The fight against inflation is the main game for central banks around the world. And recently, inflation is proving to be a little tougher to tame. It’s fair to say that central banks have won the war against the post-Covid surge, driven by unprecedented fiscal and monetary policy stimulus. But there is a lingering annoyance, causing a little caution from policymakers.

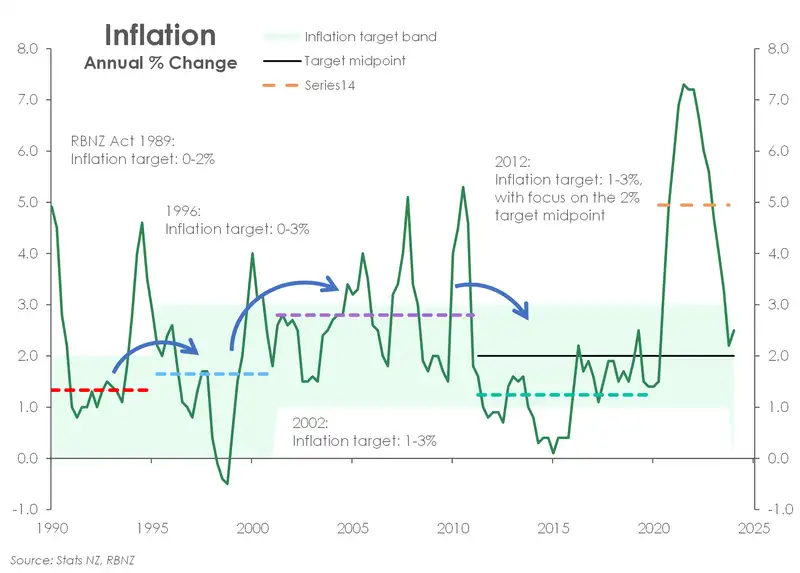

Our first chart plots the RBNZ’s focus since they pioneered inflation targeting. Currently, the RBNZ targets medium term inflation between 1% and 3%, with a focus on the 2% midpoint. After the 2008 GFC, inflation undershot, and proved hard to generate. Inflation averaged 1.24% between 2010 and 2020. Since Covid, however, central banks were forced to tighten policy to get it back under control. We believe it is under control, but at 2.5%, we still need a slight deceleration. Because inflation expectations have crept higher, again. Although they we almost certainly come back down.

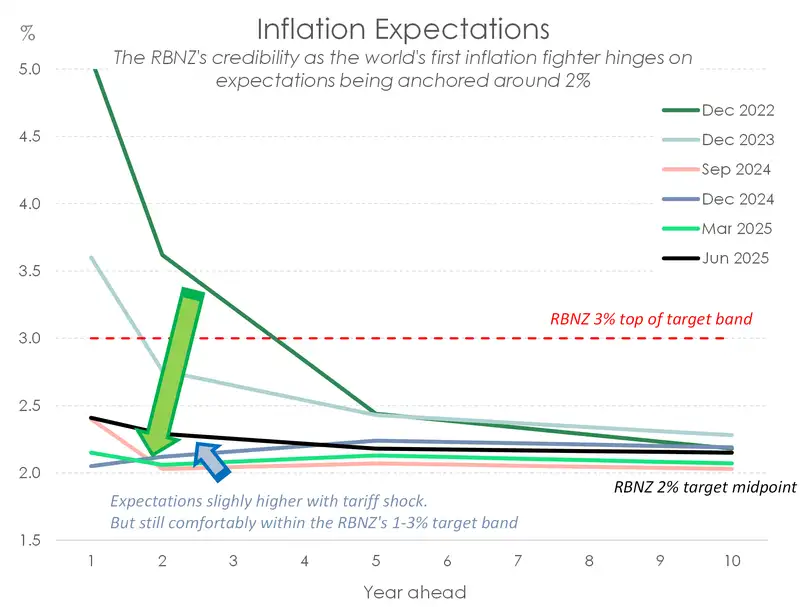

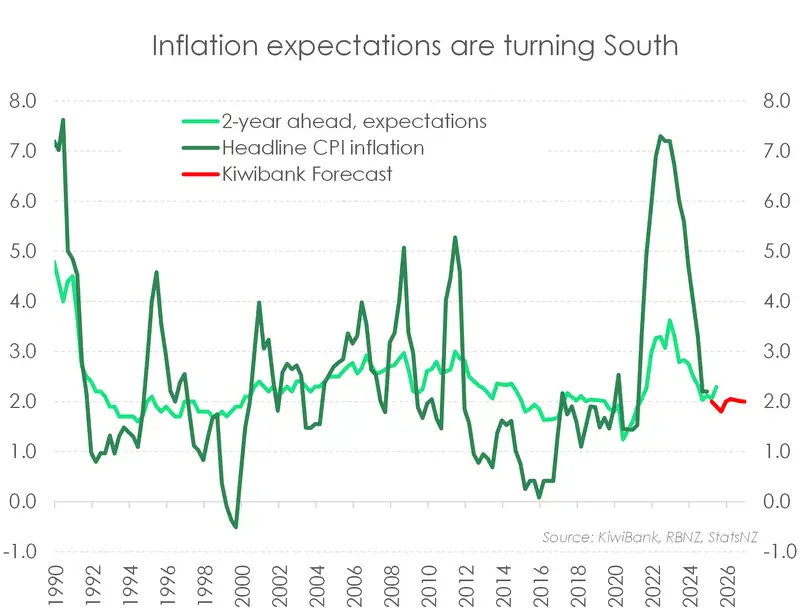

Last week’s inflation expectations survey recorded a (frustrating) lift across the curve (second chart). Respondents pencilled in a higher expected path for inflation when asked where it would be in 1 to 10 years time. But it must be noted that expectations are still below 2.5%, and are likely to drop back down. Inflation expectations are guided by actual inflation prints (third chart). As inflation rises, so too do inflation expectations. And we see (big) downside moves ahead. Domestic inflation is cooling with a cooling in the labour market, a cooling in wage growth and a probable drop in imported inflation. The tariff trade war is likely to push prices lower.

Our forecast for future inflation sees the headline rate drop below 2%. If realised, inflation expectations will drop back to 2%. And again, the RBNZ has the ability to ease policy, not tighten.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.