The sugar rush continues in level 1

And it’s looking more and more like a return to normal in some areas of the economy. We took a good, hard, LONG, look at our backyards, and decided we needed more. More of us ordered pools, fixed fences, laid pavers, and even bought pets. I guess we’re better prepared for more (forced) time at home.

Can the spend up continue? We’re still wary of the damage done and the impact to activity. The drawbridge into NZ won’t be let down anytime soon. Greater domestic tourism goes some way. But foreign tourism is a hard void to fill. And overshadowing all of this, is the rise in unemployment. The rise in unemployment may dampen future spending, and investment.

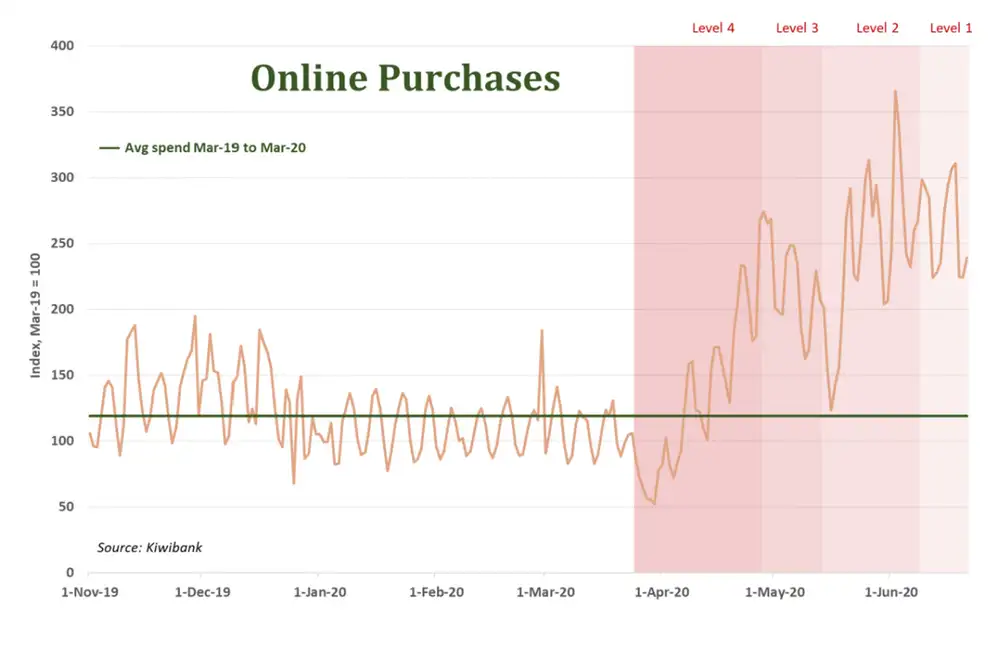

High above lockdown lows

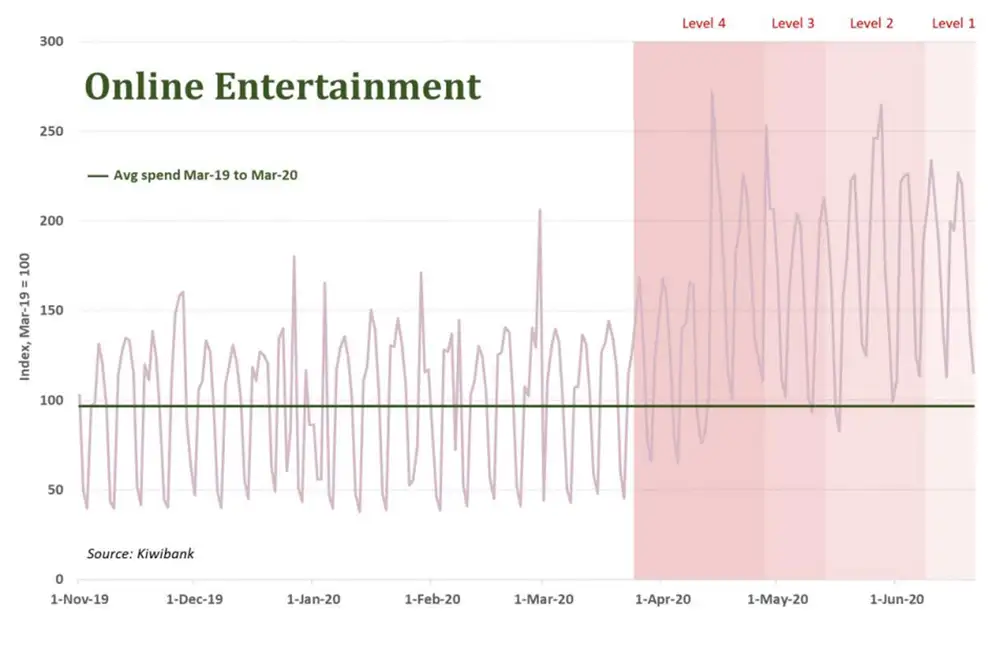

Spending on hospitality has lifted from the lockdown lows, and is still well above-average. Our spending online continues to climb. We’re entering an even more digital world. The structural shift to online has accelerated.

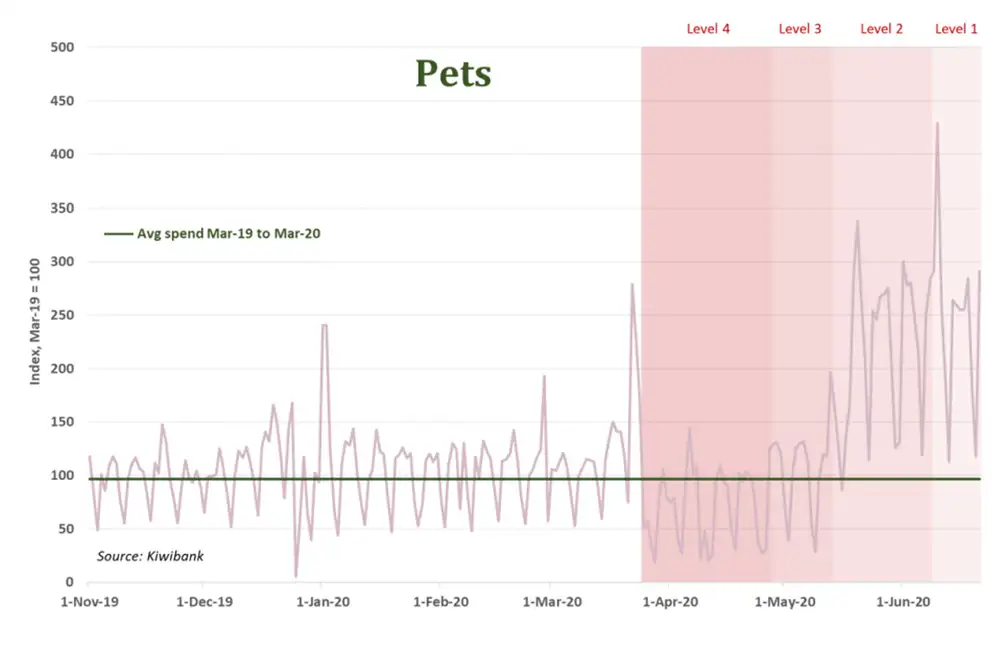

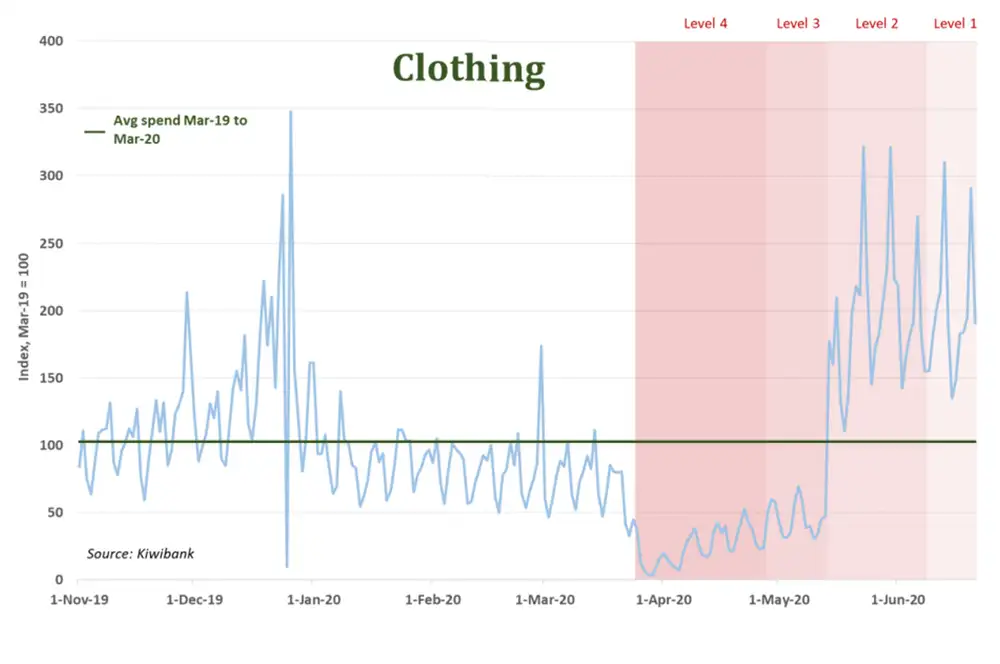

Treating ourselves and our pets

As we emerged from lockdown, it wasn’t just us needing some pampering. Our (new) pets too have enjoyed a spending spree. As clothing stores reopened, so did our wallets. And as we prepare for winter, we expect spending to remain elevated.

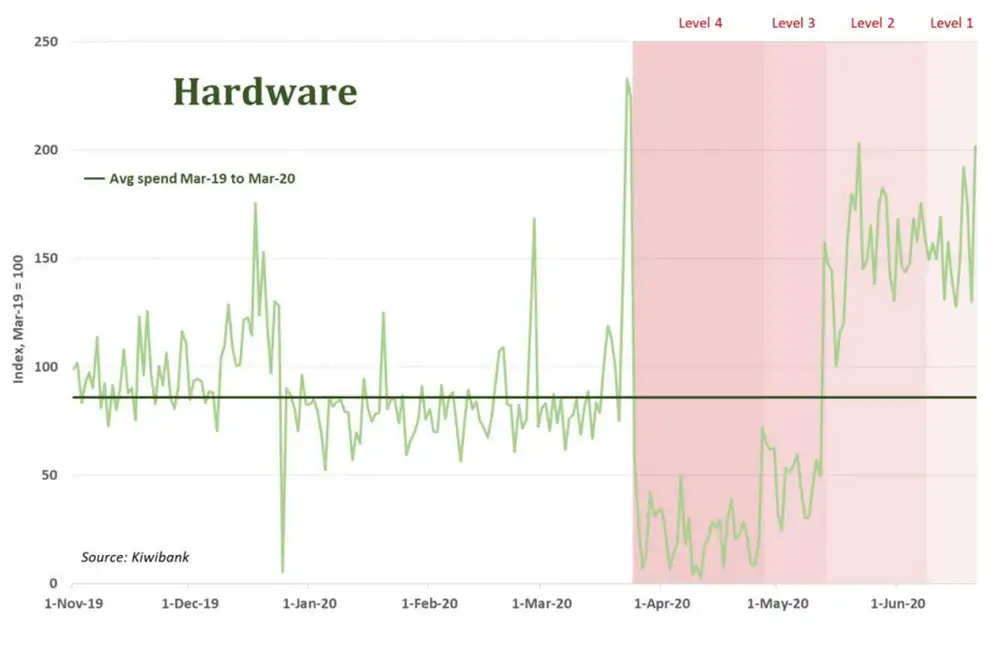

Home improvement

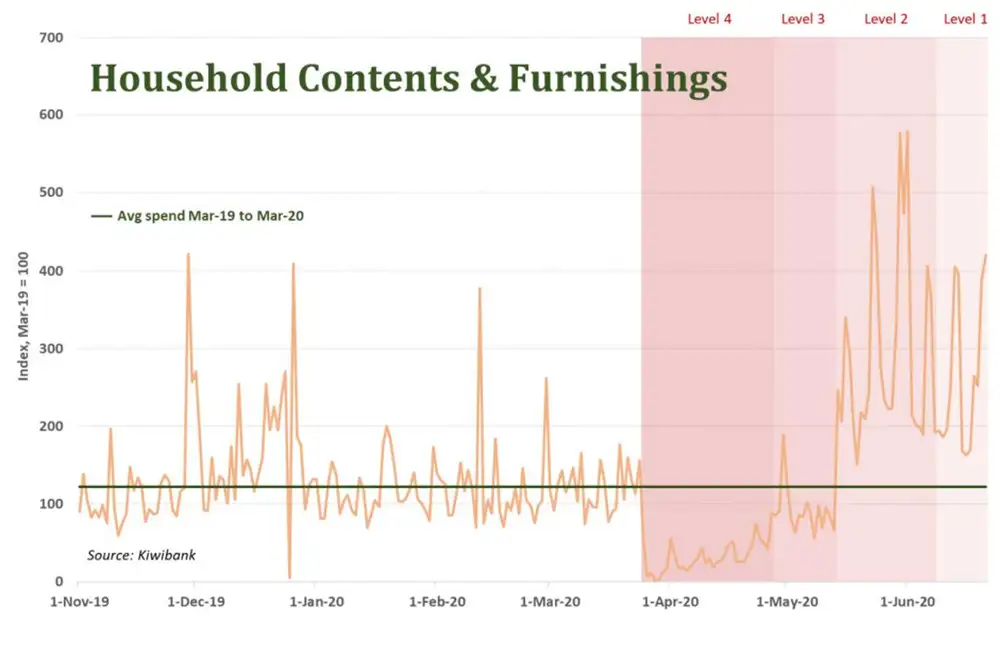

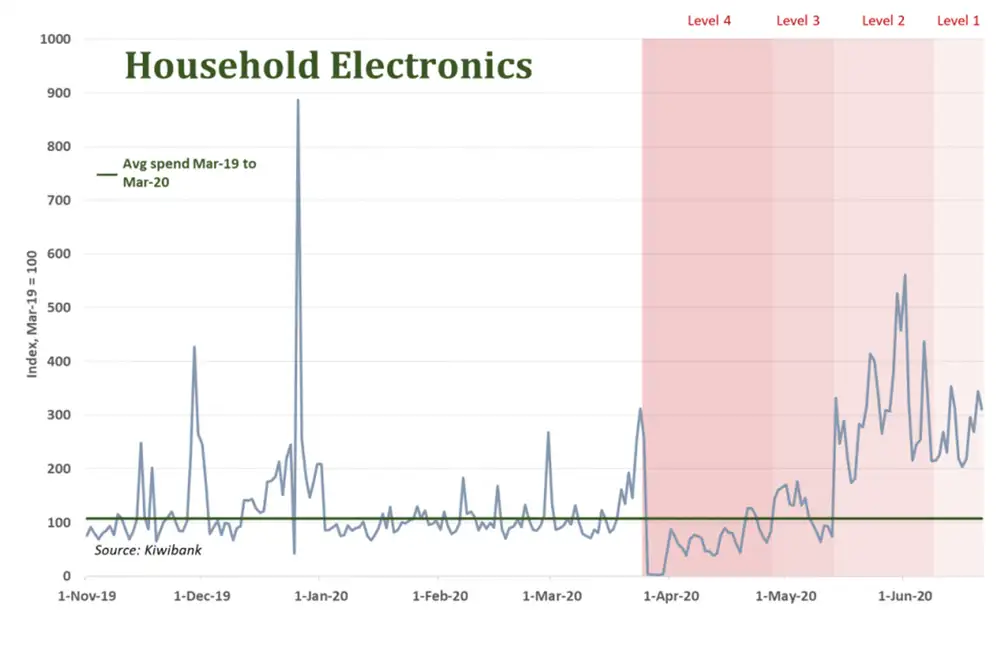

Out of lockdown, we got handy with a hammer. DIY is up with a surge in home renovations. And with our overseas trip now cancelled, we could do with a new pool, and couch.

In some areas, our spending is stabilising

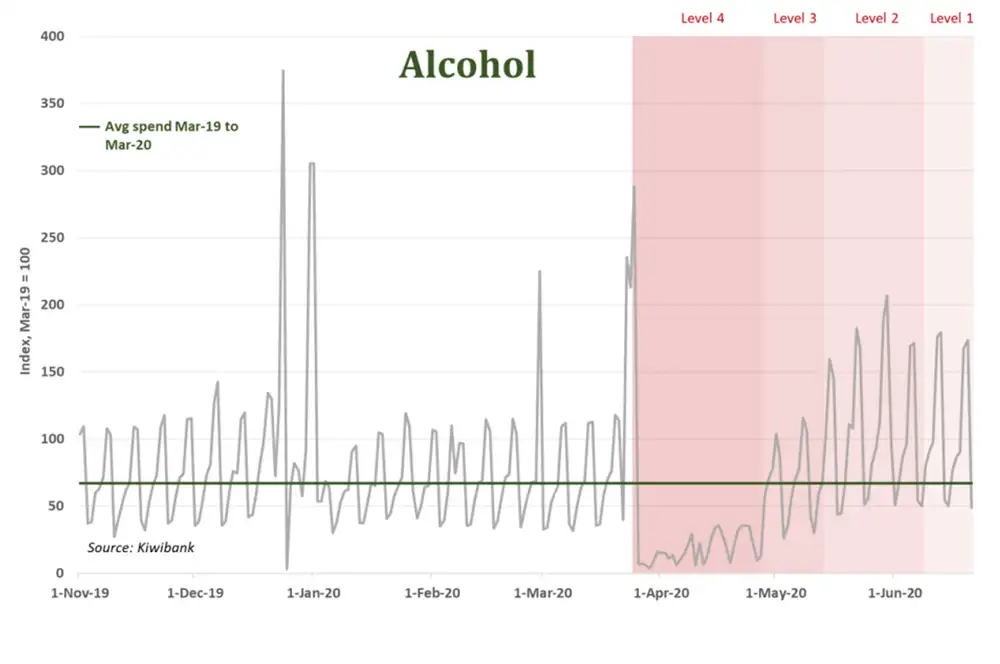

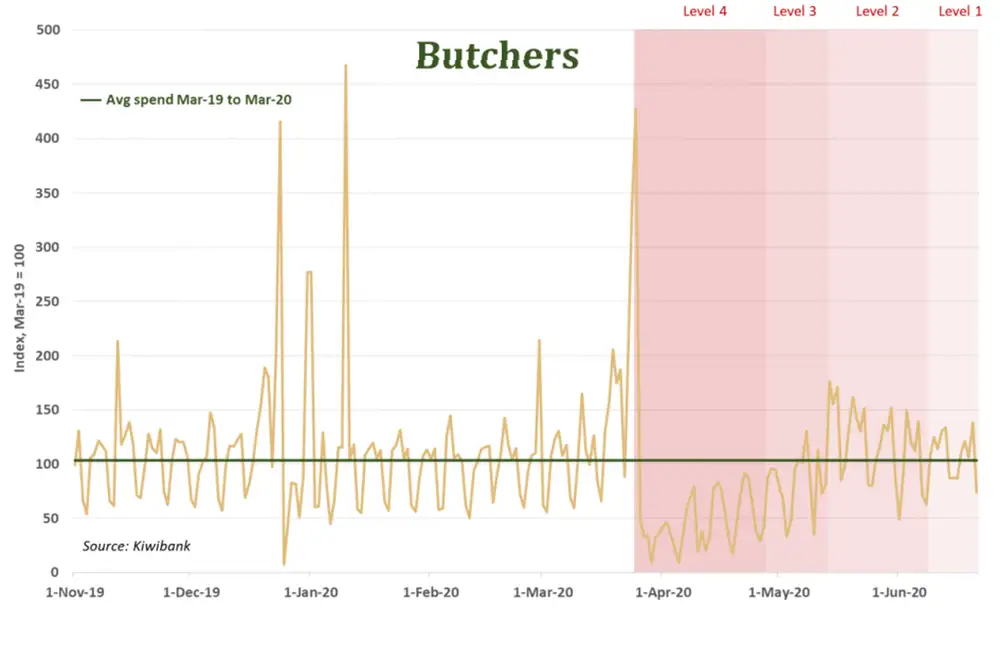

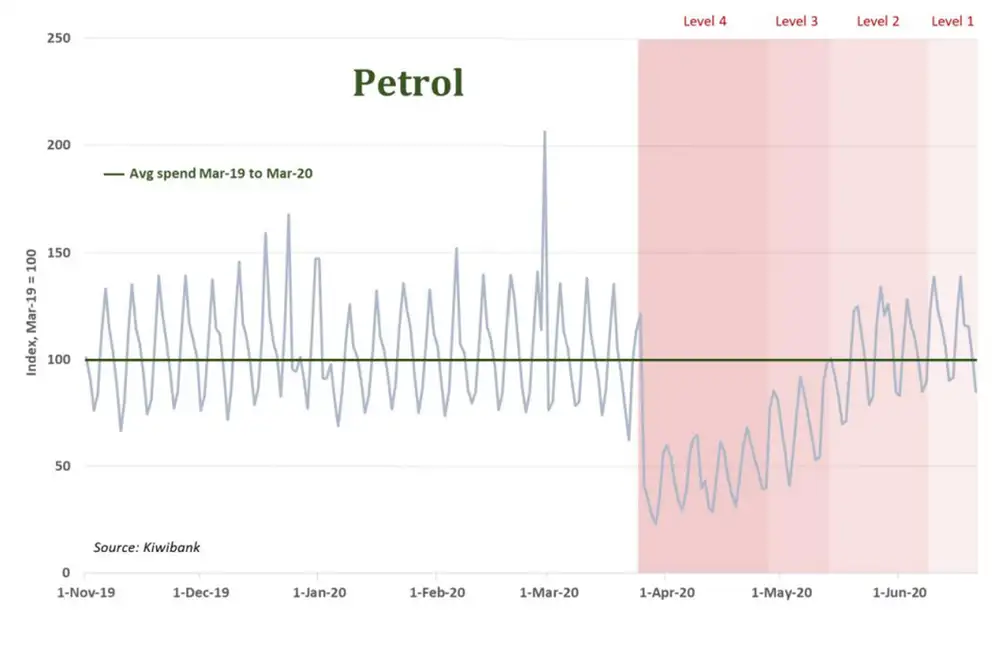

The run on alcohol and meat is starting to come off. Petrol too has returned to pre-Covid levels. But prices are lower today. So we must be buying more (in volume).

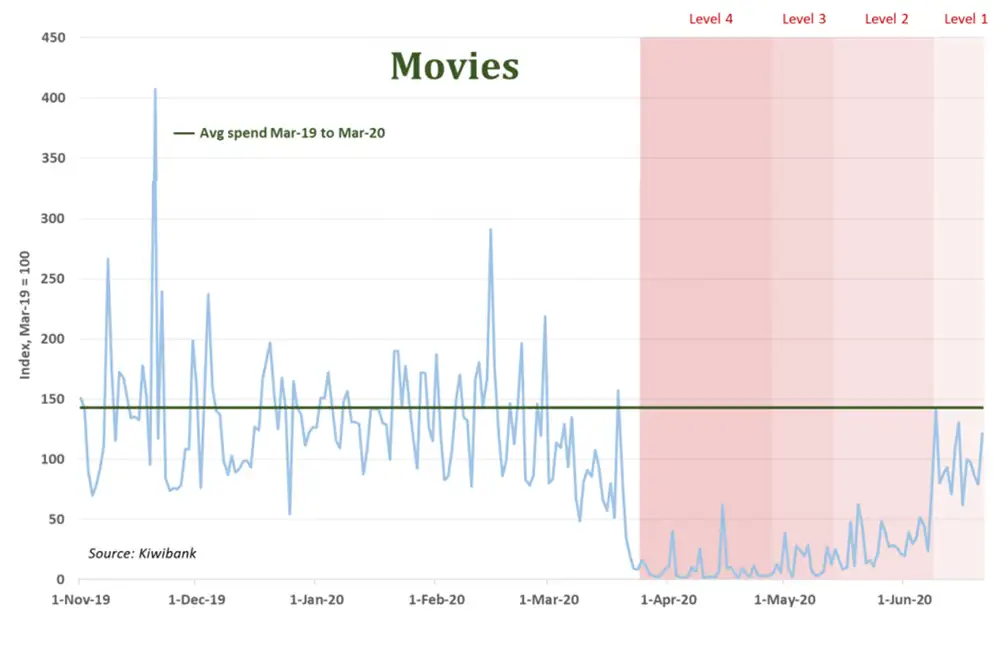

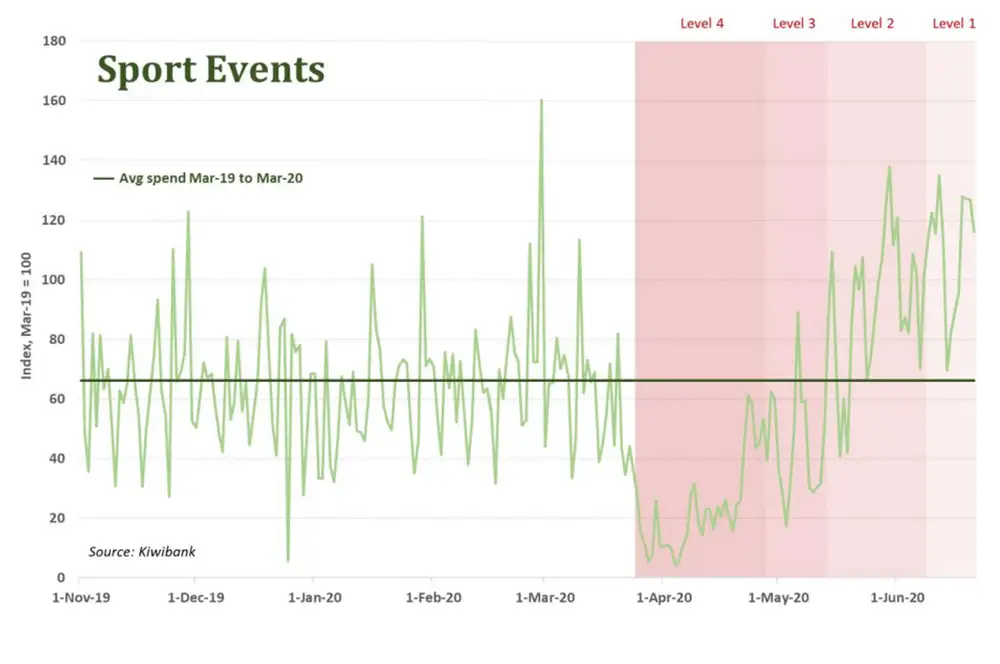

Sold-out rugby stands, but empty cinema seats

Actors must still be in quarantine. Because not much is showing at the cinemas. Netflix continues to dominate our screens. Level 1 means we celebrate the return of sport. And we’ve taken advantage.

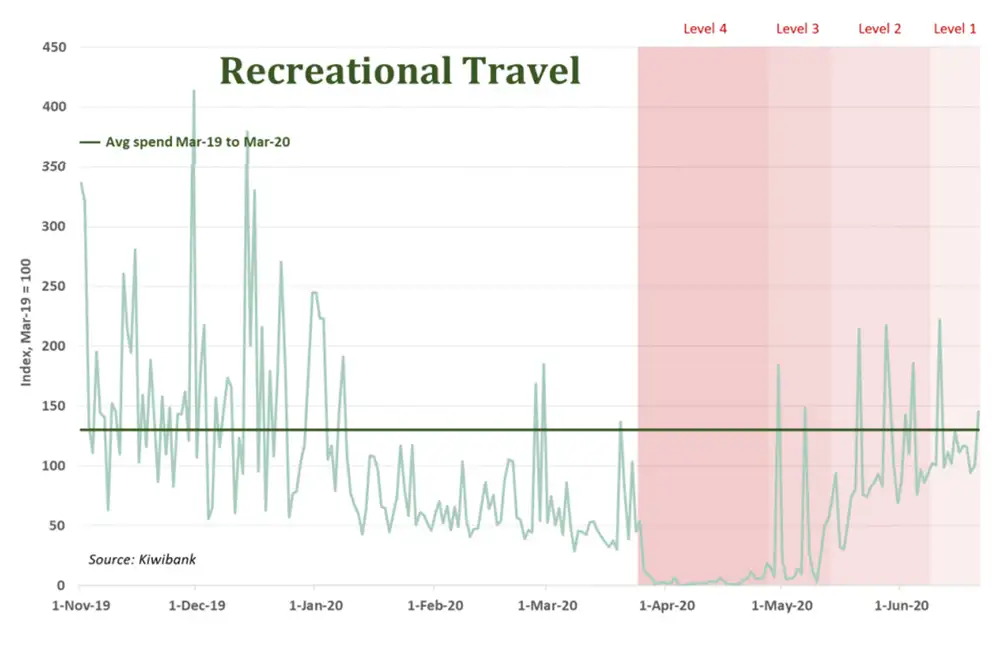

From foreign cruises to local luges

NZ’s borders will remain shut for some time. The absence of foreign tourism leaves a gaping hole. Domestic tourism goes some way to fill the void. And we’ve been surprised by the surge in accommodation spending and travel. International flights are being transferred domestically. We’re booking Kiwi holidays.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.