- Next week’s decision by the RBNZ is approaching. Will they cut? Yes. The question is magnitude. Will it be a straight bat 25bps or a bold 50bps? There’s no doubt that the Kiwi economy needs support. There’s no doubt the RBNZ should be aiming to stimulate. But do they see it that way? They should.

- The RBNZ has signalled reaching 2.50% by the end of the year. If it was up to us, we would get there next week with a 50bps cut. The broad-based weakness in the Kiwi economy clearly warrants a bold move. We would also signal another 25bps cut in November. Anything less would see interest rates head higher. Unhelpful. And the opposite of what the economy needs.

- The weakness in the economy demands stimulus. With all the risks offshore, and the pain still felt onshore, there’s a good argument to be made for taking policy firmly into stimulatory territory ASAP. An argument that is growing in support.

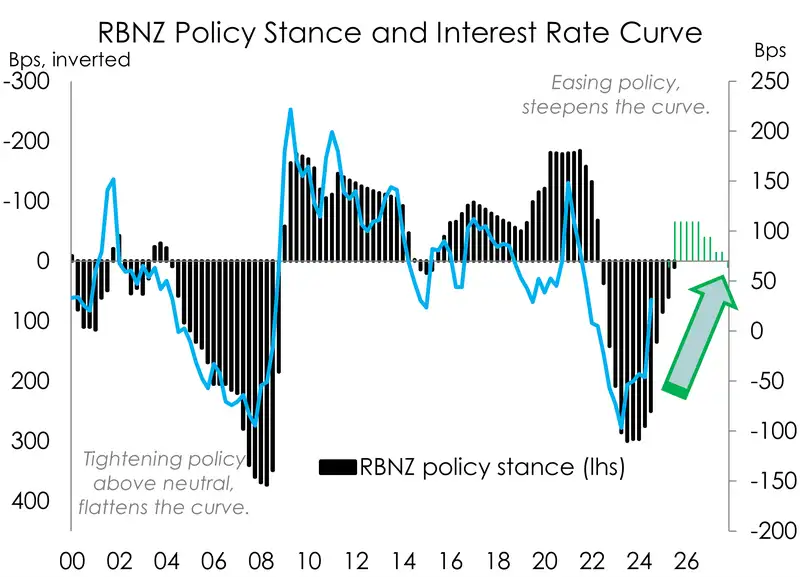

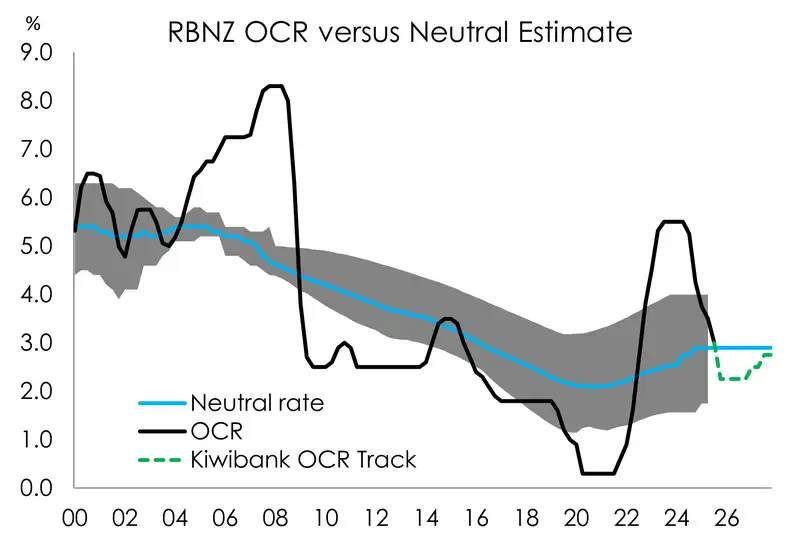

A cut from the RBNZ next week is all but a done deal. The RBNZ has delivered a significant amount of easing – 250bps to be exact. It’s a lot, and it does put the RBNZ among the most aggressive central banks. But, importantly, rate cuts to date have simply returned monetary policy to “neutral” settings. It is only next week’s eighth cut in the cycle that would work to add stimulus into the economy. Next week’s rate decision is pivotal in setting the trajectory in financial markets, and the wider economy, heading into 2026.

It’s clear that our economy needs support. There’s simply no other way to put it: the Kiwi economy is underperforming. It’s underperforming our already weak forecasts. And it’s underperforming our peers around the world. It’s saddening to see an economy still contracting after last year’s deep and destructive recession. We fell into a hole then, and we’ve only dug ourselves deeper.

The current cash rate of 3% isn’t stimulatory, and it isn’t encouraging excessive behaviour or inflation. But we need a stimulatory rate if we’re going to encourage businesses to take on risk – either invest or hire. And we need a stimulatory rate if we’re going to see embattled households boost discretionary spend. 2.5% is closer to what we need. And the risks are towards a 2% cash rate, in our opinion.

We know that the cash rate will go to at least 2.50% by Christmas. Governor Christian Hawkesby signalled (rather explicitly) as much in his remarks at the Financial Services Council Annual Conference earlier this month. However, there are several routes the cash rate may take to get to 2.50% - and potentially below.

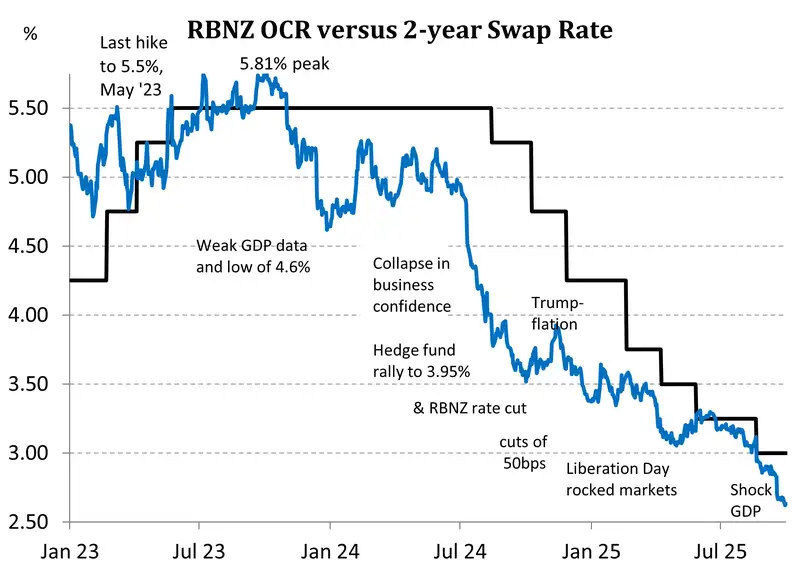

The first scenario is one in which the RBNZ cruises into next year on autopilot. Delivering a 25bps cut next week, and a 25bps cut in November. It’s a seemingly straight bat decision, but one that will no doubt trigger an unhelpful reaction in financial markets. Frustrated (again) by the RBNZ’s delay in getting the job done, wholesale market traders would push interest rates higher. The OCR endpoint priced into the OIS strip would lift from ~2.24% low towards 2.50%. The pivotal 2-year swap (interest) rate would rise from around 2.63% back above 2.80%, unwinding the 20bps post-GDP rally. Mortgage rates would barely move. And in fact, the risk further out turns towards a slight lift in mortgage rates. Very unhelpful. The Kiwi dollar would likely pop higher, back towards 59c. And that’s also very unhelpful. Our exporters could use a little currency depreciation to help offset the tariffs to the US

Given the fragile state of the economic recovery, with demand risks still abound, autopilot is exactly what we don’t need. Rather, awake at the wheel and driving the recovery into 2026 is.

The second scenario is one in which the RBNZ frontloads the signalled easing. The RBNZ could get to 2.50% in one fell swoop (a 50bps cut next week). But in the same breath, the RBNZ could also signal the end of the easing cycle.

The need for an accelerated move to 2.50% stems from the June quarter GDP figures. They were ugly. The Kiwi economy slammed into reverse, contracting 0.9% over the June quarter. This compares to the RBNZ’s forecast of a 0.3% contraction. The data may be old, but the miss is meaningful. The RBNZ will likely conclude that the output gap is more negative than last estimated. The RBNZ will be going back to the drawing board with a weaker growth starting point.

And a reminder to our readers, the RBNZ’s August rate decision came to a historic 4-2 vote, with two committee members favouring a 50bps cut. The seed has already been planted. And the recent flow of weak, uninspiring economic data could very well be the water that sees the dissenting view grow to become the consensus.

A ‘50 and done’ would still be consistent with the RBNZ’s forward guidance, but markets would interpret such a move as hawkish. We will likely see a similar reaction in financial markets as the first scenario, but perhaps not as strong. Because only 31bps are currently priced for next week, meaning there’s still an element of shock to come from a 50bp cut. But signalling “that’s all folks” would see a recalibration in market expectations. Currently, a 2.24% terminal rate is being priced by early next year. But that would quickly lift under this scenario with the OIS curve pushing higher. Naturally, wholesale rates would sell off, limiting further (needed) downside to retail rates. And the decision might also light a fire under the Kiwi dollar as the RBNZ underdelivers on current market expectations.

The third scenario is what we think they should do. Like the second scenario, the RBNZ should deliver 50bps next week. But we think some extra juice is warranted. We have long-forecasted the cash rate falling to 2.50%. But it’s becoming clear that the economy needs more support. We expect a further 25bps cut in November to 2.25%.

In this scenario, wholesale rates would likely continue their downward spiral. Because a 50bps cut is not completely priced, and the signal for another cut in November should see expected cuts brought forward. Pricing for the November meeting should drop to 2.25%, and wholesale rates along with it. It’s not hard to see a ~10bp slide in the pivotal 2-year swap, easing towards 2.50%. All mortgage rates would likely be lowered, as needed. And the Kiwi dollar would lose further ground against most other currencies. This week, the RBA has once again emphasised a gradual and cautious approach to policy easing. A relatively tight labour market across the ditch affords the RBA patience. Similarly, the Bank of England is also stressing caution as it battles persistent inflation. Meanwhile, the ECB is virtually calling time on its easing cycle. All the while the Reserve Bank remains in a position of needing to do more. And in delivering more easing than its peers, interest rate differentials are working against the Kiwi. However, risks of a sustained weakening against the Greenback seem limited as the Fed resumes its easing cycle.

We hope that 2.25% is the cycle low in the cash rate. But we think there’s about a 50/50 chance of a further move to 2% in February. It will depend on how the data and recovery play out. This summer will be an important time for data watching. Will the housing market pick up? Will consumer confidence lift into consumption? And will business confidence translate into activity? We hope it will. It will all feed into the February decision.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.