- Another RBNZ meeting, another rate cut, and another forecast cut. Today’s 25bps move to 3.25% is the sixth straight cut, and takes total easing to 225bps. And there’s more coming. Although the path is highly uncertain. Policy is much closer to neutral now, but it is still not stimulatory.

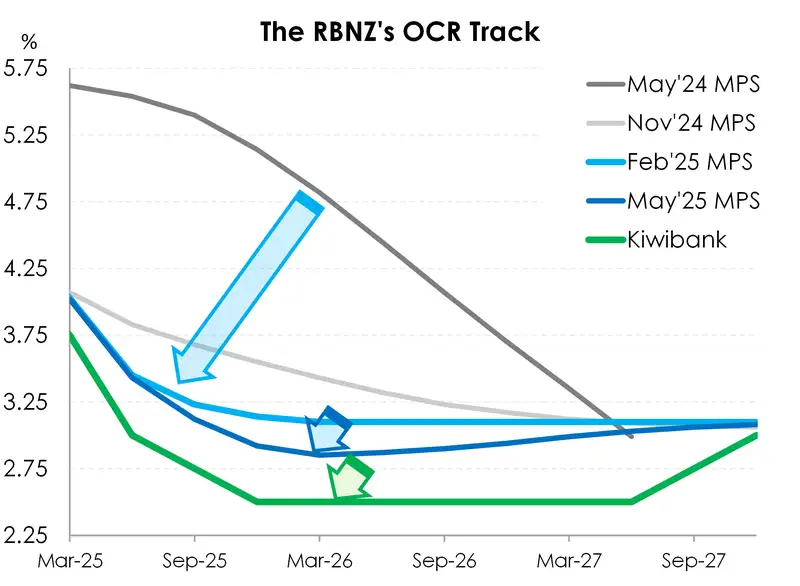

- The RBNZ has lowered the forecast OCR track 25bps, from 3.1% to 2.85%, implying a good chance of another two rate cuts to 2.75%. It’s another step in the right direction… and we continue to call for a move to 2.5%. The RBNZ has seen enough to cut again, and again, but not enough to do enough, in our view. We expect to see the OCR tracked lowered again in August towards 2.5%.

- The weakness in the economy is clear and demands more attention and less restriction. With all the risks offshore, think Trumpian tariffs, and the pain still felt onshore, there’s a good argument to be made for taking policy into stimulatory territory.

The RBNZ cut 25bps today. The cash rate sits at 3.25%. Were we surprised? Nope. Did we want more? Yes. There’s no doubt that the Kiwi economy needs support. The risks to the growth outlook are tilted to the downside. As was revealed last week, the Govt’s hands are tied (self-inflicted). So, we look to the RBNZ. In the current environment, with a future clouded by the tariff trade war, there’s more for the central bank to do to support the recovery.

Rightly so, the RBNZ is signalling more rate cuts. That’s the key takeaway from the May MPS. The OCR track was lowered from a flat lined bottom of 3.10% to a 2.85% bottom in March 2026. So now another 25bps cut to 3% is fully baked into the cake. And from there, there’s a 60% chance of another 25bps cut to 2.75%. Once again, we would love to have seen a bit more. We’re still of the view that a 2.5% cash rate is what the Kiwi economy needs. And an OCR track bottoming anywhere below 2.75% would have signalled what we had hoped to see.

But with each MPS, the terminal OCR has moved closer to our 2.5% view. Give them time, and they just might get there. But for now, such heightened uncertainty is making it harder for all policymakers to navigate. So, it’s not surprising to see the committee err on the side of caution. The fact the RBNZ “voted” 5-1, with one member voting for a pause to assess, throws some doubt on the timing of the next move, but not the direction. They are not on a “pre-set course”, and always data dependent. We think there’s enough for them to cut again in July, but they may wait until August to cut again. It depends… on what? Everything.

That seed of doubt caused a bit of a jolt in financial markets, especially short end interest rates. The pivotal 2-year swap rate rose 10bps, from 3.16% to 3.26%. It’s not a big move… but it was one Governor Christian Hawkesby pushed back on. The telling comment from Hawkesby, when asked about the market reaction, was his reference to the new OCR track matching market pricing prior to the announcement. The RBNZ’s OCR track matched market pricing of 2.85%. So they would not have expected much reaction at all.

Again, we want to reinforce the key message of today’s meeting is that the RBNZ is signalling more cuts.

An inevitable downgrade

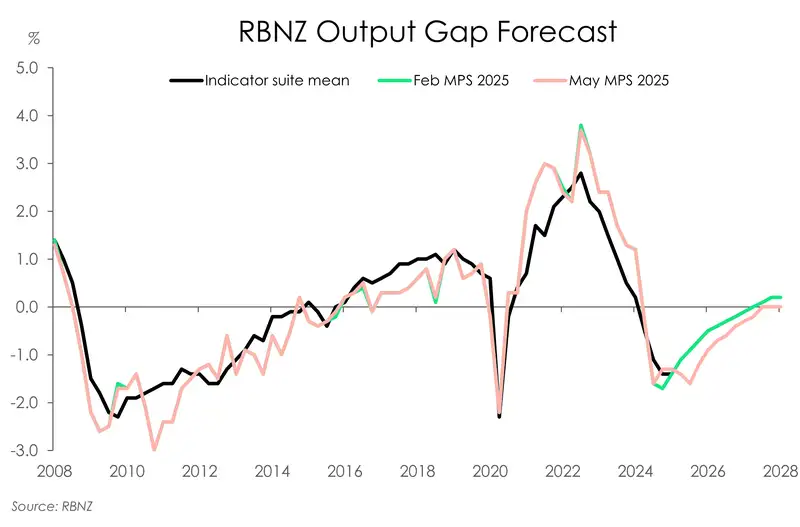

Given today’s topsy-turvy environment, we were also eager to see the RBNZ’s updated economic path ahead – their forecasts, that is. And no surprises, the RBNZ’s previous set of growth projections were rubbed out and marked down. And it’s all thanks to the evolving tariff trade war. Uncertainty is high, and the outlook for the global economy has significantly deteriorated. The RBNZ assumes that the US tariff policies (as of 22 May) shave about 0.5%pts off our trading partner growth, dampening demand for our exports. The output gap – the difference between actual output and potential output – is still modelled to be negative; meaning significant spare capacity remains in the economy. And a weaker global growth outlook doesn’t help in the near-term. Previously, it looked like the output gap had bottomed out. Now, the RBNZ expects the output gap to turn even more negative due to global trade disruptions and uncertainty. Interest-rate sensitive such as residential construction and retail, have also yet to gain momentum. All in all, the expected recovery in economic activity is forecast to be slower than projected in the February MPS. The RBNZ now projects 0.7% growth this year, down from 1%.

Another consequence of a greater spare capacity than previously modelled is a slightly higher unemployment rate. The labour market continues to ease, but according to the RBNZ, the unemployment rate is close to peaking. The current June quarter may be the high-water mark for the unemployment rate at 5.2%, but it stays higher for longer over the forecast period.

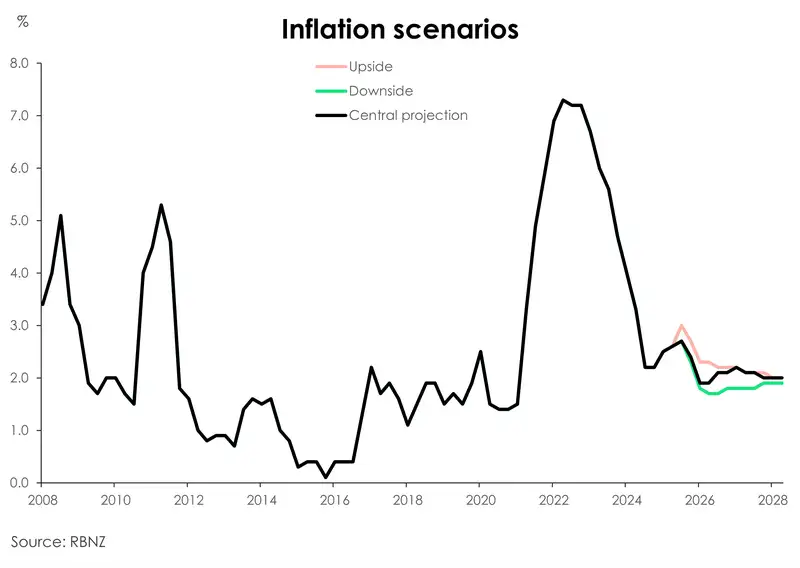

The good news is that inflation over the forecast horizon remains reasonably well-contained. There’s a short-lived blip to 2.7% later this year (Sep-25 quarter), but inflation travels back down to the 2% target midpoint in early 2026. The RBNZ’s 1-3% target band is respected. And the inflation beast has been tamed.

Scenarios: a forecasters best friend

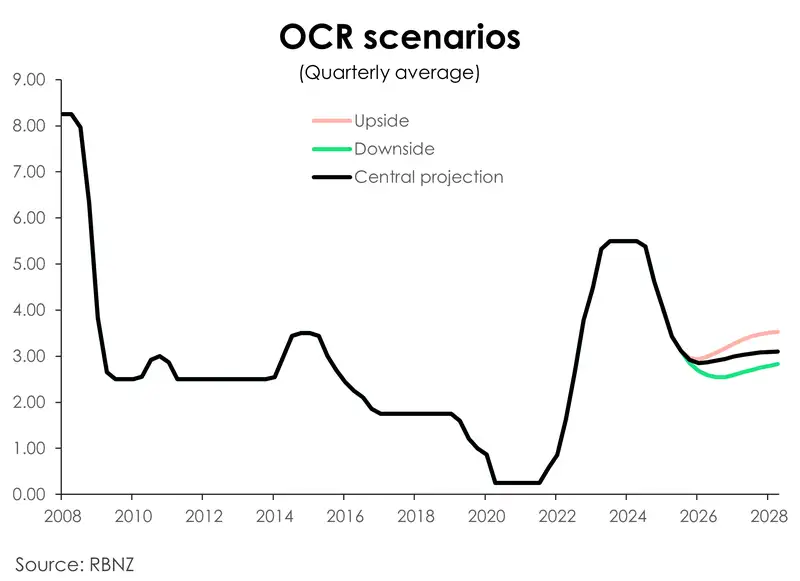

You know times are really uncertain when the word alone is mentioned 164 times throughout the Monetary Policy Statement. And in such uncertain times, scenarios are a forecasters best friend. We’d argue the case of always having scenarios, regardless of uncertainty levels. But nonetheless, we’re happy the RBNZ have presented two additional scenarios alongside their central projections. It’s the first time in five years.

So, what are the other ways the RBNZ see the economy possibly going?

Well in both the alternative scenarios provided, our trading partner’s GDP growth is lower than assumed in the Reserve Bank’s central scenario. But what differs between the two alternative scenarios is whether tariffs prove to have a greater demand or supply shock.

If trade policy turns out to have a greater demand shock, the result is weaker economic activity, lower inflation, and a lower OCR is required to stabilise inflation and support the economy. That’s the downside. Inflation falls below 2%, to a low of 1.7%. And in response we see an OCR track signalling further cuts and bottoming at 2.55% in September 2026.

If trade policies instead turn out to have a greater supply shock, the ensuing result is still weaker economic growth – than the central projections – but higher inflation. Inflation rises beyond the 2.7% peak in the RBNZ central forecast and instead peaks at 3%. And in response, we’re given a higher OCR track. One which bottoms at 2.96% at the end of this year and signals a higher cash rate. That’s the upside scenario. And even in the upside scenario, the RBNZ are still flirting with a sub 3% cash rate.

In reality, we’ll probably see a be a bit of both scenarios play out. That’s where the RBNZ’s central scenario fits in. But to us, in these uncertain times the risks are still tilted to the downside, with the demand shock more likely to dominate.

Market reaction

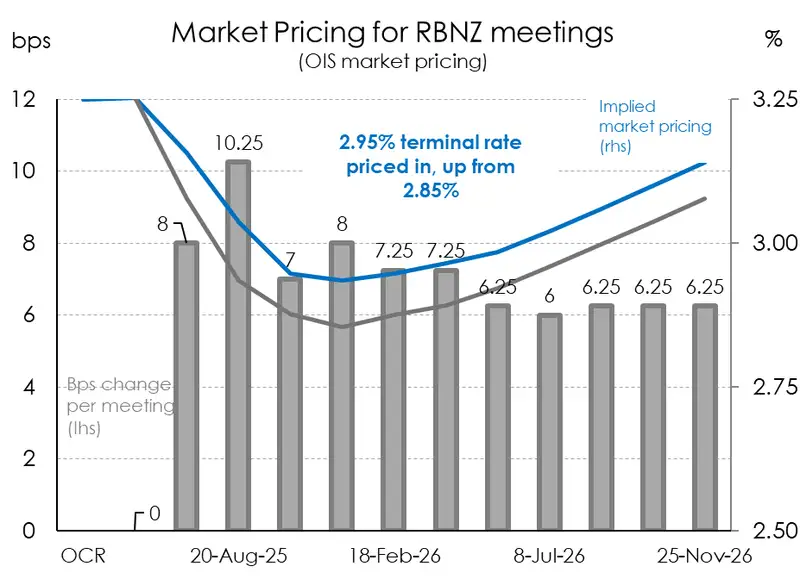

The reaction in financial markets was one of disappointment. The fact the RBNZ “voted” 5-1, with one member voting for a pause to assess, throws doubt on the timing of the next move, but not the direction. The pivotal 2-year swap rate rose 10bps, from 3.16% to 3.26%, as the implied terminal cash rate lifted from 2.85% to 2.95%. We don’t think this was the reaction the RBNZ was looking for, however. The telling comment from Hawkesby, when asked about the market reaction, was the reference to the new OCR track matching market pricing prior to the announcement. So, the RBNZ’s OCR track matched market pricing of 2.85%. Most importantly, the track was lowered from 3.1%, reflecting a willingness to cut to 2.75%. The end point in the track was not revised, however. The RBNZ track shows cuts to 2.85% by Q1 2026, and then a hike back to 3.1% by mid-2028. So while we continue to expect a move to 2.5% (not 2.75%) we do agree with rate hikes, eventually (and hopefully). The curvature in the OCR track better reflects the likely path. You cut more near term to stimulate growth and hike back to neutral (much) later on. It’s in our forecasts as well.

The chart above shows the market reaction. We saw the OIS strip lift roughly 6-to-10bps, with the terminal rate rising from 2.85% to 2.95%. The RBNZ’s track was set at 2.85%. We believe we are seeing some profit taking in wholesale rates markets. Hedge funds would have placed some bets that the RBNZ may have come out a lot more dovish (like the RBA was last week). And despite the RBNZ lowering their track by 25bps, it wasn’t enough. We think the market will settle down, and end up moving back down to 2.85%, in time (and depending on what happens in offshore markets). And then, we expect another move by markets and the RBNZ down to 2.5%.

The Kiwi currency reacted exactly as you’d expect. It fell. It rose. And then it fell again. It looked like a heart rate monitor around .5950. There wasn’t much change at all. More cuts are coming, and there are bigger issues offshore for currency traders to grapple with.

RBNZ statement

“The Monetary Policy Committee today voted to lower the OCR by 25 basis points to 3.25 percent.

Annual consumers price index inflation increased to 2.5 percent in the first quarter of 2025. Inflation expectations across firms and households have also risen. However, core inflation is declining and there is spare productive capacity in the economy. These conditions are consistent with inflation returning to the mid-point of the 1 to 3 percent target band over the medium term.

The New Zealand economy is recovering after a period of contraction. High commodity prices and lower interest rates are supporting overall economic activity.

Recent developments in the international economy are expected to reduce global economic growth. Both tariffs and increased policy uncertainty overseas are expected to moderate New Zealand’s economic recovery and reduce medium-term inflation pressures. However, there remains considerable uncertainty around these judgements.

Inflation is within the target band, and the Committee is well placed to respond to domestic and international developments to maintain price stability over the medium term.”

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.