Following the pop higher in wholesale rates, from November, the 2-year swap rate has consolidated at 3.07%, having hit 3.17%. That’s good news for homeowners looking to fix. Rates should be steady for now… assuming the RBNZ doesn’t fuel the rate hike fire.

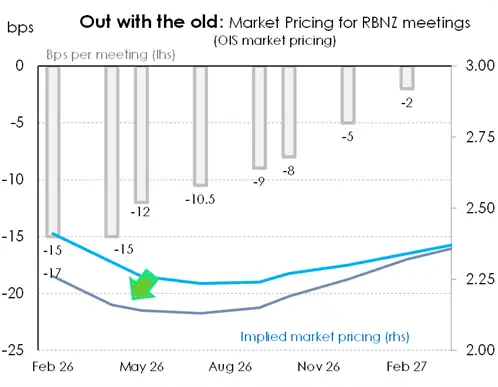

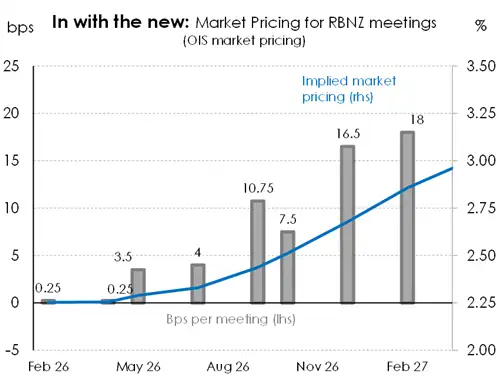

Pricing for the RBNZ is still a little punchy. There is a full 25bp hike priced by October (2.51%), and a 70% chance (17/25) of another hike in December. The 2.67% in December is down from 2.79% priced just a few weeks back. Rate expectations remain elevated, compared to the fundamentals. But we will learn more on Wednesday. The RBNZ’s OCR will be lifted, to remove the small chance of another rate cut, and to pull forward rate hikes. Currently, there are a series of rate hikes priced from October. We believe we need to see the actual recovery take hold, and business investment take off… long before we advocate delivering higher rates. There has already been a significant tightening in financial conditions. Thoughts of further rate cuts (“out with the old chart”) have been replaced with hikes (“in with the new”). This is good news as the economy shows tentative signs of recovery. But the hikes implied, are too early.

This swing saw retail mortgage rates push higher. Sooner than we would have prescribed. It’s the RBNZ’s job to manage these expectations. Do we need rate hikes this year? It’s simply too early to know, with conviction. And the path of lest regret is to hold (until next year).

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.