Key points

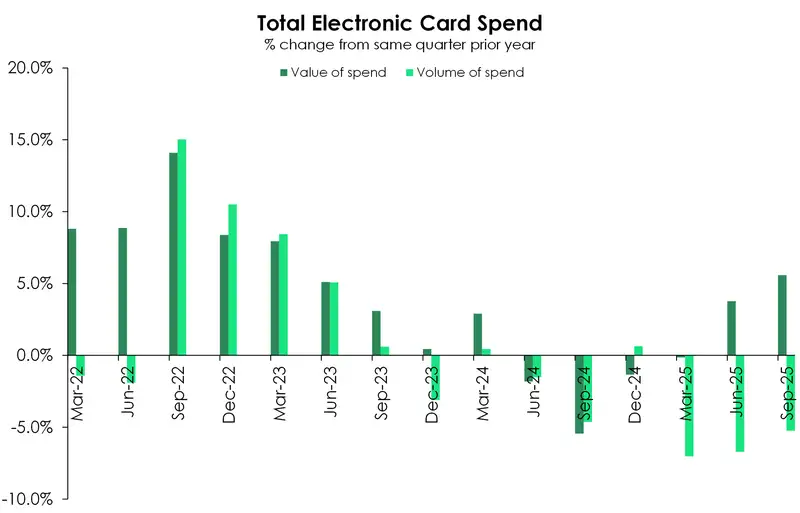

- According to Kiwibank electronic card data, total dollars spent lifted 5.6% over the September quarter compared to last year’s levels. However, the volume of transactions declined 5.2%. Fuelled by historically low interest rates and “lockdown savings”, consumer spending was strongest in 2022. Since then, spending has gently corrected lower.

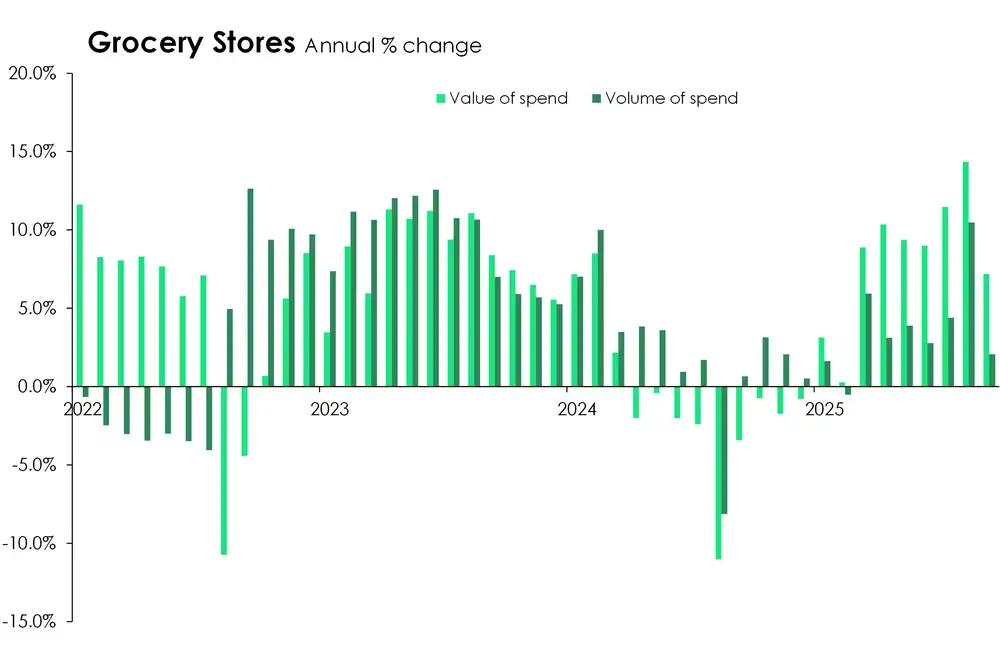

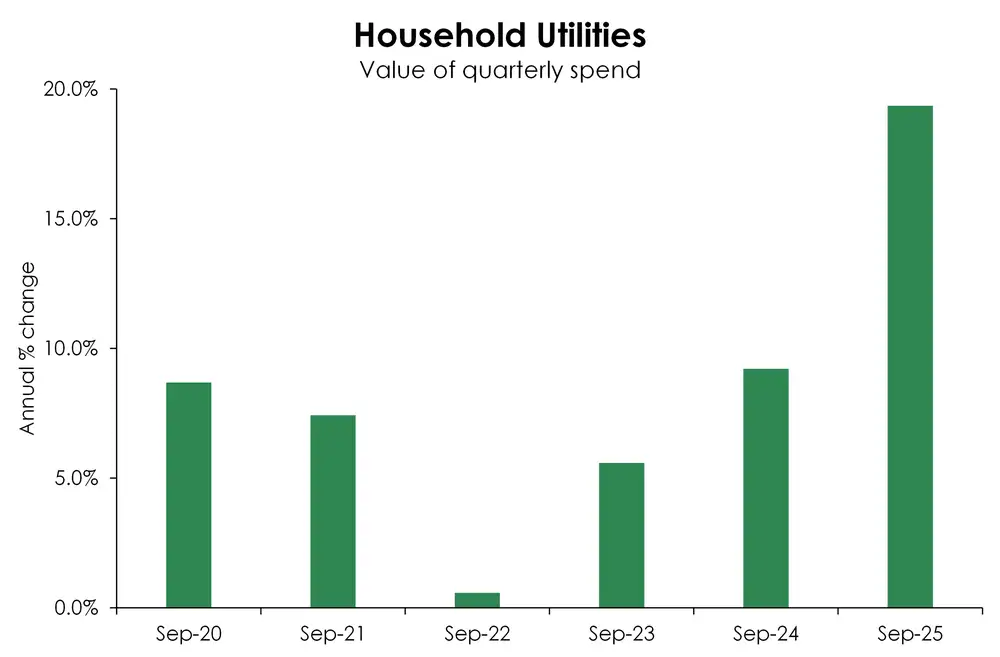

- Beneath the headline, households are clearly prioritising costlier essential goods and services over durables – despite the discounted prices. Both the value and volume of transactions made at supermarkets increased from last year. But the growth in dollars spent is double the pace of growth in the number of transactions. With food prices up 5% from last year, it’s clear that a price effect is still working behind the scenes. Similarly, the value of household utility-related transactions have also tracked higher.

- Household balance sheets have come under significant pressure over the last few years. Financial conditions have been tight, with high consumer prices and expensive credit. Household disposable incomes have been squeezed. And as households have cut back on spending, it’s been discretionary items culled first. More discretionary goods and services are getting squeezed. Although, encouraging signs are emerging within housing-related spend.

- Despite continued softness in discretionary spending, retailers remain optimistic for a pickup in activity over the fast-approaching holiday season. According to NZIER’s latest Quarterly Survey of Business Opinion, nearly a third of retailors expect an improvement in economic conditions over the current December quarter. Major upcoming spending festivities, from Black Friday and Cyber Monday to Christmas and Boxing Day, are no doubt fueling these hopes. And it’s a hope we’re holding out for too. Households are still grappling with a number of challenges, like the rising costs of essentials and lingering job insecurity. But the recent falls in interest rates should help free up disposable incomes and support a recovery in consumption.

Sticking to the bare necessities

Trips to the grocery store were up 5% over the September quarter compared to last year. But trolley carts are 11.2% more expensive. We’re paying more for less. The value per transaction is up 5.1% compared to last year. The same is true at the butchers, with 16% more dollars spent compared to last year, while volumes lifted by a lesser magnitude.

It’s not just food that’s eating into household budgets. So too are higher council rates and rising energy bills. Altogether, the dollars spent on household utilities has increased an eye-watering 19.3% compared to last year.

Cafés stay steady…

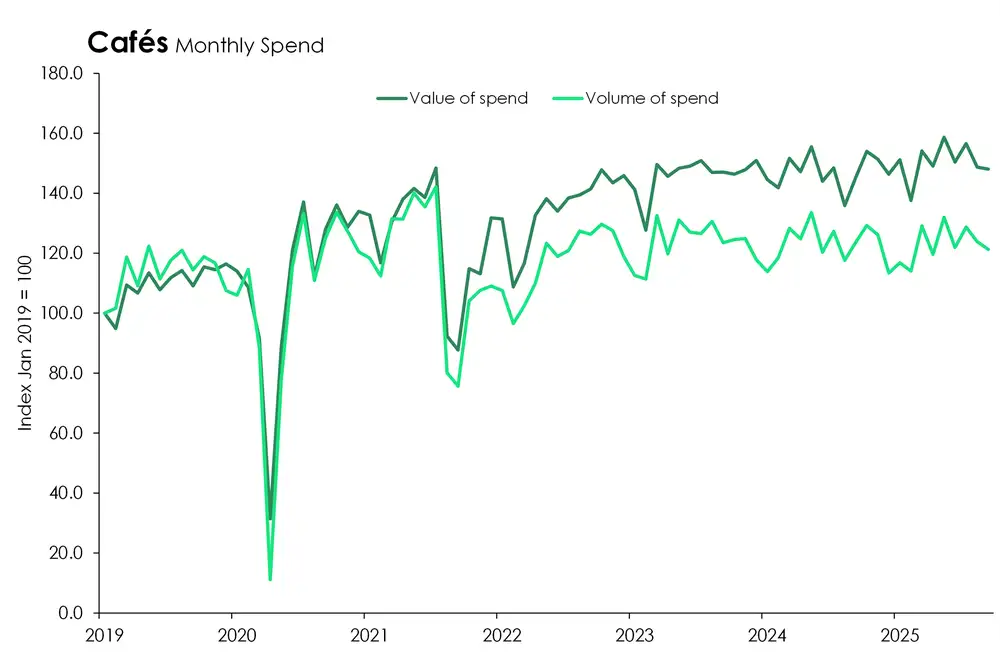

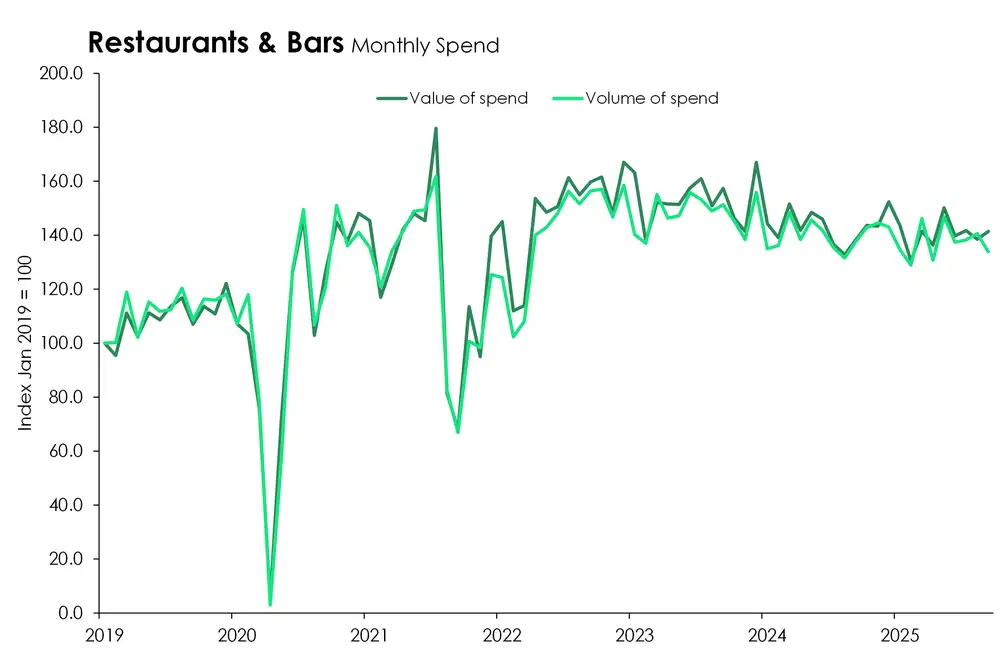

The impact of higher food prices is having an impact on the hospitality scene. The number of transactions at cafés have remained relatively steady this year. But the value has tracked higher. Compared to last year, dollars spent at cafés is up 5.5%, while volumes are up just 1.4%. Similarly, the value of spend at restaurants & bars is up 3.4% compared to a year ago, while the volume of spend is up just 2.1%.

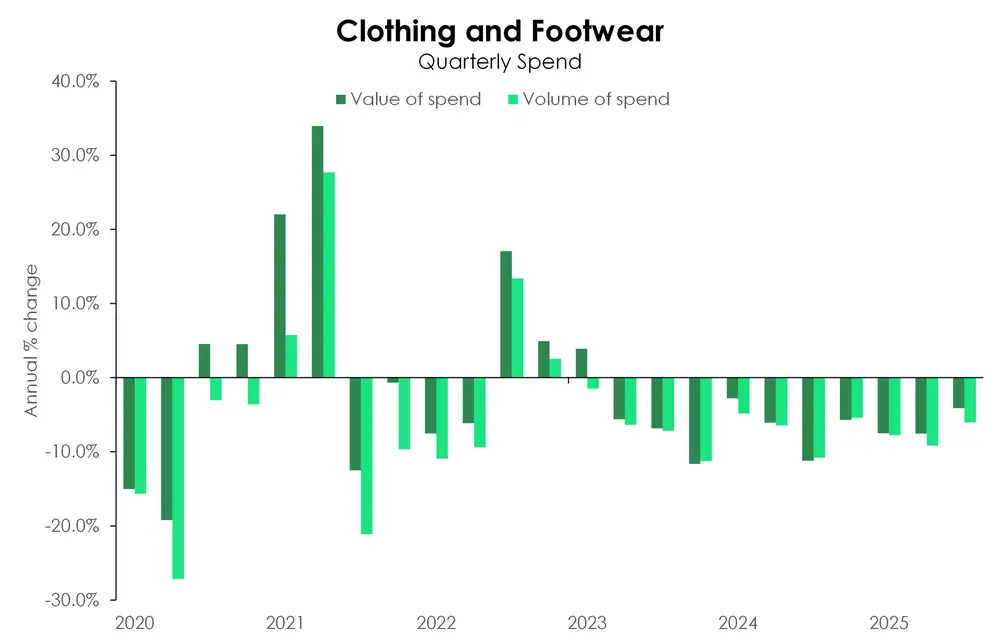

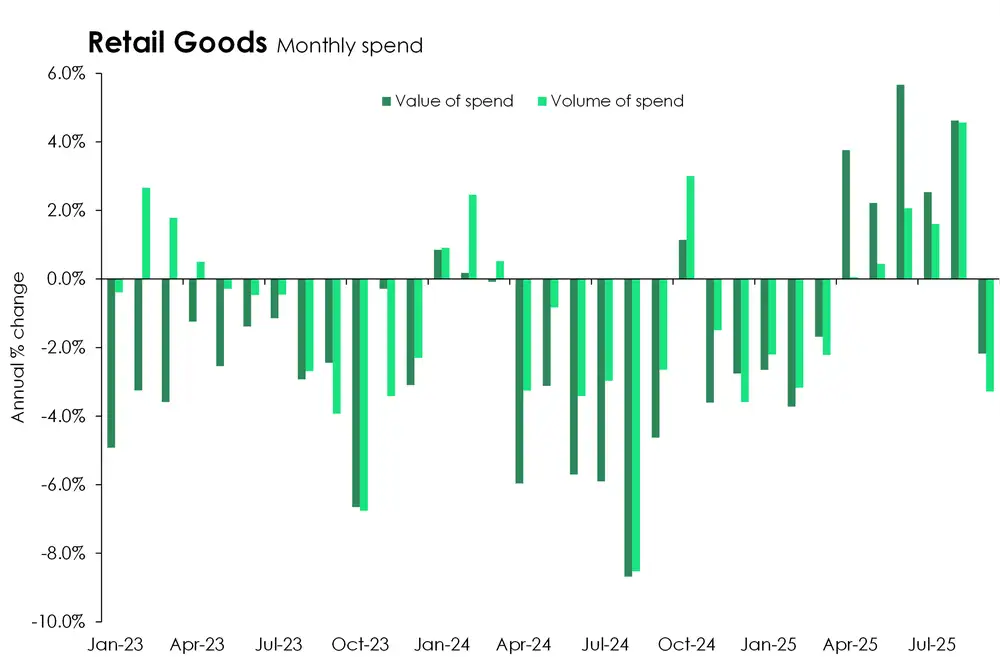

…but retail takes a hit

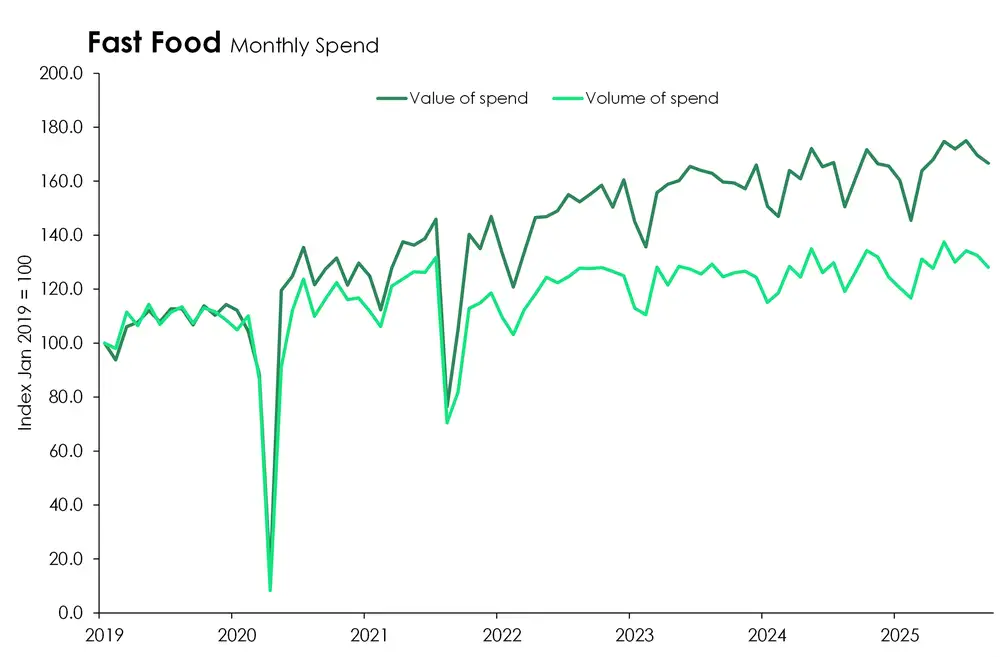

Durable consumer goods have faced heavy price discounting. Despite this, demand so far has been weak. Clothing and footwear spend is down 4.1% in dollar terms compared to last year. Meanwhile the volume of transactions posted an even deeper decline of 6.1%. Overall, the number of transactions of retail goods rose just 0.9% over the September quarter, compared to a year ago.

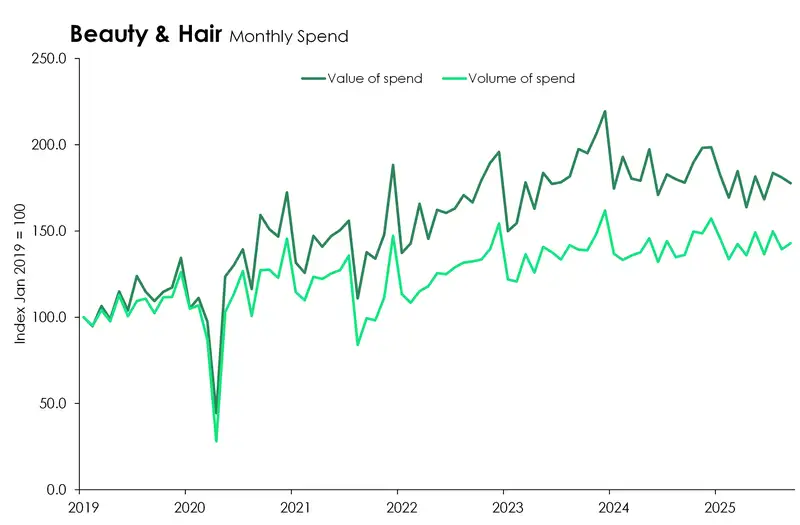

Beauty comes at a cost, and we’re willing to pay

When it comes to all things beauty and hair, a chasm has grown between the value and volume of spend. Dollars spent have tracked meaningfully higher over the last few years. As a service industry, the rise in wages no doubt explains the move. But scarred by DIY haircuts during lockdown, it seems that Kiwi are (wisely) keeping their hands off the home shears. Instead, households are willing to pay more for a professional cut. That is, the volume of spend has remained relatively stable post-Covid, despite having to fork out a bit more.

Discounts here, there and everywhere

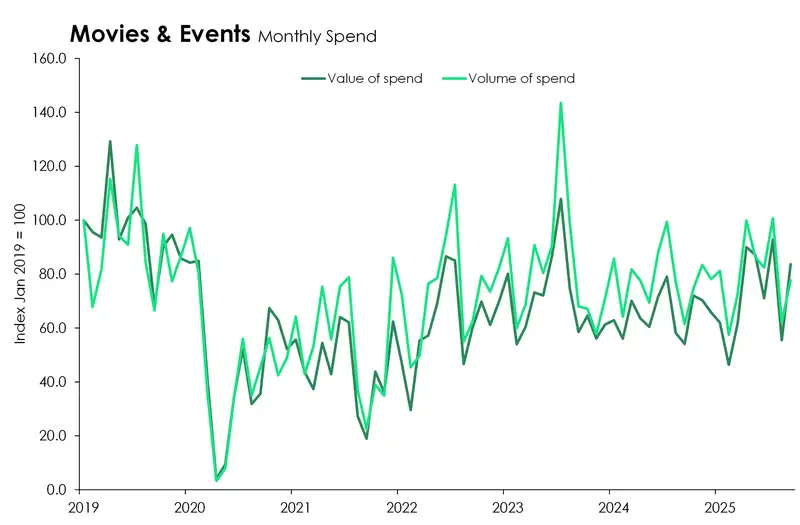

Spend at the movies remains below pre-covid levels for both volumes and values. And there have still been no major double block buster events that have been come close to recreating let alone rivalling the Barbenheimer effect we saw in mid-2023.

In the absence of such big blockbusters, cinemas appear to be leaning heavily on discount-driven strategies to pull in audiences. From “Half-Price/Cheap Tuesdays” (depending on where your loyalties lie – Event or Hoyts) to “Movie of the Week” deals, the steady pace of movie spend seems to be driven by discounted tickets as volumes consistently outpace the value of spend at the cinema.

Slowly filling the travel jar again

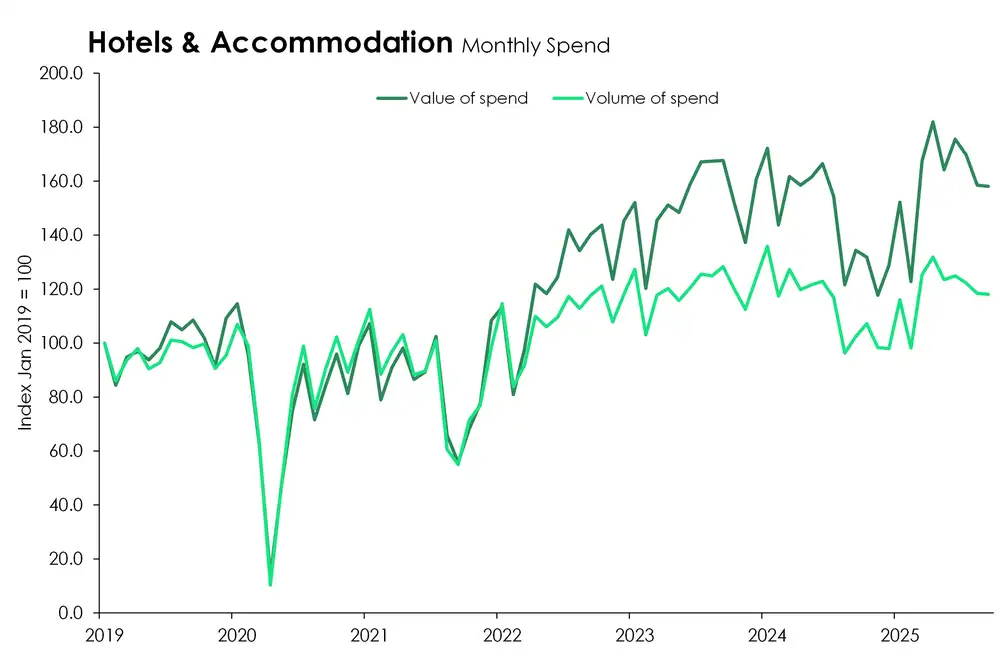

The volume of spend on hotels & accommodation increased 13.7% compared to a year ago. The double-digit increase is more reflective of the weak state of the economy in 2024 than a revival in discretionary travel.

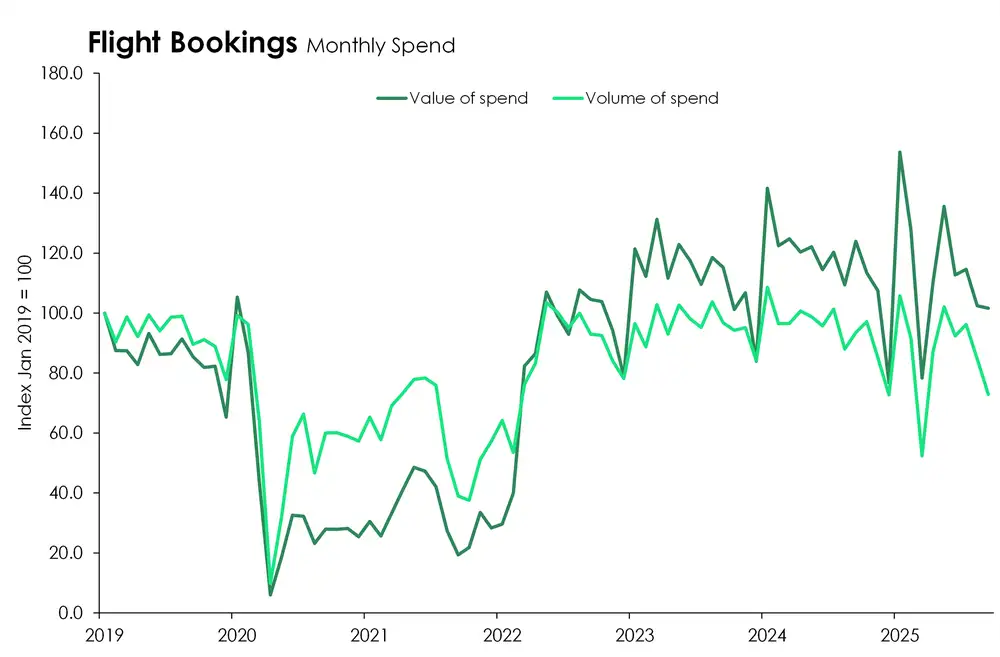

For flight bookings, September 2024 saw significant falls in domestic and international airfares. Cheaper flights likely spurred Kiwi to book those “Euro‘25 summers”. But now, we’re back to putting pennies in the travel jar. Off a high base, the volume of flight bookings are down 10.3% compared to last year.

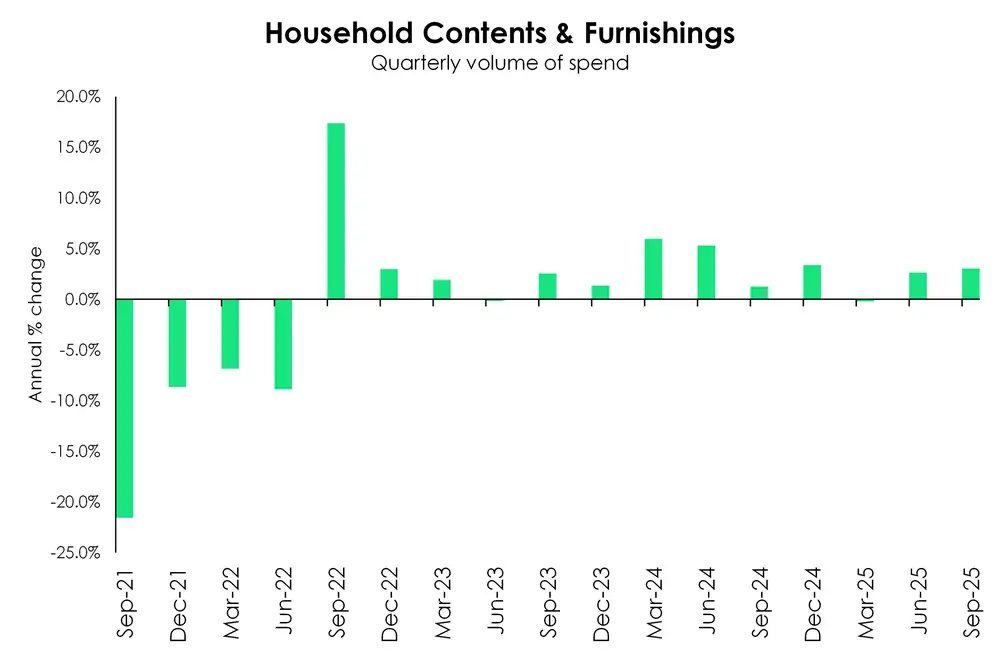

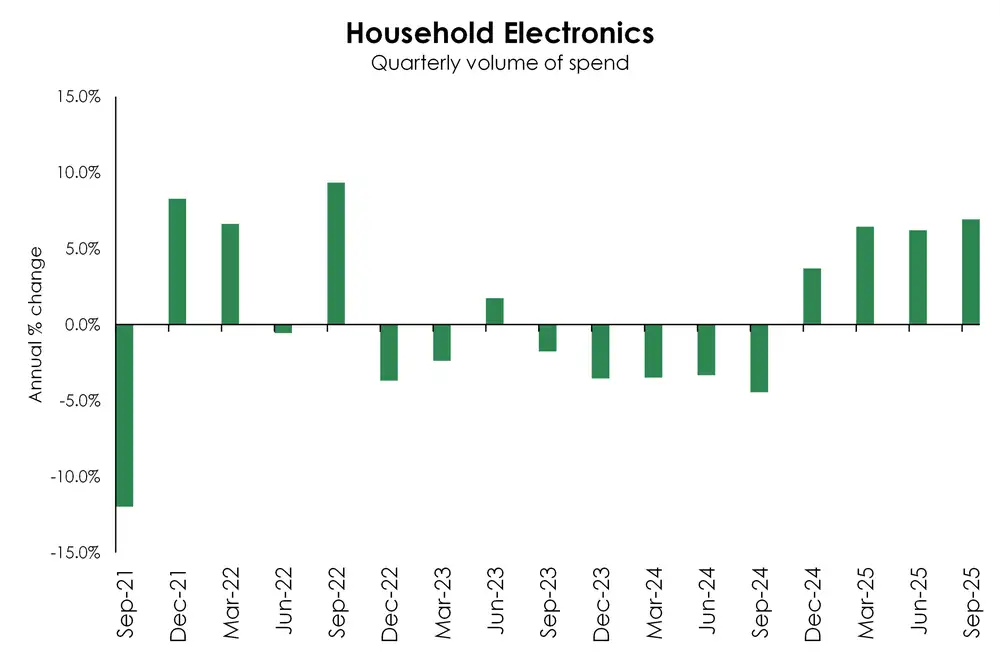

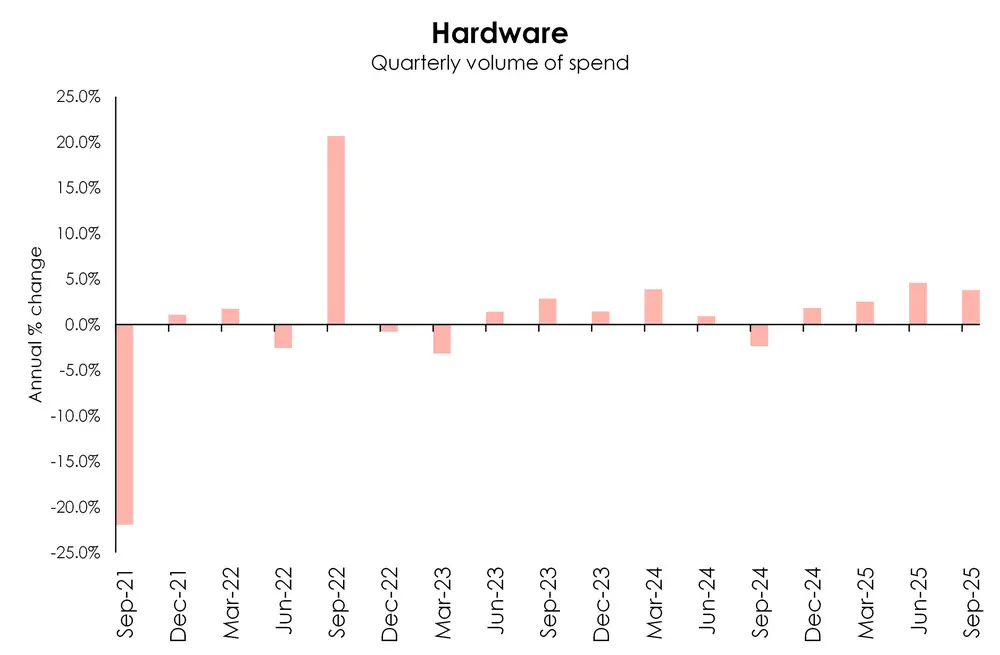

Home is where the hope is

Demand for housing-related goods appears to be improving. The volume of spend on home contents & furnishings was up 3% from a year prior while home electronics spend rose 6.9%. Spend on home building & renovations also picked up, increasing 3.8%. The housing market has been laying dormant for some time now. But interest rates are heading lower, towards levels that should breathe new life into the market. And the data may be signalling that households are getting ready for it.

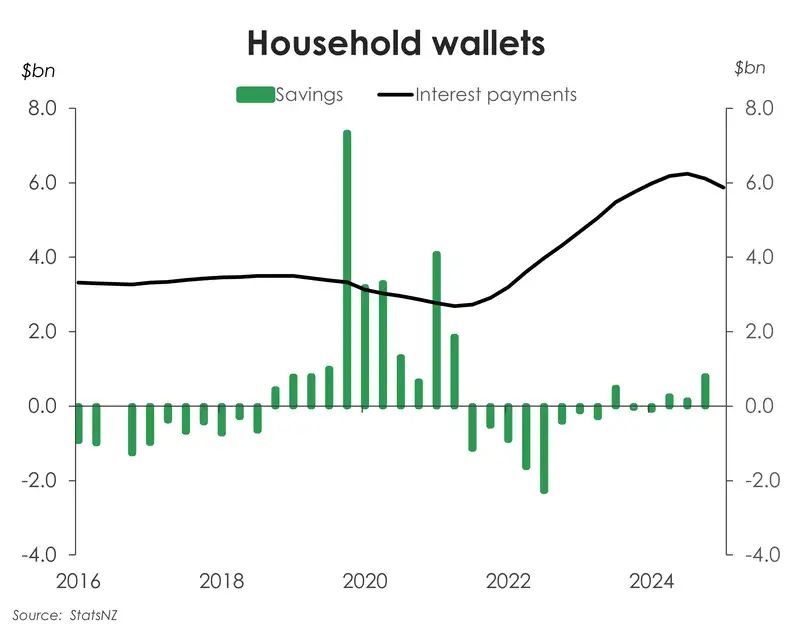

Balance sheets in better health

Household savings are recovering as interest payments ease. The sharp rise in interest rates, and subsequent rise in interest payments that began in 2022, didn’t just make a dent in household consumption, they also ate away at household savings. Savings declined consecutively for two years, followed by two more quarters of decline during the recession last year. That’s 10 out of the last 14 quarters in decline as interest repayments rose from a post-COVID low of $2.7bn to a peak of $6.2bn in December 2024.

Thankfully that trend is now reversing. Supported by a gradual decline in interest repayments, household savings have lifted for the past three quarters. Most recently, savings rose $804 million in the June 2025 quarter as interest repayments eased to $5.9bn, down 4.9% from the peak It’s a trend we expect will continue to improve as households roll onto lower rates in the coming months. And in the same vein, the easing of interest repayments should help free up disposable incomes and support a recovery in consumption.

Are we in for a summer spent shopping?

Outlook: Tailwinds and headwinds

Household balance sheets have been stretched. Debt servicing costs had risen from historically low levels during the pandemic. For mortgaged households, debt repayments had taken bigger and bigger bites into disposable incomes. The correction in the housing market also lowered household net worth, weakening balance sheets and ultimately consumption. And it was predominately discretionary goods and services that were culled from the budget.

However, the tide is turning. There are a couple key tailwinds for consumer spending heading into the summer holiday trading period.

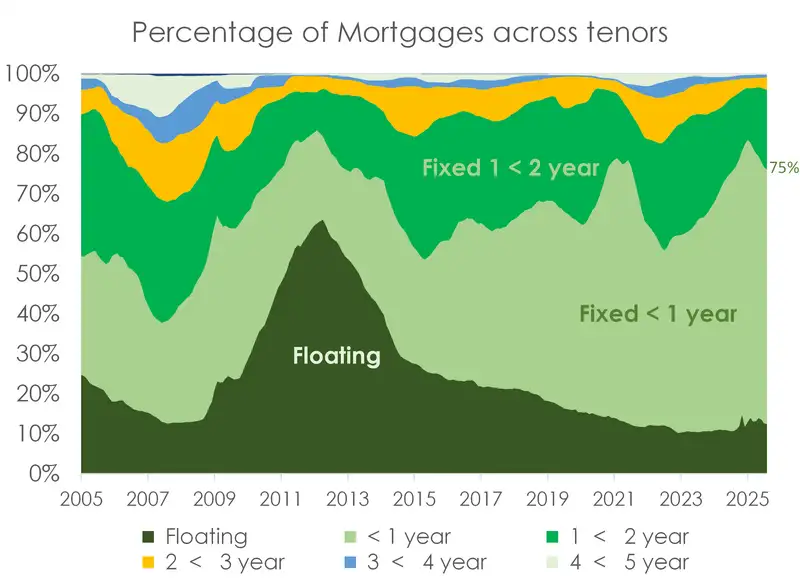

- Falling interest rates: With an aggressive cutting cycle from the RBNZ, retail interest rates have fallen significantly. And for most of the way down, households have been well positioned for it. Balance sheet health is improving. And with interest repayments easing, there’s more disposable income leftover. Just in time for the Black Friday and Cyber Monday deals.

- A rebound in house prices: We know over two-thirds of household wealth is equity in a home. The performance of the housing market is key to the recovery in consumer spend. With falling interest rates and changes to investor tax policies, the backdrop is improving for a turnaround in the housing market. The spring season will be the litmus test. As equity builds, the wealth effect should kick in and kick consumption higher.

A grey cloud hovering in the horizon is the labour market. The past two years of weak economic activity is now hitting the labour market. Hours are being slashed, and many businesses are downsizing. Employment growth is running backwards. Weakening job security risks a quiet holiday trading period.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.