Modal to play video

The Fed leapfrogs the RBNZ & shipping is expensive, again

In this episode, we cover the US Fed’s outsized 50bps cut to begin its easing cycle. As reflected by a lift in the US 10-year Treasury yield, investors are feeling confident about the growth outlook. The Fed’s updated projections still paint a rosy outlook, with unemployment peaking just 0.2%pts above the current rate of 4.2% and the economy growing above trend through to 2027. A soft landing indeed.

The new dot plot signals another 50bps of easing this year, with two meetings remaining, and 100bps of easing in 2025. The outlook has improved now that the Fed is chartering a course back to neutral policy settings.

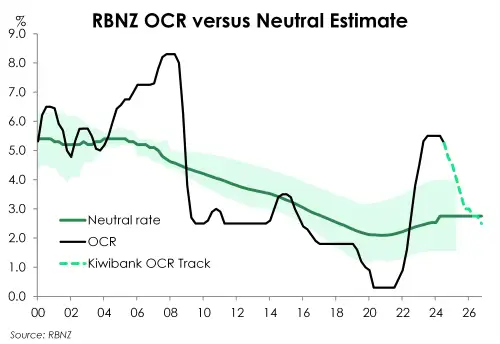

For the RBNZ, we think they will need to do more than the Fed. Because weakness in the Kiwi economy demands more rate relief. Economic output has contracted in five of the last seven quarters. And it was the 0.2% decline over the June quarter that was the latest to add to the tally. The fall of -0.2% was not as deep as the -0.4% that majority of forecasters were expecting. But it’s still a fall. And on a per capita basis, the report was miserable. We’ve seen seven consecutive contractions, with a sizable -0.5% in the June quarter. Activity per head is down 2.7% over the year, and down 4.6% from September 2022 – far worse than the cumulative 4.2% decline during the GFC. There is light at the end of the tunnel, and it’s burning brighter. We think the RBNZ’s decision to cut the cash rate in August, marks the turning point in this cycle.

Monetary policy has done enough to free up spare capacity and restrain inflationary pressures. Enough is enough. We argue the RBNZ needs to get the cash rate below 4%, asap. It takes up to 18 months for rate cuts to filter through the economy. We all love fixed rates. And fixed rates need time to roll off. Effectively, the RBNZ are cutting today for an economy at the start of 2026. We’d advocate 50bps in October, and again in November.

Later in the episode, we bring on Adrian Lodge from the Financial Markets team. Adrian takes us through what markets dealer does, day-to-day. For him and his team, it’s all about helping their customers hedge their currency risk. Exporters don’t like it when the Kiwi rallies. And importers don’t like it when the Kiwi falls. Adrian also shares the insights he’s gathering from conversations with clients. Some exporters are doing well, with solid demand. And many hedged their currency below 60c, a few months back. Importers, particularly those within the retail space, are doing it tough with a weak domestic consumer. Interest rate cuts will help. And greenshoots are emerging with the expectation of further rate cuts from the RBNZ.

Next week, we will talk to our latest FX Tactical note, and get Hamish Wilkinson to talk different currency crosses – not just NZD/USD – whatever you want.

Let us know! Aussie, Stirling, Euro, Loonie or Krona

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.