- Business owners are frustrated. They’re frustrated with fiscal (government) policy. They’re even more frustrated with monetary (interest rate) policy. And they’re simply frustrated it’s taking so long to recover. And fair enough. It’s still dark before dawn.

- We’re hearing farmers are doing more on the farm, but not off the farm. So, they’re spending more on maintenance and animal welfare, but they’re not spending in the restaurants or going on holiday. Construction is down, and it’s a real survival of the fittest. There’s (just) enough work to keep the “good tradies” going, especially on the farms, but the “cowboys” are vanishing. It’s Darwinesque.

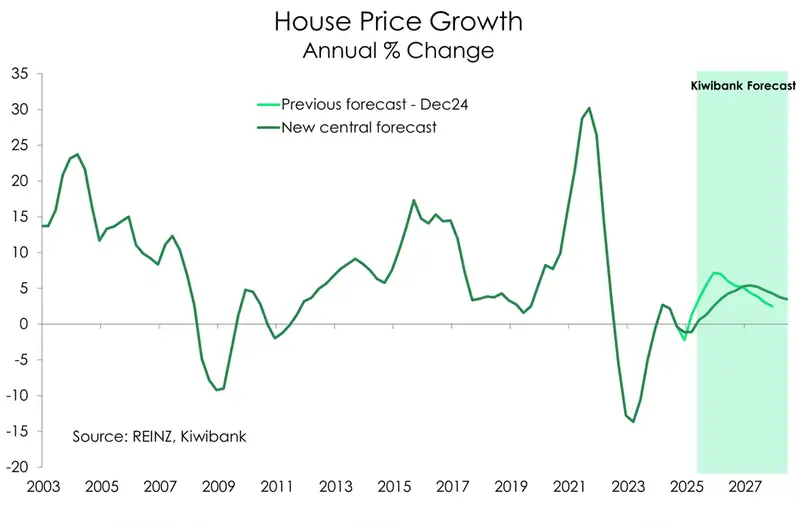

- Mortgage brokers are reporting activity, but not enough to get excited about (just yet). It’s taking much longer than we thought, but confidence is returning, and house prices are likely to rise over 2026. Although we said the same thing last year, and we have been disappointed. The RBNZ has work to do.

- My life as an economist resembles a rolling roadshow. The spike in activity that started in August last year, has continued. Over the year to June 2025, my team of 3 delivered a whopping 242 presentations, of which I did 166. That’s well above our average of 150. And we have great momentum into 2026. It’s a privilege we don’t take for granted. And it’s our greatest strength. We get to hear firsthand how things are evolving across regions and industries.

We have good news… the RBNZ has rolled over, again. But it comes in response to some really bad news. The RBNZ has finally relented to reality and realised they really must remove their restrictive settings… and they now know they need to stimulate. Finally… And following the RBNZ’s change of heart in August, the data went from bad to worse, with a massive contraction in economic output. Now, we’re looking at a bank, with a new incoming Governor, caught well behind the curve. They’ve been far too reactive and shown poor leadership. The economy is languishing as a result. That will change, with deeper rate cuts expected (see The RBNZ need to do more. And more we will get). But for many businesses it has been too little, too late.

Last year’s mantra of “survive ‘til ‘25” turned into we’re “alive in ‘25” and let’s “thrive in ‘25”. We started the year with a positive tone. But here we are now, most of our way through ‘25, and we’ve lost our drive in ‘25. It’s frustrating for many. And we have found ourselves postponing our forecast recovery into next year, with a glimmer of hope held out for a spring/summer bounce.

Now we’re looking to ‘26 for a grand fix, with policymakers in need of a few tricks, despite a year of politics. (that was cringeworthy, I apologise).

Here’s what I said in November last year “After years of struggle, turbulence and volatility, with restrictive policies, we’re delivering good news. And the outlook is simply much brighter. Our forecast recovery next year is unchanged, but our conviction in our call has strengthened. 2025 will be a better year than 2024, and let’s put 2023 behind us and look to 2026 with some vitality.”

Unfortunately, Trump’s tariffs caused much disruption and paralysed some business owners, at least temporarily. The global backdrop worsened and the renewed confidence heading into this year faded away.

Business owners are looking to next year with some confidence. But they remain cautious. Once bitten, twice shy. Talk of investment, even with the Government’s investment boost scheme, is still too early. The investment boost should stimulate investment, eventually, but the lack of demand domestically is hindering the decision to expand. Sabrina shines a light on the investment boost to date, see “Investment Boost: Just a cherry on top for well-placed businesses?” “In response to whether clients were considering taking up the Government’s “Investment Boost”, two thirds of the survey responses were no… It’s what we expected might be the case. Businesses are still holding out for calmer waters, and a brighter outlook. And for those who did report clients taking up the scheme, it seems that most businesses using the incentive were either already planning to invest in capex or were catching up on deferred investment from the past couple of years.”

In a similar view, hiring intentions are muted. When I ask of recruitment plans, more business owners talk about headcount reductions (not expansion). The unemployment rate is still climbing and hours worked is down. No wonder consumer confidence is so low… and demand is soft.

Credit is the oil in the economy’s engine

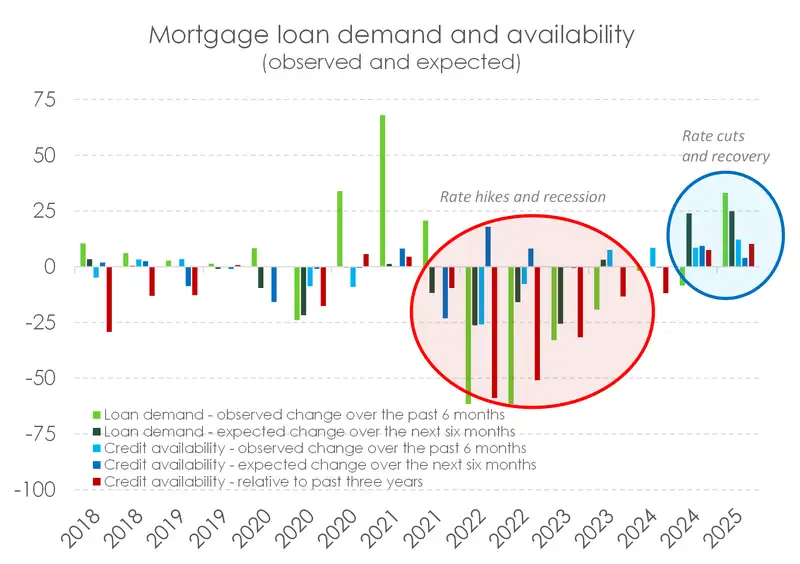

One of the big macroeconomic shocks of the last few years has been the availability of credit. Across the banking system, banks have recorded a contraction in appetite to lend. There’s also been a contraction in appetite for firms to borrow. The evaporation of credit is like watching the oil run out of the economic engine… and it seized up.

Of all business banking over the year to June 2025, lending increased by just $1 billion. That’s not a lot. Over that period, Kiwibank increased its business lending by $1 billion. That’s a large number for Kiwibank. So what were the others doing? Well, they were running down lending in some areas (like agriculture) and lending little amounts elsewhere, without expanding their book. A net zero for lending, that does not help business climate.

The good news, it seems, is that the big banks are back. Appetite is returning. We’re hearing it on the ground. And it’s also showing up in the RBNZ’s mortgage credit conditions chart below. We need an “oil change” to get the economic engine humming once more.

Paint finds its way around the economy

At the Master Painters conference I spoke to a country manager from one of NZ’s largest paint manufacturers (think Dulux or Resene), and he made some interesting observations. Firstly, the Covid period was simply off the charts. Many of us, stuck at home, chose to do a little long overdue maintenance (myself included). It felt great having something to do. During Covid, we assigned a much greater value to our homes. And we did some DIY. Remember the spa and pool shortage? We also went out and purchased pets. Interestingly, the paint manufacturer was well placed to handle the surge, having invested a lot in capacity – plant and machinery – in prior years. And now, they are maintaining pre-Covid levels, despite the recession. He made the comment that “paint tends to follow its way around the economy”. It drops off in some areas and picks up in others. And at the moment, construction has dropped off, while work on the farms and some other areas has picked up. New builds, both residential and commercial, represent one third of paint demand. And it’s down, significantly. But there’s “always money in the economy”. He noted that the recession proof well-heeled wealthy are doing more. Now is the time to do the work, if you can. And the wealthy can. They’re taking advantage of the ability to get trades done. There are minimal waiting periods, and tradies are grateful for the work. And lastly, when it comes to the housing market, paint can be a useful leading indicator. People like to give their property a lick of paint before selling. And new owners like to give their new property a bit of their personality. “Make it our own”. We haven’t seen much of this activity yet.

The Master Painters Conference followed the Master Builders Conference, and I heard a lot about migration… the wrong way. Apprenticeships are an integral part of the business. They even have awards for New Zealand Apprentice of the Year, with hopefuls flying in from around the country. But they’re losing them. Young apprentices are doing their time, and then heading to Australia. Just another source of frustration for local business owners. This should turn around with the economy… but we’ve been waiting for too long already.

For the Master Builders, I heard that now is a great time to get some building done. It was a feeling I’ve heard from a few developers as well. “Now is the time to build… we can give you tighter timelines, without blowouts.. tighter costs, without inflation… and we have ample trades wanting work”. It was only a few years ago when the industry was working above capacity, screaming out for workers, and screaming blue murder when paying for materials. Well now, many materials costs have eased back (a bit), there’s not the same shortage of workers, and time delays are few and far between. Once again, the well-heeled wealthy are taking advantage… getting stuff done… in an industry that has contracted heavily during the downturn.

Exporters are doing well, and it’s not just dairy and meat

Another really insightful conference was the Natural Health Products conference in Christchurch. Of all the crowds, this conference was the most upbeat. I thought it was more to do with Christchurch than anything else. Cantabrians are simply more optimistic, alongside business owners in Otago and Southland. But businesses came to the conference from all around the country. So it can’t be the region, it’s the industry. It’s exporters out of NZ and into Asia in particular. The US is also a high performing market for Kiwi product. No one was worried about the 15% tariff… put it that way. It seems that exporters of natural health products are doing better than most. When I asked the room, of well over 200, if they are investing for growth and/or expanding their workforce, nearly half put their hand up. That compares to around 10-15% in Auckland. In Wellington, I asked a crowd of 200 the same question, and only 8 people put their hand up.

The products themselves were interesting. You “naturally” think of the success of honey, but there is so much more. You may have a vitamin or magic bean you want people to take. You can deliver it a few ways, like in a capsule, a powder or a gummy. And it all depends on your target demographic. Older people prefer capsules, younger people prefer gummies, and those pumping iron prefer powder. It also depends on your export market. Some Asian countries prefer probiotics, others prefer vitamins etc… it’s fascinating. And there are massive markets out there. All of them recognise and love a Kiwi brand.

It’s all about housing

The most “important’ topic we generally cover, is the path of interest rates. That won’t change for a bank economist. We do get a lot of feedback around our call for a lower cash rate. It’s clearly needed for businesses to rebound. Business owners want to know how far rates are falling, and what it means for their business. And it has been unfortunate that the RBNZ has flip-flopped again, as they did last year. Only now they’ve found themselves forced to cut once again in August after having “no bias” in May and mistakenly pausing in July.

Will the housing market actually recover this time? Or is it 2024 all over again?

When talking to frontline lenders, mostly external mortgage advisers, we’re hearing that enquiry is picking up, again. There was some interest following the RBNZ’s renewed rate cutting agenda in August. And we suspect there will be a lot more interest following our forecast 50bp RBNZ cut in October, and another 25bps in November. Check out our podcast episode Just do it: 75bps needed now.

It’s still a waiting game. Again, enquiry is one thing, action is another. And the true litmus test for the housing market is now, in spring. We continue to forecast a lift in house prices… but we have been disappointed to date.

Politics in ‘26 is reducing drive in ‘25

Unfortunately, one of the frequently asked questions I get is around next year’s election. I’m regularly asked if a change in government will worsen the economic outlook. It saddens me that business owners, and more often property investors, are worrying about an election distant on the horizon.

The fear stems from thoughts of extended brightline tests, the removal of interest deductibility, policies that once again inhibit bank appetite, as well as capital gains or wealth taxes. What sounded like an excuse for sitting on one’s hands, especially among property investors, is becoming a self-fulling fear. Part of the problem is an election cycle that is too short. Three years isn’t enough for either side to get things done. Politicians themselves are already thinking about going into campaign mode. Both sides suffer from quarter-by-quarter thinking, unable to think much beyond the next 12 months. Progress is being made on some of the longer-term problems and aspirations… but it’s hard to measure success in the next 12 months.

What do you make of AI and productivity?

Artificial intelligence is no longer a degree in philosophy. It’s a force that will shape all of our lives, and in ways we haven’t thought of.

One question I’m asked in most sessions is around AI, and how it’s going to transform the economy… boosting productivity. I’m firmly of the belief that AI will enhance much of what we do. We’re only truly limited by our imaginations here. The momentous challenges we face around our woeful infrastructure deficit, ageing population, climate change goals and energy security, could all be fixed with the help of improving existing technologies (like solar and wind farms, driverless cars, prefabrication or 3D printing) and new technologies we haven’t thought of yet. It is exciting. Especially when you think of the applications in healthcare for an ageing demographic with a burgeoning healthcare system.

“In conclusion, AI will certainly replace many specific tasks and jobs, but it will also enable humans to focus on higher-value, more complex work. The ultimate impact will depend on how quickly workers can adapt and how effectively society can manage the transition to this new, collaborative work environment.” (this paragraph was generated by AI. So AI is playing along for now… giving me false hope)

When asked about being replaced by AI, I simply point to my charts and say “I use data to draw pretty pictures… I use data to develop views and forecast. I could easily be replaced by AI. And let’s face it, there are some economists out there who could be replaced by a game of Tetris.”

This is your Captain, sorry economist, speaking

There have been a few delays and cancellations of flights. Rather than complain, I took matters into my own hands. Kiwibankers do whatever it takes to get to our client meetings.

It’s not so much an economist’s dream to fly the plane, it’s the captive audience.

All passengers were given an economic briefing, for the full flight, and told that inflation is NOT blowing into a mouthpiece!

Delays or not, AirNZ is still the best airline… and it’s Kiwi. Big thanks to my mate Matt for letting me (pretend to) fly the plane to Wellywood (like a 12-year-old).

I must give a massive shout out to all the business bankers for tirelessly organising each event, and loading every venue with Kiwi business owners.

Looking back at my diary, and I’ve been in a different part of the country for each of the last 10 weeks.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.