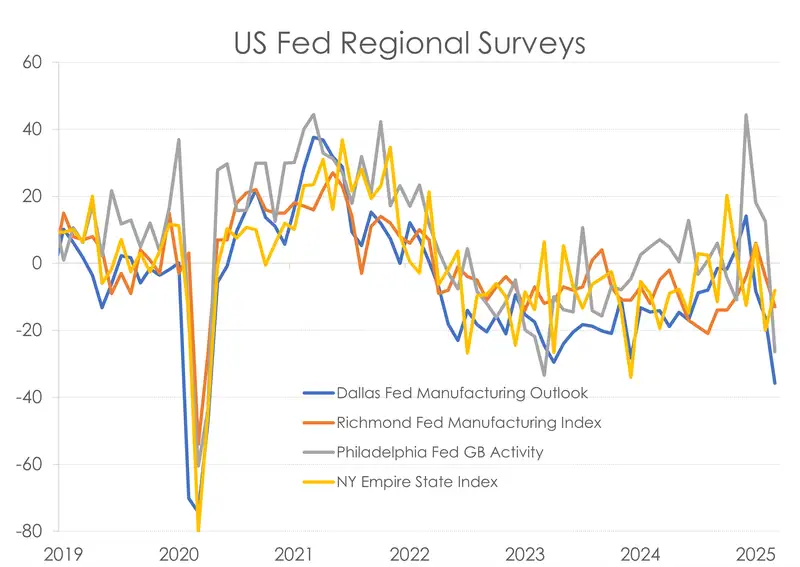

Forecasts for growth are being slashed left, right, and centre as tariff turmoil takes it’s toll. Damage has been done and there’s more to come. Across the US, several regional business manufacturing surveys saw sharp declines in activity over April. Most notably, Philadelphia’s general business activity index dropped nearly 40 points over the month. Meanwhile, the Dallas Fed’s measure fell 20 points to -35.8, it’s lowest reading since May 2020.

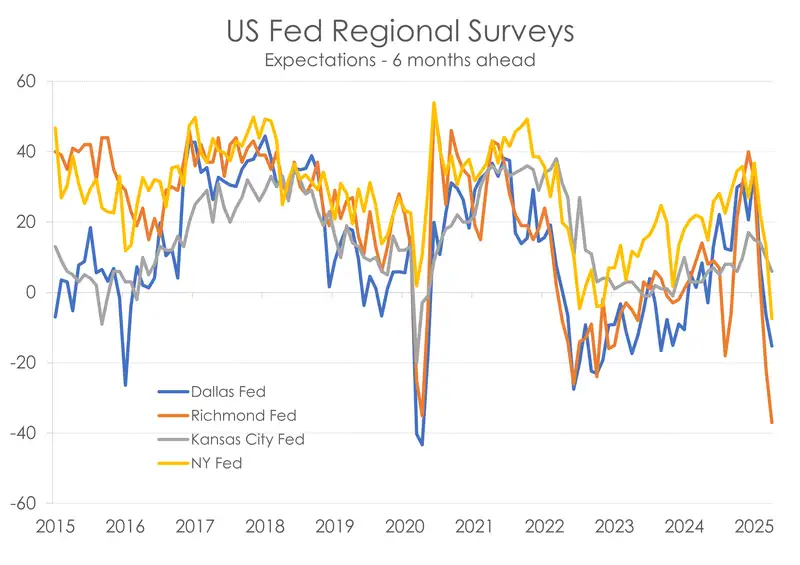

What’s even worse is the downturn in expected activity. The Richmond Fed’s future activity index tumbled to -37, marking the lowest reading since the series began (though it must be noted that the series began in 2010, and omits a little event called the Global Financial Crisis). And the New York Fed’s expectations index slipped to -7.4, falling deeper than levels seen during the GFC when the trough hit -5.1.

As a leading indicator of economic output, the sharp decline in expected business activity is a worrying sign of what may lie ahead. Especially on the heels of the US economy recording its first quarterly contraction in GDP since the start of 2022. The deterioration in confidence around future demand is likely to be met with greater pullback from firms. Expansion efforts and investment plans may be shelved. Hiring too may slow. All of which risks a further slowdown of the US economy.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.