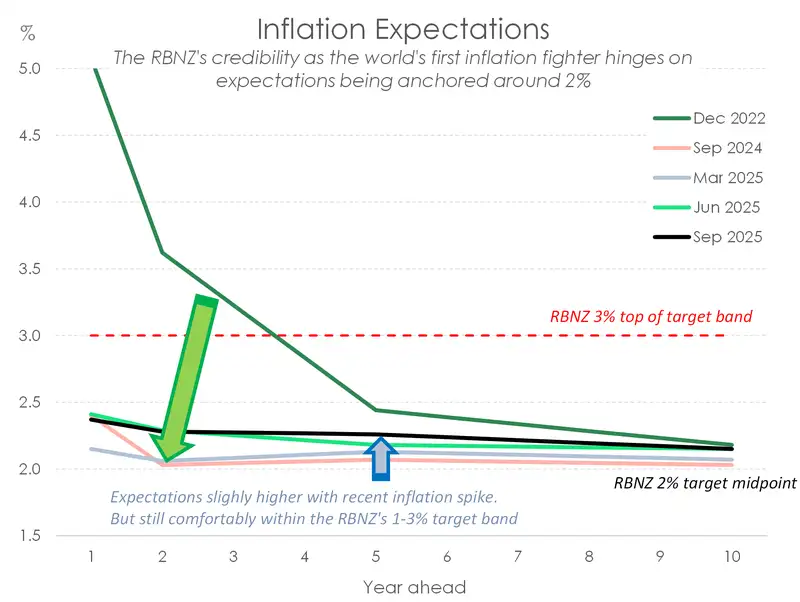

Inflation expectations tend to follow actual inflation. So when we saw the headline rate accelerate from 2.5% to 2.7% over the June quarter, it was almost a given that we’d see a lift across inflation expectations. That wouldn’t have gone down too well at the RBNZ. Remember the 5-1vote at the May MPS? The argument to hold rates was grounded in concerns around rising inflation expectations. Thankfully, the latest round of the RBNZ’s survey of inflation expectations showed expectations comfortably contained within the RBNZ’s 1-3% target band.

In fact, inflation expectations for 1-year ahead dropped 4bps to 2.37%. The 2-year ahead measure – key horizon to consider for setting monetary policy – also dropped by 1bp to 2.28%. We like to see that. And we’re sure the RBNZ was pleased with the move lower too. Especially in the face of the temporary inflation spike we’re seeing right now.

Further out, there was a bit more movement in the 5-year ahead measure, up 8bps to 2.26%. While the 10-year ahead measure remain unchanged at 2.15%. On balance, all measures remain comfortably within the RBNZ’s target band. It confirms that there remains little risk this bout of high inflation will persist. As we’ve seen in NZIER’s Quarterly Survey of Business Opinion, firm’s pricing power is evaporating. And spare capacity in our deteriorating labour market is another disinflationary force. The bigger risk continues to be inflation undershooting the 2% midpoint over the medium term. Hence our call for a lower more stimulatory 2.5% cash rate.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.