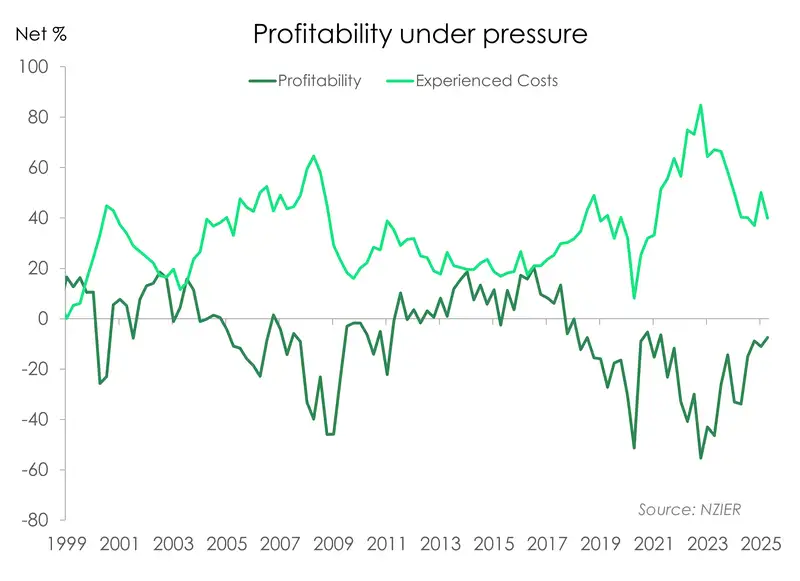

- The gap between hopeful optimism and the harsh reality of daily business, continues to widen. As to be expected, firms are looking to the economic recovery with greater confidence. Interest rates have fallen. But activity has failed to lift (yet). And it’s showing up in price pressures. Experienced costs are easing, that’s great; but pricing power is evaporating, not so great.

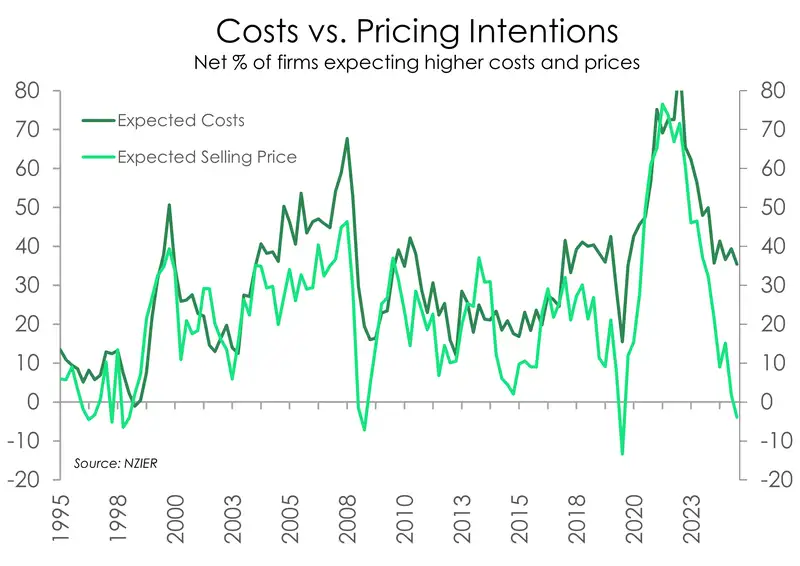

- The NZIER correctly deduce that: “Overall, these indicators continue to suggest inflation pressures should be contained in the New Zealand economy.” And that’s key for policy. Rate cuts are required to lift failing activity, without much fear of fuelling inflation.

- The QSBO survey may have shown a lift in optimism. But confidence is fragile, and at risk of reversing if offshore forces deteriorate. The RBNZ should cut below 3%.

“The latest NZIER Quarterly Survey of Business Opinion (QSBO) showed firms remained optimistic about an improvement in the general economic outlook. This upbeat mood remains in stark contrast to the continued weak demand as reported by firms.” NZIER

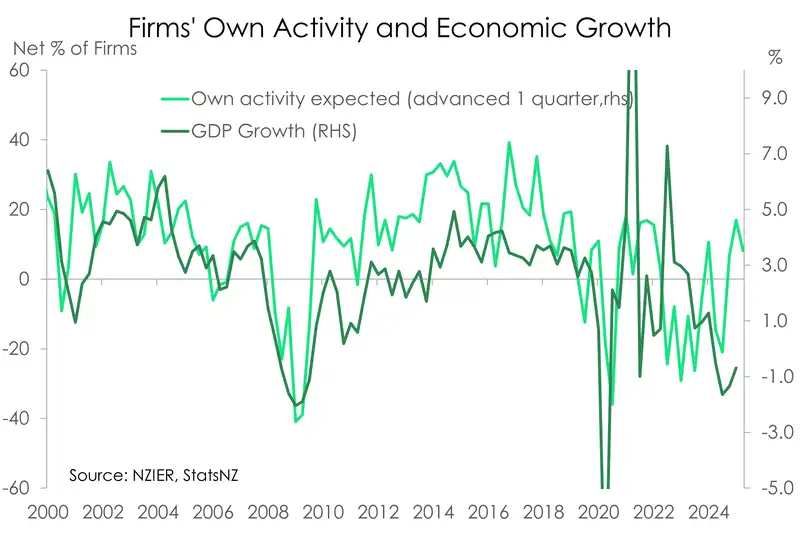

Being optimistic is one thing. We’re optimistic about the outlook. Because interest rates are falling and feeding through to households and businesses. A net 27% of firms expect brighter days ahead, up from 23%. In the same breath, a net 23% of firms recorded a decline in activity. And 68% of firms put a ‘lack of sales’ as their primary constraint on their businesses. “The continued divergence between optimism about the general economic outlook and weak activity was widespread across the sectors.” NZIER

The survey’s divergence mirrors the feedback we’re hearing from our SME business owners: I expect things to improve, after a miserable few years. But I haven’t seen it yet. I want to expand into 2026, but I have my plans for investment on the shelf. I want to expand into 2026, but I’m going through my third restructure to gut costs. I’m optimistic about tomorrow, but I’m realistic about today. And reality bites.

The results are not unexpected. The divergence has been in place for a while now. The lift in confidence has been steady, since the depths of despair this time last year. But the economy is crawling, not running, out of the recession. And the argument for stimulatory monetary policy is unequivocal. Interest rates must be lowered to stimulate activity.

But what about inflation? Will lower rates fuel inflation? Not yet. The cash rate of 3.25% is close to neutral, and is not stimulatory. And firms are saying they are feeling less pressure, and passing on less pressure. Fewer firms are reporting an increase in costs (42%, down from 50%), and there’s been a reduction in pricing power and passthrough.

And then there are the risks…

The risks to the global outlook, and New Zealand’s outlook, remain tilted to the downside. We have a lot of headline risk, particularly out of the Trump administration. The run of recent news has calmed market participants, for now, but we’re still waiting on trade deals. We expect most to get done, and end up close to 10%. But risks remain. The geopolitical landscape is simply more hazardous.

No one likes to live in the past. And when the present isn’t all that great, we tend to look to the future with some optimism. Firms are doing just that. The current reality still bites. On a seasonally adjusted basis a net 23% of firms reported reduced activity in the June quarter - a touch more than the net 21% over the March quarter. It adds weight to the pile of evidence that a slower pace of recovery lies ahead for the Kiwi economy compared to the growth we experienced over the summer months. Despite the slight deterioration in activity over Q2, firms continue to march on with their heads held high. Expected activity for the coming months ahead lifted again. A net 18% of firms expect higher trading activity in the September quarter. That’s up from the net 12% last quarter. And the net 13% of firms who a year ago were still expecting a deterioration in future activity. The future seems to be shining brighter with each release. But it should be noted that firms have had improving sentiment about expected activity for the past 4 consecutive quarters all whilst experienced activity has tracked sideways in the red.

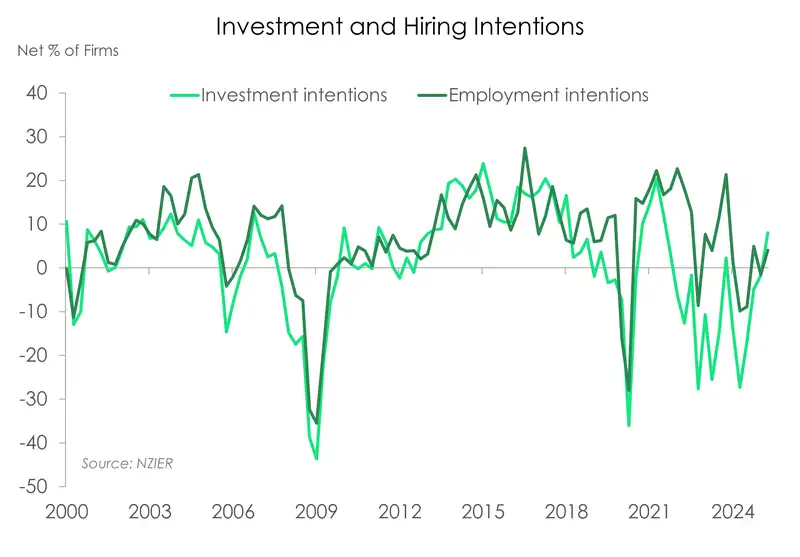

It’s what we’ve been waiting for. After 13 consecutive quarters of negative investment intentions (excluding a short-lived blip following the election), investment intentions are finally back in the black. Well, mostly. A net 1% of firms are still planning on reducing investment in buildings. But a net 8% of firms are planning to get back to investing in plant and machinery over the coming year. The Government’s “Investment Boost” scheme has likely helped get some firms off the side lines. But we imagine others will still be holding off until they have more conviction about a sustained recovery in demand. Looking over at hiring, firms continued to cut headcount over Q2, though fewer than over Q1. A net 12% of firms reduced staff numbers in the June quarter compared with the net 17% in the March quarter. Although it seems hiring in the quarter ahead seems more promising with a net 4% of firms looking at expanding headcount.

In some good news, the price-related indicators suggest that inflation remains well-contained. Both cost and pricing indicators eased over the June quarter. Fewer firms reported an increase in costs, from half of firms to a net 42%. The improvement was likely supported by the recent appreciation in the Kiwi dollar after starting the year on the backfoot (trading in the 55-56c range). At the industry level, the experience however is mixed. Fewer retailers experienced higher costs over the quarter, while cost pressures have intensified in the building sector. A net 59% of builders reported increased costs, up from net 35% in Q1). Despite this, the building sector reported the biggest fall in pricing – from a net 3% raising their prices last quarter, to a net 35% decreasing their prices. Meanwhile, pricing across retailers held steady. Overall, the weak demand environment continues to weigh on firms’ pricing power. A net 1% of firms had dropped their prices over the quarter, and a net 2% expect to do the same in the coming quarter. Outside of the Covid pandemic, 2009 was the last time the survey pointed to an expectation for price declines.

Costs may have eased in the June quarter, but it only partly reverses the surge at the beginning of the year. Alongside the reduced ability to lift prices, firms’ profitability remains under pressure. A net 31% of firms reported a decline in profits last quarter, well below the long-run average. Profitability remains weak across the board. Some sectors, including retailers, expect profitability to improve in the coming months. But both builders and manufacturers reported a stark deterioration in expected profitability.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.