Business confidence deteriorated in the June quarter. High interest rates are weighing on demand, with more businesses seeing a decline in trading activity. Weak-to-miserable growth remains the outlook. Overall, it supports our call for RBNZ rate cuts, sooner rather than later. We’re sticking to our call for cuts to begin in November. Otherwise, we’re likely to see severe economic scarring.

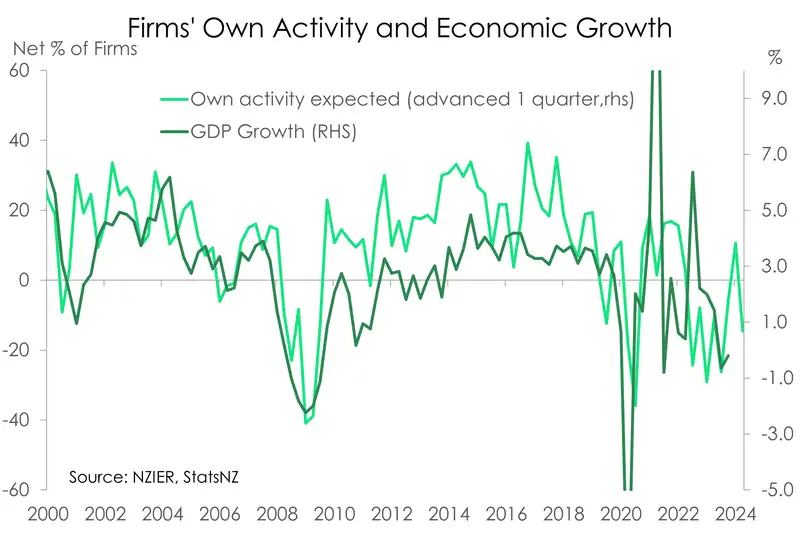

A further deterioration in activity indicators reminds us that we’re not out of the woods yet. A net 25% of firms reported a decline in trading activity, up from 23% last quarter. Given the clear correlation between trading activity and growth, the economy seems to be shaping up for another contraction in the June quarter. Looking ahead, the outlook is not much better, hence our downgraded growth forecasts. As we pointed out in our latest outlook note Survive ‘til 25: it’s a white-knuckle ride we now see the economy growing just 0.1% this year. That’s well below the long-term average of 2.5%. The RBNZ has the economy in a chokehold, and the pulse will only strengthen once rates are reduced.

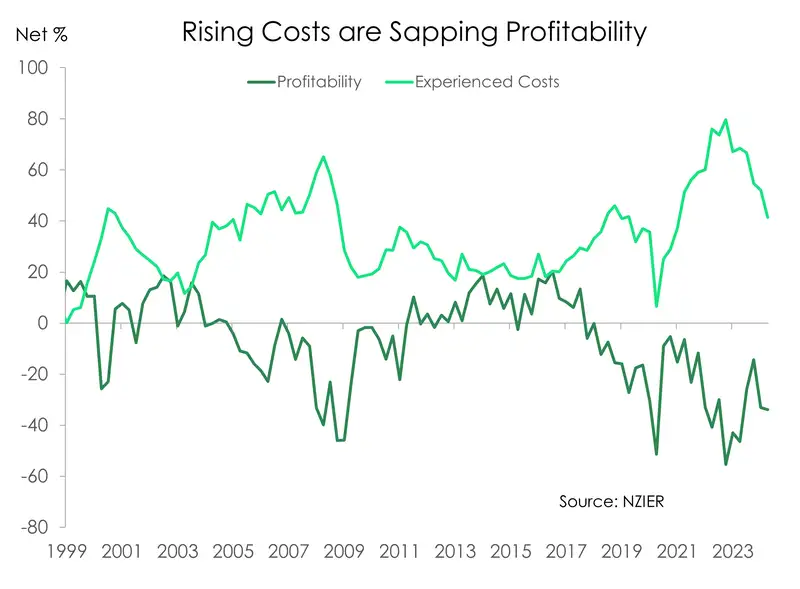

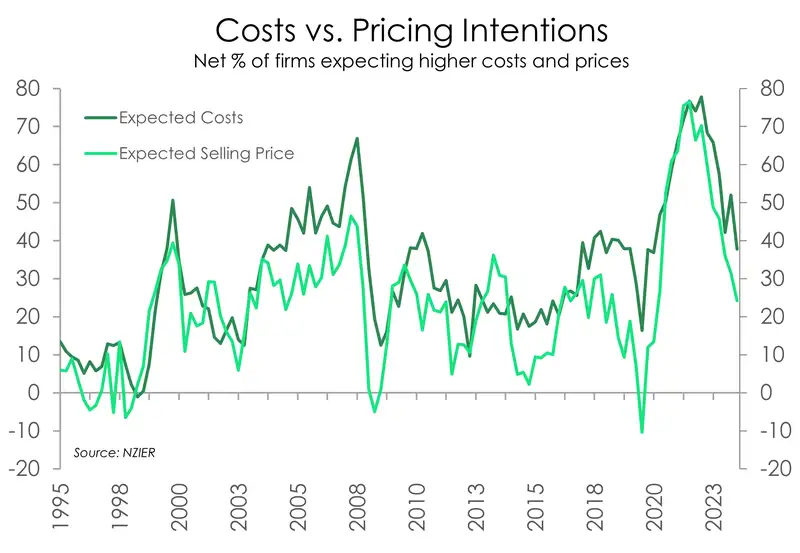

The ”good news” in the report was the fall in experienced ‘costs’. The inflation dragon has been slain, we’re just waiting for it to hit the turf. This is good news for businesses, who have had to deal with rapid inflation in parts. High inflation, coupled with weakening demand, has hurt profitability. And it appears ‘profitability’ is not looking too good. It’s hard to invest for future growth when your profitability is in decline.

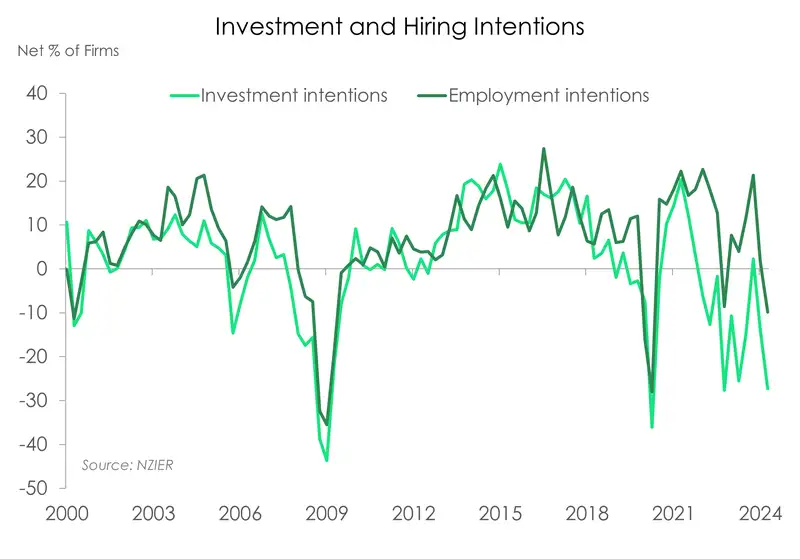

When businesses stop investing for the future, that kills growth. When businesses tell us they’re unwilling to invest in more staff, equipment, buildings and all that good stuff that generates growth, well, we take a red pen to our forecasts. Yes, the RBNZ’s actions are designed to rein in business intentions, from the rapid rebound out of Covid. But enough is enough. The risk here is severe economic scarring, from overly restrictive monetary policy.

Fewer firms reported increased costs and raised prices over the quarter. A net 42% of firms experienced higher costs, far fewer than the net 49% of firms last quarter and net 70% last year. The improvement is feeding through to an easing in pricing. A net 23% of firms raised prices over the quarter – down from the last print of a net 35%. That’s the lowest since March 2021. And looking ahead, the proportion of firms expecting to raise prices is also shrinking.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.