- The Kiwi economy is crawling out of last year’s deep recession. But the recovery is taking longer than we expected. The outlook for global growth is cloudier than ever. And as a small open economy, we’re especially vulnerable.

- These days, the multiverse feels acutely vast as news headlines roll in. The future may unfold in many different ways, but the balance of risks is skewed to the downside for the Kiwi economy, near term. But we maintain a sense of optimism into 2026.

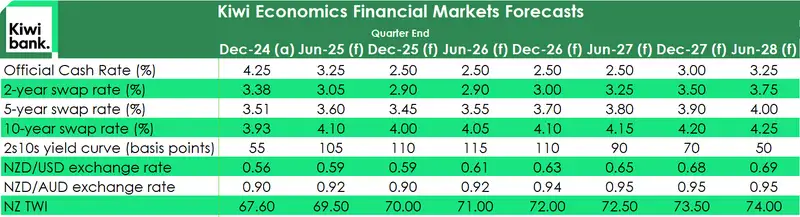

- We are getting closer to the bottom in interest rates. We’ve seen 225bps of easing thus far, and we forecast another 75bps to come. Although nothing is guaranteed.

The Kiwi economy was poised, primed and positioned for a recovery. Timely economic data were showing promising signs of a turnaround in activity. From PMIs popping into positive territory, to healthy export earnings for the rural sector. But the beginnings of our economic recovery – as fragile as it was – has largely been driven by the external sector. And it’s the external sector which is most vulnerable to the risks offshore. A certainty amidst all this uncertainty, is that a slowdown in global growth is inevitable. The likes of the IMF and OECD have slashed their forecasts, just as we’re starting to get back on our feet.

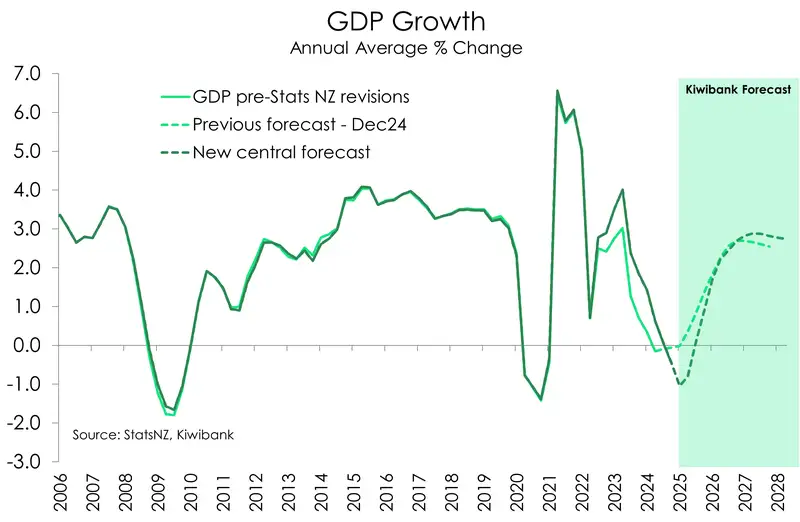

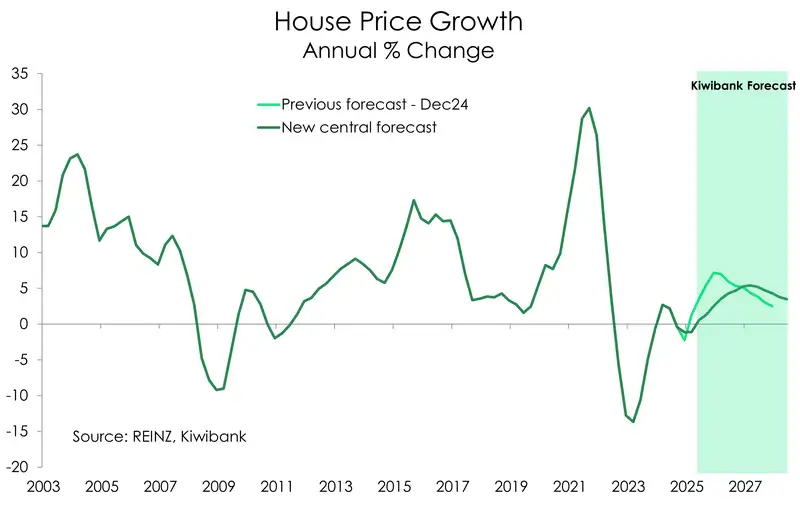

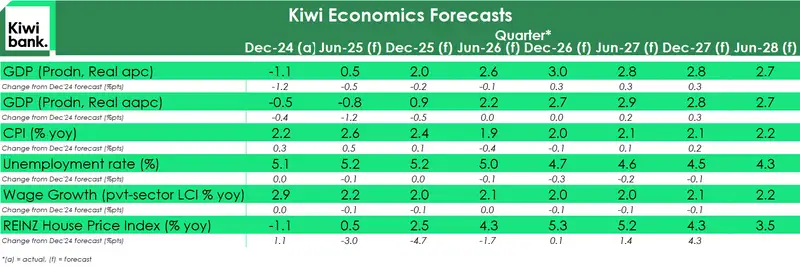

The NZ economy crawled out of a deep, deep hole last year. It was a recession the RBNZ made us have. It’s been a tough time for many businesses and households. On a per capita basis, economic activity has shrunk by more than during the GFC. Unfortunately, we may be crawling for a little longer. We continue to expect economic growth in 2025, but at a much slower pace. We forecast the economy growing just 0.9% this year, down from our previous forecast (which was already below-trend, and consensus) of 1.4%. Our previous house price forecast has proved too optimistic, as high levels of stock have flooded the market. We still (somewhat optimistically) expect to see a lift in prices over the spring and summer months, recording a 2-3% gain by year end. Trailing the broader economic cycle, a further loosening in the labour market is expected before employment growth rebounds into 2026.

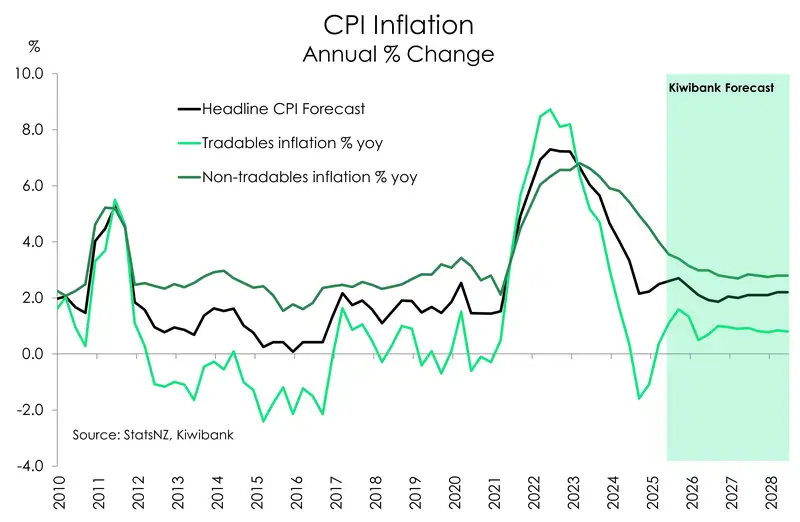

We see a near-term spike in inflation to 2.7% this year. But there’s no need to panic. The implementation of higher tariffs will likely reduce medium-term inflationary pressures. Import prices will likely fall as exporters adjust to weaker global demand. Trade diversion will also weigh on import prices. Goods made in China and destined for the US, may wash up on our shores at a discount.

Inflation respects the RBNZ’s 1-3% target band, but there’s risk of it falling below the 2% midpoint.

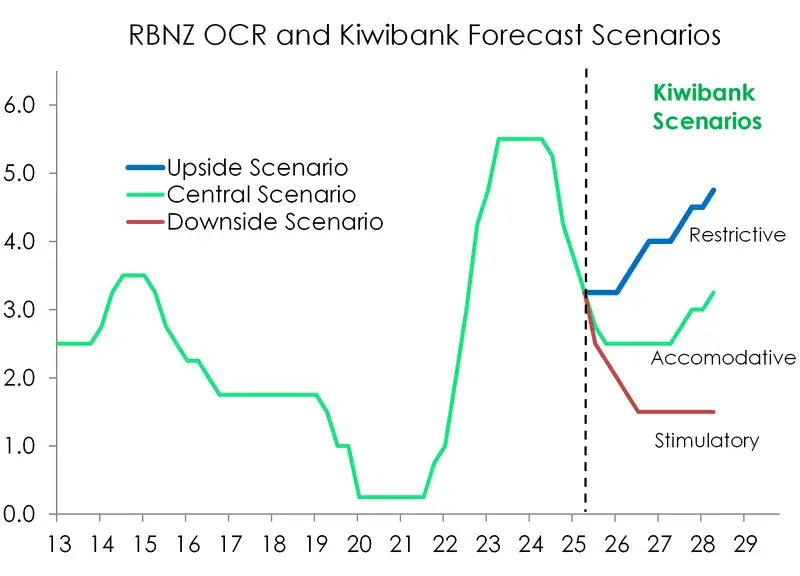

For the RBNZ, they will need to move policy settings from restraining the economy to supporting it. The outlook requires further easing. The RBNZ has delivered 225bps of cuts since August 2024, and we forecast another 75bps to set policy at more stimulatory levels. A 2.5% cash rate is still our forecast terminal rate, although the path toward is shrouded in uncertainty.

Yes, we are (heavily) influenced by our environment and the policies that change the rules of the game. We may be far from the global action, but we’re no Robinson Crusoe Island. Our economic prosperity is inextricably tied to that of our trading partners. At risk of stating the obvious, there are many ways the future may unfold. We explore just two realistic scenarios. And the way we see things, the balance of risks is tilted to the downside.

The global outlook: A back page feature turned front-page focus

The global outlook always plays an important role in forecasting the Kiwi economy. In today’s environment of heightened geopolitical tensions and de-globalisation, the uncertainty is dominating our thinking. And the global outlook has significantly deteriorated since our last forecast refresh.

Trump’s “Liberation Day” tariffs quickly threw market traders, policymakers, exporters and importers, and everyday businesses and households into disarray. Recently, things have calmed down following Trump’s 90 day pause on reciprocal tariffs, alongside a limited de-escalation in trade tensions with China. But the clock is ticking. And despite all that has unfolded post liberation day, we’re still no closer to any concrete resolution or direction from here. We’ve seen tariff exclusions, pauses, one lonely and unfinished trade deal with the UK, and now a legal battle on the legality "Liberation Day" tariffs. But wait we must. What will become of the 70+ deals to be made with countries scrambling to protect their exports to the US? The global outlook is highly uncertainty with further policy developments unclear. And as such, the full economic impact has yet to materialise.

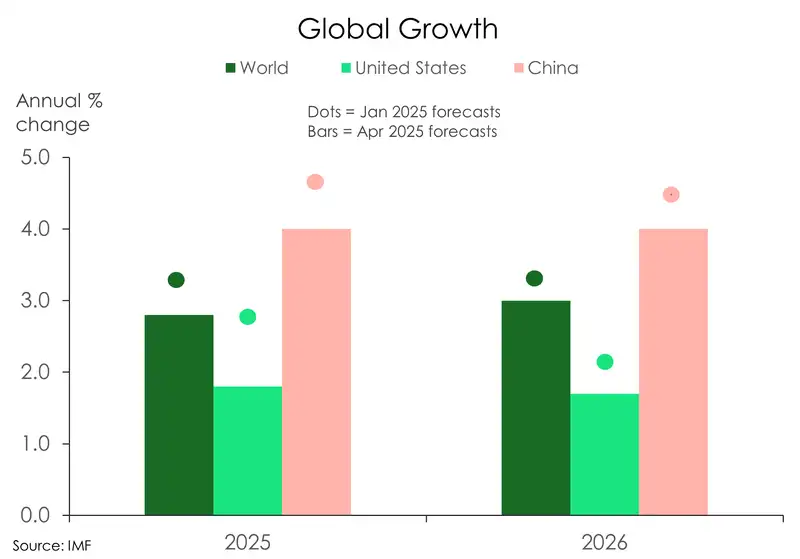

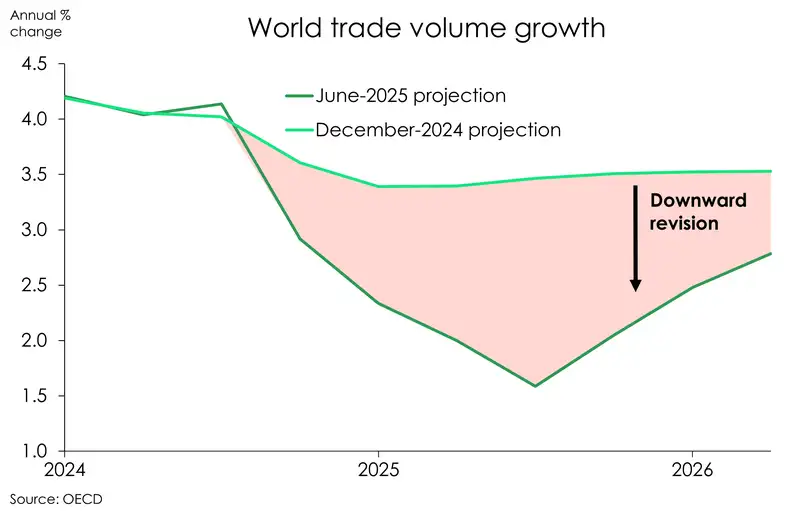

So much is subject to change. But under current conditions, and across almost all plausible scenarios, weaker global growth has become the accepted consensus. No matter where you look, global growth forecasts have been slashed. The IMF now expects global growth to slow to 2.8% in 2025, down from its earlier estimate of 3.3%. While the OECD also echoes a similar outlook, projecting growth to ease from 3.3% in 2024 to 2.9% in both 2025 and 2026. And growth in world trade volumes has been meaningfully downgraded. The slowdown is widespread, though heavily concentrated in advanced economies. At the heart of tariff turmoil, our second largest export partner the US has had its forecast growth cut by over a full percentage point this year by the IMF. Meanwhile China, our largest trading partner, is set to average growth of 4% over the next two years – falling short of policymakers 5% target.

After nearly a hundred years of reducing tariffs globalisation has slowed, and may reverse into protectionism. It’s disheartening. And it raises questions about a new world order. All of this when things were starting to turn for the better. Globally, central banks had won the war on inflation and had begun pivoting policy, delivering long awaited interest rate relief over the past year. And a lower rate environment was set to propel global growth. But, as forementioned, cold water has been thrown over such upbeat assessments. And to make matters worse, inflation concerns have re-emerged.

With trade policy still in flux, the full impact on such policies on inflation is uncertain. The mechanics of how tariffs will impact inflation are comprised of many moving parts and a wide range of factors. Ultimately the direction inflation takes will hinge on whether tariffs act more as a demand shock or a supply shock, an outcome which will likely be idiosyncratic across countries. For example, the US is imposing tariffs, a tax, and is more exposed to inflationary pressure, with higher import costs acting as a supply shock. Meanwhile, countries facing tariffs are more exposed to deflationary pressures, with reduced export demand slowing growth, and exerting downward pressure on prices.

While inflation risks remain, the balance of risks are tilted to the downside. Weaker global growth is expected to exert downward pressure on prices over the medium term. Even in cases where supply shocks push inflation up. Because the uncertainty of trade policy today is acting as a demand drag with businesses and households holding back on investment and spending. Reflecting this, the IMF still expects global inflation to decline, but at a slower pace than previously forecast in January.

Amid the complex and uncertain environment, central banks have begun shifting gears with greater caution. Despite slowing global momentum, the potential inflation risks and unpredictable trade developments has made it harder for all policymakers to navigate. Many central banks are signalling a data-dependent approach, waiting for clearer signals before making their next move. The RBNZ are included. But ultimately, a world of weaker growth will force central banks to do more (rate cuts), not less.

So, what’s the key takeaway for little ol’ New Zealand?

Well, we’re not coming out of this unscathed.

Trade policies aside, uncertainty, whether through weaker business investment, or household spending, kills growth. And the global slowdown will weigh on demand for Kiwi exports, weakening the recovery for the Kiwi economy

Some thriving, others still surviving

Last year, we wrote: Thrive in ’25 or Survive in ’25. Now six months into 2025, there’s a clear divide between the sectors that are indeed thriving, and those that are still in survival mode. Although, the worst is behind us.

The modest and still fragile recovery that we’ve seen to date since the end of 2024 has been largely concentrated in the external sector, with particular strength across the primary industries. Compared to a year ago, Kiwi export prices in the March quarter were up 17%, driven primarily by continued gains in dairy prices. Dairy prices, our largest export commodity, were up 10% over the March quarter alone. While meat prices, our second-largest export was up 7.2%. At the same time, prices for other key commodities, including forestry products and fruit, also continue to trend higher. And together, the lift in export prices, alongside the weaker Kiwi dollar at the end of last year and into the first quarter of this year has helped increase activity across the agricultural sector. Most recently, we’ve recorded a sizable trade surplus of $1.4bn over the month of April - of which a monthly surplus of that size has only been seen four other times in history. Meanwhile our Kiwi terms of trade, the ratio of prices at which a country sells its exports to the prices it pays for its import, continues to edge higher.

Higher prices and solid production are now feeding through to stronger export earnings healthier rural incomes and job creation in the industry. All offering a meaningful tailwind to the broader economy. But as forementioned it’s a highly uneven recovery. Beyond the agriculture-led rebound, most other sectors remain stuck in the mud. Interest rate-sensitive industries like construction remain weak, and business services are underperforming. And we should note that the primary sector is most exposed to further potential global shocks and trade turbulence.

We are at the beginnings of a cyclical rebound. But the forecast slowdown in global growth has led us to shave a few %pts off our growth projections for the Kiwi economy. We continue to expect economic growth this year, as the full effect of the RBNZ’s easing cycle feeds through. But the growth profile is weaker than our previous projections. Heightened uncertainty surrounding global trade policies is weighing on sentiment and business investment. The weaker growth trajectory also reflects the underperformance of the Kiwi housing market to date. We forecast the economy growing 0.9% this year, slower than our previous forecast of 1.4%. In 2026 and beyond, the economy should return to more normal levels of growth of about 2.7% per annum.

Reality Check

Markets, Mystics & Mayhem podcast

Urgent couriers front run an economy without green shoots

We were recently joined by Steve Bonnici, Managing Director of Urgent Couriers, for some great insights on the courier and logistics industry and what it tells us about the broader economy.

As Steve aptly puts it, rapid delivery services are a bellwether for the economy. When the market shifts, they’re the first to experience it. So, what’s the industry signalling for the Kiwi economy? According to Steve and his team, green shoots are not in sight. Enquiries are low and clients are still price-sensitive. Not quite the signs of a recovering economy. On the ground (literally) anecdotes like these from Urgent Couriers reinforce our position: The Kiwi economy demands more rate relief.

When asked about the current cycle and monetary policy actions of the RBNZ, Steve said: "I'm frustrated (by the RBNZ's actions) ...The lack of understanding of what Kiwi businesses were going through out there. The time for easing was the beginning of 2024, not the end of 2024... we're a bellwether... we've had more clients go into receivership or liquidation in the last 12 months than in any of the other cycles (back to the 1980s)". That’s what we’re hearing for the vast majority of Kiwi businesses.

Two potential paths ahead

What if the tariff negotiations fall flat and we return to Liberation Day settings? Winding back the clock on globalisation, our downside scenario, resembles a world of highly disrupted international trade. A deeper slowdown in global economic growth would push the Kiwi economy back into recession and lead to a deeper deterioration in the labour market. The unemployment rate would rise to GFC-type levels. And the correction lower in house prices would likely continue throughout 2026. A more negative output gap results in inflation falling below 1%. Our downside scenario assumes a deeper cutting cycle from the RBNZ, as inflation undershoots their target. Our central scenario for a 2.5% cash rate would look out of sorts. We could see the RBNZ cutting below 2% in a heartbeat.

And now, what if the domestic economy gathers pace earlier and faster? As the adage goes, we can be the master of our fate. Tariffs will be a feature of the future. But we way benefit in parts. We face a 10% tariff, and many of our international competitors may face even higher tariffs. Our export sector may go from strength to strength. The agriculture sector has lifted us out of recession, and continues to show impressive strength in export prices and volumes. Our urban centres need to build on that momentum. A (long-overdue) turn in the housing market would help, supported by an uplift in net migration (Aussie labour market is starting to struggle, just saying). Business and consumer confidence would improve, leading to firmer investment decisions and household spending. Broader economic growth would gain momentum, helping the labour market back on the mend. Naturally, inflation accelerates, potentially breaking above 3%, as the output gap turns positive. In this upside scenario, the current 3.25% could mark the bottom of the RBNZ’s easing cycle. And the next chapter, rate hikes, begins in 2026. It must be said, however, the likelihood of this scenario playing out is relatively low, but not zero.

Near-term inflation noise

Inflation is set to rise to the top-end of the RBNZ’s 1-3% target band later this year. The rapid deceleration in imported inflation, which helped to pull down headline, is reversing course. We’re no longer importing deflation. Prices for some food items like dairy and meat have increased recently, which will support tradables in the near term. We forecast annual tradable inflation pushing higher to a peak of 1.6% in the September quarter. The medium-term however is another story. And the introduction of higher US tariffs should be disinflationary, if not deflationary, for us. Import prices will likely fall as exporters adjust their prices in response to weak global demand. Trade diversion will also weigh on import prices.

Domestic inflation remains elevated, but has become less broad-based. Capacity pressures have eased, and the moderation in wage growth suggests that price-setting behaviour is adapting to the low-inflation environment. Given significant spare capacity remains in the economy, we expect further easing in non-tradables. However, administered price increases remain frustratingly high, and have slowed the overall return of domestic inflation to its long-run average. Rental inflation, once a domestic inflation hot spot, has cooled significantly. However, household energy prices have increased substantially (7.2%) over the last year, while council rates are running faster than historical averages. We forecast a slower easing in non-tradables due to the proven persistence in administered inflation.

Overall, annual headline inflation is forecast to hit a high of 2.7% later this year, before declining back to the 2% midpoint. Over the forecast period, we see inflation respecting the RBNZ’s target band, with risk of it falling below 2%.

Despite an expected near-term lift in inflation, we’re encouraged by the direction in most measures of core inflation. Core inflation has fallen to 2.6%, suggesting that the underlying trend in inflation is converging towards the 2% target midpoint.

Holding on for housing

The housing market has continually surprised us, and the RBNZ, on the downside. And we’re holding out for a recovery. We’ve seen green shoots emerge, and then die off, only to re-emerge again. But we must wait, like gardeners, until spring… to see if the green shoots start blossoming, or remain in drought.

Ultimately, we trust the process. Lower interest rates, and we still need lower rates from the RBNZ, will stimulate demand (eventually) and lift house prices (and other assets). And the housing market plays an important role in the Kiwi economy. Rising prices boosts consumer confidence, and business confidence, especially within the SME space. This is the “wealth effect” of monetary policy.

The expected recovery in the housing market will not just boost confidence. But a rising housing market will encourage households to spend a little more (or save less), and may just help businesses repair their balance sheets a little faster, and eventually help lift hiring and investment intentions. It’s been a long time coming.

The housing market remains sluggish in 2025, as it did in 2024, but better than the correction in 2023. House prices have virtually traded sideways over the past two years. Nonetheless, we (somewhat optimistically) believe we will see a pick up over the spring and summer months, and record a 2-3% gain by year end. We maintain our long-held forecast of 5-7% house price growth next year.

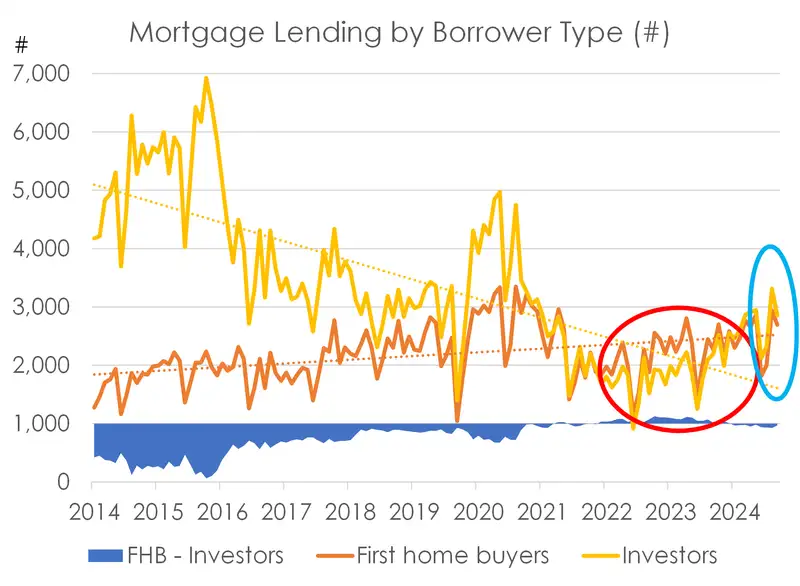

Falling interest rates is one strong tailwind for the housing market. The return of the investor is another. We continue to hear from investors that they are waiting to rebuild equity in their portfolios – they need house prices rising not going sideways. And many are worried about a change in Government with a possible reintroduction of a harsher brightline test and/or the removal of interest deductibility. To be clear, investors today are worried about an election late next year. But that may be turning, at least in the data.

First-home buyers remain active participants in the market. Atypically, more bank lending was going to first home buyers than investors. However, we are seeing a lift in investor activity, off a very low base. We expect this segment of the market to be more involved going forward.

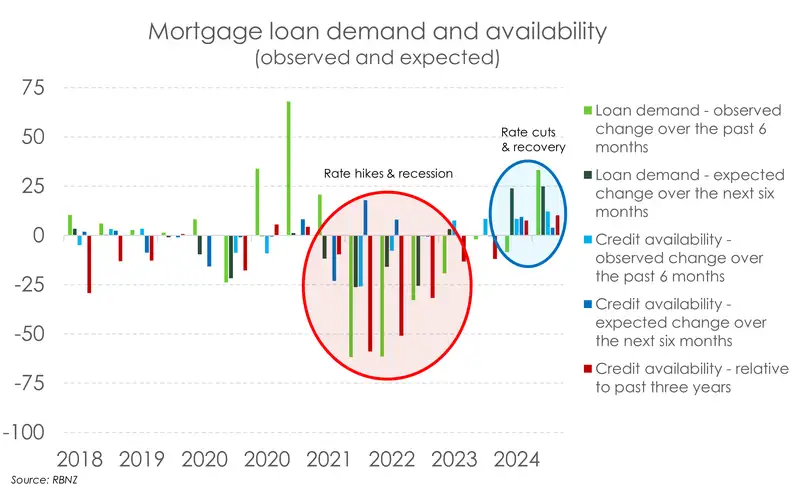

Beyond lower interest rates, an improvement in rental yields should also entice investors back. While rental inflation has eased, it’s still outstripping general inflation. As term deposit rates decline, rental yields will become more attractive to investors. More importantly, the demand and supply of credit has improved. The chart below shows the significant uplift in credit availability. Banks are lending again. And there’s a tentative lift in the demand for credit. Buyers want loans again. Credit is the oil in the economic engine. Credit dried up over 2022-23, contributing to the recession, as the engine seized. Now, conditions are conducive to growth.

A stabilising yet strained labour market

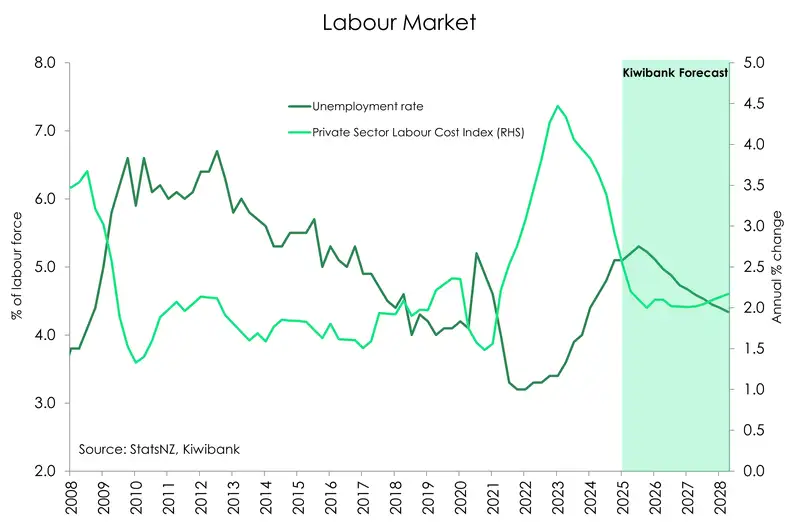

Not helping the “wealth effect” nor the Kiwi housing market is the ongoing weakness in the Kiwi jobs market. In line with our previous forecasts, the labour market has continued to deteriorate. At 5.1%, the unemployment rate sits at 3-year high, up from a low of 3.2%. And beyond the headline rate, all other labour indicators remain anaemic. Employment is barely growing. The full-time workforce continues to shrink. And valuable working hours (down close to 3% over the year to March25) are being cut. All evidence of the still fresh recession scars of the past two years. And with a slower economic recovery as the base case scenario, excess capacity is still building, and the labour market is set to remain weak for some time longer. Weakness which will continue feeding through to the broader economy. Whether through lingering job insecurity weighing on household confidence and the housing market, or through fewer hours worked keeping discretionary income and spending power under pressure.

Our refreshed set of forecasts for the labour market are not too dissimilar from the ones published at the end of last year. We still see unemployment peaking at 5.3% but now in the upcoming September quarter, instead of the current June quarter. The peak is in part restrained and tempered from lifting higher with the rapid decline of active participants in the workforce. With the demand for workers falling, obtaining a job has become so difficult that many would-be workers are giving up on the job hunt altogether. Some are returning to further study. Others are fleeing the nest entirely in search of better job prospects. We’ve seen Kiwi departures running at record highs. And it is not until the end of 2025 that unemployment begins to taper away from the peak. Soft labour demand is also causing wage growth to moderate. Having already fallen from its recent peak of 4.5% to 2.5% today, we expect wage growth to ease to 2% into 2026.

Finding the bottom in interest rates

We are getting closer to the bottom in interest rates. We’ve seen 225bps of easing thus far, and we forecast another 75bps to come. Although nothing is guaranteed.

Wholesale markets have just one more 25bp cut to 3% priced. That’s not enough, in our view. We’re likely to need another 50bps beyond that, to get the economy humming once more. We forecast another 25bp cut in July (or August), followed by one last thrust to 2.5% by year end. The exact timing is up for debate. The RBNZ may pause in July at 3.25%, but we expect the data to evolve in a way that demands more rate relief.

If the market is right, and we only see a move to 3%, then we may have recorded the lows in wholesale rates, and lending rates will track sideways. Longer dated mortgage rates may lift in this world of better-than-expected growth and tariffs tensions. Deposit rates will also twist a little higher. In this world, the Kiwi currency holds above 60c, and ends the year higher than our central view of 60c. We could be at 63c or higher.

If the RBNZ is right, and we get a move to 2.75%, we may equal the recent lows in wholesale rates, and lending rates will only be tweaked, ever so slightly. Deposit rates may have found the bottom also. In this world, the Kiwi currency holds above 60c, and ends the year slightly above 60c.

If we’re right, well, we’ll get lower wholesale, deposit, and lending rates. Kiwi households and businesses are rolling off rapidly, and will scoop up better rates faster. We need it. In this world, the Kiwi currency breaks back below 60c and ends the year close to 60c. If we move down our downside scenario, outlined above, we could see a cash rate below 2%, possibly 1.5%. Our assessment of the harsh risks is below the RBNZ’s forecast downside scenario, which sees a cut to 2.5%. Not a lot of down has gone into their downside scenario.

At the end of the day, excluding up or downside scenarios, we’re no longer arguing over a massive amount. We’re arguing over 50bps. This time last year, we were arguing over a lot more. Some commentators were calling for a 6% cash rate, while others (like us) were calling for a 2.5% cash rate. Now, we’re rather close in our call

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.