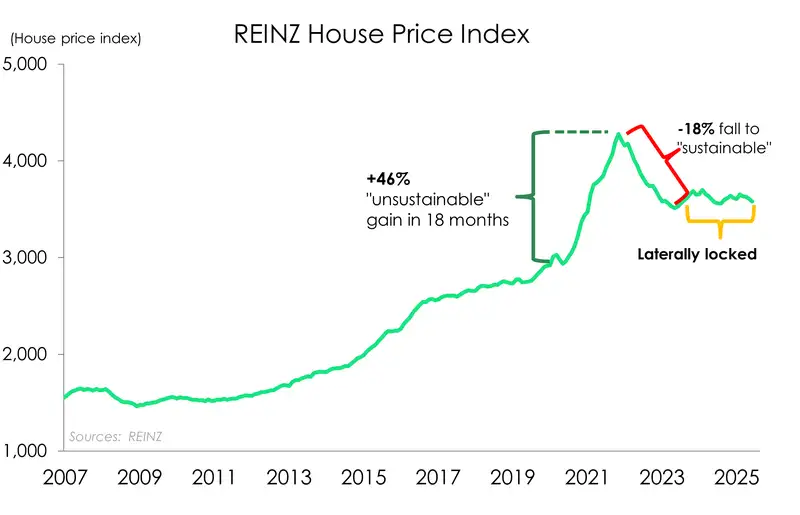

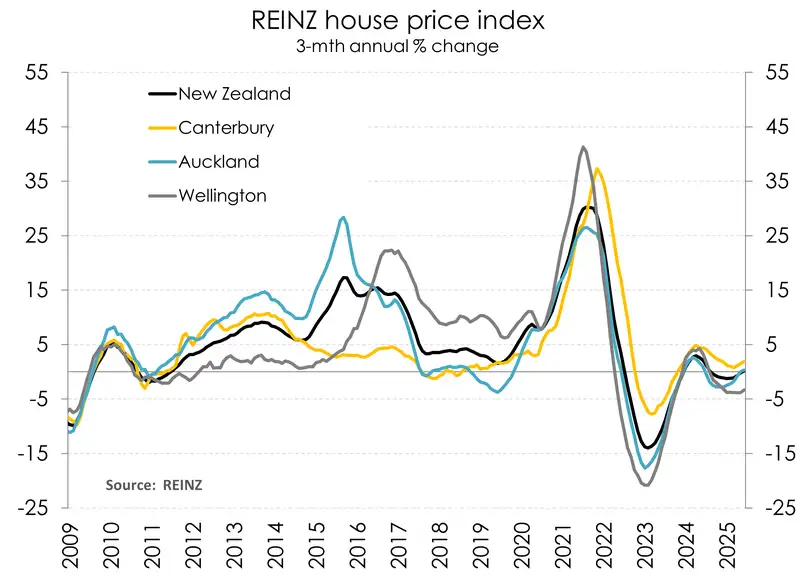

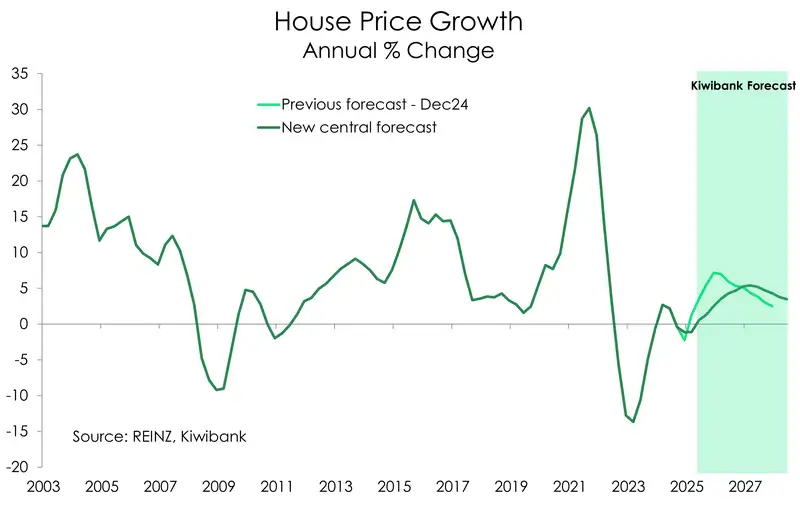

- The Kiwi housing market continues to stumble sideways. Yes, there was an unsustainable 46% surge out of Covid. Yes, the RBNZ orchestrated an 18% correction back to more sustainable levels. But over the last 2 years, house prices have gone nowhere. That will change, next year. Interest rate cuts will fuel confidence. And confidence will generate activity.

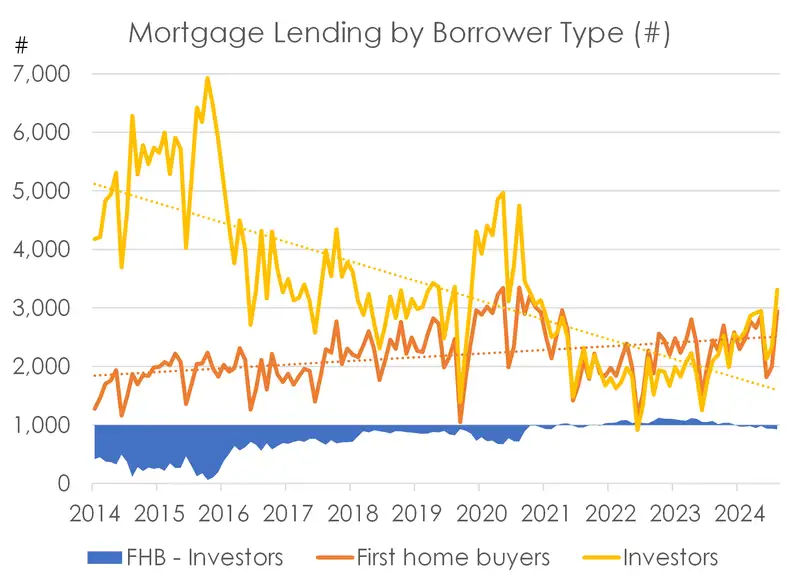

- Investors have been hunted by policymakers, both from the last Government and RBNZ. Interest rate deductibility, Brightline tests, and laser focussed LVR restrictions have all targeted investors. Precisely what we don’t need with a chronic housing shortage. It’s investors that will reignite the housing market. But now, they remain sidelined, waiting to rebuild equity in their portfolios. It’s chicken and the egg. Which one came first? Interest rate cuts.

- Interest rates are the biggest driver of house prices. Swift interest rate cuts are feeding through fast. But they have not gone far enough. And investors no longer need to worry about the Brightline test or interest deductibility. But they do still worry. They’re waiting for the economy to recover. They’re waiting for their own businesses to improve. They’re waiting.

- The true test will come over the warmer months.

The latest REINZ data shows a housing market that remains largely locked in lateral moves. After seven consecutive months of (very) modest gains, house prices dipped by a seasonally adjusted 0.3% in June. Over the year, house prices were up just 0.3%. That’s not a market in recovery. It’s a market that is failing to find its footing. And after 225bps of rate cuts, the recovery lacks any real conviction.

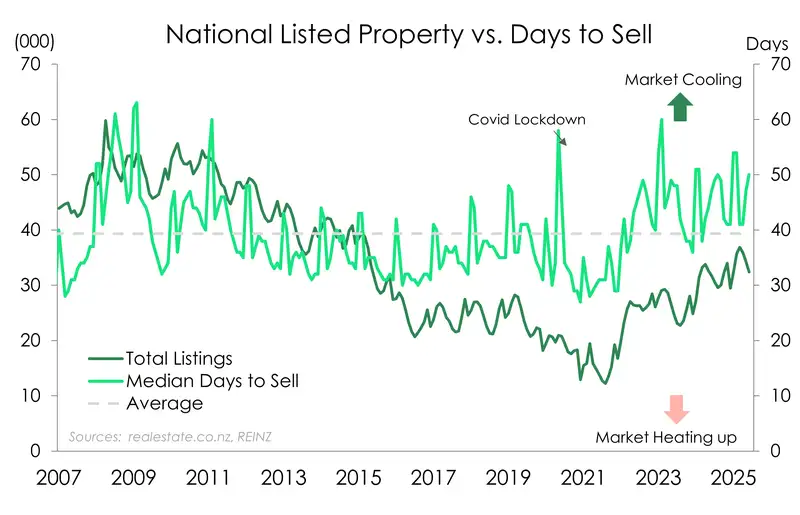

House prices are still down 16.3% from the November 2021 peak. And prices have only lifted half a percent since the RBNZ started cutting in August last year. Rate cuts have not yet triggered investors. The median national house price sits virtually unchanged from a year ago at $770,000. And the median days to sell, one of the best real-time indicators of housing dynamics, continues to yo-yo above the long-term average of 40. The longer it takes to sell, the weaker the market. And days to sell lifted to 50 from 47 last month. It’s still a buyer’s market out there.

As we said in our latest outlook “We’ve seen green shoots emerge, and then die off, only to re-emerge again. But we must wait, like gardeners, until spring… to see if the green shoots start blossoming or remain in drought.”

The data for June was frost bitten. The colder months are always harder on the housing market. But nevertheless, this is certainly not a hallmark of an economy that has undergone a significant easing cycle.

And if anything, the unresponsiveness of investors is a sign that there is more work for the RBNZ to do. More rate cuts are needed to stimulate demand in housing. Much of our optimistic forecasts for growth in the Kiwi economy into 2026 is predicated on a bounce in housing demand.

It’s the Kiwi way.

Heightened job insecurity from a labour market still bleeding out, a surge in housing stock, the continued absence of investors, and rapidly declining net migration are all weighing heavily on the housing market’s recovery. Many of these pressures are themselves by-products of an economy that still needs stimulus.

Yes, we are getting closer to the bottom in interest rates. And these days forecasters, including ourselves, are arguing over just 50bps. It’s not much, but it is still important. Do we need a neutral (unhelpful) rate of 3%, or do we need a stimulatory (helpful) rate of 2.5%. We argue that the economy needs (more) help.

Regional round up

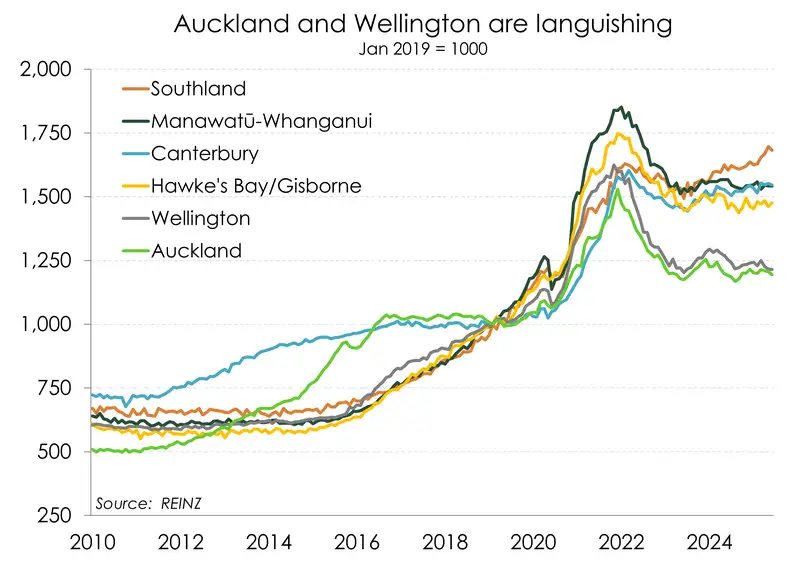

The contrast in regional housing performance appears to be widening, with conditions remaining mixed across the country.

Unsurprisingly, Wellington’s housing market trajectory remains most subdued. House prices in the capital fell 0.3% over the month and 2.6% over the year. And overall, Wellington house prices are up just half a percent from their 25% correction that ended in May 2023. Looking at it another way, (in case one measure wasn’t bleak enough) the median house price in Wellington dropped by $32,000 over June alone, falling to $760,000. That’s a 4% decline over the month, and the sharpest monthly fall in over a year. The peak of $995,000 in 2021 is a distant memory. And it’s clear Wellingtonians are still grappling with the fallout of widespread public sector job cuts.

In stark contrast, Canterbury, the strongest performing region over the past 12 months saw a 0.4% gain over June, and a 2.2% gain over the year. Overall, house prices in Canterbury remain 4.1% below their early 2022 peak. But have recovered 6.5% from their 10% correction. Activity is simply more alive in the home of the Garden city. The (seasonally adjusted) median days to sell sits at 40, which although still sits above the region’s long-term average of 36, is among the lowest in the country.

In general, the South Island continues to outperform the North. Otago saw a 0.2% gain over the month and 0.4% over the year. Meanwhile, Southland, despite recording a chunky 3% monthly decline, still saw a 0.9% gain over the year.

The North Island however remains a little patchier. Alongside the windy capital, Gisborne, the Hawke’s Bay, and Northland all posted monthly and annual declines over June. Meanwhile, Taranaki and the Bay of Plenty saw monthly declines of 0.2% and 0.8% respectively. But house prices are still up from this time last year, the Naki up 2% and the Bay of Plenty up 0.6%. In comparison Waikato, showed modest growth with a 0.1% gain over the month and a 1.6% increase year-on-year.

Now for the city you’ve all been waiting for, Auckland saw a 0.5% decline over the month, but prices were still up (a very modest 0.2%) compared to this time last year. Much like Wellington, Auckland still has a long way to go with house prices up just 1% from their 23% correction lower that ended in May 2023. The median sale price in the City of Sails has popped higher to $990,000 up $10,000 from last month. But remains below the $1million mark seen over the last summer months. And again, the peak of $1.3mil remains a distant, almost forgotten memory.

Investors remain sidelined, for now

Last night our Chief Economist, Jarrod Kerr, had the privilege of speaking to the Tauranga Property Investors Association. It was a great event with around 100 investors keen on an economic update.

The presentation was optimistic, pointing to a recovery in the housing market and the economy into 2026. Of course we need more rate relief to solidify these forecasts. But, things will get better, eventually.

When asked if they were looking to increase headcount or investment in their own businesses, or business they work for, only 8 people, out of 100, put their hands up. If only 8% of the group were seeking growth in their own business, then no wonder they’re not confident in investing in a housing market that hasn’t recovered.

When it came to Q&A time, there were a lot. We went well over time. There were questions around international developments (clouding judgements), the multi-speed economy, (esp. across the regions), inflation (with a focus on building costs), policymakers stance on investors (brightline tests, interest deductibility, LVRs, DTIs, and the threat of capital gains tax), and interest rates (of course). There was a lot of uncertainty.

But it was the focus on migration flows that stood out, both from a property perspective and business perspective. One of the property investors works in horticulture and lamented the covid period where he had to pay as much as $60 an hour to get Kiwi to pick fruit, with the loss of migrants. He worried this might happen again. There was also a feeling that the heavy outflow of Kiwi across to Australia (and beyond) will dampen rental demand, and property prices.

With all this uncertainty, we’re lending more to first home buyers than investors. That’s highly unusual. But the Government kept its promise to unshackle restraints. The ‘promised’ reintroduction of interest deductibility, shortening the Brightline test timeline, and watering down of the CCCFA, have helped calm the investor community. Although some point to the possible return of a labour government in 2026 with caution.

Opti-mystics: what we expect

Forecasting is as much an art as it is a science. And we mystics, are optimystic, and see a glass that is half full. Looking to next year, the decline in interest rates will lift heads, attract investors, and boost confidence. We trust the process, with interest rates the biggest driver in demand.

Our best guess is house prices will rise by 5-to-7% over 2026. Call it 6% to sound precise. Although we said the exact same thing coming into 2025. Unfortunately, the housing market has underperformed for longer, much longer, than we expected. Rate cuts to date have not kicked in. Rate cuts to date have not enticed investors. Rate cuts to date are not enough.

Beyond interest rates, there is still a shortage of affordable dwellings in New Zealand. That’s a constant frustration for renters, first home buyers, and even investors looking for a more reasonable rental yield. It’s supply, not demand, that’s the problem with the Kiwi housing market.

For more detail on the drivers of the Kiwi housing market, see: “Kiwi housing: all you need to know for the great BBQ debate this summer.” We wrote the note in December 2024, but the drivers and key messages are still relevant.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.