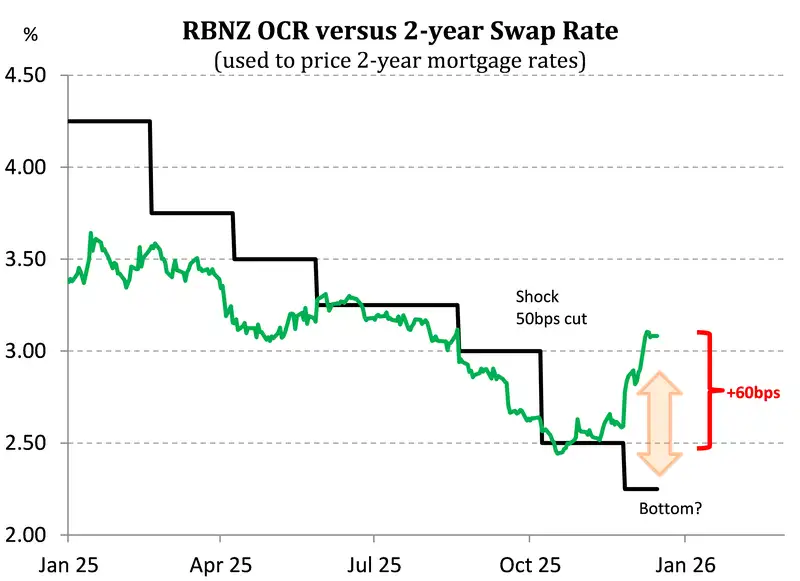

Only the RBNZ can cut and hike at the same time. And here they are undoing the last 75bps of rate cuts delivered since October. How can that be? Well, market traders are always looking for the next move… rarely satisfied with the last… and unwilling to price in rates “on hold”. Traders have gone from expecting cuts, to expecting hikes. And we have seen a massive move in wholesale rates. The 2-year swap rate, used by banks to price 2-year mortgage rates, has catapulted higher to 3.08%. That’s a massive 60bps. The 2-year swap rate hit a low of 2.45% in October, following the RBNZ’s surprise 50bp rate cut. Yes, just two months ago the RBNZ was clambering to cut, and in size. Because the economy contracted in the second quarter. And the RBNZ realised (belatedly) that they had more work to do. But here we are today, with higher rates.

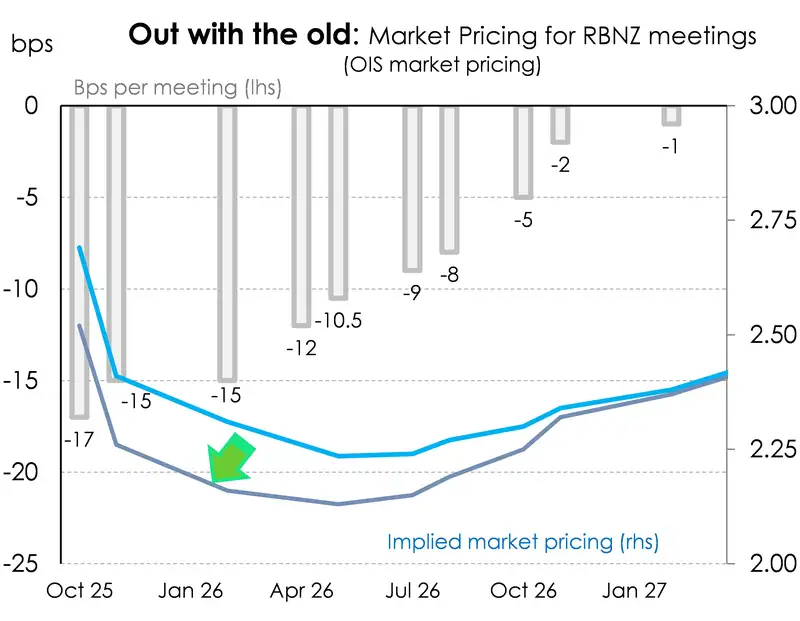

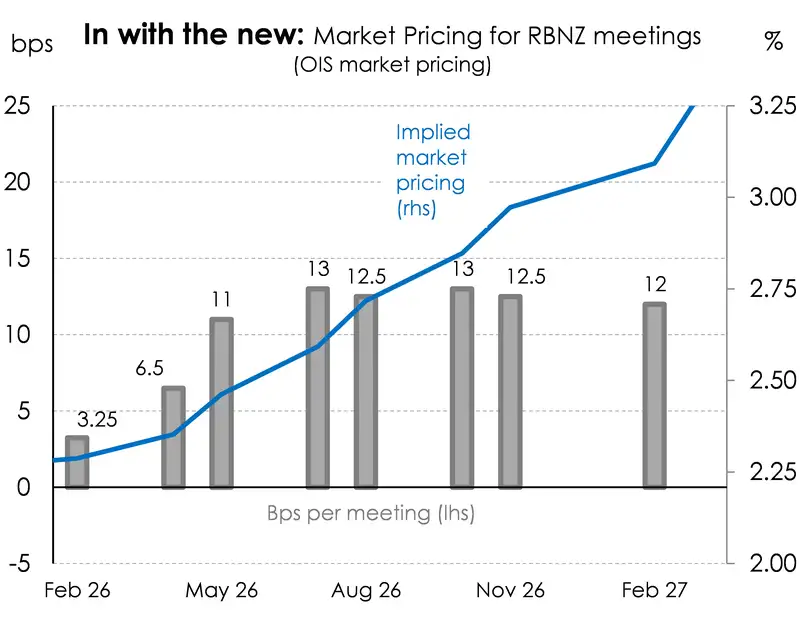

The wholesale market is pricing in hikes from July next year, with a few active bets beforehand. The RBNZ’s OCR track was a little higher than expected, and signalled the RBNZ was close to finished. And that’s all it took. If they’re no longer cutting, then they must be hiking. And wham! Market pricing for the OCR mid-way through next year, has shifted from 2.1% priced just 2 months ago, to 2.5%. But it’s the steepness into 2027 that shows just how overblown the move is. We have a 3.5% cash rate priced in 2027… that’s 125bps of hikes in an economy still operating below potential and with a gaping output gap. In our opinion, wholesale markets have gone too far. And policy relief has barely begun. It’s simply too early to call for hikes, let alone that many.

There is some good news beneath the move higher in interest rates. The outlook for the economy has improved, and the data flow is supportive of an economy in recovery. That’s fine and well. But we are miles away from reversing course and demanding higher rates.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.