- What we all expected was what we got. The RBNZ kept the cash rate unchanged at 3.25% today. It’s the first pause since the cutting cycle commenced in August last year.

- The RBNZ are taking a wait and see approach amid high global uncertainty and a near-term spike in inflation. But their bias still leans towards further easing.

- Risks to the outlook remain tilted to the downside. Our forecast continues to see medium term inflation at risk of falling below 2%. The direction for rates from here is still clear. But the timing is more up in the air.

After six straight meetings delivering rate cuts, totalling 225bps, the RBNZ has today taken a widely expected breather. The cash rate remains unchanged at 3.25%...for now. The RBNZ’s bias still leans towards further easing. But the pace of delivery has clearly slowed as policymakers feel their way towards the bottom of this cycle.

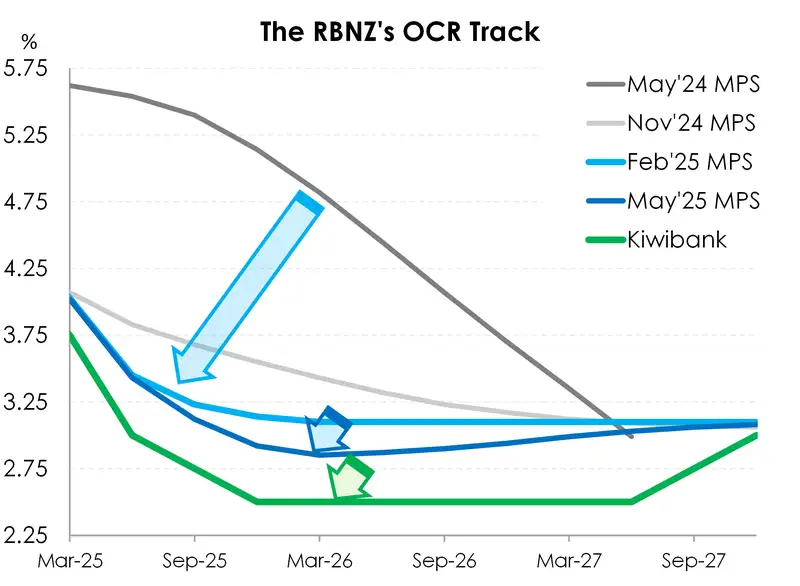

It’s a bottom which we’re all still trying to figure it out. Some have it at 3%, others at 2.75%, while we continue to advocate for a stimulatory 2.5%. The RBNZ’s OCR track in May printed a 2.85% endpoint. That signals a move to 3% and a 60% chance of a move to 2.75%.

We’re still on the trajectory for lower rates. As the RBNZ have put it “If medium-term inflation pressures continue to ease as projected, the Committee expects to lower the Official Cash Rate further.”

The RBNZ are well aware of the temporary inflation spike we’re seeing right now. Food prices have reaccelerated, household energy costs are climbing, all the while administrated costs have remained elevated. A lift in inflation towards the top of the RBNZ target band is expected over the current and coming quarter. But a spike is still just a spike. And in the medium-term, the RBNZ continues to expect headline inflation returning to around 2% by early 2026.

So if it had been us today, we would have cut. And we would cut again in August. Because why wait when medium term inflation remains contained? Yes, there is worry right now about the spike in inflation we’re experiencing. But monetary policymakers must look through short-term volatility, even if it’s eye-watering.

Monetary policy is set today to influence the medium-term. And risks to the outlook are skewed to the downside. A global growth slowdown is expected with US tariffs. And NZ export prices are likely to come under pressure. At the same time, as the RBNZ’s statement points out, there is “significant spare capacity” and a “large negative output gap” in the New Zealand economy. Note the use of the words significant and large. We think it’s significant.

All of these factors are disinflationary. And we’ve seen that in the QSBO survey. There is a net 2% of firms looking to reduce their prices in the coming months. History tells us that pricing behaviour like that only happens during recessions. If things continue as we expect then in the medium term the real risk is that inflation undershoots the RBNZ 2% mid-point.

Still taking a page out of the RBA’s playbook, the RBNZ have decided to take a wait and see approach today. Waiting for what? Well, “Some members emphasised that waiting would allow the Committee to assess whether weakness in the domestic economy persists, and how inflation and inflation expectations evolve.” So, the next few data releases will be carefully picked apart. Here’s three data prints we’ve circled before the August meeting:

- June quarter inflation (21 July): will likely come in hot. But the factors driving the acceleration must be considered. Inflation is set to rise to the top-end of the RBNZ’s 1-3% target band. The rapid deceleration in imported inflation, which helped to pull down the headline rate, is reversing course. Prices for some food items like dairy and meat have increased recently, which will support tradables in the near term. So it’s largely a story of imported inflation – the type over which the RBNZ has no influence. Rather, domestic inflation is their domain. Non-tradables remains elevated, but has become less broad-based. Capacity pressures have eased, and the moderation in wage growth suggests that price-setting behaviour is adapting to the low-inflation environment. Given significant spare capacity remains in the economy, we expect further easing in non-tradables. Watch the headline rate on 21 July. Watch even closer the non-tradables rate. The RBNZ has pencilled in 2.6%yoy and 3.7%yoy, respectively.

- June quarter labour market (06 August): will likely show a further increase in the unemployment rate. We see the unemployment rate lifting to 5.2% in the June quarter, on its way to a slightly higher peak of 5.3%, well above the goldilocks NAIRU of around 4%. We may be nearing the peak, but we’re still some way away from a rebound in employment growth. Hiring intentions remain weak.

- September quarter inflation expectations (07 August): Near-term inflation expectations (1- and 2-year ahead) will likely print higher, pulled up by headline inflation. But as per the RBNZ’s focus on “medium-term inflation pressures”, how the 5-year and 10-year ahead measures evolve will be of greater interest. And given the dominant downside risks to the economic outlook, we may well see inflation fall below their 2% target. Forecasts like that could see the medium-term expectations fall.

Market reaction

In terms of reaction in financial markets, there wasn’t one… not really. The Kiwi currency wanted to go higher, it tried to go higher, but ended up slightly lower. It was a nice scenic trip to nowhere. The Kiwi looks to be glued to 60c (give or take). Whereas wholesale rates markets were much more convinced, without conviction. The two-year swap rate lifted 4bps, only to fall back to where it started, at 3.21%. So, no reaction in rates either. That’s a whole lot of talk about nothing. Only an economist could write so much about so little. But that’s not a bad thing. The RBNZ delivered as expected. It was a pause to assess. It was a wait and see. So, let’s come back in August.

RBNZ statement

“The Monetary Policy Committee today agreed to hold the Official Cash Rate at 3.25 percent.

Annual consumers price inflation will likely increase towards the top of the Monetary Policy Committee’s 1 to 3 percent target band over mid-2025. However, with spare productive capacity in the economy and declining domestic inflation pressures, headline inflation is expected to remain in the band and return to around 2 percent by early 2026.

Elevated export prices and lower interest rates are supporting a recovery in the New Zealand economy. However, heightened global policy uncertainty and tariffs are expected to reduce global economic growth. This will likely slow the pace of New Zealand’s economic recovery, reducing inflation pressures.

The economic outlook remains highly uncertain. Further data on the speed of New Zealand’s economic recovery, the persistence of inflation, and the impacts of tariffs will influence the future path of the Official Cash Rate.

If medium-term inflation pressures continue to ease as projected, the Committee expects to lower the Official Cash Rate further.”

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.