- Kiwi inflation lifted to 3%yoy from 2.7%yoy over the September quarter. But context is key. A reacceleration in imported inflation as well as sticky administered costs are driving the move higher. Broadly speaking, domestic price pressures continue to cool.

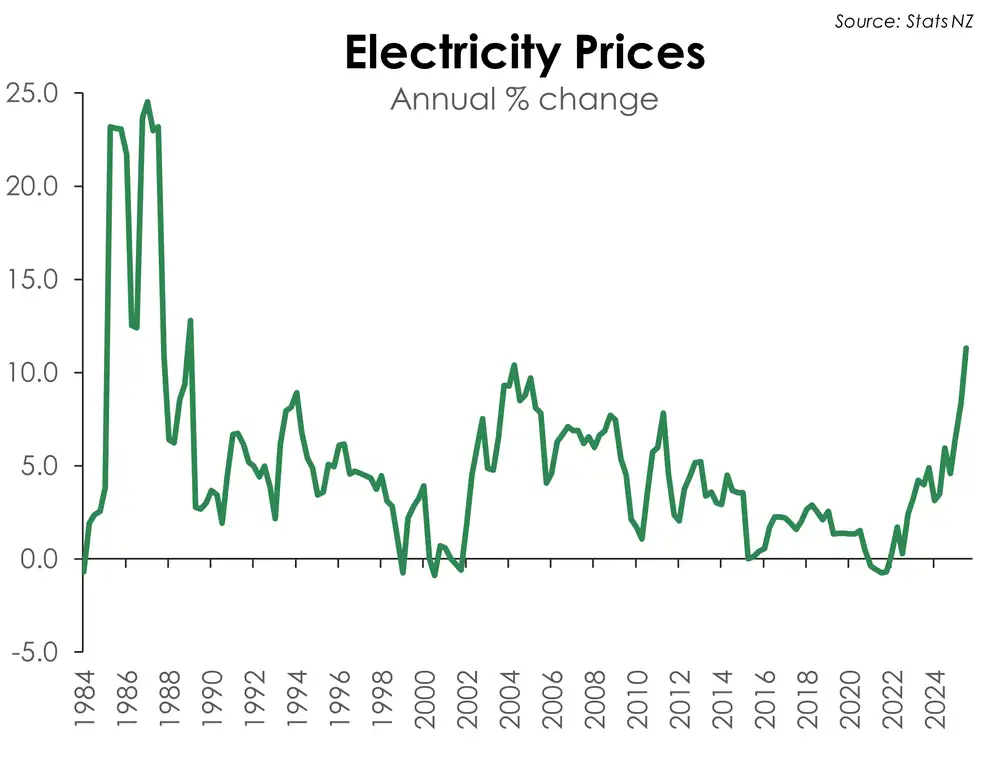

- It is the more volatile components of CPI that are pushing the headline rate higher. Council rates alone were up 8.8% over the quarter. And electricity bills have climbed to highest annual rates since the 1980s. The more interest rate sensitive components within the CPI basket however are clearly soft.

- Inflation has climbed to the top end of the RBNZ’s target band. But it stops there. We continue to expect inflation to return towards the RBNZ’s 2% mid-point in early 2026. And beyond that, see further risk of inflation falling below the 2% sweet spot over the course of the year.

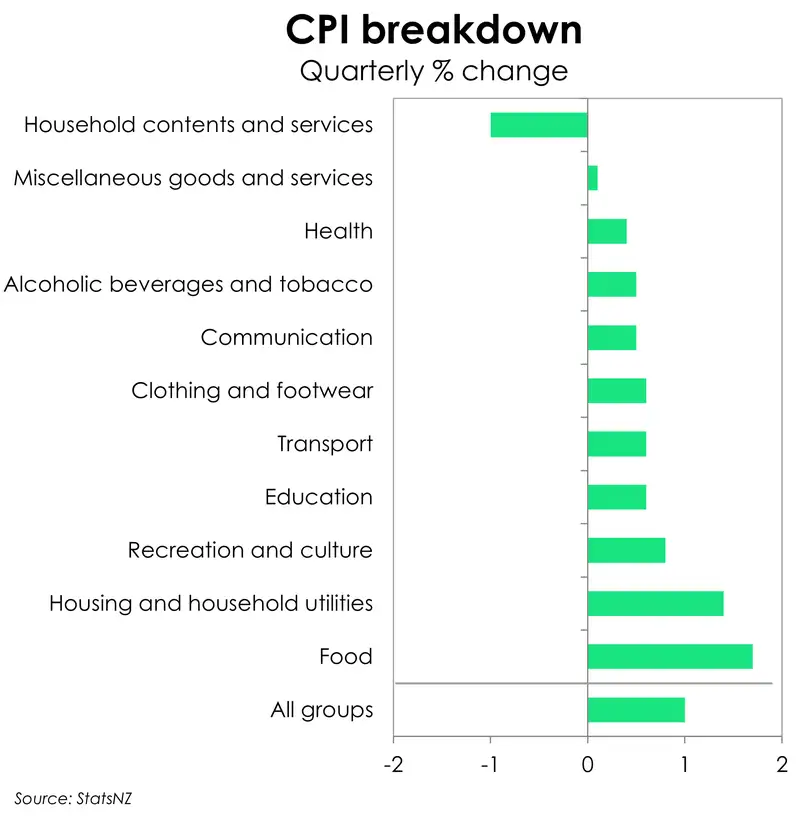

At 3%, Kiwi inflation has climbed back to the top of the RBNZ’s target band. Over the quarter, consumer prices rose by 1%. There was little in today’s data that surprised. The factors driving inflation higher, like food and administered costs, should prove temporary. While the more interest rate sensitive components of CPI, like rents and construction costs, are clearly soft. For now, we think the risk that this bout of inflation will persist is low. Because there is significant spare capacity still sloshing in the economy, and keeping downward pressure on medium-term inflation. More importantly, inflation expectations remain well anchored to the 2% target midpoint.

Today’s report showed that price increases are becoming less extreme. Around 36% of the CPI basket recorded a decline in price, unchanged from the previous quarter. Meanwhile, the proportion of all measured goods and services that lifted in price fell from 54% to 51.8%.

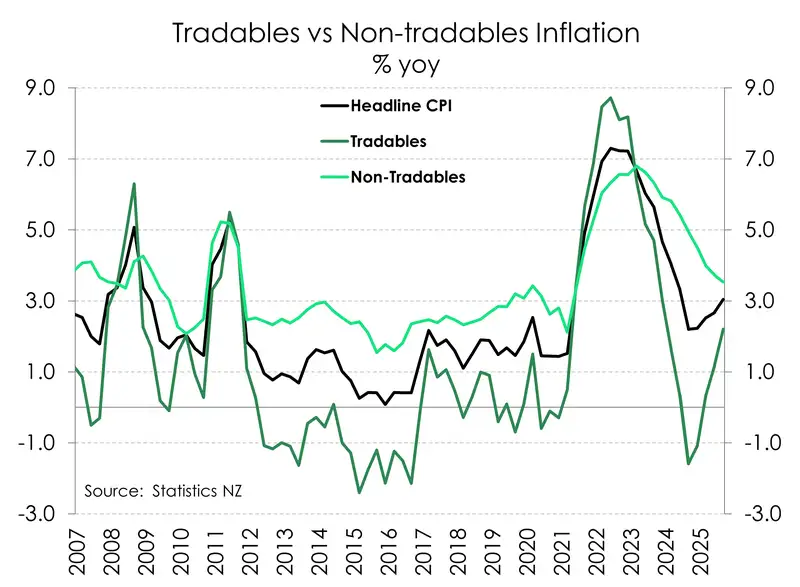

The rapid deceleration in imported inflation, which helped to pull down headline, is reversing course. We’re no longer importing deflation. Annual tradables inflation lifted from 1.2% to 2.2% - the highest since late 2023. Food inflation, specifically the 12.2% lift in meat prices, was the largest contributor. But if we were to strip out food and fuel, tradables inflation would instead be sitting at 1.4%.

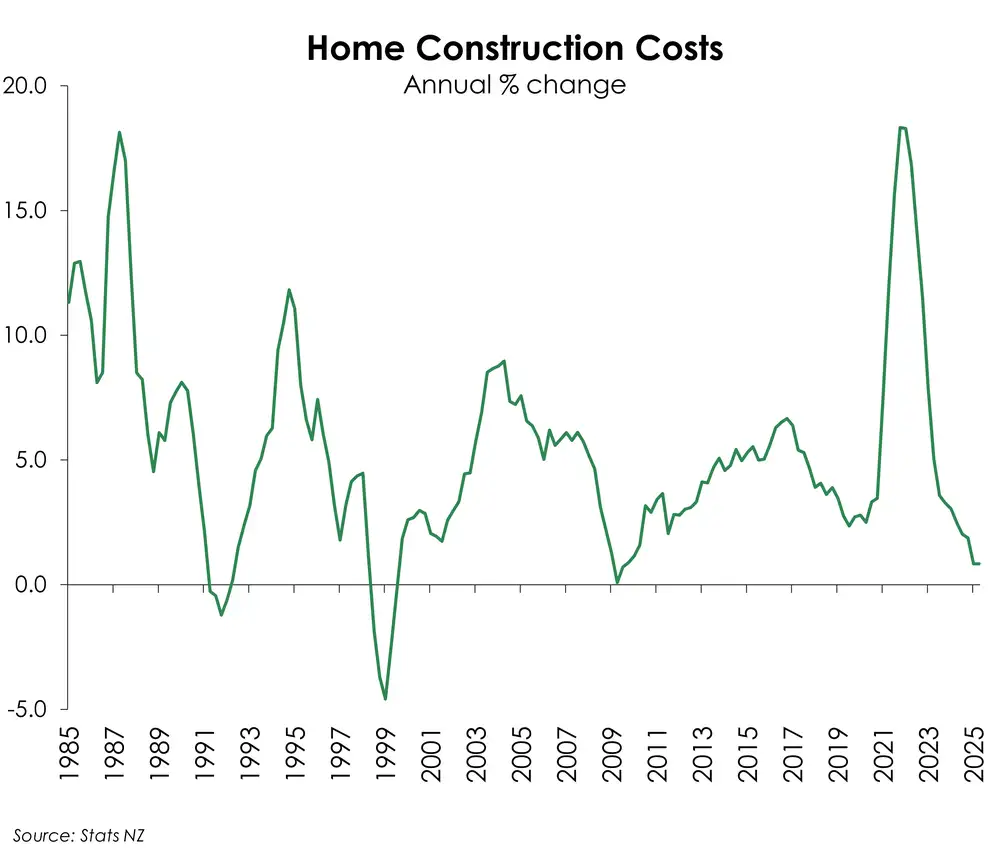

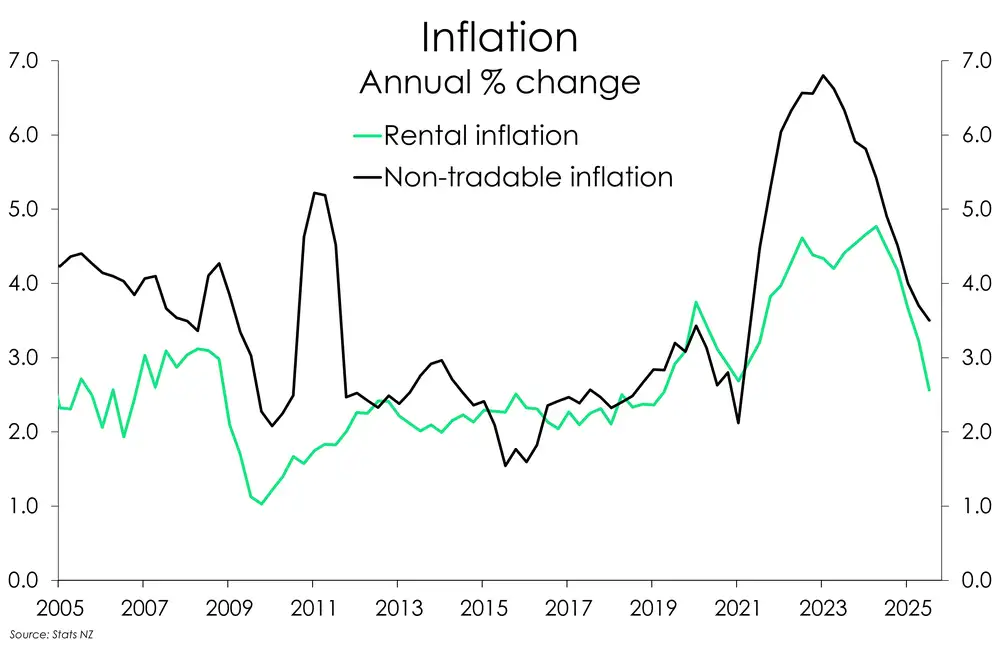

Domestic inflation, in contrast, continues its (slow) move south. Annual non-tradables inflation has fallen to 3.5% from 3.7%. Domestic inflation has fallen some way from its 6.8% peak in 2023, but it is still sitting above the long-term average (~3%). And that’s despite such a weak domestic economy. Such persistence is due to the lingering strength in administered prices. Council rates jumped 8.8% in the quarter alone. Insurance costs are up 4.1%yoy. On top of that, households are contending with high electricity charges, climbing to 11.3%yoy – the highest annual increase since the 1980s. These so-called cost-push inflation movements are being offset to some extent by weak price growth in other components of housing-related inflation. Construction costs are still running at the weakest rate since the end of 2009 (0.8%yoy), while rental inflation fell to sub-3%. If we exclude these government administered costs, domestic inflation sits at a 2.6%. And that’s a better reflection of the current weak state of the economy.

A temporary blip

The September quarter will likely mark the peak in inflation. The current December quarter is also typically the weakest quarter for inflation with seasonally weak food prices as well as the usual retail discounting that takes place. With that in mind, we expect inflation to fall back below 3% from here. And the risks further out are still tilted to the downside as the economic undercurrents are weak.

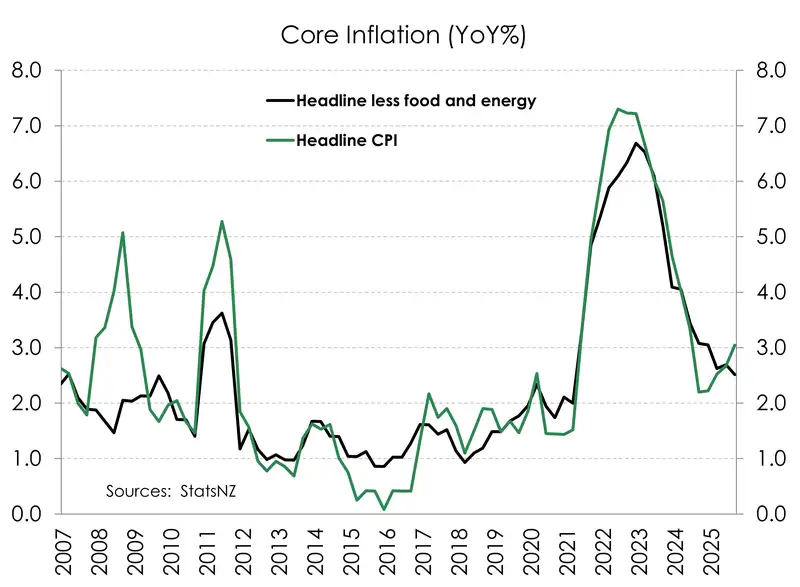

Today’s result was largely in line with the RBNZ’s forecast. The move to 3% is unwanted. But it shouldn’t stand in the way of the RBNZ delivering further rate cuts. They should take comfort in underlying inflation which remains subdued. Core measures of inflation strip out the volatile price movements. And encouragingly, core inflation fell from 2.7% to 2.5% - still within the RBNZ’s target band and the lowest since March 2021. It is the RBNZ’s job to look through volatile movements in inflation, and set policy for late next year. And in 2026, inflation is set to slow below the mid-point of the target band (2%). We continue to expect a move to 2.25% in the cash rate next month.

Food and housing

Contributing close to 45% of the lift in prices over the quarter and 35% over the year, the housing and household utilities group is where most of the inflation pain is being felt. Within that, council rates and electricity prices are the biggest upward drivers. Over the quarter council rates, up 8.8%, accounted for 30% of the quarterly lift in prices. Meanwhile, electricity prices up 11.3% over the year are the highest since the late 1980s. However, providing some offset, construction costs remain weak. Prices were up just 0.8% over the year, keeping construction costs at the lowest levels since the GFC. And at the same time, rental inflation pressures continue to ease down to 2.6% from a not-too-distant series high of 4.8%. Our dormant housing market as well as weak migration flows are having a clear impact.

Beyond the housing group, elevated food prices continue to eat away at our wallets (pun most certainly intended) Food prices, up 1.7%, accounted for a third of the lift in total prices over the September quarter. And it’s a hard time to be a vegetarian right now. Vegetable prices were up 12.2% over the September quarter and contributed over 15% to the lift in prices over Q3. That said, it’s not easy for the meat eaters out their either. Meat and poultry prices were up 4% over the quarter and similarly contributed close to 10% of the lift in prices over the three months to September. The only saving grace: prices for confectionery, nuts, and snacks (even if we’re only interested in the first and last one) fell 1.8% over the quarter. Still, we continue to expect a moderation in food prices from here. Seasonality is still feeding through onto prices for fruit & veg (again pun intended). But is likely to dissipate into the warmer summer months. Meanwhile strong export commodity prices have pushed up the price of meat products. But it does appear that we’re past the peak in food inflation.

A note on currencies

The Kiwi dollar has traded near recent lows over the past week as it struggles for some direction. Last week the range was 0.5686 – 0.5750, with the brief dip below 0.5700 perhaps somewhat unconvincing. NZDAUD traded between 0.8780-0.8860, with weak Aussie employment data providing the cross with a minor boost. The US dollar slipped to close the week, following concerns around bank credit quality, as 2 regional banks came under scrutiny. The concern was short lived, seen as a localised issue. The CPI print this morning came in very close to expectations, so if anything it simply cemented the view that the RBNZ are still in a position to proceed with a 25bp cut in November. Prior to the CPI print the Kiwi was trading at 0.5730 vs the US dollar and 0.8823 vs the Aussie, both crosses moved just 10 pts lower as the upside risks to CPI did not eventuate. We think it likely that the Kiwi will continue to stick near recent ranges, with little local data to provide flavour. The lack of data out of the US with the continuing Government shutdown, is making it harder for traders to get a gauge on direction. The upcoming risk events for the Kiwi is the US CPI print due on Friday and then the Fed’s FOMC next week. Mieneke Perniskie -Senior Dealer, Financial Markets

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.