- The RBNZ’s decision, updated forecasts, and OCR track, will dominate Kiwi headlines this week. The cash rate will be left at 2.25%. But that’s not in question. It’s the lift in forecasts, with good news, that will see a lift in the OCR track. How far will they go? Hopefully not too far in signalling a hike this year (which is too early)

- It’s important to note that we’ve seen a tightening in financial conditions since the RBNZ’s last decision in November. Wholesale rates have lifted, and mortgage rates have lifted. Do we need higher rates? No, not yet. Give it time. See more around the move in wholesale and retail rates in this week's special topic

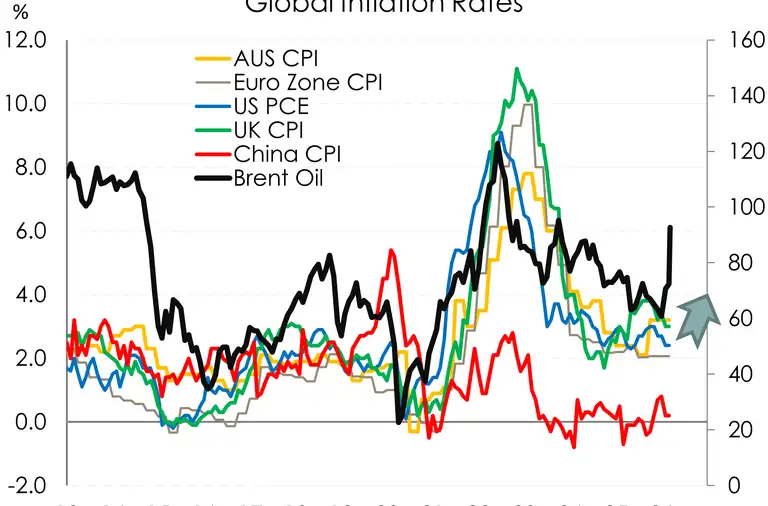

- Our Chart of the Week takes a look at the ugly lift in inflation expectations. They’ve naturally followed the move higher in actual inflation over the past year. But with headline inflation set to cool over the coming months, expectations should follow suit, and we should see a lessening in inflation pressure.

New year, new governor, new guidance. So, what’s in store from the Reserve Bank in 2026? On Wednesday, we will get a refreshed read on how the RBNZ are assessing current economic conditions since their last meeting. And it has been a long wait since all the way back in November.

There is no question that the cash rate will remain on hold at 2.25% on Wednesday. So, it’s the overall tone, the updated forecasts, and the lift in the OCR track, that will be closely watched by all.

It’s clear the RBNZ will enjoy summarising the stronger data we’ve seen since November. There’s good news for a change. The lift in activity indicators and sentiment have many calling out “green shoots” again. Added to the good news, was some heat in prices. The stronger inflation print that ended last year, was linked to the ugly lift in inflation expectations (see our COTW for more). And taking all that into account, the RBNZ’s updated forecasts will show stronger growth and stickier inflation. That should translate into the OCR track being pushed up and pulled forward.

We expect the small chance of a further rate cut, which was embedded in November’s track, to be removed. The economy has shown enough signs of recovery to justify calling time on the easing cycle. And we agree with markets that the next move is up. But it’s the timing of that move that we disagree with (for now).

The RBNZ’s November track had implied the hiking cycle commencing in the second half of 2027. With stickier inflation and better growth, that’s likely to be brought forward. The key question is: by how much? We hope the RBNZ avoids getting ahead of itself. A refreshed track pointing to an early‑2027 lift‑off feels appropriate to us. But market traders are much more aggressive, with almost two hikes priced this year. That’s too punchy, and premature.

Yes, we’ve had stronger than expected data. We like it. We’re recovering. But the economy is not yet taking off, and a year from fully recovering. But what does it mean for Governor Breman’s laser focus on inflation? Good, all central bankers should be. But being laser‑focused on inflation means looking beyond the headline inflation print, understanding the underlying drivers, and looking at the inflation outlook. In our case, inflation may have lifted to 3.1% in the December quarter, but it’s not being driven by demand yet. And we still expect inflation to ease to 2% through 2026, without the need for rate hikes, supported by spare capacity in the economy. The looseness in the labour market and softness in the housing market being the big ones.

For the economic recovery, we’re just at the starting line. And it’s like doing the 400m hurdles with a broken leg in cast. It’s still a painful and awkward recovery. And it’s way too early to claim victory over the recovery. And as such settings should remain accommodative over 2026, to further support the recovery.

Financial Markets

The comments below were provided by Kiwibank traders. Trader comments may not reflect the view of the research team.

In rates, global yields retreat while Kiwi yields consolidate

“Global yields have retreated from recent highs as uncertainty builds around US data. Each day, the US rates market reassesses both the timing and scale of the roughly 60bp of cuts priced for 2026. That dynamic is likely to persist this week, especially given the mixed messages coming from various Fed speakers (10 speeches this week) and FOMC voters. In periods with limited domestic data, NZ rates tend to take their lead from offshore moves, which have generally been lower in yield.

Following a strong run of NZ data, softer employment figures gave the local rates market a reason to pause after what had felt like a relentless push higher in yields. Short dated yields have since consolidated, with around +45bp of hikes priced into 2026 and a total of +145bp through mid 2028. These higher rates are now flowing through into mortgage pricing and the currency, tightening financial conditions quickly. That transmission is expected given the OCR operate with long and variable lags. The key question is magnitude: how much tightening is too much? There is no clear consensus among market analysts on the timing or scale of future hikes, and Brenman’s first RBNZ meeting this week adding another layer of uncertainty. Expect the RBNZ to be cautiously positive, aware that the recovery quickly faded this time last year. Expect hikes to be pulled forward but not to the degree the market has priced, small rally expected.

The NZ rates market feels caught between accrual based receiving interest (e.g. receiving 2 year at 3.10% versus paying BKBM at 2.50%, with attractive roll down between 2 and 1 year tenors) and bank balance sheet paying as balance sheets hedge fixed term mortgages longer than one year. With roughly +145bp of hikes priced in, the NZ curve now has meaningful positive slope. Forward rates are significantly above today’s levels. 1 year rates at 2.70% today compare with 1 year rates in one year at 3.60%, and the 2 years forward for 2 years sitting above 4.00%. This type of analysis helps identify value across the curve, though it ultimately depends on your view of the OCR endpoint. Some premium is embedded in OCR pricing due to uneven flows (notably mortgage related paying) and the continued elevation in short end funding spreads (BKBM–OIS).” Ross Weston, Head of Balance Sheet Management – Treasury.

In currencies, the MPS is the focus this week for the Kiwi

“The Kiwi dollar has found relative strength versus the US dollar in recent weeks, and remains somewhat elevated, comfortably trading in the 0.6040/0.6050 levels over the past week. Last week the focus for the US dollar was the delayed US nonfarm payrolls and employment data, which were slightly stronger than anticipated, giving the dollar index (DXY) a nudge higher above 97.00. Friday’s US CPI print was softer than expected, and the US dollar closed the week at 96.88. The Kiwi opens the week close to the 0.6030/0.6040 levels, largely unscathed by offshore moves. The NZDAUD cross certainly had more movement last week, after already opening slightly on the back foot following the RBA’s rate hike the week prior, at 0.8535 to start the week. Hawkish comments from RBA officials last week saw the NZDAUD cross dip to a low of 0.8480 as interest rate differentials remained in focus. The RBNZ’s 2 year ahead inflation expectations print indicated a move in the wrong direction, which saw the NZDAUD cross recover ground to close at 0.8542. The focus turns now to the MPS this Wednesday. With market pricing still implying a full hike from the RBNZ as early as October, we think that there is a possibility of correction if the RBNZ manage a careful balance in their tone this week. We expect that they will remain on hold this week but may try to imply that the timing of hikes is premature. Should this come to fruition we will likely see some further downward correction in the Kiwi, with the NZDAUD cross looking at the low 0.8400s and the NZDUSD potentially in the high 0.5900’s again. However, with little to provide a boost higher for the US dollar at present, the NZDAUD correction is more likely. Watch this space.” Mieneke Perniskie– Senior Dealer, Financial Markets.

Weekly Calendar

- The main event this week is of course the RBNZ’s February Monetary Policy Statement. The first of the year, and the first for new Governor Anna Breman. There is no question that the cash rate will remain on hold at 2.25% on Wednesdays MPS. Instead, it’s the updated forecasts, particularly the RBNZ’s OCR track, and the overall tone that will be closely watched by all. See our preview above for more.

- It’s a double whammy this week for the UK with jobs and inflation data out tomorrow and Wednesday respectively. The Unemployment rate is expected to hold steady at 5.1% with consensus for a loss of 20k jobs over January as weakness in the labour market persists. Meanwhile inflation is expected to cool with consensus for the headline rate for a drop to 3% from 3.4%. Such results would prove in line with the BoE’s dovish tilt at their policy meeting earlier this month.

- Across the ditch Aussie jobs data is out on Thursday, with consensus expecting around 20k jobs added in January and the unemployment rate ticking up to 4.2% from 4.1%. This release will be closely watched given the RBA’s recent pivot in policy and especially because the previous labour force report surprised meaningfully to the upside. In December 2025, employment jumped by 65.2k, far exceeding market consensus estimates of 20k. And the unemployment rate also unexpectedly fell from 4.3% to 4.1%. But as always, a cautionary reminder: Australia’s monthly jobs data can be volatile, particularly around the summer months when seasonal patterns can distort the data.

See our "Weekly Calendar" for more

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.