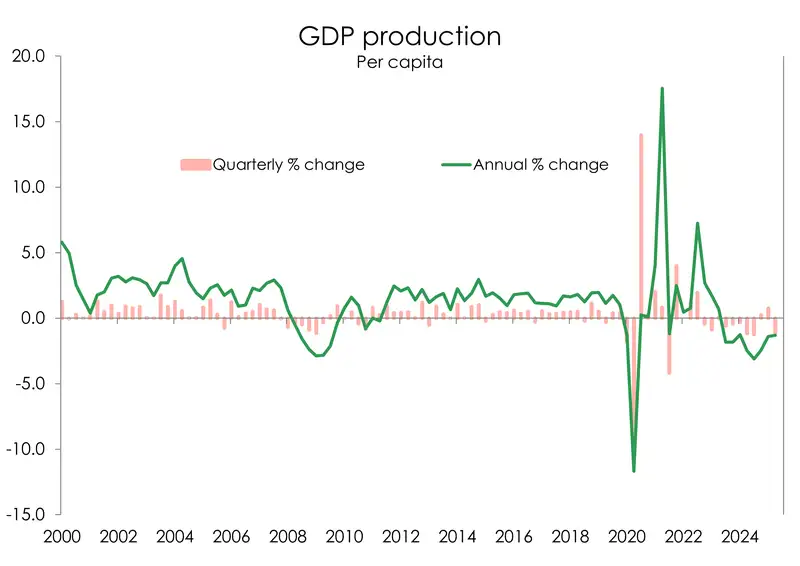

- The Kiwi economy slammed into reverse. We were just climbing out of last year’s recession, but here we are moving backwards, once again. Economic output shrank by a deep 0.9% over the June quarter. On an annual basis, the economy contracted 0.6%.

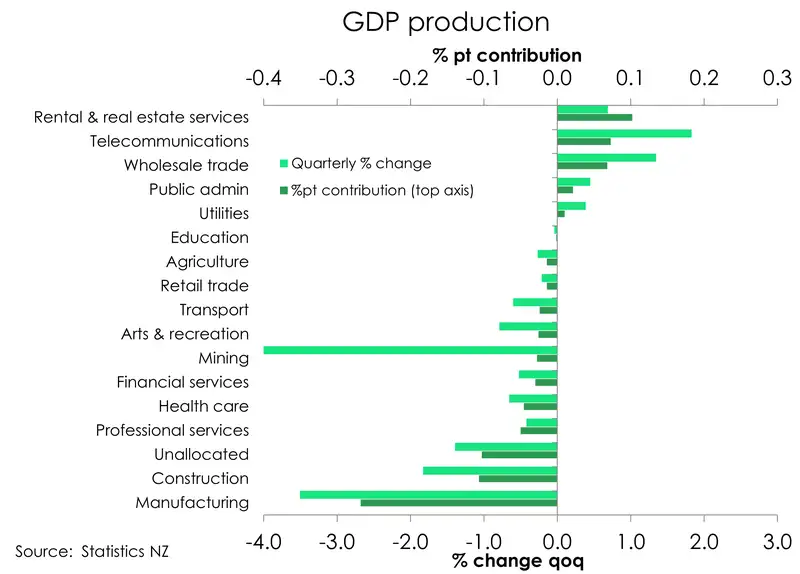

- Weakness was broad-based, with 10 of the 16 measured industries recording a decline in output.

- The 0.9% contraction over the June quarter proves that once again the RBNZ finds itself playing catch up to the deteriorating economy, rather than leading us out. But enough is enough. And where monetary policy settings are today are clearly not enough.

The Kiwi economy didn’t just stall over the June quarter; it slammed into reverse. The 0.9% contraction over the quarter was much deeper than all forecasters had expected. Most forecasters, including ourselves and the Reserve Bank, had expected a much shallower 0.3% decline. What we got today was uglier. And as usual, things are even bleaker on a per capita basis. Economic growth on a per person basis contracted 1.1% over the quarter alone and is down 1.3% from June last year.

As usual, there were revisions to historical data. Most notably, last quarter’s growth was revised up from 0.8% to 0.9%. However, today’s release effectively wipes out all the gains made since the start of the year. The June quarter’s contraction erases that progress entirely. Compared to June last year, the economy has shrunk by 0.6%. And that’s from an already low base. This time last year, we were in the midst of a cumulative 2% recession.

Taken at face value the significant drop-in activity proves, once again, that the RBNZ has not yet delivered the appropriate monetary policy setting. We have been advocating for a 2.5% cash rate for over 2 years. And now it is crystal clear that current monetary policy settings, with a 3% cash rate, are not enough. We are advocating a 50bp move in October. Get it done. Get to 2.5% asap. No more time for mucking around. It’s time for leadership out of the RBNZ.

A reminder to our readers, the RBNZ’s August rate decision came to a historic 4-2 vote, with two committee members favouring a 50bps cut. The seed has already been planted. And the recent flow of weak, uninspiring economic data could very well be the water that sees the dissenting view grow to become the consensus view.

Once a 2.5%, rate is delivered, we can start the debate about a further move to 2%. It’s hopefully not required, but it will quell those calling for no more cuts from 3%. It’s simply out of touch.

The Breakdown

Overall, the 0.9% fall in activity over the quarter was broad-based with falls in output across 10 out of the 16 recorded industries. And by high level sectors, two of the three sectors, the goods producing and primary sector, recorded quarterly declines. While the services industry remained flat.

Expected declines in manufacturing and construction were the main drivers of the quarterly contraction. But the weakness extended far and wide. Several service industries also underperformed, with retail trade and accommodation delivering downside surprises. This was despite preliminary retail data suggesting a strong lift in sales over the June quarter. And despite a solid run from dairy and meat exports (up 0.4%), weak performance in the forestry sector (down 0.8%) saw overall agricultural output fall 0.3% over the quarter. Like previous quarters, the ongoing weakness in China’s economy and property sector continues to weigh on forestry, given China’s role as our main log export market. And despite resilience in some export categories, we continue to face the risk that the broader global slowdown from tariffs could soon dampen demand for our other exports.

Overall though, the goods producing sector was the biggest drag on the economy. Contracting 2.3% overall, a 3.5% and 1.8% decline across manufacturing and construction respectively weighed heavily on the sector. Despite having seen a lift in activity over the start of the year, falls across both industries came with little surprise. For construction, the still subdued housing market alongside unenticing interest rates has done little to incentivise activity across the industry. And indicator building activity data ahead of today’s release had forewarned the persistent weakness across the sector.

The strength seen in manufacturing over summer evaporated in the June quarter, as weak business confidence and tariff uncertainty weighed heavily on new orders and overall demand. Within the sector, transport and machinery manufacturing plunged 6.2%, while food and beverage manufacturing declined 2.2%, driven by a 1.2% drop in export volumes—particularly in dairy and meat.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.