The detail

“But we never learn. Trusting in the fire while the cruel flame burns.” Tim Finn

Kiwi interest rate markets are perfectly priced, in our opinion. We expect interest rate curves to continue to bear steepen into next year. But there will come a time when equity valuations are tested.

For now, the focus is firmly fixated on the Govt’s budget, due May 20th. And the RBNZ will formally upgrade their forecasts on May 26th and deliver the FSR with housing intentions on May 5th.

Kiwi wholesale interest rates should end the year a little higher, and the Kiwi currency should finish 2021 around 75c. Our forecasts haven’t changed.

Today’s review was a rinse and repeat of the February statement

As “…risks to the economic outlook remain balanced, conditional on ongoing stimulatory fiscal and monetary policies.” RBNZ

The RBNZ kept the cash rate, and LSAP and FLP programmes sharply unchanged. As expected by every man, woman and child economist with 98% confidence. Although none of us admitted to agreeing with the others on principle.

The global outlook is much better

The IMF has recently re-revised their forecasts higher, again. Our mindsets have changed. We’ve turned from counting Covid cases, to counting Covid vaccinations. Herd immunity is likely in a matter of months, not years. The risks surrounding the pandemic have receded, and the global economic outlook has improved. Asset markets have been fuelled by record fiscal policy support, especially in developed markets, and ultra-accommodative monetary policy. And the policymakers are well aware of the risks of tapering with tantrums.

What’s needed, is time and patience. It’s the game plan most central banks around the world are running. And the RBNZ confirmed such a stance today. The RBNZ’s mandate is to “maintain stability in the general level of prices over the medium-term, and support maximum sustainable employment.” Based on our forecasts, the return to full employment and stable inflation (~2%) will take two years to achieve with confidence, and that’s without any further shocks. Risks remain, both to the upside and downside, but they’re balanced at least.

The key line in the RBNZ’s statement was: “The planned trans-Tasman travel arrangements should support incomes and employment in the tourism sector both in New Zealand and Australia. However, the net impact on overall domestic spending will be determined by the two-way nature of this travel. The extent of the dampening effect of the Government’s new housing policies on house price growth, and hence consumer price inflation and employment, will also take time to be observed.” Basically, the economy’s looking like a Picasso painting. There’s a lot going on, and it will take time to decipher the impacts, both good and bad.

With regards to the NZ$100bn LSAP programme, the improvement in the Government’s budgetary books, means fewer bonds for the RBNZ to buy. And the RBNZ is already bumping up against its self-imposed 60% ownership limit. “Staff noted that reduced government bond issuance was placing less upward pressure on New Zealand government bond yields and providing less scope for LSAP purchases." It’s becoming difficult for the RBNZ to buy the full $100bn without widening the scope to all councils (which it should in support of the Government’s Acceleration Fund).

The FLP is slow on the uptake, but is helping to keep a lid on lending rates (or else). There’s no need to make any changes to a programme that all banks will tap in time. Although the RBNZ reminded the banks of the expectations of use, and fired a warning shot to banks, noting “The Committee agreed that any increase in bank lending rates would be premature given the current economic outlook.”

All monetary policy levers were left unchanged. Monetary policy is likely to remain unchanged well into 2022. So today’s statement was never going to get us too excited. The excitement “may” come in the May Financial Stability report, which the RBNZ did touch on today. “As distinct from the Monetary Policy Committee’s remit, the Bank has been directed under its financial stability mandate to have regard to the Government’s policy of supporting more sustainable house prices, including by dampening investor demand for existing housing stock, which would improve affordability for first-home buyers. Staff presented and discussed a preliminary suite of indicators assessing house price sustainability with the Committee. Preliminary assessments on the Bank’s response to the Ministerial direction will be included in the May Financial Stability Report.”

May is shaping up to be a big month, with the RBNZ’s housing related FSR on May 5th, The Govt’s budget on May 20th, and the next RBNZ MPS on May 26th.

New Zealand’s severe shortage of sustainable and affordable dwellings is in focus. Because house prices have risen at an unsustainable rate. Although it is more of a discussion for the RBNZ’s regulatory arm, under financial stability.

Six months in a leaky boat

“The tyranny of distance. Didn't stop the cavalier. So why should it stop me. I'll conquer and stay free.” Split Enz

Policymakers are firmly focussed on fixing New Zealand’s “housing crisis”. A crisis of underinvestment and unaffordability. The Government’s recent package takes some steps in the right direction. Unfortunately, the flagship “Housing Acceleration Fund” was underfunded before it began. The $3.8bn allocation is a mere drop in the bucket, and it’s a leaky bucket at that. We do like the accelerator fund, and we expect the fund to receive more funding in the May budget. It is then up to the fund itself, to prove efficacy and force further funding in future budgets. The greatest challenge developers face is finding viable land to develop, and getting council consent. We will never balance New Zealand’s chronic housing shortage without ramping up supply.

The easiest, most politically palatable, response to rampant house price appreciation is to suffocate investor demand. Both the RBNZ and Government have made it harder to invest. The hurdles for investors include a 40% deposit coupled with the possibility of a firm Debt-to-income (DTI) restriction, laced with evaporating interest deductibility and a 10-year bright-line test. The changes will influence the marginal investor, and may lead to a slight uplift in rents. But we are encouraged by the exclusion of new properties. New properties may also be eligible to interest deduction. Nudging investor demand into new builds will help boost supply. The changes also make investing in commercial property more attractive.

We expect the Government to hand the RBNZ approval to use DTI and interest-only lending restrictions on investors. We’d expect to hear more of DTI’s and interest-only loan restrictions by May.

Also in the mix, is the surgical repricing of mortgage credit risk. We believe there’s more we can do to price the risk associated with interest-only investor lending. It’s a small pocket of the housing market, but it’s not priced fairly in mortgage rates. We’ve been banging the table on this for a while now. We should simply have a higher risk weighting for investors on interest only loans. An investor interest-only loan should be charged a higher interest rate to reflect the higher risk. The RBNZ should do this via its financial stability mandate. Although, the 4-year run down and removal of interest deductibility on investment properties reduces the incentive for investors to go on interest only anyway.

Beside you: bonds steepening

“You run from the river when it long ran over you. And now I'm running here beside you.” Tin Finn, Bic Runga, Dave Dobbyn – together in concert.

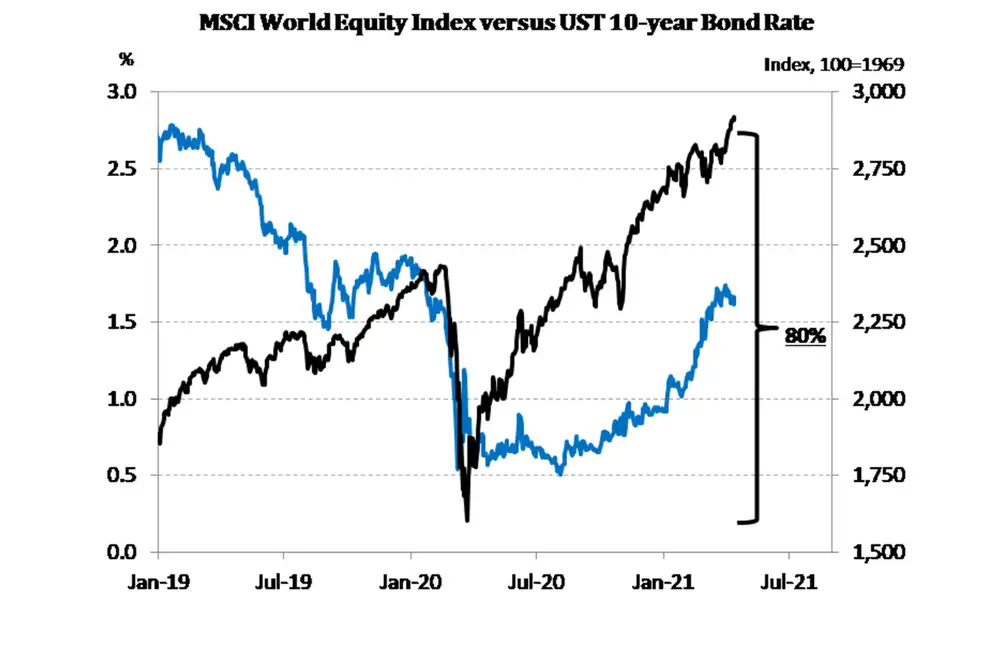

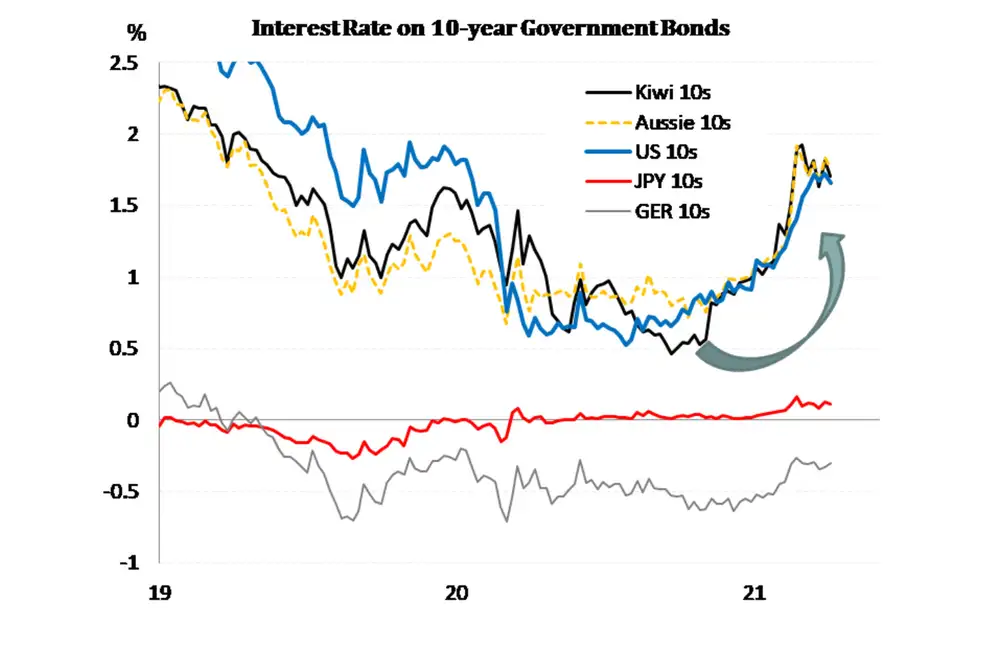

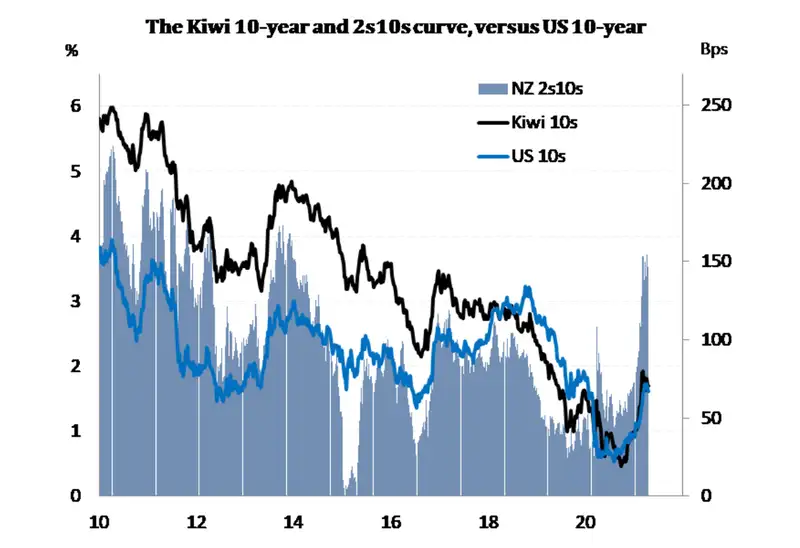

Global interest rates have lifted from the depths of last year (and despair). The improvement in growth prospects and the threat of inflation rising above central bank targets, has pushed longer-dated yields. The Kiwi 10-year Government bond yield has risen from an incredibly low 0.44%, to a much more reasonable 1.69%. The move itself was abrupt, violent, and took a few prisoners. But the level itself, 1.7%, is perfectly reasonable, and not restrictive. We’re still well below 2019 levels. And we’re still well below the 2.5-3.0% levels we believe would test valuations in equity markets and other assets more broadly.

One learns very quickly that long-end Kiwi bond yields move more at the mercy of foreign forces, than local. And the global bond market sell-off push higher in yields, has caused a sharp steepening in the Kiwi curves. And it’s good news. Good news is being priced into global bond markets.

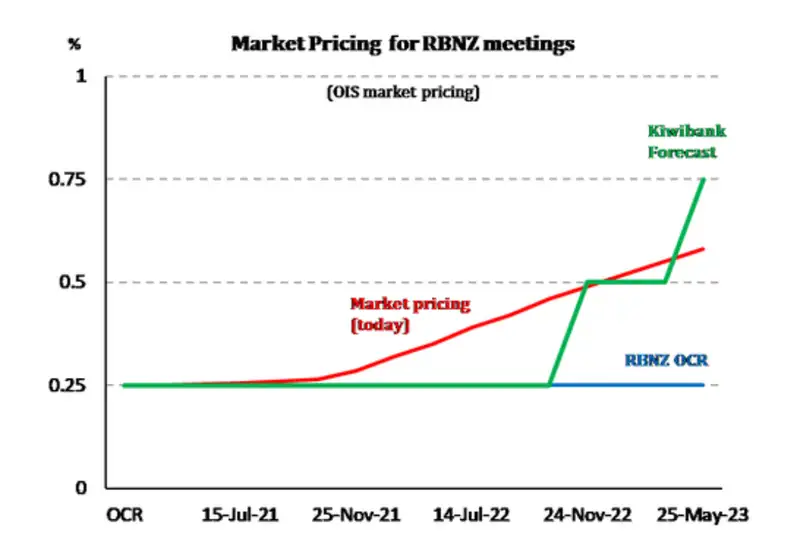

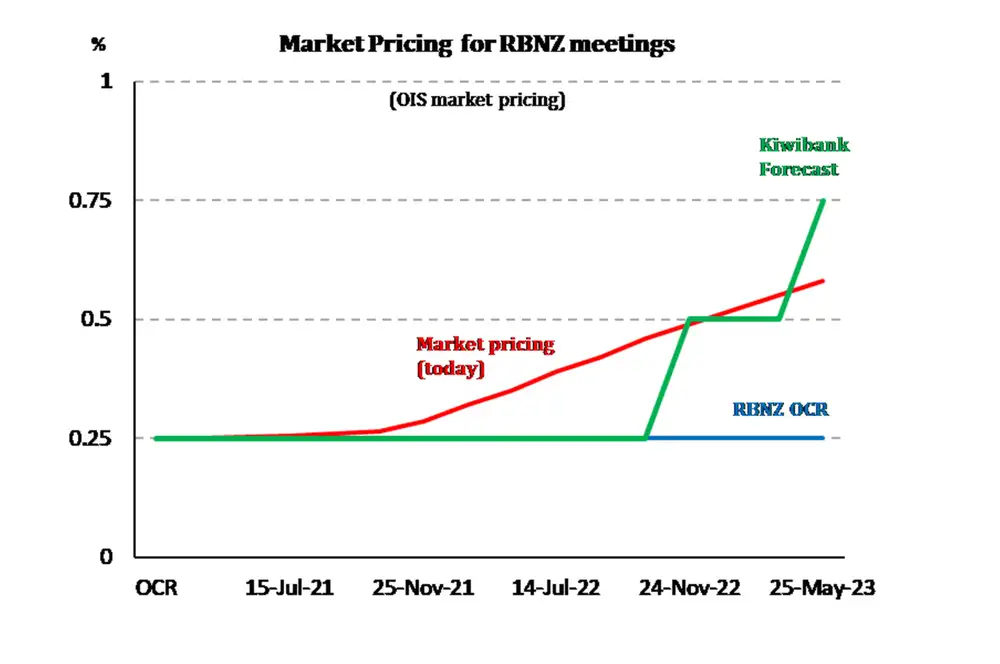

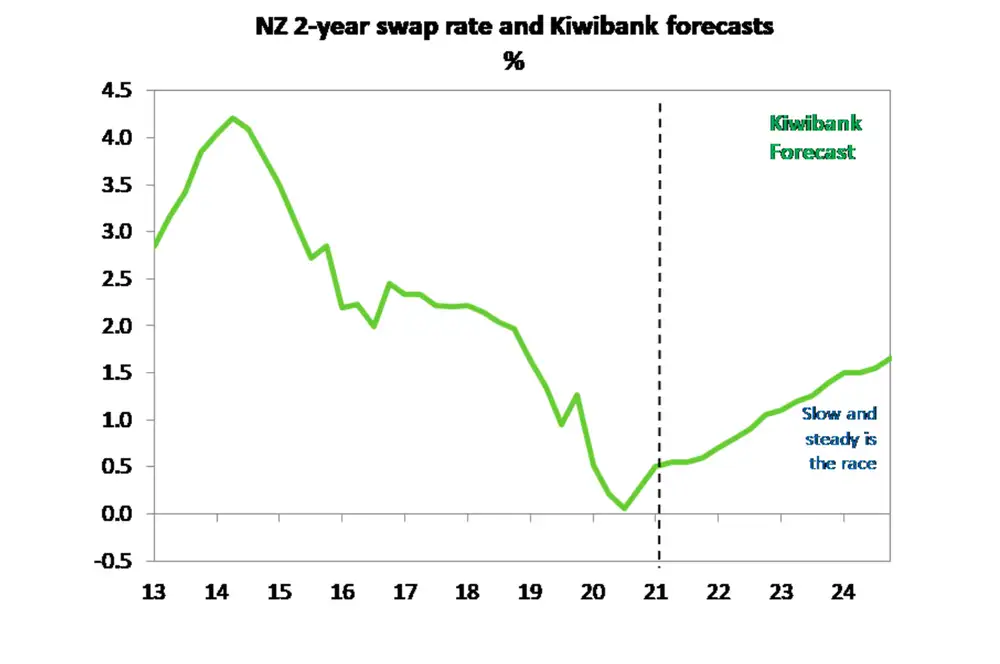

The RBNZ, rightly, concerns itself more with movements in the short-end – out to 2-3 years. After all, Kiwi mortgage rates are predominantly priced at short-end wholesale rates. The short-end has pushed higher. It wasn’t long ago we had the RBNZ’s threat of negative rates partially priced. The 2-year swap rate has bounced from an Alice in Wonderland inspired -0.01%, to +0.44%. And we agree with the 0.4-0.5% range we’re in. In fact, we deem the Kiwi rates market to be perfectly priced. The first RBNZ rate hike is priced by November 2022, bang on our forecast. And the curve glides higher thereafter, with another hike by the middle of 2023. It's a long way out, and much will happen between now and then. But in terms of financial market positioning, we see no reason to push against it. Our forecast for the pivotal 2 year swap rate highlights the need for a tortoise, not a hare.

Weather with you: the Kiwi flyer should return higher

“Well, there's a small boat made of china. It's going nowhere on the mantlepiece. Well, do I lie like a loungeroom lizard. Or do I sing like a bird released?” Crowded House

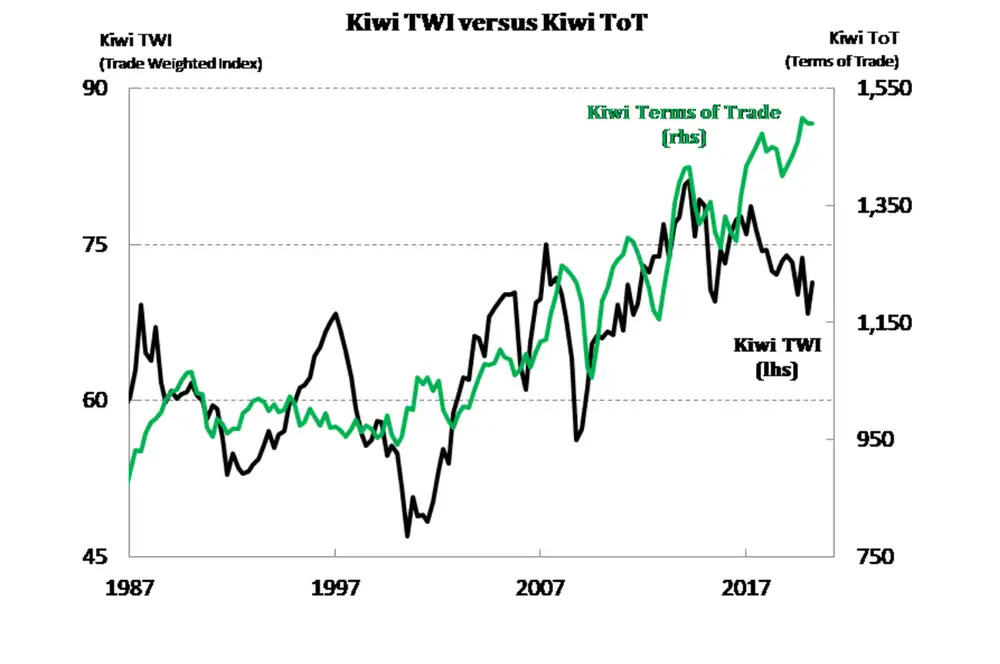

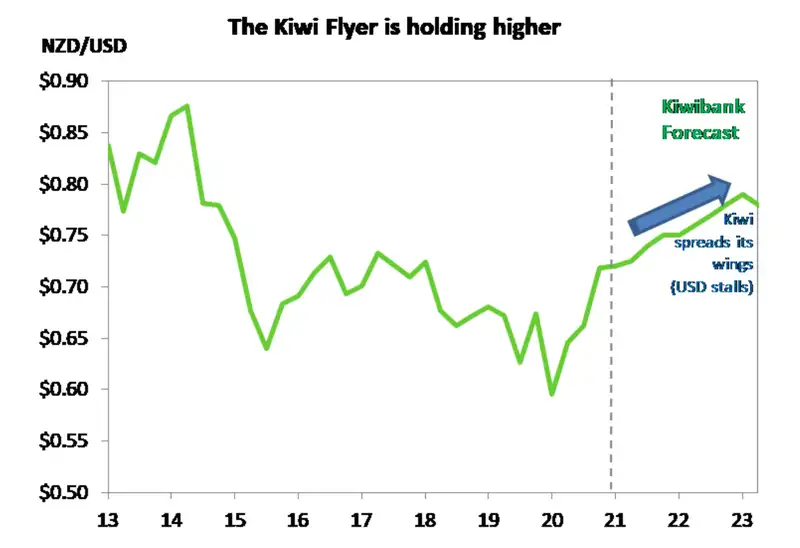

The little Kiwi flyer, AKA the bird, is perched on 70c. Earlier this year, the Kiwi slipped into a slipstream and was propelled toward 75c (our year-end forecast). Fortunately, the USD has strengthened, causing the bird to glide back to 70c. The slight downdraft comes at a time of incredibly strong export prices and an advantageous terms of trade. Our export prices have held up incredibly well, given the weakness in Global growth (last year). And our imported prices have eased. The elevated terms of trade is supportive during our time of need, especially on the export side. The slight fall back in the currency is also providing exporters with a bit more bang for foreign buck.

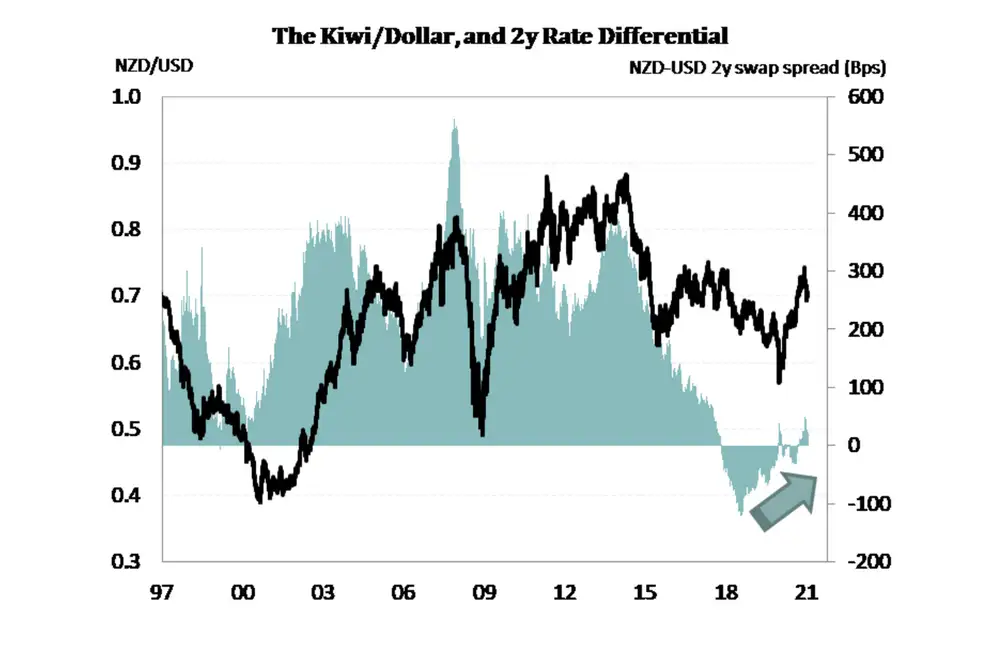

The other major driver of the Kiwi flyer is interest rate differentials. The Kiwi currency is also being supported by more advantageous interest rate differentials. The RBNZ are likely to be one of the first central banks, globally, to actually start tightening policy, even if not until the end of next year.

We continue to forecast the Kiwi flyer to end the year higher

Our NZD/USD forecasts have barely changed from last year, but the complexities around the forecasts continue to evolve. The Kiwi should remain relatively well bid in the mid to high 60s over 2021. At 70c today, the risk seem relatively well balanced. Our year end forecast of 75c offers just a little in the way of upside. As the world eventually (hopefully) recovers into 2022, we expect the Kiwi to a bit more. Risk assets will gather momentum. And with a rise in risk appetite, the Kiwi flyer surges higher.

If you’re an exporter, hedging exposures to a rising currency can assist. You will hopefully get your turn to play (again) in the mid 60s.

If you’re an importer, 73c is still within sight, and there may be another push back towards 75c temporarily. Our traders are calling for a move to 77c eventually. Beware of negative press, central bank jawboning and downside scenarios.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.