- Business confidence markedly improved in the September quarter. Expectations of further RBNZ rate cuts underpins the improved sentiment. However, experienced trading activity remains weak. The here and now demands more rate relief.

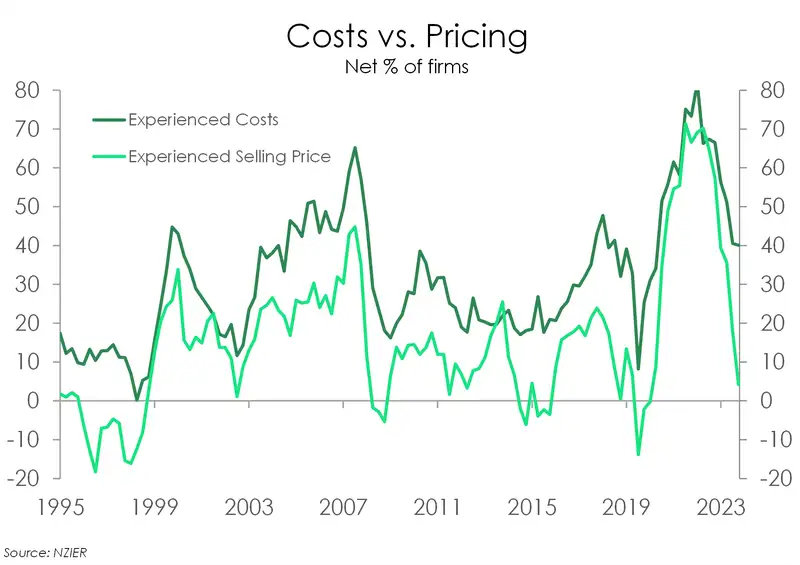

- The most encouraging read was the substantial improvement in pricing indicators. Compared to previous quarters, a far smaller proportion of firms have raised their prices. Inflation is under control.

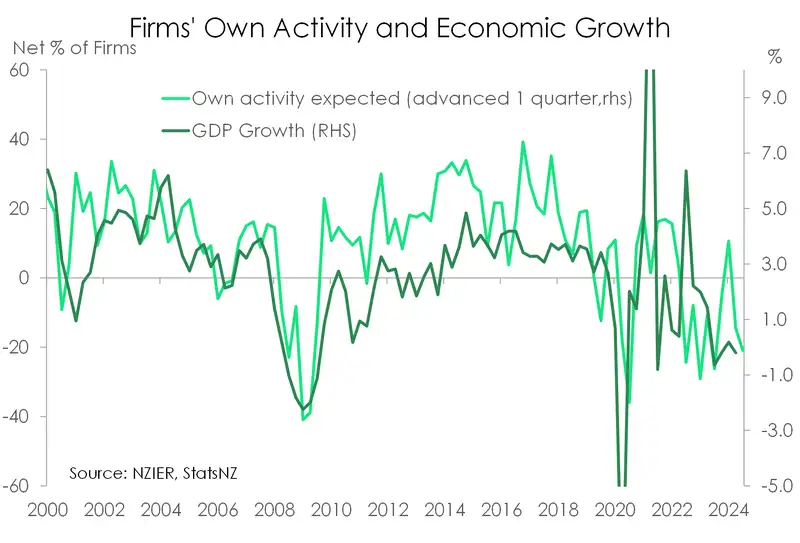

- We remain in recession... with experienced activity subdued. But the outlook has improved, so long as the RBNZ keeps cutting. Businesses are more optimistic. But that optimism has yet to translate into activity.

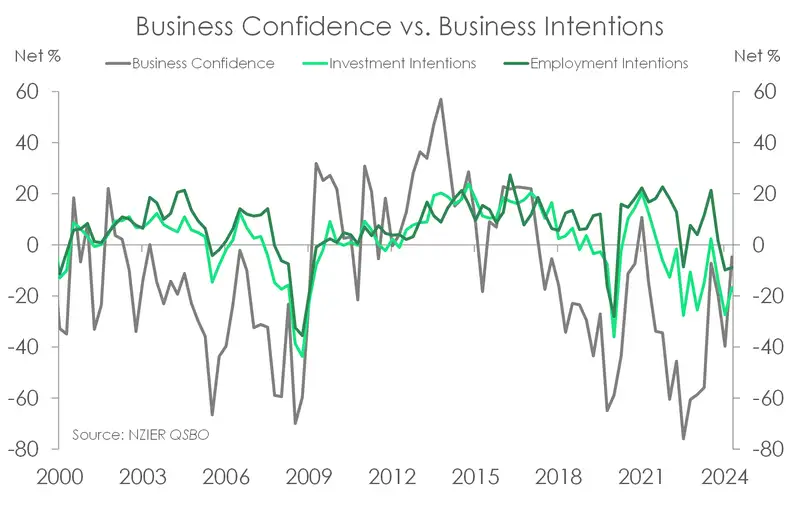

The NZIER’s quarterly survey of business opinion (QSBO), the best on the street, showed a marked improvement in business confidence. In the September quarter, only a (seasonally adjusted) net 5% of businesses expect economic conditions to deteriorate in the coming months – a much smaller proportion than the net 40% in the prior quarter. The meaningful improvement is an emphatic sigh of relief from Kiwi businesses. Policy settings have been too restrictive for too long. But now that the cutting cycle has begun, businesses are lifting their heads and looking to next year. To keep up confidence, the RBNZ now needs to deliver.

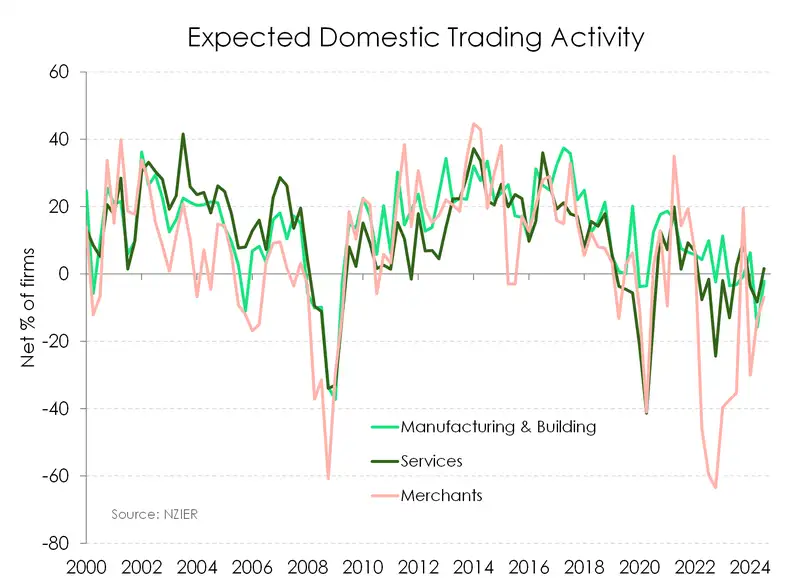

There is light at the end of the tunnel. But it’s still some distance away until we’re out of the shadows. According to Kiwi businesses, it is still a challenge to navigate the current economic environment. Experienced activity levels remain subdued. A net 31% of firms reported a decline in trading activity, an increase from a net 27% in the June quarter. There’s risk we do record a triple-trough recession. The data points to yet another quarter of the Kiwi economy running backwards. At the very least, below-trend growth remains the near-term outlook.

It's no surprise to see the retail sector as the most optimistic of the bunch. Because they’ve been hardest hit by the slowdown in domestic consumption. The expectation of easier financial conditions has improved the mood among retailers. A net 13% are expecting an improvement in economic conditions over the coming months. And a net 8% expect domestic sales to increase. At the other end of the spectrum, the construction sector is feeling the most pessimistic. But it’s not as bad as it once was. A net 9% of builders expect a deterioration of economic conditions in the coming months. That is, however, a much better print than the net 65% of firms feeling the same in Q2. But what is common across the sectors is that profitability and current activity levels remain weak.

The most encouraging read in the report involves pricing. While cost pressures were little changed over the quarter, pricing indicators improved substantially. A largely unchanged net 41% of firms experienced higher costs in Q3. But only a net 3% of firms raised their prices in Q3, a substantially smaller proportion than the net 23% in Q2. The inability to pass on costs is another sign of weak domestic demand. It’s great news for the inflation outlook. And what’s even better is the shrinking proportion of firms looking to increase prices over the coming quarter – from a net 23% to a net 7%.

Just as pricing pressures are easing, so too are capacity pressures. Capacity utilisation – a measure of the intensity with which firms are using their resources – has markedly declined over the past year, after reaching record-highs in 2022. More firms are reporting the ease in finding labour. Whether it’s unskilled or skilled labour, firms are no longer having to scrape the barrel. Over a quarter of firms reported it being easier to find skilled labour, while a net 57% are reporting the same for unskilled labour. We’ve seen a rapid return of migrants, and their impact on the economy is clearly felt.

A deterioration in labour demand (as supply increases) was crystal clear. Increasing supply alongside decreasing demand, reduces the price. And the price is wages. There has been a clear mindset shift among business – from increasing headcount, to cutting headcount. A net 33% of firms reduced their workforce over the quarter, an increase from last quarter’s net 25%. And a net 9% of firms are looking to do the same in the coming months. These are ugly numbers, reminiscent of the 2008-09 GFC. Unemployment is set to continue rising, with an unemployment rate likely exceeding 5% by year-end.

Not only are firms cautious about hiring, but investment as well. A quarter of firms plan to cut back on investment in buildings. And a net 17% plan to do the same for plant and machinery. It is only when there are clear signs that a recovery is underway that these investment intentions will strengthen.

Both the improvement in capacity utilisation and labour availability point to a considerable easing in capacity pressures in the economy. That’s good news for domestic inflation. A capacity-constrained economy for the last three years created a breeding ground for inflation. But the narrative is shifting. And as capacity pressures ease, downside risks to domestic inflation are building. The steep rise in interest rates is squeezing household incomes, and demand is slowing. Since the beginning of 2023, sales have eclipsed labour as the main constraint for businesses. And a year later, even more firms are experiencing the same. Of the firms surveyed, a growing majority (64%) reported sales as their top constraint.

The outlook has improved. But the here and now demands more rate relief from the RBNZ – and quick in order to stave off further unnecessary weakness in the Kiwi economy and labour market. The lift in business confidence is underpinned by the expectation of more rate cuts. The RBNZ must deliver.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.