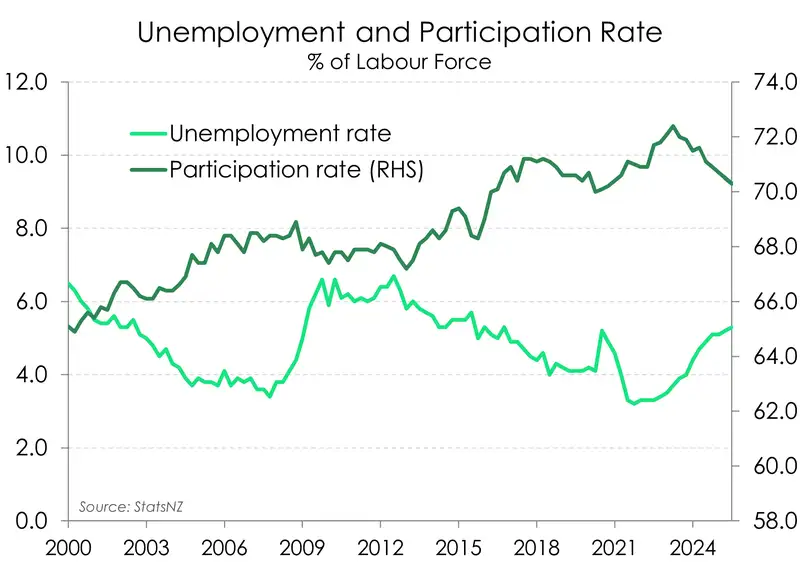

- The Kiwi unemployment rate rose to 5.3% from 5.2%, and employment was flat over the quarter. The broader measure of slack in the labour market, the underutilisation rate, lifted to 12.9% from 12.8%.

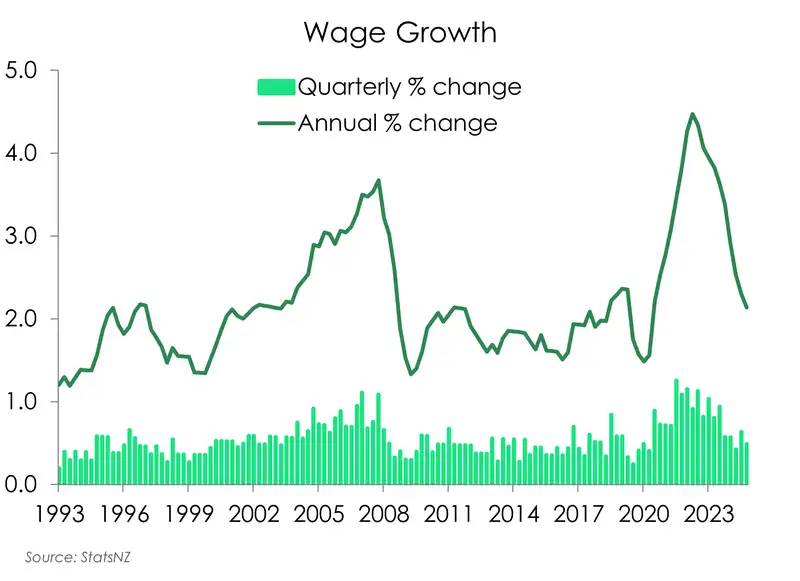

- The moderation in wage inflation continued. Annual wage growth slowed to 2.1%, down from 2.3% - the weakest in over four years. Weaker wage inflation is helping to drive further easing in domestic inflation. It’s that famous Phillips curve.

- Today’s data reinforces the need for further monetary policy easing. Downside risks to medium-term inflation are growing given the soft labour market and dimming global outlook. We expect the RBNZ to cut the cash rate by 25bps at the November meeting.

The latest look into the labour market lacked any big bang fireworks. Market conditions loosened a little over the September quarter. As expected, the unemployment rate lifted to a nine-year high of 5.3%, up from 5.2%. The underutilisation rate – a broader measure of untapped labour market capacity – rose to 12.9% from 12.8%, the highest since September 2020.

Employment was flat over the quarter as well-signalled by the monthly filled jobs data. The appetite for labour is slowly improving. Filled jobs appears to have hit a trough in July. Since then, filled jobs began to tick higher with a decent (albeit likely overstated) 0.3% in September. Given current weak economic activity, we don’t expect labour demand to take off like a bucking horse. Annual employment growth is still down 0.6%. But the September quarter likely marked the turning point.

A duo of a 0.3% lift in working age population but flat employment resulted in both higher unemployment and lower participation in the labour force. The number of unemployed in New Zealand hit 160k, the highest since March 1994 (162k). The labour force participation rate dropped to 70.3% from 70.5%. It’s the lowest in over four years. Right now, no one is dusting off their CVs and rushing to get into the market. The economy is simply not strong enough.

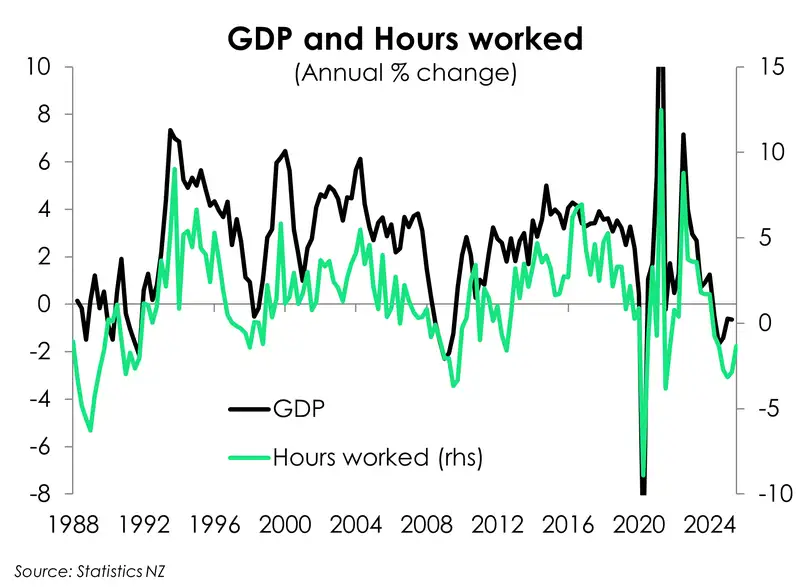

Hours worked provided a sparkle of good news. Total hours worked lifted 0.9% over the September quarter, breaking a steady seven-quarter stretch of declines. Employers had previously been slashing hours in response to soft economic demand. But this appears to be reversing. However, on an annual basis, hours worked is still down 1.4%. The quarterly lift supports forecasts for a rebound in economic activity over the third quarter.

Wage growth continues to moderate. More and more workers are receiving smaller and smaller pay rises. For example, the number of workers receiving a pay rise above 2% but below 3% has been steadily increasing for the last two years. And the wage bill (private sector Labour Cost Index) rose 2.1% over the year – the lowest since March 2021. That’s quite the drop from the 4.5% peak and a return to a smidge above the pre-covid average.

Today’s report came largely in line with our and the RBNZ’s forecasts. The labour market appears to be stabilising. But the degree of slack still in the market should provide the RBNZ with comfort that inflation will return to the 2% target next year. Indeed, with weak wage growth, the labour market is not a source of inflationary pressure. The door remains wide open for a 25bps cut to the cash rate later this month.

The evolving employment landscape

Employment growth over the September quarter broke a year-long streak of quarterly declines. The flat quarterly print in job growth is still far from ideal, but the stabilisation is welcome. Downwards revisions to employment growth over the earlier parts of the year did however see annual employment down 0.6%. As such, a net 19k jobs were lost over the year to September. But that’s far fewer than the ~30k we’ve been averaging over the last couple of reports. Nevertheless, job creation will likely still take some time from here. But the worst appears to be behind us with the September quarter marking a possible turning point in employment growth.

The composition of the labour force is also evolving. The number of part-time workers appears to be declining, while the full-time workforce is beginning to recover. Employment in full-time roles increased for the second straight quarter, reversing the downward trend seen throughout most of 2024 and early 2025. In contrast, part-time employment has now declined for two quarters in a row. Despite the recent lift, full-time employment remains 0.8% below levels seen a year ago. Meanwhile, part-time employment is up 0.1% annually. Still, the shift may be signalling a growing capability among employers to offer full-time roles as the economic outlook into 2026 improves.

Looking across all age groups, it’s clear the younger cohort has borne the brunt of the current weak labour market. For those in the 15-24 year age group, the unemployment rate lifted to 15.2% from 13.1%.

Weak wages

The slack in the labour market and a slowdown in inflation has shifted the balance of power back to employers. The shift is shown by the continued cooling in wage costs. The costly combo of high inflation and labour shortages lit a fire under wage growth, with the private labour cost index (LCI) hitting a series-high of 4.5%. That fire has now been put out, with the wage growth slowing to 2.1% - the lowest in four years.

The distribution of annual wage growth also underscored cooling wage pressures. The proportion that received no pay increase rose to 44% - the highest since June 2021. Meanwhile the proportion of jobs that did receive a pay rise dropped to 56%, smaller than the 63% share last year. And the distribution of wage increases continues to move away from the chunky increases of more than 5% which was once the favoured rate. That proportion rose to a high of 40% in 2023, and has fallen to just 11% today. Majority are pocketing increases of between 3% and 5%. And now that inflation has corrected lower, the proportion receiving wage increases of more than 2% but less than 3% has been steadily increasing, from 8% last year to 15%. It’s yet another clear sign of softening employment demand.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.