Boom! The RBNZ delivered what was needed. The cash rate was cut by 50bps to 2.5%. The stalled recovery demanded a bold move.

WHAM! At 2.5%, monetary policy has gone from neutral to stimulatory settings. It’s a move that puts interest rates low enough to encourage activity. This sets up the economy for next year.

KAPOW! 300bps of cuts delivered to date. And it’s not over yet. The RBNZ “remains open to further reductions” in the cash rate. We continue to expect a further move to 2.25% in November. And we’re keeping an eye on a potential move to 2% in February.

The RBNZ delivered on what the Kiwi economy desperately needs. The cash rate was cut 50bps today to 2.5%. A move we knew we should get, but one that was not guaranteed. The consensus view for today was for a smaller 25bps cut with commentators divided on the outcome. But ultimately, the weakness in the Kiwi economy saw the RBNZ pull through. And we’re glad they did.

We’ve now had 300bps of rate cuts delivered. It sounds like a lot. And it is. But until today, the rate cuts we’ve had simply removed the restrictiveness in policy, and only taken us to neutral ground. The move to 2.5% finally positions interest rates towards levels that will inject stimulus into the economy. In other words, levels that should encourage households and businesses to spend, invest, and hire.

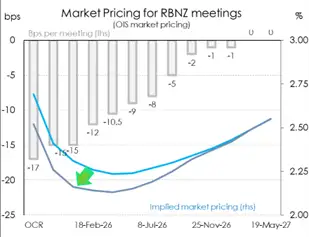

We don’t think the easing cycle is over yet. And the RBNZ is far from signalling the end. In fact, with just one word the RBNZ has kept the door open to a cash rate below 2.5%. “The Committee remains open to further reductions in the OCR”. The key word here – “reductions”. Forgive us for getting grammatical, but that little ‘s’ at the" end makes all the difference. In market-speak, the RBNZ has given themselves optionality. Financial markets have caught on, and started pricing in better odds of a move even below 2.25%. As we’ve previously pointed out, we think there’s about a 50/50 chance of a further move to 2% in February. It will depend on how the data and recovery play out.

Inflation may be at the upper-end of the RBNZ’s 1-3% target band. But we think only temporary. And, importantly, the RBNZ have reaffirmed that they see it that way too. The weak undercurrents and ongoing spare capacity risk inflation falling below the 2% sweet spot in 2026. We’re concerned about the fragility in the recovery to date. Especially, with the ongoing risks offshore. This summer will be an important time for data watching. Will the housing market pick up? Will consumer confidence lift into consumption? And will business confidence translate into activity? We hope it will. And today’s move certainly helps.

Market reaction

The financial markets reacted exactly as you’d expect, and exactly as the RBNZ would have wanted. A 50bp move flushed out those calling for 25bps, and caused a decisive move lower in wholesale rates and FX. Both the moves in interest rates – lower - and the moves in currency cross rates - lower - will help boost the re-recovery of the Kiwi economy.

In front end rates, we saw a 17bp drop in OIS pricing for the October date, a 15bp move in November, and a similar move in February. The market had to react to the 50bps cut we got today, and the likely 25bp cut we’ll get in November. It’s the expectations over 2026 that get more fun. In February, the market is pricing in a good chance of a cut to 2.0%, with 2.16% implied. That’s basically a 35% chance of a cut to 2%. Odds for a 2% cash rate are even stronger in May, with 2.13% (basically 50/50. The reaction was in line with our expectations, outlined in our preview. Coming into today’s meeting, we had highlighted the 50bp in October, followed by a 25bp move in November and then a 50/50 chance of another move to 2%. And that’s exactly what is priced. We couldn’t agree more.

Looking at the pivotal 2-year swap rate, we saw a helpful drop from 2.62% to 2.55%. If we get a move to 2%, there’s more downside… albeit limited. If we get a move to 2.25% and that’s it, then we’re looking at the lows in interest rates right now.

The Kiwi flyer (NZD)hit an airpocket, falling against all major crosses. Against the greenback, the Kiwi dropped from ~58 to 57.45. There was a slightly larger decline against the Aussie dollar from 88.20 to 87.50. And it makes sense. The RBA are not cutting (as much), and the Fed is not cutting (as much). So the Kiwi is offering less incentive. Interest rate differentials matter most. And our exporters will love this.

RBNZ statement

“Annual consumers price index inflation is currently around the top of the Monetary Policy Committee’s 1 to 3 percent target band. However, with spare capacity in the economy, inflation is expected to return to around the 2 percent target mid-point over the first half of 2026.

Economic activity through the middle of 2025 was weak. In part, this reflects domestic constraints on the supply of goods and services in some industries, and the impact of global economic policy uncertainty. Household consumption is recovering, partly because of lower interest rates, and elevated commodity prices continue to support the primary sector. House prices are flat, and residential and business investment remain weak.

Economic growth in New Zealand’s trading partners is proving resilient, partly because of strong investment in AI-related activity, but is expected to slow in 2026.

There are upside and downside risks to the inflation outlook in New Zealand. Cautious behaviour by households and businesses could slow the economic recovery, reducing medium-term inflation pressure. Alternatively, higher near-term inflation could prove to be more persistent.

On balance, the Committee reached consensus to reduce the OCR by 50 basis points to 2.5 percent. The Committee remains open to further reductions in the OCR as required for inflation to settle sustainably near the 2 percent target mid-point in the medium term.”

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.