- The RBNZ cut the cash rate by 25bps to 5.25% last week. Businesses and households have been eagerly awaiting the relief. More cuts will follow. And last week’s step (in the right direction) was the first of twelve. The RBNZ’s rate cut is a gift that will keep on giving.

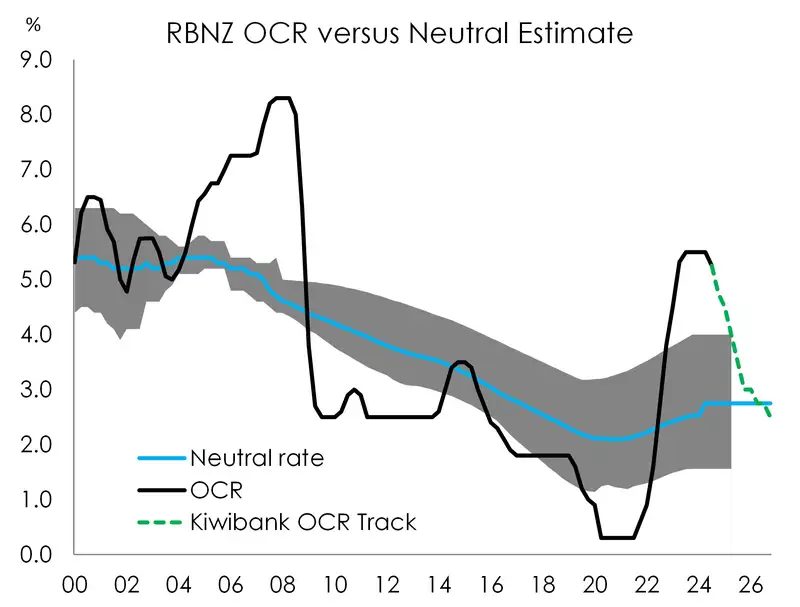

- Now that the RBNZ has started cutting, it’s important to think about the magnitude of cuts to come. We forecast a cutting cycle back to neutral, if not a little below. Neutral is 2.75%, we forecast a 300bp cutting spree to 2.5%.

- Financial markets have reacted well to the news. Wholesale interest rates have continued falling, with very assertive rate cut pricing. And the Kiwi remains (in our minds), in a downward glide path.

What a week. If you’ve somehow missed the news, the Reserve Bank cut the OCR last week for the first time in four years. (See our full review). They did what we didn’t think they’d be comfortable doing, but did anyway. The Governor noted last week’s 25bp cut from 5.5% to 5.25% was a “relatively safe first step”. And that’s important. It’s just the first of many steps. We applaud their confidence to cut. And we expect to see many more.

We’ve spent a lot of time talking (and agonising) about the timing of the first move. And now that it is out of the way, we’re going to spend a lot more time talking about the magnitude. And it’s the magnitude that matters most.

Last week’s move was the first step in a twelve step move. We expect to see twelve 25bp cuts, so 300bps in total. If the RBNZ wants to remove the restrictiveness of interest rates, they need to go back to a neutral (Goldilocks, not to hot , not too cold) setting. That Goldilocks rate is estimated to be around 2.75%, a long way from 5.25%. And we think they’ll need to go a little below, to get things moving. Mortgage rates, business lending rates have a long way to go, south. And so too do savings rates.

It’s the magnitude of rate cuts that impacts business decisions, and household confidence. We forecast, with a much greater degree of confidence, that 2025 will be a better year than 2024, and let’s put 2023 behind us.

As great as the delivery of rate cuts is, we can’t ignore the complete U-turn that the RBNZ has pulled from May. To go from signalling rate hikes to cutting in one forecasting round is a huge shift. And there was a very dramatic downgrade to their forecasts. See our COTW to see the massive revisions.

From the RBNZ’s point of view, they claimed the weakening in high frequency data was one of the main reasons they had the confidence to cut. That’s all well and true. But, and here’s the important part, the high frequency data turned and deteriorated a long time ago. It’s why we have called for much earlier cuts from the RBNZ. Back in May, when they signalled a hike (not a cut) and no chance of a cut until the second half of 2025, we pushed back, and highlighted the downside risks. And we recommended a cut last week as well.

Financial Markets

The comments below were provided by Kiwibank traders. Trader comments may not reflect the view of the research team.

In rates, flow continues to be one-way:

“In Kiwi rates, last week was all about the MPS. The RBNZ, having gained the confidence inflation will be back in the target band this year, cut the OCR by 25bps. In the statement the MPC emphasised a full suite of high frequency indictors all flashing red while at the same time sounding much more sanguine about non-tradable inflation.

The RBNZ endorsed the pre-MPS market pricing with their track. Though, true to form, the market leapfrogged ahead again and is currently pricing another 75bps of further cuts this year. In the press conference Orr said the committee discussed a 50bps move, however that didn’t seem to be indicating that 50bps moves are necessarily likely.

Post the announcement rates have gapped lower with one way flow as offshore participants wanting to get received was exacerbated by a continued lack of pay side flow. This has potential to change in coming weeks as mortgage curve inverts further.

In government bonds we had the announcement of JLMs for syndication of new 2036 line last week. This sets up a launch for either this week or next. Looking ahead main event for global rates will be Powell’s speech at Jackson Hole. Locally we have PSI and retail sales which will be much more closely watched given weight given to second tier data in the MPS.” Matthew Crowder, Balance Sheet Manager – Treasury.

In currencies, the Kiwi dollar holds its ground:

“Despite the about turn from the RBNZ last week, where they dropped the OCR by 25 basis points much sooner than most market participants were expecting, the Kiwi dollar managed to hold onto some solid ground. Largely on the back of so many cuts already being priced in by the market. This was also helped by an improvement in risk sentiment globally, especially towards the end of the week. After opening the week at 0.6008 the Kiwi traded to a high of 0.6083. The MPS saw the Kiwi then fall to an initial low of 0.6007 on Wednesday. We tracked further lower to 0.5980 and then traded back up to 0.6047 to close out the week, as risk sentiment improved. So very much range bound moves across the week. With the Kiwi trading sideways for now, we need some further market moving data to push outside of this range. With the Jackson Hole symposium being held this week, there are potentially some opportunities here. With market participants expecting the Fed to commence their cutting cycle next month, comments from Powell will likely play into that rhetoric, which may see the US dollar a little lower as rate differentials continue to play a role in currency markets. Economic data improvements are also key, as we have seen with the Pound as the UK continues to print solid growth. The Pound is currently the top performer in the G10. We still see the Kiwi eventually lower, as the outlook for our economy continues to be dim. And with the RBNZ now having commenced their cutting cycle, market participants are still potentially over pricing further cuts. We see a more likely trajectory from here being more even handed, with 25bp of cuts per meeting until we hit the terminal rate. However, as the RBNZ have warned, further cuts from here are data dependent. The Kiwi/Aussie cross last week also was very much range bound. The cross opened the week treading water around 0.9135 and managed a brief high of 0.9170 before falling to 0.9060 and then 0.9048 following the MPS. So we are still in the 0.8950-0.9150 range for the time being.” Mieneke Perniskie, Trader - Financial Markets.

Weekly Calendar

- Here at home, the retail trade survey for the June quarter is the data to watch. Retail sales likely declined over the quarter given the higher interst rate environment and weak consumer confidence. Monthly electronic card spend has shown a decline in nominal spend over the quarter which suggests a drop in the volume of sales after adjusting for inflation.

- Across the Tasman, Aussie labour market data is the focus. The update will likely show a lift in employment, up 25k, just enough keep the unemployment rate unchanged at 4.1%. Labour supply continues to rise due to immigration and high levels of participation.

- The FOMC meeting minutes are due out this week and will provide insight on the Committee's appetite for cutting interest rates at next month's meeting. The minutes will likely show members agree that substantial progress has been made on inflation, but there may be disagreement on labour market strength. Overall, the meeting minutes will likely show that at the July meeting, a consensus view that rate cuts are needed, had not yet formed. However, the softer-than-expected labour market data have may since changed the mind of some members.

- The final estimate of Euro-area inflation for July will be released this week. Driven by energy costs, headline inflation climbed to 2.6%yoy from 2.5%yoy. Core inflation was also steady at 2.9%yoy. Services inflation eased only slightly to 4%yoy in July from 4.1%yoy. This week's release will shed more light on the stickiness in services price inflation, which has not sustained a break below 4%. The final release will also provide insight on measures of underlying inflation, including super-core inflation, which have been in a downtrend since the beginning of 2023 but has slowed in recent months.

- Japan inflation for June is due out this week. Core inflation likely accelerated to 2.7%yoy in July from 2.6%yoy. The lift in inflation should be further evidence that the wage increases are continuing to feed into consumer prices. Bank of Japan Governor Ueda is due to speak in parliament on the same day the inflation data is released.

- Central bankers will gather this week (Aug 22-24) at the annual Jackson Hole Symposium. This year, the title of the symposium is "Reassessing the Effectiveness and Transmission of Monetary Policy". US Fed Chair Jerome Powell is scheduled to speak, and may use it as an opportunity to signal a rate cut next month.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.