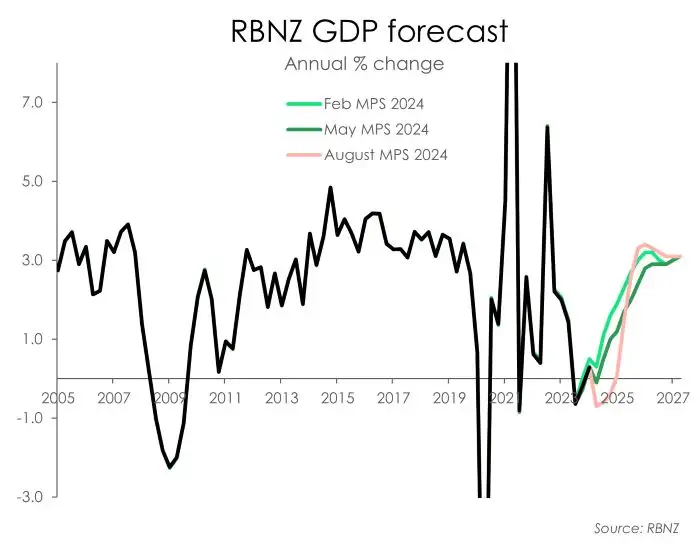

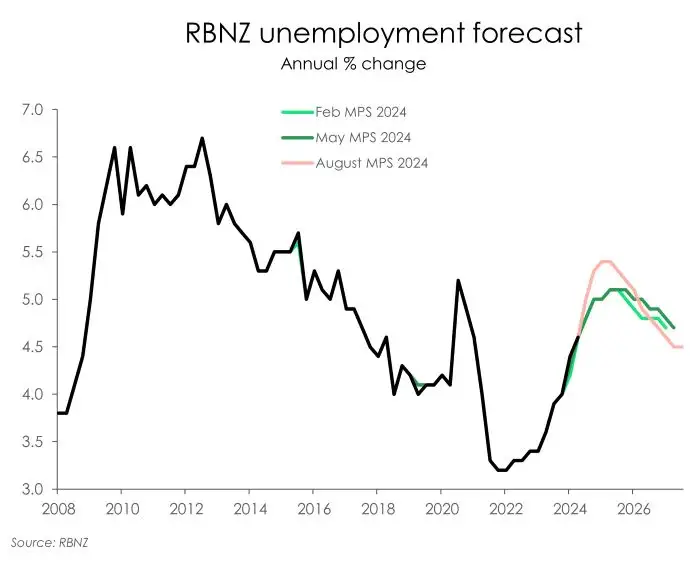

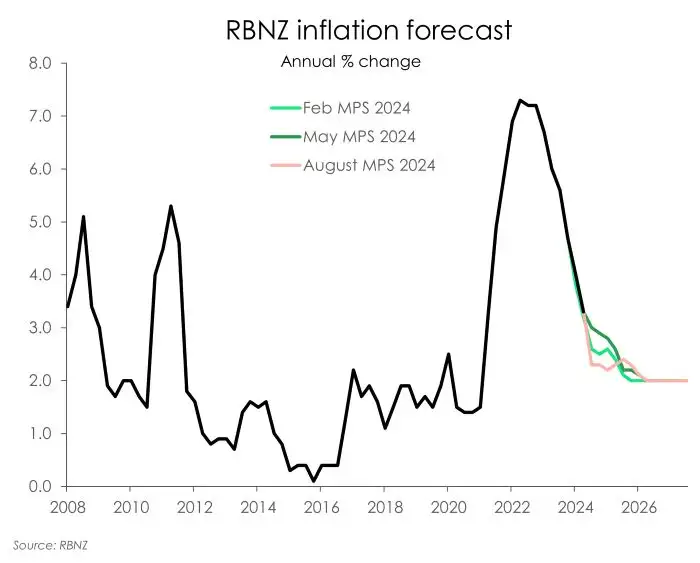

The RBNZ have argued that there weren’t significant changes to their forecasts and outlook for the Kiwi economy. But these charts comparing their own previous forecasts show otherwise.

Central to their updated view is the downward revision to their estimations of the output gap – the extent to which demand is running above or below sustainable supply. The RBNZ now assumes increased spare capacity in the economy, meaning less inflation pressure, compared to their thinking back in May.

Previously, the RBNZ forecasted moderate economic growth with the economy expanding 1% over 2024. However, that view is proving optimistic. High-frequency indicators have been signalling a slowdown in activity for some time now. And the RBNZ has updated its outlook accordingly. A mid-year recession is now expected, with the economy seen contracting 0.5% and 0.2% in the June and September quarter respectively. The Kiwi economy is forecast to shrink 0.4% this year. Looking beyond, the economy is expected to resume growing circa 3% on an annual basis.

Along with a deteriorating economic outlook, the unemployment rate is forecast to peak higher than previously expected. The unemployment rate is seen exceeding 5% by year-end, and peaking at 5.4% early next year – 0.3%pts above the previous peak – consistent with a declining output gap. The loosening in the labour market has so far been driven by an increase in labour supply as migration surged over 2023. But early indicators point to a slowing in employment growth, which will drive further loosening in the labour market. Along with a softer labour market outlook, wage inflation is now forecast to moderate faster than previously expected.

But the biggest surprise in the RBNZ’s fresh set of forecasts surrounded the inflation outlook. Inflation is expected to print at 2.3% in the current (September) quarter, a big downward revision from the May forecast of 3%. The rapid deceleration in imported price growth is expected to strengthen, with tradables falling into deflationary territory. On the domestic inflation side, the persistent strength in some components that are relatively insensitive to interest rates – e.g. council rates, insurance, utilities – is keeping inflation from hitting 2% until mid-2026. Nonetheless, domestic inflation is seen to decline slightly faster given the RBNZ’s revised assumptions around a smaller output gap.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.