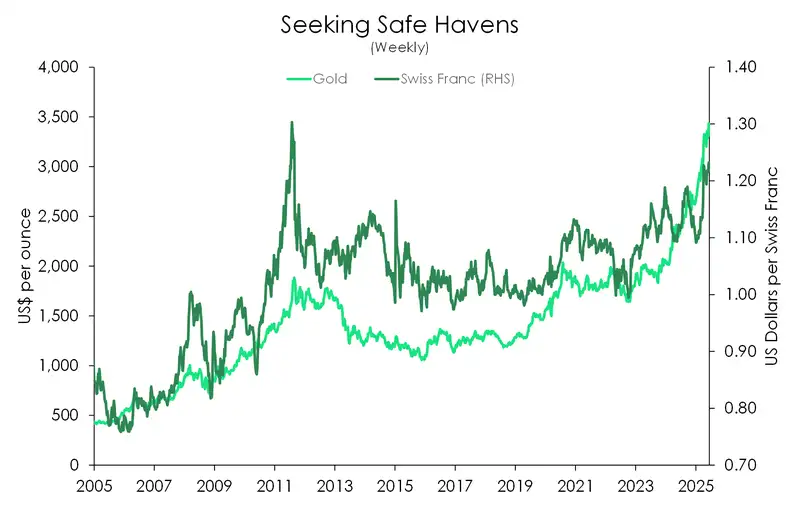

The dollar is still the global reserve. If it was the end of USD dominance, we would see a much more meaningful flight out of US Treasuries. The bond market vigilantes have made much noise, but little movement. The US 10-year yield is stable around 4.4%, a level consistent with the economic environment plus a little term premium. The yield would have to be 100bps higher, around 5.4%, to get us worried, and convinced in de-dollarisation. And such a move out of dollars would see a far more aggressive flight into gold. US$3,365 per ounce sounds high, and it is historically. But if you truly want out of fiat currencies, it should be higher. Although Bitcoin has had a fair run, cryptos would also get more (consistent) interest without USDs.

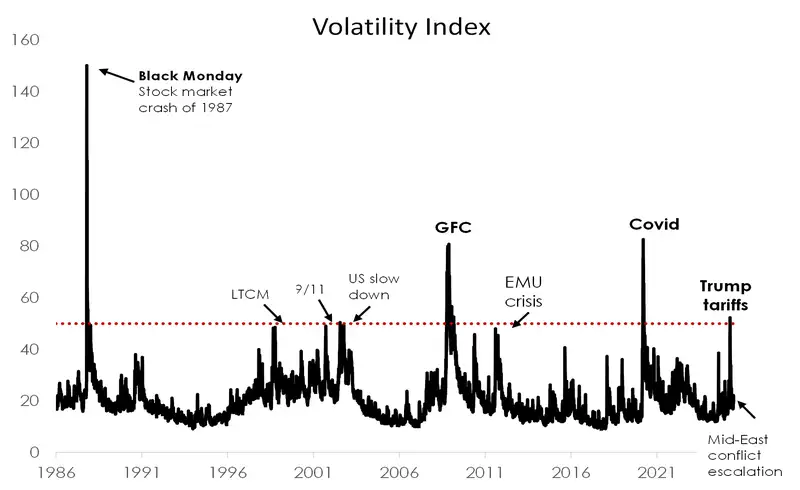

The lack of conviction in the flight to safety trade may also reflect the fact that markets simply care less. Despite (depressing) headlines and daunting dealing room discussions (“are we on the brink of WWIII?”), financial markets are quizzically calm. There was more panic in the fallout of President Trump’s Liberation Day back in April. The VIX – ‘fear index – shot up above 50 for only the fourth time in history. In today’s abnormal times, its back running at ‘normal’ levels.

Getting out of US dollars is harder than you think. The Euro has been an obvious (next largest, next best) option. But we must remind readers that it was only 12-14 years ago when we had the European debt crisis… remember Grexit? Serious strategists at the time were predicting the end of the EU altogether… a view many still think is inevitable without fiscal union. So, the EU has problems. Clearly the Swiss francs and Japanese yen hold dear to the hearts of panicked investors. But they too have issues around the strength of their currencies at times… remember the Swiss dropping its peg in 2015? Now that’s volatility. Yes, Francs always make sense, but to a point. So where else do you go? The British pound is an option… but they received a double notch downgrade in 2016 after Brexit. BRICS? Sure… but they’ve fallen around 30% in the last five years. And we only like the “I” and “C” in BRICS. So do you explore Asia? Yes, but slowly. We think the Chinese Yuan and Indian Rupee will have a much larger role to play in global finance… eventually. But they want weaker currencies.

It’s hard when every country wants a weaker currency to help their exports. We can’t all fall together. Because currency is a relative price… one goes down, the other up… and you need to find another safe home.

When we look at NZDAUD, it’s a cleaner play on the outlook of both countries. The RBA has become more dovish. Late to hike, late to cut – the RBA reduced the cash rate in May for just the second time this cycle. And there’s more coming. As inflation eases, so too should interest rates. Meanwhile, the RBNZ has become more ambiguous. The May statement read dovish, with its projections appropriately downgraded. Similar to our house view, trade uncertainty presents downside risks to both growth and inflation. But communication by RBNZ officials stop short in signalling an easing bias consistent with its outlook. As it turns out, a 3% terminal cash rate by year-end is priced for both economies. What does this all mean for the KiwiAussie cross? More of the same, oscillating closely around 92c.

A certainty amidst high uncertainty: Weaker growth

It’s useful to acknowledge that our currency forecasts flow through from our latest update on the Kiwi economic outlook. The outlook for global growth is cloudier than ever. And as a small open economy, we’re especially vulnerable.

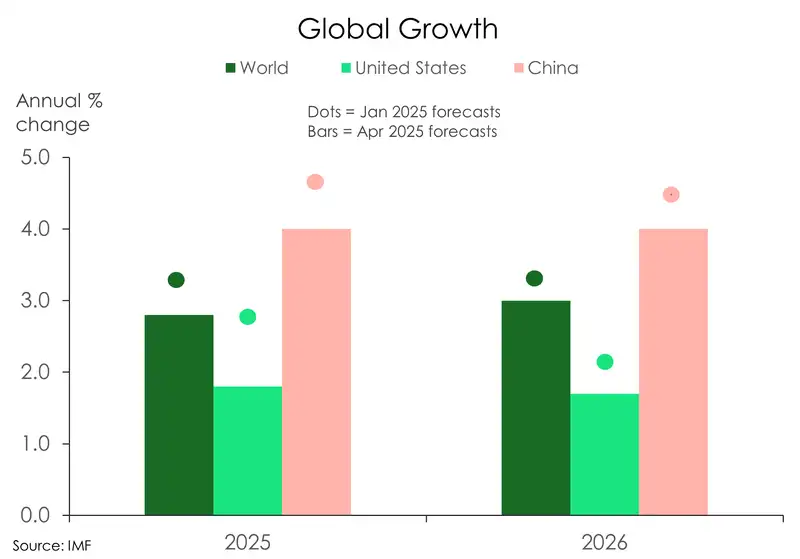

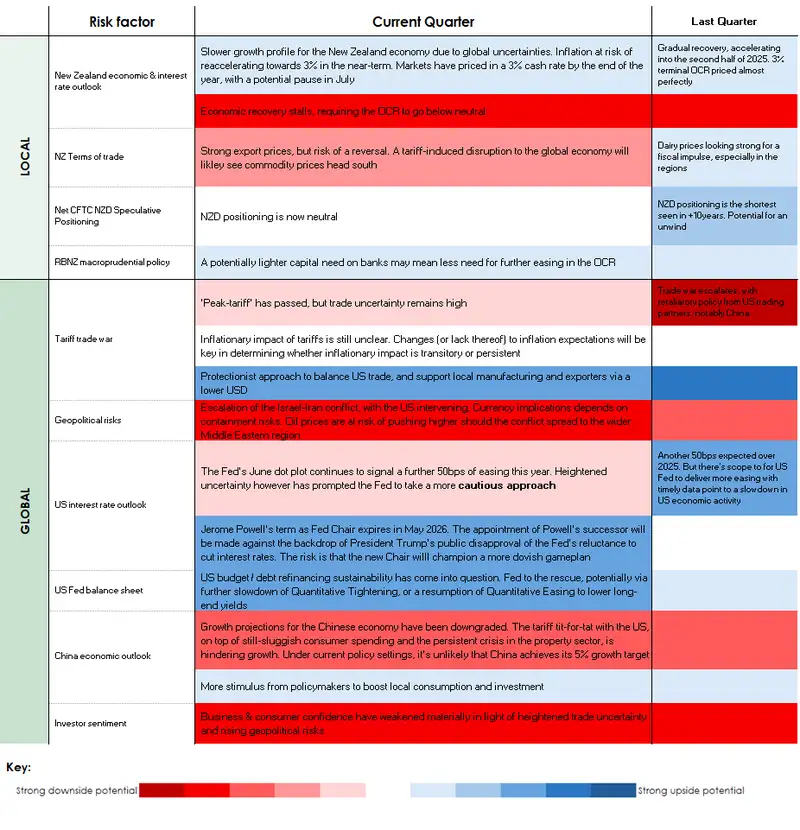

One certainty amidst all the uncertainty, is that a slowdown in global growth is inevitable. The likes of the IMF and OECD have slashed their forecasts, just as we were starting to get back on our feet. The IMF now expects global growth to slow to 2.8% in 2025, down from its earlier estimate of 3.3%. While the OECD also echoes a similar outlook, projecting growth to ease from 3.3% in 2024 to 2.9% in both 2025 and 2026. And growth in world trade volumes has been meaningfully downgraded. The slowdown is widespread, though heavily concentrated in advanced economies. At the heart of tariff turmoil, our second largest export partner the US has had its forecast growth cut by over a full percentage point this year by the IMF. Meanwhile China, our largest trading partner, is set to average growth of 4% over the next two years – falling short of policymakers 5% target.

And all in all, the global slowdown will weigh on demand for Kiwi exports, weakening the recovery for the Kiwi economy, and pushing downside pressure on the Kiwi dollar.

See our latest outlook note “We’ve updated our forecasts, as we think our way through tumultuous times” for more.

Trading view, what’s next?

Mieneke Perniskie – Trader, Financial Markets

In our last tactical, the Kiwi was trading around the 0.5700/0.5750 mark, after a brief run lower to 0.5500 as the world took in the ‘US First policies’ that were about to start becoming reality. The US dollar had been favoured, under the ‘Trump 2.0’ trade, but the worm was starting to turn as the world looked at the US economy under a microscope. Our view was that the Kiwi would trade to 0.6000 by the end of the year as the greenshoots we had been seeing in the NZ economy would continue to flourish. We were right – kind of. While the Kiwi has indeed traded to 0.6088 now, it was far sooner than we expected, and not entirely for the same rationale we initially had. And the ‘Trump 2.0’ trade has been replaced by the ‘TACO’ trade (Trump Always Chickens Out). All jokes aside, the outlook is certainly murkier now. But ultimately our view for the Kiwi is pretty much unchanged. We still think the Kiwi will end the year around the 0.6000 level, but we may have some forays above that in the meantime, as the Kiwi has increasingly been heading towards a key technical level, 0.6125. Should we make a sustained break above this, then the next level is 0.6375. In the meantime however, risk sentiment has soured.

Every time we write up a Tactical, it feels as though there are additional complications to add. And this time is no exception. We have had the tariff trade war situation on our hands since April, which was the main source of uncertainty until recently, and we now have huge concerns around the potential impacts of a wider scale war in the Middle East. The green shoots we were seeing in the NZ economy, appear to have been taken out by an early frost. A lot of the high frequency indicators are pointing to a continuation of struggle in the economy, particularly around business confidence. The easing to the OCR that has been delivered by the RBNZ, has not been enough to push business and consumer sentiment into positive territory. And the RBNZ is keeping an eye on all of the uncertainty. Ordinarily this back drop should have the Kiwi dollar lower. It’s not all doom and gloom though, with commodity prices, like milk and meat prices boosting the revenue streams for primary industries. The interest rate differential between the US and NZ is still a driver for trader’s view on the Kiwi, but it has taken a bit of a back seat (if not the boot) as geo-political and trade concerns hog the limelight.

Since the US ‘Liberation Day’ in April, the US dollar has since taken a bit of a hammering, as the cold realities of tariffs and their potential impacts on the US economy have hit home. There is also the matter of the US fiscal deficit, which shows no signs of having moderation applied, any time soon. This has led the US dollar to lose some footing as a ‘safe haven’ currency, although we think some of the rhetoric about the US Dollar reserve status is overdone in reality. The key factor here is volatility. The Greenback is still somewhat a safe haven, as we have seen with return of some US dollar buying as Middle East tensions grow more and more concerning. But it is no longer assumed. In fact, it feels more likely that some of the US dollar rebound has been driven more by oil prices spiking, and some reduction in US dollar short positioning. Ultimately, we saw a huge surge in uncertainty with the Middle East tensions, and the corresponding lift in the US dollar lacked proportionally.

A key story that we think will start to play out in the coming months, and into 2026, is Fed Chair Jerome Powell’s end of term in May 2026. A new incoming Fed Chair will be announced soon. And given that Trump likes to have, shall we say ‘oversight’...there is the potential that the new Fed Chair will take a more dovish position on interest rates. This could in effect create a ‘Shadow Board’ that the market will take cues from, in addition to the ‘Actual Board’. This scenario could have quite an impact on US rates, and by extension global interest rate views. And it would likely cause more fall out for the US dollar. This scenario could see the Kiwi dollar perform well into the 2026 period, especially if this aligns with the return of real growth to our economy.

But to conclude, uncertainty is the word du jour, but looking through this to next year, there are plenty of opportunities for better days on the horizon. Our view is that the Kiwi has likely bottomed out at 0.5500, and has firm footing at 0.5750/0.5850, even in a heightened risk environment. So therefore 0.6000 is a firm level, with potential further upside on the back of a softer Greenback.

A (non-exhaustive) list of key Kiwi risks

Kiwi crosses in the months ahead

Hamish Wilkinson – Senior Dealer, Financial Markets

NZDUSD (5-year daily)

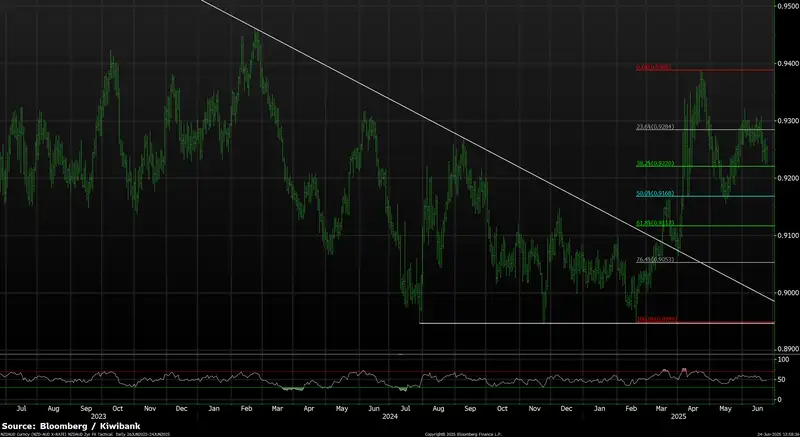

Our full-year 2025 view has been compressed into just one quarter! Immediately following the release of our last update, post-Liberation Day risk-off moves look set to see the demise of the triple bottom low at 55 cents. But as investors began to question the USD's reserve currency status, the broader technical structure held firm – sending the Kiwi rallying roughly 11%, from its early April low of 0.5486 to a mid-June high of 0.6088. A lot has changed fundamentally in FX markets, but from a technical standpoint, the setup feels familiar. Heading into Q3, multi-year downtrend resistance near 0.6150 remains the key hurdle for any sustained upside move. On the downside, while 0.55 remains a target amid the still-intact converging triangle structure, the more neutral fundamental backdrop suggests the broader low in this multi-year NZD/USD decline may already be in place. For the quarter ahead, downside targets include 0.5860, 0.5720, and 0.5500. However, we suggest USD sellers be active on any dips. On the topside, USD buyers should take note of the recent high and the critical resistance zone at 0.6100–0.6150. A clear break of that level opens upside potential toward 0.6375 and 0.6470.

NZDAUD (2-year daily)

In a world full of uncertainty, one tariff appears certain. The initial announcement of a 25% tariff on imported steel and aluminium into the US – and its subsequent hike to 50% – sparked a deeper fallout for the Aussie Dollar through Q2. Meanwhile, robust prices for soft commodities (dairy and meat) have supported the NZD, as concerns mount around Australia’s export outlook. The result: a capitulation through trend resistance at 0.9080, followed by a sharp rally to a late-April high of 0.9388.

Looking ahead, with RBA cash rate expectations now tracking closely with the RBNZ, market pricing implies terminal rates near 3% for both economies by Christmas. From here, NZD/AUD direction will be shaped by subtle differences in economic data and the timing of central bank action.

AUD buyers should keep an eye on resistance levels at 0.9310, 0.9380, and 0.9460. On the downside, key support targets sit at 0.9170, 0.9120, and 0.8950 – all well within range in the current environment.

NZDEUR (2-year daily)

Does the Euro take its moment in time? With questions swirling around the USD’s reserve currency status, the Euro has emerged as a key beneficiary. After crashing to a post-COVID five-year low of 0.4998 in April, NZD/EUR has struggled to regain a clear foothold above 0.5300, despite continued expectations for lower ECB cash rates. Market pricing now implies a terminal ECB rate of 1.65% by Q1 2026, marking an anticipated 130bp negative carry differential to RBNZ OIS pricing over the same timeframe. However, given our view that the RBNZ may need to deliver more easing than what’s currently priced, we expect this negative EUR carry spread to erode through H2 2025. Beyond the recent EUR outperformance against the USD, we see added downside risk for NZD/EUR through the narrowing of interest rate differentials. In the quarter ahead, EUR buyers should watch resistance levels at 0.5240, 0.5310, and 0.5390. On the downside, supports lie at 0.5130 and 0.5000.

NZDGBP (10-year weekly)

The march lower continues. Post-Liberation Day jitters saw NZD/GBP extend its slide to a fresh 10-year low of 0.4281 in Q2. With UK inflation readings persistently above target, the Bank of England has shifted into pause mode, holding rates at 4.25%. The ongoing carry advantage continues to favour GBP over NZD, adding further weight to the cross. Adding fuel to the downside, GBP has benefitted from safe haven inflows as investors reduce exposure to the US Dollar. Technically, the setup still points lower: a retest of the 0.4280 low looks likely, and if domestic dynamics push the RBNZ toward cutting its cash rate to 2.50%, the 2015 low of 0.3941 becomes a live downside target. On the topside, GBP buyers should remain active on rallies, with trend resistance now sitting around 0.4500—a key pivot to watch.

NZDJPY (3-year daily)

Mission Accomplished. Over the past few FX Tactical updates, we’ve maintained a downside target of 80.50, anchored by narrowing rate differentials driven by Bank of Japan tightening and aggressive RBNZ easing. That thesis played out, with NZD/JPY briefly hitting a low of 79.82 last quarter – supported by post-U.S. tariff headlines, where JPY emerged as another key beneficiary. But in a classic case of “you snooze, you lose”, those losses were swiftly unwound as markets questioned the sustainability of higher Japanese interest rates, with concerns building around JGB issuance volumes and the potential need for BOJ intervention to stablise longer term funding costs. While theory tells us that higher real rates typically mean a stronger currency, the transition is rarely linear. In Japan’s case, normalising long-end yields after decades of ultra-low/negative rates presents a delicate fiscal balancing act. Looking into Q3, upside targets sit at 88.95, 89.40, and 91.60. On the preferred downside path, levels to watch include 85.20, 84.40, and a retest of the 80.00 handle.

Glossary

Commodity currencies: include the Kiwi dollar, Aussie dollar, Canadian dollar, Norwegian krone as well as currencies of some developing nations like the Brazilian real. These countries export large amounts of commodities (raw materials like oil, metals and dairy) to the world. And commodity currencies are highly correlated with the global prices of such commodities. When the global economy is strong and demand for commodities is high, commodity prices and thus commodity currencies, tend to outperform. The Aussie and Kiwi dollars are famously known for the sensitivity to good news (risk on) and bad news (risk off).

Interest rate differentials: The difference between the interest rates earnt on two different currencies. New Zealand may offer a significantly higher interest rate than those in Japan, for example, and we see an inflow of Yen into Kiwi dollars (known as the “carry trade”). The widening, and narrowing, of interest rate differentials can have a material impact on capital flows and therefore the exchange rate.

Monetary hawk (hawkish) and Monetary dove (dovish): Characterisations of central bank monetary policy. The hawk is a bird of prey and describes a central bank aggressively raising interest rates to slow economic growth and tame the inflation beast. The peace-loving dove however, reflects a central bank trying to stimulate economic growth by cutting interest rates.

Moving averages: A common method used in technical analysis to smooth out price data by showing the average over various time periods.

Relative Strength Index (RSI): is a popular momentum indicator used by forex traders to measure the speed and change of movements in currencies. It is a useful tool to evaluate overbought or oversold market conditions, in turn signalling whether a currency pair is due a trend reversal or a corrective pullback in price. Low RSI levels indicate oversold conditions (buy signal), while high RSI levels indicate overbought conditions (sell signal).

Reserve currency: The US dollar is the global reserve currency. The dominance of the US dollar in international trade means most central banks and financial institutions hold large amounts. The majority of FX reserves are held in US dollars. The US currency and debt markets are the most liquid in the world. And liquidity (the ability to buy and sell, especially in times of stress) is important. The next most traded currency is the Euro, but it is nowhere near as popular as the US dollar. About 60% of global reserves are held in dollars, with the Euro attracting only 20%, according to the IMF.

Safe haven currencies: A safe haven currency is one where investors hide from extreme market turbulence. The US dollar tops the list of safe haven currencies. But the Yen and Swiss Franc are also beneficiaries of save haven flows (money searching for safety). If a war breaks out tomorrow, we’re likely to see a spike in the USD, Yen, and Swiss Franc. The Kiwi dollar would be hit quite hard, and fall against these three currencies. Gold is also considered to be a safe haven asset during times of stress.

Support and Resistance levels: These are chart levels that appear to limit a currency’s price movement. A support level limits moves to the downside; a resistance level limits moves to the upside.

Terms of trade: The ratio of the prices at which a country sells its exports to the prices it pays for its imports. Put simply, terms of trade is a measure of a country’s purchasing power with the rest of the world. How many imports can be purchased per unit of exports – import bang per export buck. An increase in our terms of trade means New Zealand can purchase more import goods for the same quantity of exports. And a rising terms of trade lifts the incomes of exporters and the businesses and communities that support them.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.