We saw 3 stages of spending: pre-spike, flat-line, post-spike

There were 3 clear spending patterns as we entered and exited lockdown:

-

1Tahi

In the lead up to lockdown D-Day, we saw transactions at supermarkets spike. The lines snaked outside supermarkets in the final hours before lockdown. We stocked up, ready to bunker down. Our tower of toilet paper is a constant reminder.

-

2Rua

Then our streets fell quiet. And with nowhere to go, we clocked Netflix. Our spending in Grocery Stores lifted from ~20% of average spend, to 40%. And we became our own chefs with the help of our delivery food bags, thankfully.

-

3Toru

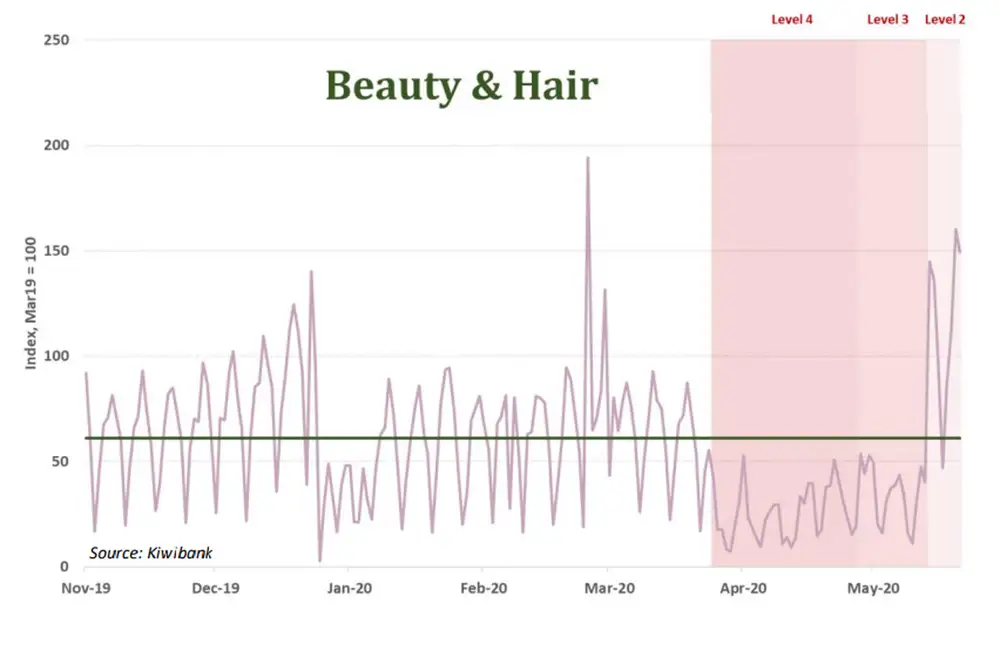

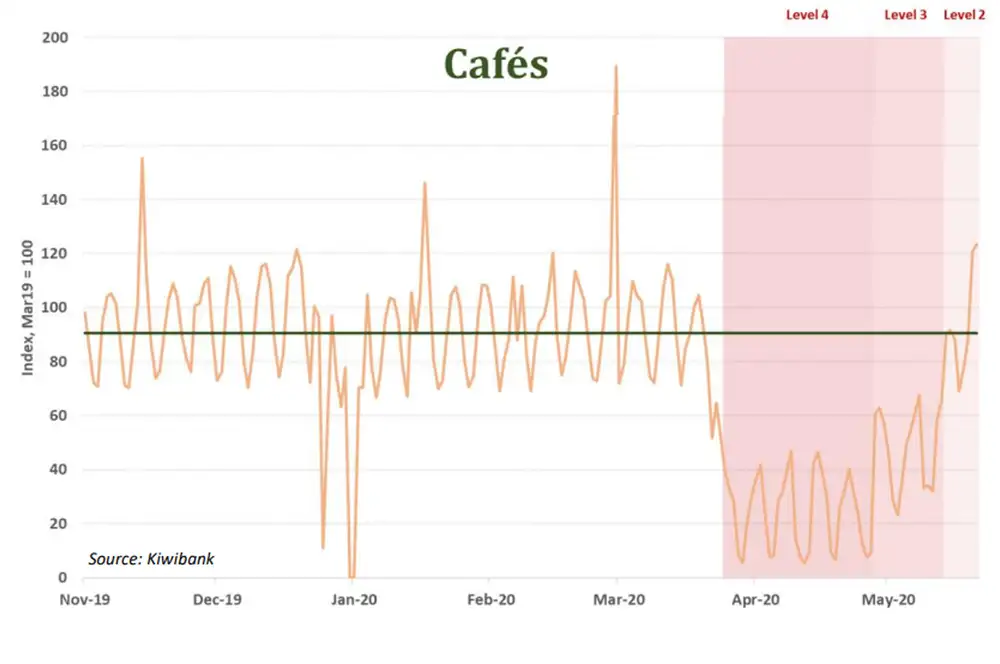

Then after 50 days spent under levels 4 and 3, we were more than ready to do away with our “covid castaway curls”. Level 2 came along, and we emerged from our bunkers. As expected, transactional data spiked, particularly in the retail and hospitality space. We put down our remote, got our local coffee fix and supported local. The level 2 spike in spending was just as immediate as the level 4 plunge in spending.

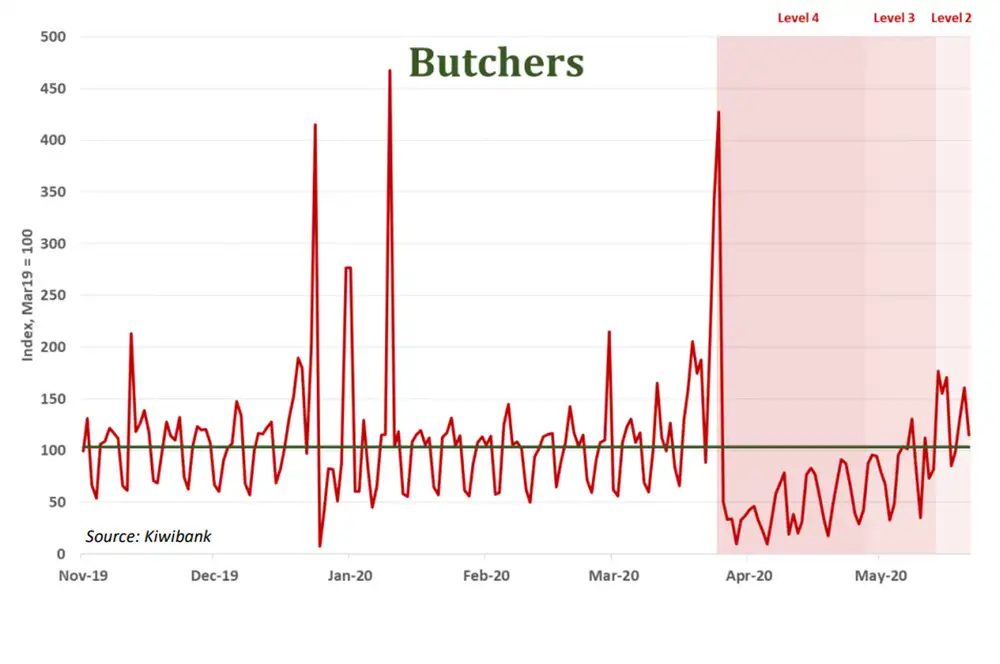

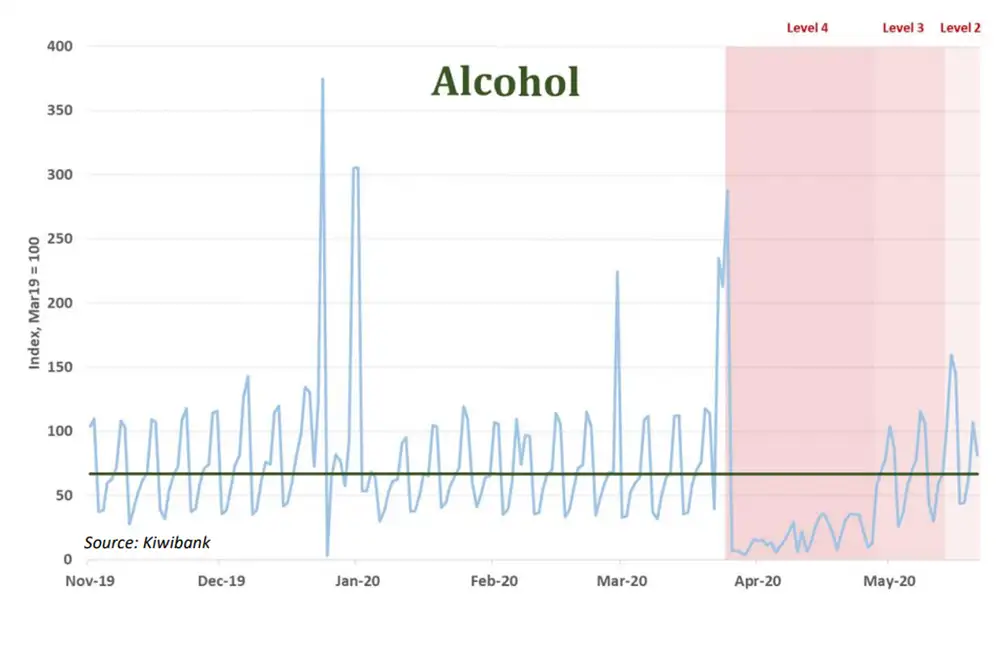

The pre-lockdown pre-load

We filled our freezers with meat, our cabinets with alcohol, and our bathrooms with (too much) toilet paper and sanitiser. Spending across all 3 has returned to ‘normal’ post-lockdown.

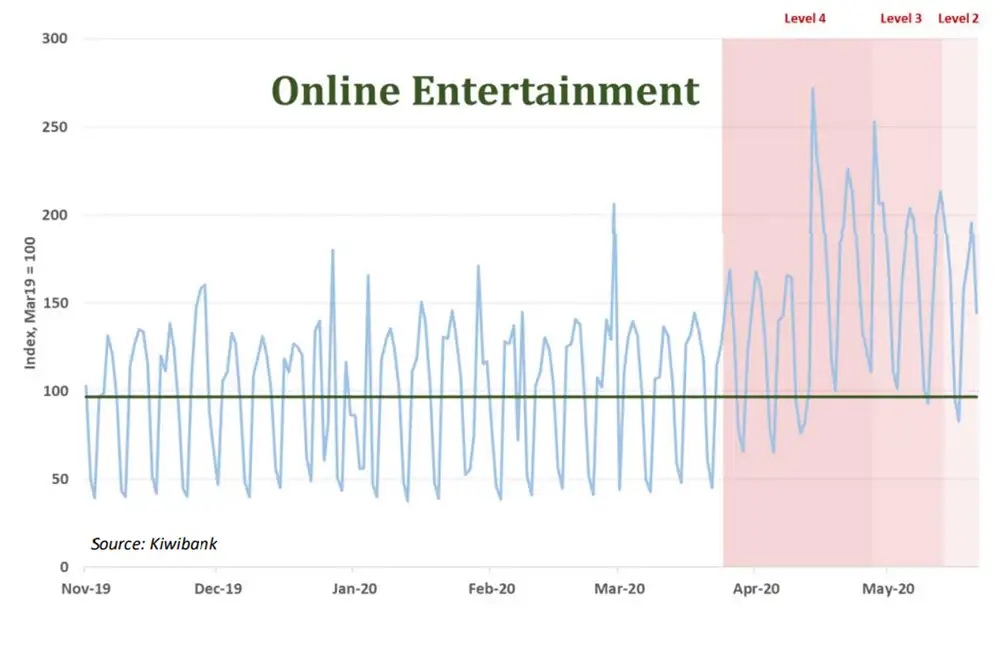

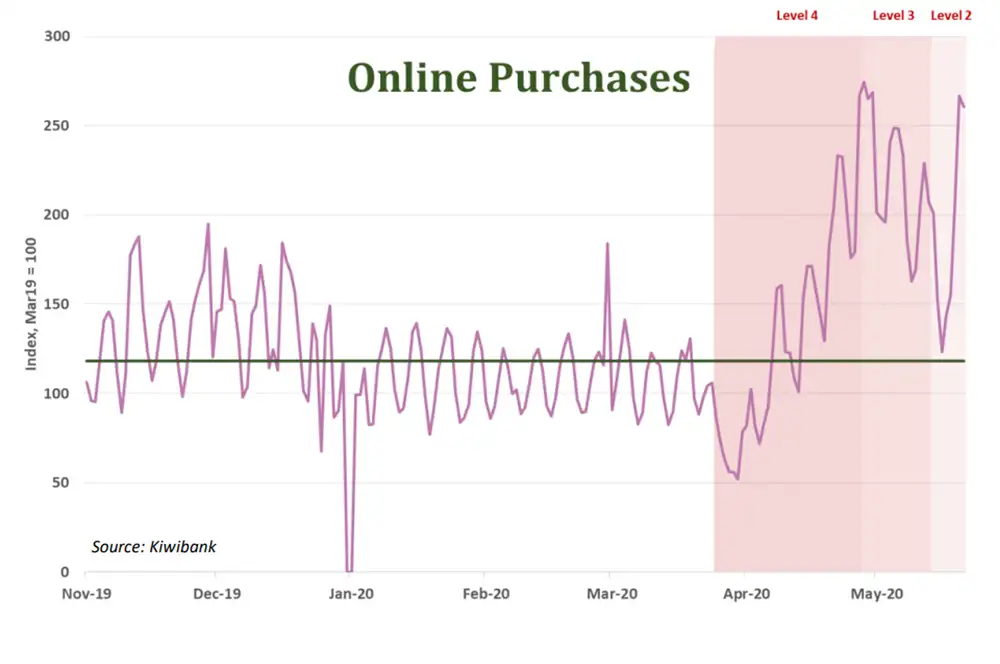

During lockdown we went digital

We went online for entertainment and retail therapy. Spending across all 3 has remained elevated. Are we seeing a structural shift? Yes, most definitely. We already were. The Covid-lockdown has only accelerated the digital move.

It’s a digital world - Previous trends are accelerating

Even before the Covid-19 crisis, there were well-advanced trends around how we consume, work, and travel. Trends that are expected to now accelerate.

- Online shopping was already a pastime for many Kiwis, from Trademe to Amazon, and from the Warehouse to AliExpress. Social distancing forced us away entirely from shops and online for bargains. And this is how old habits are broken and new ones are formed.

- We expect an acceleration in the switch in behaviour to permanently higher online retail shopping.

- Does this trend spell the death of high-street retail? Probably not. Many physical retail outlets will likely have a smaller footprint in future. Those that remain will need to trade on a point of difference, such as consumer experience or where it’s convenient for consumers to try before they buy.

- For retail more broadly it would be wise to have a slick online presence.

During lockdown we baked

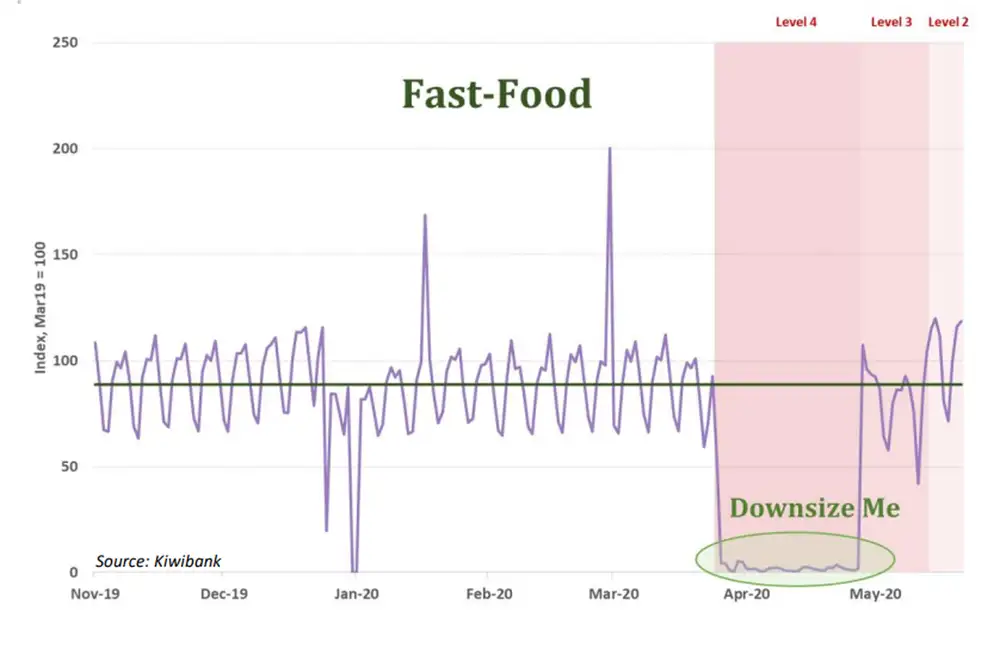

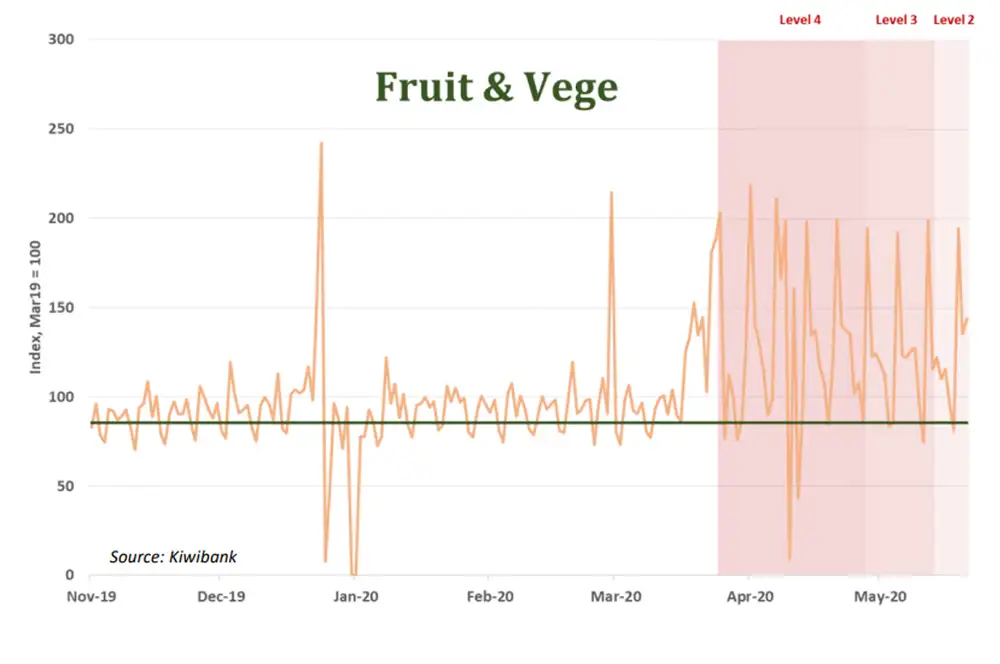

We (seemingly) ate a heathier diet. Fruit & Vege spend is holding higher, so too is spend on food delivery bags. Good on us! Fast food spending was downsized, but then bounced straight back. McDonald’s was our “favourite” with highest spend.

Unlockdown

We got haircuts, finally! And we went to see our friends and family. We expect to see a continued lift in spending as more of us are allowed to fit into every restaurant, bar and café.

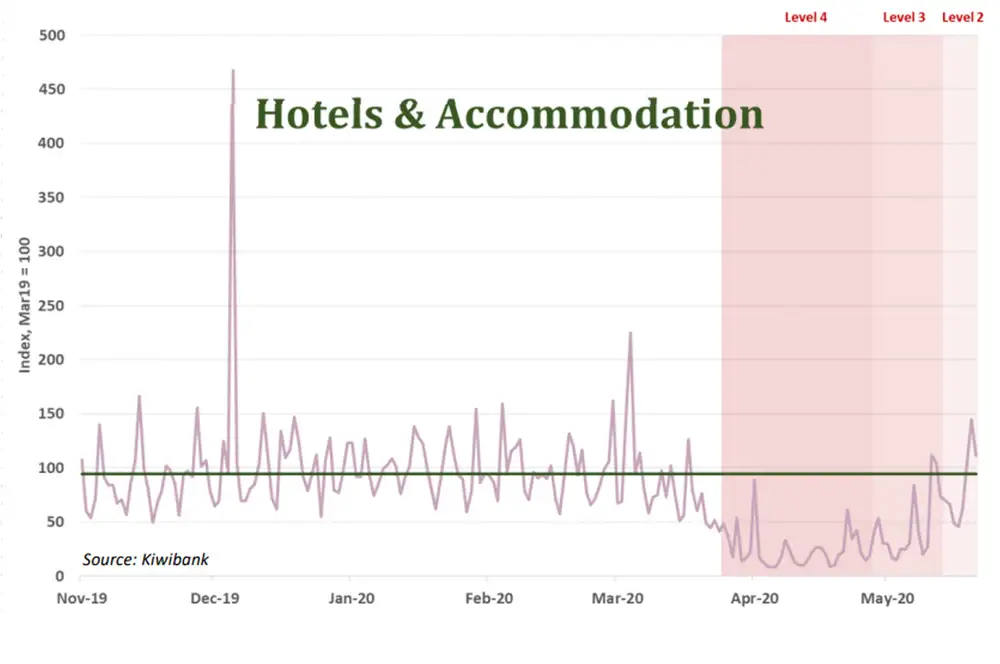

Locked out

Although we’ve seen a bounce in hotels and accommodation, and a small lift in flights, these areas are of most concern. Even under level 1, foreign tourists will be conspicuously absent.

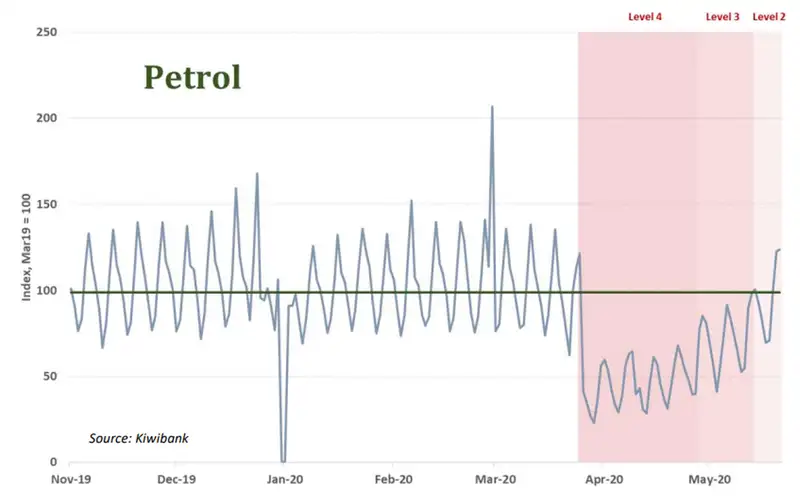

A climate change chance

Can we force change? Our spending on petrol (and diesel) has spiked right back to pre-lockdown levels. And there’s a price difference. Petrol prices are lower today. So we must be buying a little more – perhaps to get away.

We would hope Kiwi use their new found online powers to work from home more often. Fewer cars on the road, and in the CBD, is a goal worth fighting for.

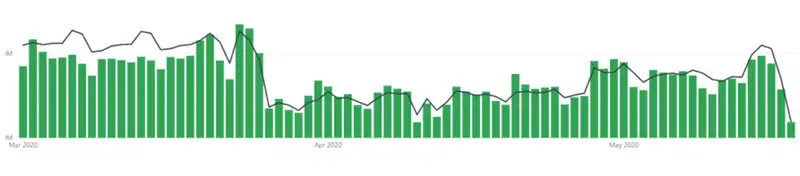

We’re still spending less on our credit cards (both volume and value)

Job security is still front of mind for many NZers. There’s an understandable reluctance to go out and spend given such uncertainty. Moreover, there’s still a clear sense of caution in the air. NZ has done incredibly well in managing the spread of Covid-19, but we’re all fearing a second wave. And if history’s any guide, it’s possible.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.