- 2025 was a year of frustration for many. But the settings are about right, now. We have the makings of a recovery, and not just in a few areas, most will recover. And no, inflation is unlikely to be a threat.

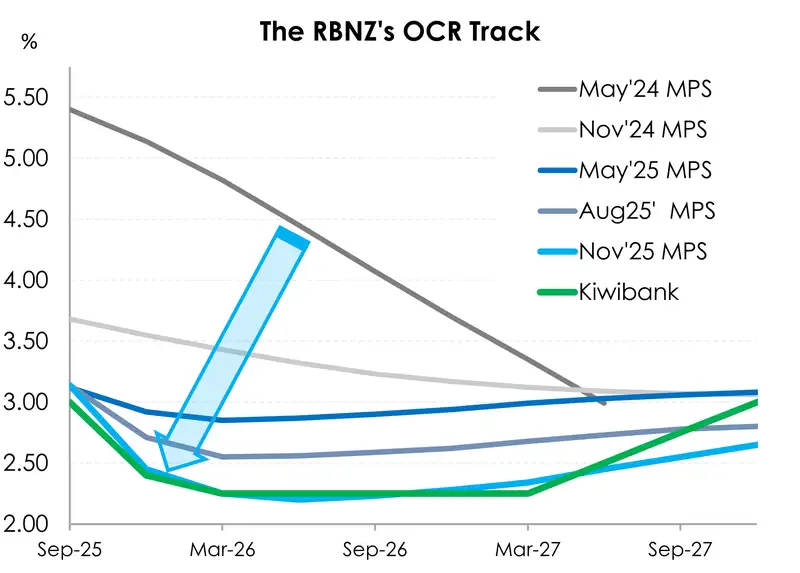

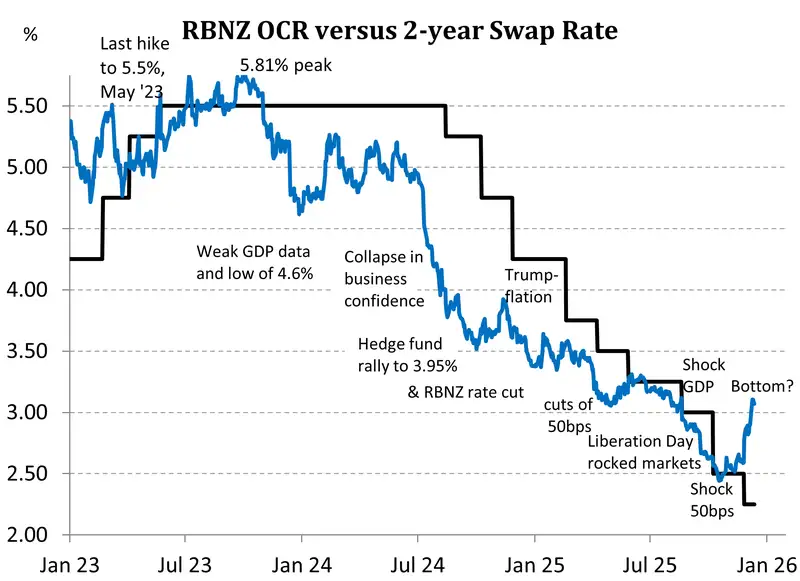

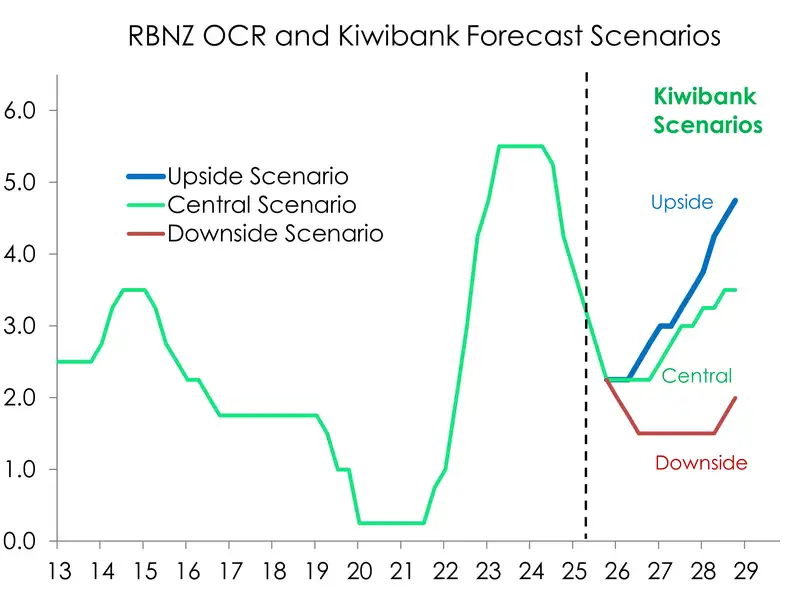

- We think 2025 will mark the low in interest rates for this cycle. That’s good news. Risks of rate cuts outweigh risks of rate hikes, for now. Although, if all goes according to plan, interest rates will rise over 2026, as rate hikes come into focus later in the year. Wholesale markets are factoring in too many hikes, however, putting premature upwards pressure on retail rates.

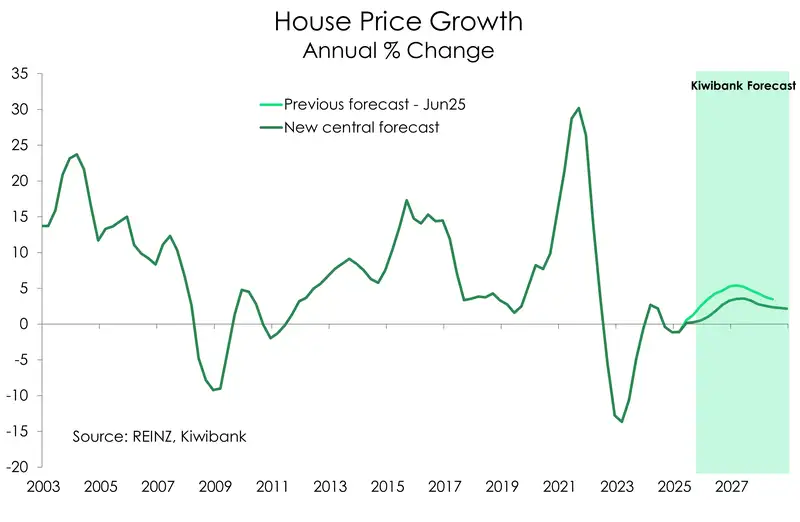

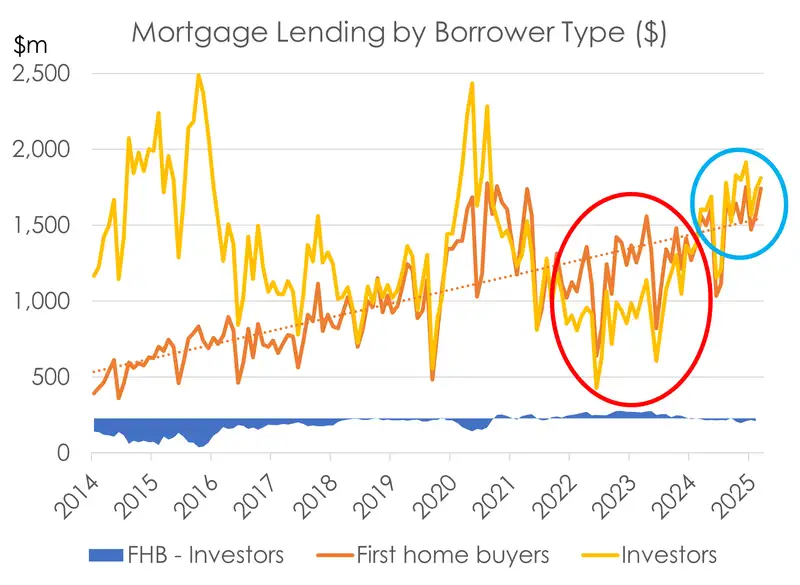

- The housing market is forecast to recover in 2026. There’s a glut of supply, especially in rentals, that needs to be worked through. But we expect investor appetite to improve as first home buyers remain active. Lower rates should lift prices, eventually.

The song remains the same, but the settings are about right. We continue to forecast a robust recovery for the Kiwi economy. We’re growing in confidence as interest rates have been (belatedly) set at stimulatory levels. And we’re hearing more from investors, after a few years of conspicuous absence. Household budgets are improving, despite the heavy burden of higher prices on essentials. Our card data shows a spreading of consumption into more fun, discretionary spending. That’s a good sign. And business owners are starting to see a lift in activity. It’s not just confidence, it’s action. And no, we’re not worried about inflation. Recessions kill inflation. And that weed has had a proper dose of economic herbicide. Looking offshore, concerns around a reacceleration in inflation have eased. We like that.

It's not all easy and straight forward, however. The RBNZ is again at the centre of some confusion. More miscommunication from the RBNZ is complicating the pass-through of lower rates… but that can be easily addressed come February. Although the RBNZ cut rates, with the obvious intention of lowering retail rates for businesses and households, a higher-than-expected OCR track has catapulted wholesale rates higher. Traders are now factoring in rate hikes (no longer cuts) in early 2026. That’s way too aggressive and premature. The RBNZ’s misstep is all-too familiar. Over the last few years, the RBNZ have bounced around from being hawkish in November, dovish in February, hawkish in May, and then dovish in August. There seems to be some seasonality to their mishaps. The RBNZ’s miscommunication in November, along with climbing wholesale rates, and higher retail lending rates, suggest we may indeed get another dovish commentary in February. It’s silly… we know. At the end of the day, retail rates are in a lower bound, although not as low as they should be. The RBNZ can (and should) lower wholesale rates with the stroke of a pen in February, or from a speech at any time.

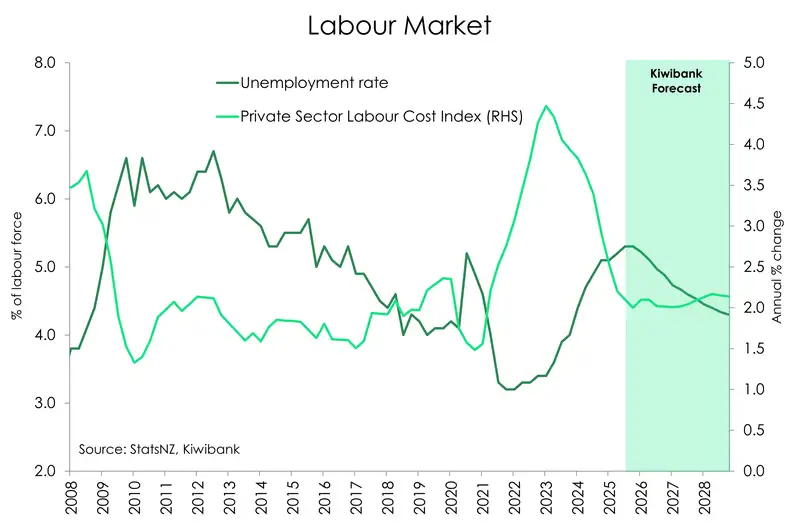

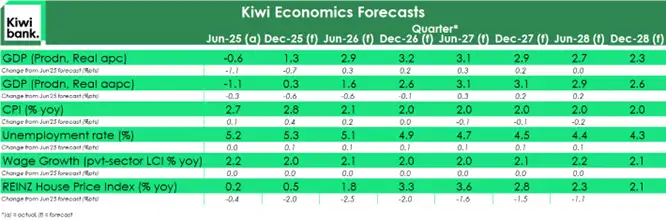

With the economic recovery already underway, there are signs that the labour market is stabilising. Filled jobs are crawling higher, and the decline in total hours worked is reversing course. The unemployment rate may be at a nine-year high, but 5.3% should mark the peak. And employment growth should rebound from the middle of 2026, as economic demand strengthens.

The housing market is also set for firmer gains in 2026. Signs of life are already showing. Sales are up 6% compared to October last year. And where sales go, prices follow. Interest rates are the strongest driver of the housing market. However, balanced against ample supply and weak population growth, we expect house prices to rise around 2-3% next year. That’s not exactly shooting the lights out, but it is an improvement from trekking sideways over the last two years.

The Kiwi economy may enjoy a period of above-trend growth. 2025 belonged to the external sector, the likes of agriculture and tourism. It’s an impressive feat considering that the rules of the global playground were being rewritten. But 2026 should be the year that the interest rate sensitive sectors play catch up. Sectors acutely affected by the demand destruction caused by high interest rates stand to gain the most from loose(r) policy settings.

We have all the ingredients laid out on the kitchen bench: a rebound in household consumption – check; a stable jobs market – check; an uptick in house prices – check; and firmer business investment – check. We expect the Kiwi economy to expand around 2.4% next year, and by around 3% in 2027 – if no adverse external shocks come about. Granted, that’s a big if.

It is hard to be outright optimistic as we still face into gusty winds from offshore. The risk of derailment remains in the back of our minds. For now, the threats from offshore look to be receding. And that follows six months of noise around Trumpian tariffs. Our export sectors have been star performers. That won’t change next year. But softening commodity prices may dampen things a little. Although demand for our products and services should remain strong, if not improve. We’re waiting to see what summer brings in tourism. We’re back at 90% of pre-Covid levels. We expect a move back to full noise, full coaches, full bars, and flying bungies come Christmas.

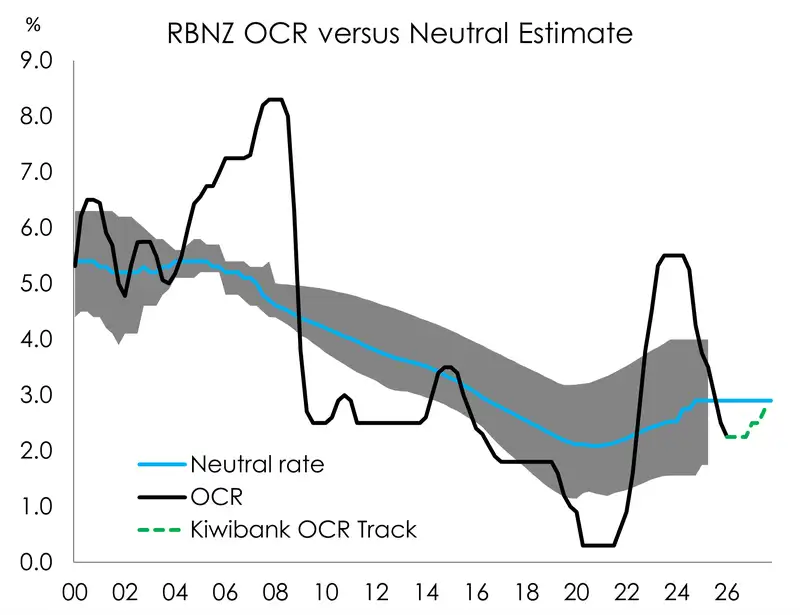

When it comes to interest rate settings, we think we’ve found the low in rates. The RBNZ’s various guestimates of “neutral” (a Goldilocks rate that’s neither too hot nor too cold) gravitate around 3%. And at 2.25%, we’re at levels that matter. Levels that should relieve household budgets, entice investors to invest, and encourage businesses to expand and hire. It’s all about restoring demand and boosting activity across all four corners of the economy. We hope we have seen enough… enough to get the economy moving again.

The taming of Trump’s tariffs restores trade trajectories

As a small open economy at the edge of the Earth, 2025 was yet another reminder of how exposed we are to global forces. Trump’s thunderous tariff announcements, coupled with the prospect of a trade war with China, sent shockwaves through financial markets. Tariffs consumed the headlines. And many business owners found themselves paralysed by the relentless run of bad news. No more…

At the time of our last update in June, the threat of tariffs upon tariffs was still at large. We were in the midst of President Trump’s 90 day pause on reciprocal tariffs, with the clock ticking for trade deals and little progress made. At the time, a multiverse of scenarios could have played out. We are not out of the woods, but the worst-case scenarios have dissipated. Why? Trump has stepped back, allowing the average tariff rate to settle just below 15%. That’s still the highest since 1939. But it’s far below the 28% peak under Liberation Day (Trumped up) announcements.

[Many used the term TACO: Trump Always Chickens Out].

In August, President Trump announced reduced tariff rates for most countries. Emerging Asia was initially slapped with outsized rates of 40-50%. Those rates have been whittled down to 10-20%. More importantly, the two global superpowers – the US and China – have agreed to a one-year truce. And the average tariff rate on China has been reduced to 45%. It’s a move in the right direction, and certainly a better outcome than the 100%+ tariffs threatened earlier in the year. It’s all gamesmanship when striking the “deal”. And a lot is happening behind the scenes.

For NZ, the reciprocal tariff was lifted from 10% to 15%. But Trump gives with one hand, and takes with the other. US beef imports – along with several other agricultural goods – have now been made exempt. Beef is our biggest export to the US ($2.95bn in the year to Sep25). They love our beef. And the exemption was applauded by our beef exporters.

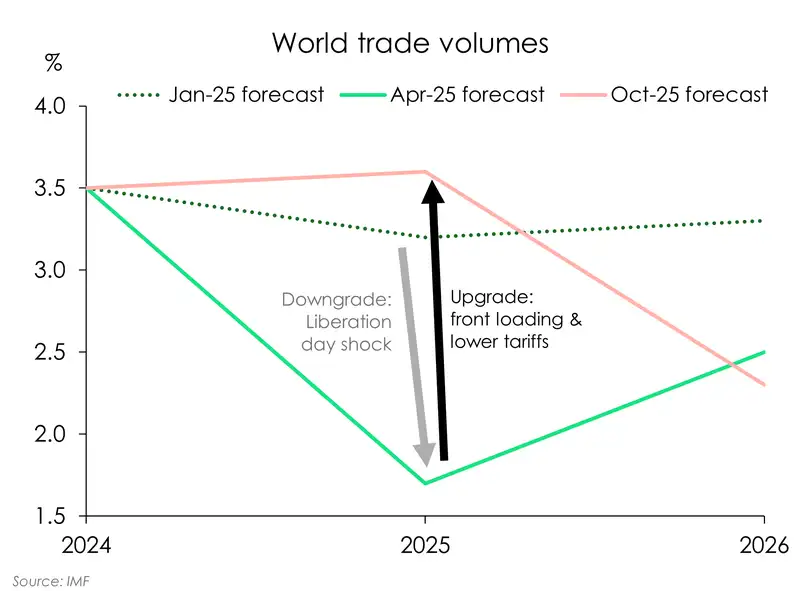

With the worst of the tariff scenarios averted, global trade volumes have held up better than expected. In April, the IMF expected volumes to rise just 1.7% this year. That’s now been significantly upgraded to 3.6%. Volumes have also been supported by the front-loading of activity ahead of the increase in tariffs. We have also witnessed an aggressive redirection of Chinese exports away from the US and into India, Southeast Asia and Europe. Next year, the support from front-loading should fade, and growth in global trade volumes is expected to slow to 2.3%. That’s 0.2%pts weaker than the April forecasts, and a whole 1%pt below January’s (pre-Liberation Day) forecasts.

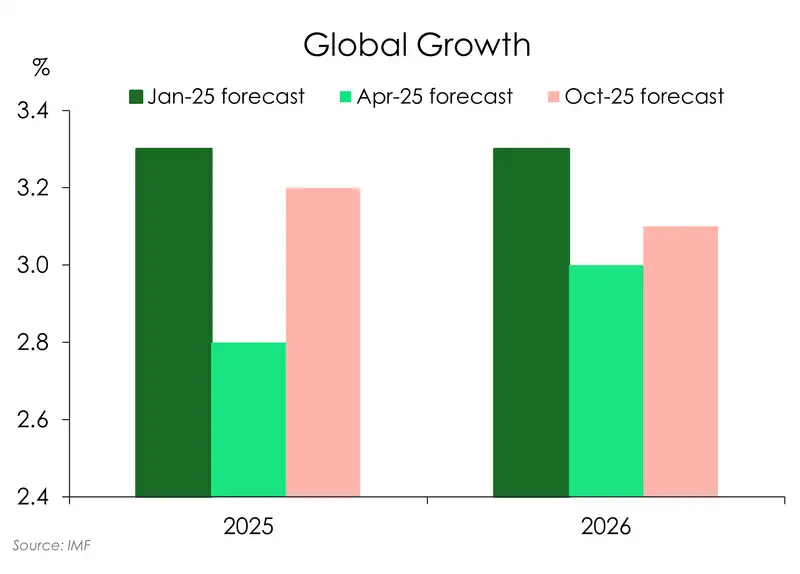

The IMF now expects the world economy to have grown 3.2% in 2025, up from its April estimate of 2.8%. Into next year, growth is projected to ease to 3.1%. The growth outlook for 2026 is just modestly above April’s forecast. But notably, global growth forecasts for 2025-26 remain 0.2%pts below projections made prior to the tariff announcements.

At the heart of the tariff turmoil, our second largest export partner, the US, is expected to see a slowdown in growth. From 2.8% in 2024, the US economy is forecast to expand just 2% in 2025 and 2026. Meanwhile, China, our largest trading partner, is projected to continue undershooting their growth policy target of 5%. China likely grew by 4.8% in 2025, and is expected to ease further to 4.2% in 2026. Policymakers are all too-aware of the underperformance, and risks of undershooting. We will see more stimulus next year, as the 5% water mark becomes out of reach.

Concerns around a reacceleration in global inflation have eased. There’s slight deflation coming out of China, and price pressures are easing across our trading partners. As we anticipated in our previous update, tariffs have not triggered a surge in global prices. As the tariff imposer, there is certainly more inflationary pressure in the US, particularly in food prices (hence Trump’s recent exemption across agricultural products). Though overall inflation pressures remain subdued with a continued moderation in global inflation expected into 2026.

In short, a global slowdown is still underway. But the downside risks are evaporating. And growth is proving more resilient than previously expected. In that sense the global outlook for 2026 has improved. However, it is important to note that lingering trade tensions means global growth, and by extension Kiwi growth, are still facing more drag than otherwise would be the case. It’s less bad but far from really good.

It should be good news ahead, but it was a frustrating year that’s been

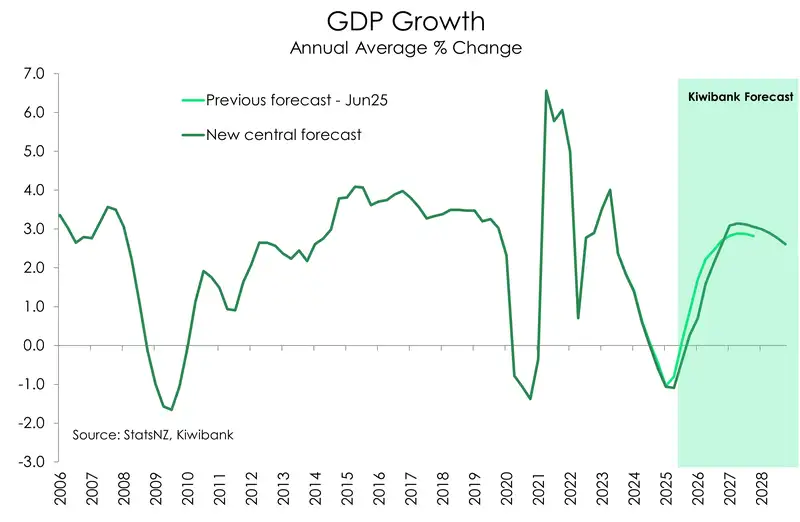

It goes without saying 2025 was a major let down on the recovery that was widely expected. The start of 2025 showed glimpses of the recovery we were meant to have. The external sector, namely the agriculture and tourism industries, kickstarted the year strong. And beyond that, PMIs (the activity index for manufacturing) were finally at expansionary levels. All the markers were there for a better year. But it all came to a crashing halt in the middle of this year when the Kiwi economy slammed into reverse. Economic output declined 0.6% in the year to June 2025, after already contracting 0.5% the year before.

So, what happened to the recovery we were meant to have? Well, two things.

The first, was the shock from liberation day tariffs. Confidence across households and businesses took a major hit. Business expansion plans were shelved as uncertainty paralysed investment decisions, halting the momentum we saw at the start of the year. Thankfully, most of the shock to confidence has now dissipated as tariff volatility has eased.

The second, most important factor that derailed our recovery was the delay in interest rates cuts to levels which support growth. It was only in October, that the RBNZ took the cash rate below neutral and into more stimulatory territory. For most of the year, policy remained restrictive.

We won’t dwell on the RBNZ’s past mistakes though. It would take too much ink and paper. And we’re mindful of climate change. Plus this is our outlook note after all. And what matters most for the Kiwi outlook is that policy settings are now at levels which should encourage activity. A cash rate at 2.25% is more supportive of a solid recovery in 2026. Compared to last year, interest rates are meaningfully lower. And they should stay low for a while yet.

As lower interest rates feed through the economy, output is set to expand 2.4% in 2026 and 3.1% in 2027.

The robust performance of the external sector is likely to continue into next year. Although there is likely to be some moderation in some areas. Global dairy prices, for example, have fallen consecutively over the past four months. High prices have spurred an increase in production and supply. Nevertheless, dairy prices remain historically high. And there is of course the upcoming Fonterra payout next year that will add extra cash to farmer’s pockets. Beyond dairy, the outlook for Kiwi meat remains strong, supported by tight global supply and firm demand. And away from our goods exports, the summer tourism season looks primed for another solid run, with visitor numbers now sitting at around 90% of pre-COVID levels. Will we return to 100%? Yeah, for sure. Give it time.

What we’re most looking forward to, however, is the outlook for the domestic economy. For most of this year, the Kiwi economy has been characterised as operating at two-speeds. The external sector powering ahead, while the domestic, interest-rate sensitive parts of the economy, remained stuck in the mud. But that’s now starting to turn. The interest rate sensitive sectors of the economy are starting to respond. Because interest rates have finally reached supportive levels. Retail volumes in the September quarter, for example, posted their largest increase since late 2021. Meanwhile, building activity, particularly in the residential sector, appears to have found its floor. Consents are showing upward momentum, likely in anticipation of a housing market recovery. Around 33% of households are set to roll onto lower mortgage rates over the next six months, and 75% over the next year. Rate relief should see the outlook for these sectors improve into 2026 and beyond.

A stabilising yet strained labour market

It’s like standing in quicksand. It’s horrible as you sink. But it’s great relief when you hit hard ground… up to your waist… and the sinking stops. That’s where we’re at. Now we’re looking to get a leg up, and out.

Despite weaker growth over 2025, the labour market has continued to soften in line with our previous forecasts. At 5.3%, the unemployment rate has reached a 9-year high. Similarly, the underutilisation rate – a broader measure of slack – has reached a 5-year high at 12.9%. The loss of momentum in this year’s recovery has kept spare labour capacity elevated, with demand for workers subdued. At the same time, persistent weak net migration and the return to education and upskilling for many have kept workforce participation in decline, preventing sharper rises in unemployment.

Like our previous forecast in June, we continue to expect 5.3% to mark the peak in the unemployment rate for this cycle. Signals are emerging of a stabilisation in labour market conditions and an improvement in the demand for labour. For example, the September quarter recorded the first quarterly lift in total hours worked in nearly two years. In an economic slowdown, hours worked typically falls before unemployment rises, as firms try to hold onto labour for as long as possible before cutting headcount. It’s exactly what we’ve seen over the past couple of years. Whereas now the recent increase in hours worked suggests a renewed appetite for labour.

Nevertheless, with the labour market lagging the broader economy, we don’t expect employment growth to take off like a bucking horse. It will take time, and a stronger pickup in activity, before excess labour capacity is absorbed. In line with our broader growth forecasts, we expect the unemployment rate to begin gradually easing from its current peak in 2026, hopefully ending next year below 5%.

Wage growth, at 2.1%, has instead largely returned to its long-term average. And in line with consumer price inflation settling back near 2% in 2026 we expect wages to hover around 2% as well.

Coming back home

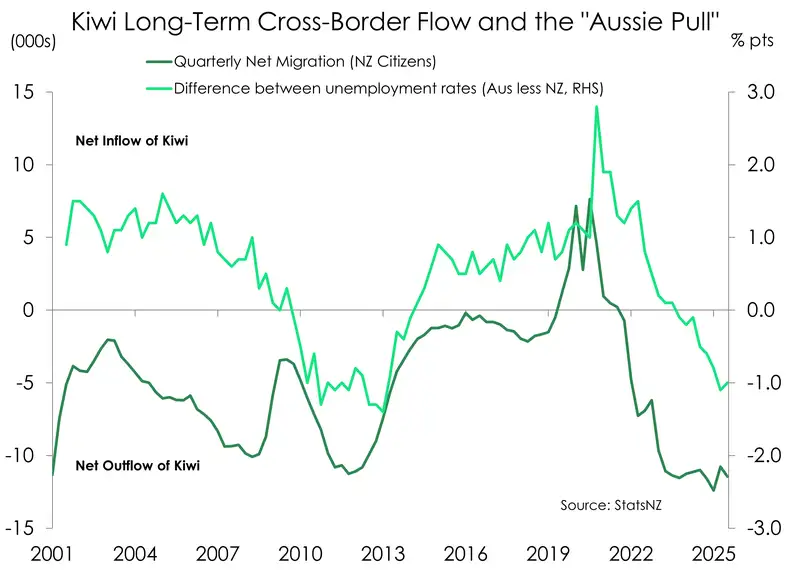

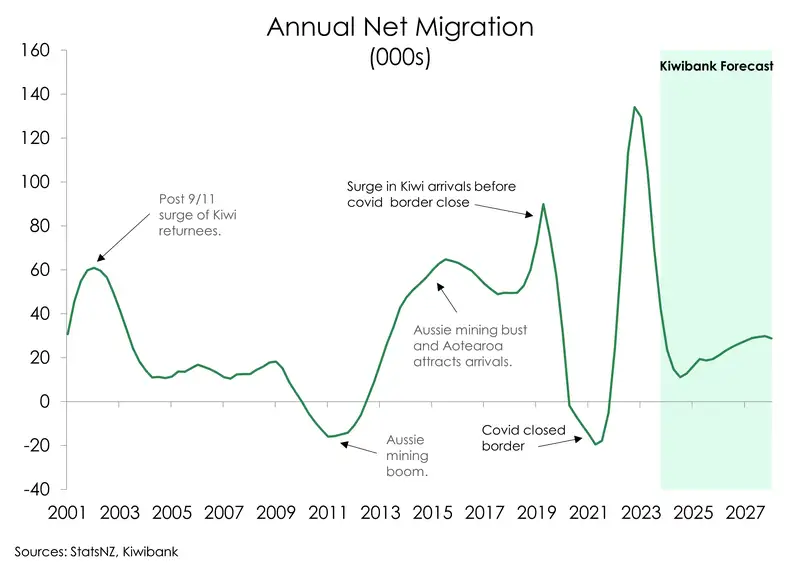

Net migration has sharply slowed over the past two years. From a record-setting peak of 134k, we’re now recording annual net inflows of a little over 10k. That’s well below the pre-covid average of ~20k. Departures of Kiwi remain high by historical standards, above 70k. And where are most of them going? To geographically browner but economically greener pastures – Australia. Earlier this year, Stats NZ reported that in the year to March, 47.7k permanent and long-term migrants headed across the ditch. And 86% of them were holding Kiwi passports. Such elevated departure numbers reflect stronger job prospects elsewhere. The pull of work is a powerful one when it comes to migration flows. The chart below shows a stronger Australian labour market compared to ours. Aussie jobs growth is strongly positive, while it’s all about right-sizing for Kiwi businesses. Wage growth in Australia is outpacing Kiwi wages. And the Aussie unemployment rate at 4.3% is a full percentage point below the Kiwi rate.

The starkly different labour market outcomes is a result of starkly different economic trajectories driven by starkly different monetary policy strategies. The RBNZ “engineered” a recession with an aggressive hiking campaign. And a painful recession we got. The RBA opted for a gentler approach, increasing rates by only 400bps (compared to 525bps by the RBNZ). But with the RBNZ having lowered rates since August, the Kiwi economy is on the road to recovery. At the same time, Australia’s slow and steady approach has meant persistent inflation, and so fewer rate cuts. We expect the labour market narrative to shift next year as our economy regains momentum. We forecast net inflows to rise to around 20k in 2026.

Breaking the house price plateau

It has been yet another quiet year for the Kiwi housing market. Our previous forecasts have been proven too optimistic. Since bottoming out in May 2023, house prices have virtually traded sideways. At the national level, house prices are up only 0.3% compared to October last year. Although, the regional picture is more diverse. We’ve witnessed a stronger performance across the South Island, while markets in the North Island have remained crippled. Auckland house prices are up just 2% from the trough. Wellington house prices are actually 0.5% below May 2023 levels. In contrast, Canterbury house prices are 9% above the trough. And Southland is recording new highs. Overall, national house prices look set to end 2025 around 0.5-1% higher than last year’s levels.

2026 however should be a livelier story for the housing market. We’re already seeing a lift in activity with sales up 6% compared to last year. But new listings are coming onto the market, faster than houses are being snapped up. Residential construction also appears to be gaining ground, which should support supply next year. For now, weak population growth and elevated stock are capping price growth. But the fall in interest rates is one strong tailwind for the housing market. We’re expecting a modest recovery in house prices, with growth of about 2-3% next year.

Another missing piece of the puzzle that is now falling into place is the return of the investor. First home buyers had been active participants in the market as they claimed a greater share of total bank lending than investors. Today, investors are coming off the sidelines and getting back into the market. In the last six months, lending to investors is almost 10% higher than lending to FHB. Whereas, for the same period last year, FHB received around 4% more lending than investors. We’re reverting to more typical behaviour. Beyond lower interest rates, an improvement in rental yields should also entice investors back. Given the low levels of term deposit rates, rental yields will become more attractive to investors.

What awaits us next year is the election, and we’re left brainstorming what a change in government might mean. On the ground, we’re hearing of concerns around capital gains tax, extended brightline tests, the removal of interest deductibility – all policies that inhibit bank appetite. Just at a time when all banks are back in business and lending again. The demand for credit was on the road to recovery too. But risk of a change in policy does question how durable the pick-up in credit demand will be next year.

We’re trusting the process. Lower interest rates will stimulate demand (eventually) and lift house prices (and other assets). And the housing market plays an important role in the Kiwi economy. Rising prices boosts consumer confidence, and business confidence, especially within the SME space. This is the “wealth effect” of monetary policy.

The expected recovery in the housing market will not just boost confidence. But a rising housing market will encourage households to spend a little more (or save less), and may just help businesses repair their balance sheets a little faster, and eventually help lift hiring and investment intentions. It’s been a long time coming.

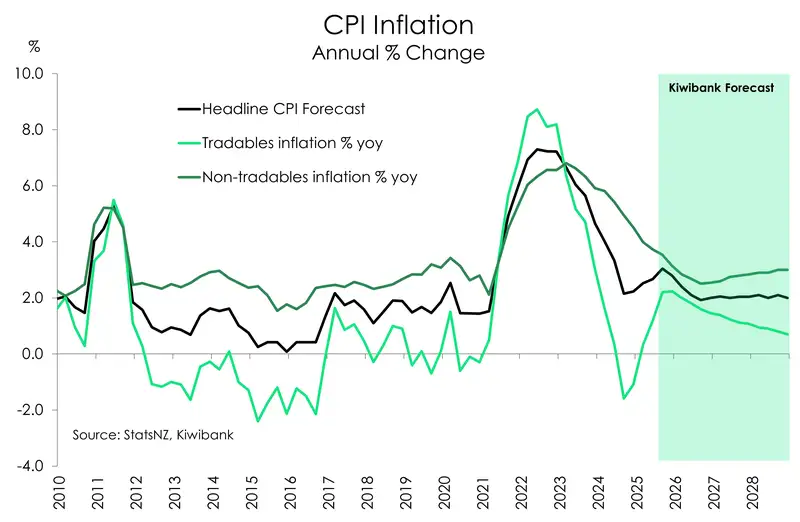

The return to 2% inflation

Inflation has climbed to the top end of the RBNZ’s 1-3% target band. But it stops there. We continue to expect inflation to return towards the RBNZ’s 2% target midpoint next year. And although headline inflation has accelerated, measures of core inflation have decelerated. Underlying inflation pressures are moderating.

Domestic inflation continues its slow grind south. Annual non-tradables inflation has fallen some way from its 6.8% peak in 2023 and price pressures have become less broad-based. Rental inflation, once a domestic inflation hot spot, has cooled significantly, now sub-3% And construction costs are running at the weakest rates since the end of 2009. But at 3.5%, domestic inflation is still sitting above long-term average levels (~3%). Such persistence is down to the lingering strength in administered prices. Council rates are up 8.8% on the year – ouch. Insurance costs are up 4.1% - oof. And electricity charges are running at the fastest pace since the late 1980s – sheesh. Stripping out these govt charges, domestic inflation would be sitting at 2.6%. And that’s a better reflection of the high degree of spare capacity in the economy. Such slack should limit price increases moving forward. And we expect to see some moderation in the pace of increases in administered costs.

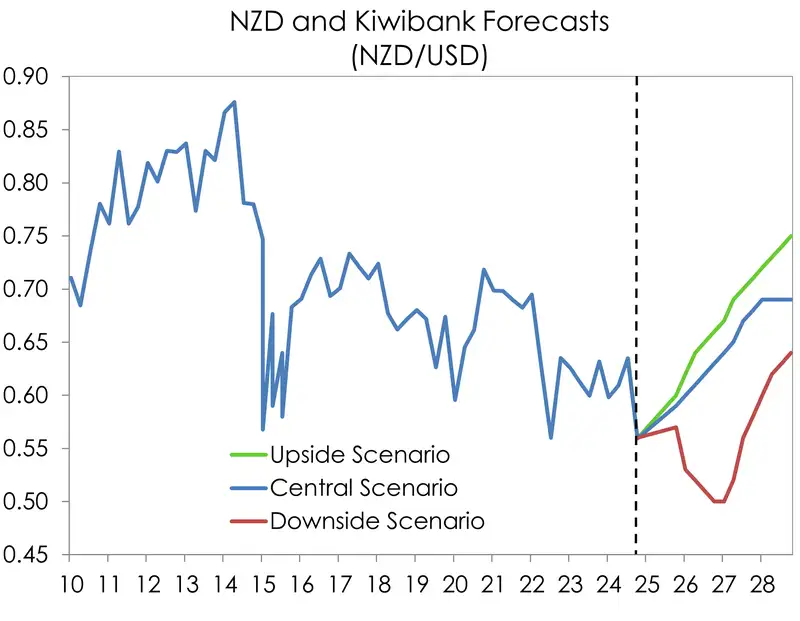

The recent rebound in headline inflation has in part been underpinned by a bounce back in imported inflation. But with global commodity prices easing recently, we’d expect the likes of food prices to moderate as well. The exchange rate has weakened since our last update in June, which adds some upside risk to imported inflation in the near-term. Over the medium-term, it is still our view that higher US tariffs will be disinflationary, if not deflationary, for us. Plus, as the economic recovery strengthens, so too should the Kiwi which would relieve some of that inflationary pressure.

Overall, annual headline inflation is forecast to fall back to 2% by the middle of next year. Over the forecast period, we see inflation respecting the RBNZ’s target band, but risk of a sub-2% inflation remains.

Have we found the low in interest rates? Hopefully yes

We think we have found the low in interest rates. Although they didn’t last long. We have seen 325bps of cuts, from a rather restrictive 5.5% (when mortgage rates hit 7.5%). The RBNZ, belatedly, cut the cash rate to 2.25% in November. The move followed a 50bp cut (to make up for lost time) in October to 2.5%. It was only then that interest rates were taken into a stimulatory setting. As mortgage rates fell into the 5s, we heard the relief of those indebted. But it was only relief. Households and investors seemed more willing to pay down debt, and take any further ”savings” to spend on the ever-increasing cost of essentials. But now that we’ve cracked into stimulatory settings, there seems to be a groundswell of optimism. Psychologically, we have seen a lot more interest from households and investors as mortgage rates fell into the 4s. And we’re seeing tentative signs of broadening demand into the fun (discretionary) items.

Nothing is ever simple, however. There’s a new gust of headwind facing the Kiwi economy. It’s the premature rise of retail rates. And it’s a move caused by yet another misstep from the RBNZ. Wholesale rates have ratcheted higher following the poorly executed 25bps cut in November. The RBNZ basically cut, said that’s all folks, and encouraged traders to price in rate hikes (no longer cuts). The RBNZ’s hawkish talons has led to hikes being priced early in 2026. It’s too soon. The output gap is still deeply negative. There is still a lot of slack sloshing in the economy that needs to be eaten away. We’re still trying to gauge if the economy is recovering. We still trying to gauge if lower interest rates are gaining traction. But now, financial conditions have tightened, reversing the work of the circuit-breaking 50bps cut back in October.

Don’t get us wrong, rate hikes would be good news - if they were off the back of a recovery. Higher rates mean the economy is on the mend and growth is returning. But we’re not there yet. The signs of life have only just sprung and they need nurturing, not squashing.

It is important to stress that interest rates today are significantly lower than they were this time last year. That matters. And it's having an impact.

We hope we have seen enough… enough to get the economy moving again. Although nothing is guaranteed. We have been arguing, for over two years, for a stimulatory setting. And finally, we have that (just). Even with the RBNZ’s misstep, the various guestimates of “neutral” (a Goldilocks rate that’s neither too hot nor too cold) gravitate around 3%. And at 2.25%, we’re at levels that matter. It’s early days. It was only a few weeks ago that the cash rate was put firmly into stimulatory territory. And some rates have reversed higher. But we do have interest rates that should help household budgets, entice investors to invest, and encourage businesses to expand and hire. It’s all about restoring demand and boosting activity across all four corners of the economy.

We believe a MORE obvious easing bias should have been delivered in the RBNZ’s OCR track. The RBNZ cut the cash rate 25bps to 2.25%. A move that made sense, and was called for by the vast majority of economists and arm-chair critics. But what they did with the OCR track was premature. The RBNZ cut the track to just 2.20%. They gave a nod, a slight tip of the hat, to the chance of another rate cut. But 5bps (2.25-2.20) is just a 20% chance of a cut to 2.0%. That’s a low probability given the risks. We would put it closer to a 40-50% chance (2.15%). And it’s the reaction in markets, which they should have been aware of, that undoes some great work. As the RBNZ cut the cash rate 25bps to 2.25%, the 2-year swap rate jumped 28bps immediately… and has risen further to a little over 3%. We’re now back to levels last seen in August when the cash rate was cut from 3.25% to 3.0% - effectively undoing their last two moves. Banks deal in wholesale markets. And wholesale rates are back to levels last seen in August and September. Some fixed mortgage rates have actually risen following the November cut. That’s a misstep. All the RBNZ had to do was deliver an OCR track with a 2.15% low, just another 5bps, and markets would have largely held the last cut in place. Printing a 2.20% rate was immature. They should have maintained a clearer easing bias, in order to allow lower rates to feed through the economy. Once again, we found ourselves scratching our heads, in disbelief of the RBNZ’s prematurely “hawkish” stance. There’s been some ridiculously hot, cold, hot and then cold biases from the RBNZ post-Covid. Over the last few years the November decisions have been “hawkish”, only to be followed by a “dovish” (we stuffed up) February, then a “hawkish” (we’ve misread it again) May, and a “dovish” (sorry about that, again) August. Stranger things…

Wholesale markets are now focussed on the next move, a hike. If the RBNZ aren’t cutting, then they’re hiking. Wholesale markets struggle to price in “on hold”. The RBNZ’s track implies the chance of rate hikes from the first quarter of 2027. Market traders are contemplating hikes in the first half of 2026. At this stage, we believe it is way too early. Everything needs to go well, really well, for an economy with such a deep output gap, deflationary pressures, and soft labour market, before we can consider hikes. It’s likely to be a discussion for early in 2027… but not now. 2026 will need to be there year of material recovery.

If the market is right, and we start to see the cash rate rise in 6-12 months time, then we have seen the lows in interest rates, and all rates will be materially higher over 2026. Longer dated mortgage rates will lift in this world, well ahead of the RBNZ. Deposit rates will also twist higher. In this world, the Kiwi currency breaks back above 60c, and ends the year in the mid-60s or higher.

If the RBNZ is right, and they hold into 2027, we have seen the lows in wholesale rates, and lending rates will rise, but to a lesser extent to that above. Deposit rates will bounce off the bottom also. In this world, the Kiwi currency holds below 60c for 3-6 months, and then ends the year close to 63c as hikes come closer. And this is our central scenario. We agree with the RBNZ’s forecast trajectory, but we were disappointed with the delivery. The RBNZ’s last cut could have been delivered without tightening financial conditions. It just makes it a little harder to recover.

It’s not all rosy outlooks. There are significant risks to the downside. If we move down our downside scenario, outlined above, we could see a cash rate below 2%, possibly 1.5%. And let’s face it… the downside risks have materialised over the last two years. We hope this time is truly different. In a downside scenario, the Kiwi currency does what is asked of it – it depreciates. We could see a move towards 55c. And if we get a cash rate of 1.5%, then 50c is possible.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.