- A surge in migration over 2023 has led to a rapid increase in population. The boost to labour supply was embraced with open arms. But the stress placed on the rental market is exposing our failure to invest in infrastructure – a decades long issue.

- We promised special guests on the pod, and in episode 2 we introduce our very first one – Mieneke Perniskie, a FX trader in the Financial Markets team. We chat through what a FX trader does, and why playing with currencies is a hard game right now.

- You can stream the podcast on Spotify, or watch the episodes over on the Kiwibank YouTube channel.

Ep2: Massive migration, hindered housing, and confusing currencies

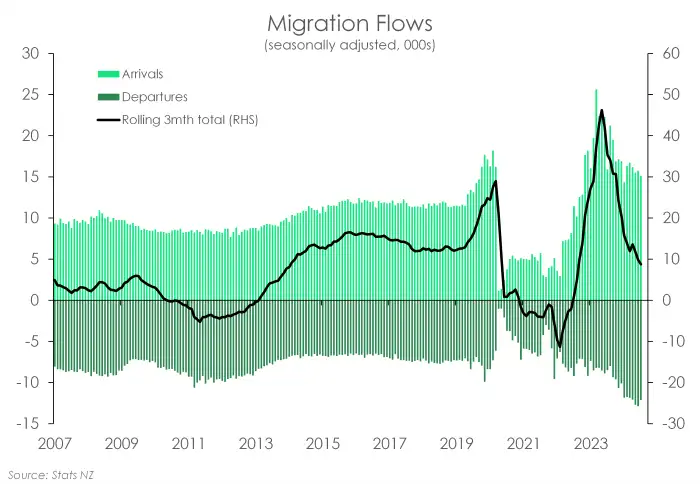

In this episode, we cover the record flow of migration in NZ over the last few year. 2023 in particular, was the year of migration, when monthly net inflows averaged over 10k. The annual net inflow peaked at 142k. Today, monthly net migration remains positive but has slowed to an average pace of just 3.5k. And the annual balance has fallen to around 67k in July. On a rolling 3 month basis, net inflows have fallen to below pre-covid levels – again, highlighting the slowdown in 2024.

Annual migrant arrivals have fallen to around 200k from 214k in July 2023, but it is the record rise in departures that explains the slowdown in net inflows. The net outflow of Kiwi, in particular, is sitting at a record high (80.7k) and will likely continue to climb. Just as was the case in the fallout of the GFC, our labour market is deteriorating faster and deeper than across the Tasman.

The thing about migration is that it’s a double-edged sword. In the episode, we talk through the demand and supply side impacts. The boost to supply has been front and centre with migrants plugging the staffing gaps that plagued many businesses during covid. But on the other side of the coin, a rapid increase in population has placed pressure on the rental market. And it’s exposing our decades-long failure to invest in infrastructure.

Indeed, a discussion on migration is not complete without a discussion on infrastructure. Health, housing, hospitals – you name it, we’ve underinvested in it. Net migration is a net positive story in the long-run. But it’s how we accommodate the (unpredictable) spikes in migration that needs to be addressed.

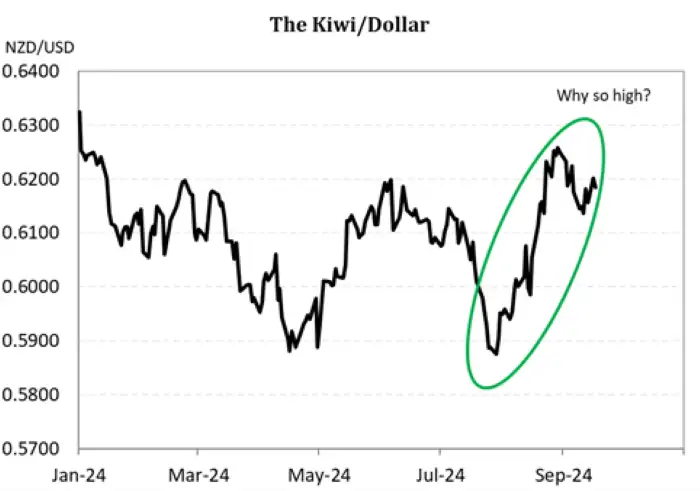

Then turning to markets, we speak to Mieneke Perniskie, a FX trader in the Financial Markets team, to chat through her day-to-day and why we’re all scratching our heads at the Kiwi dollar. Being short Kiwi should have been the no-brainer trade this year. The RBNZ begun cutting rates before the US Fed. And the Kiwi economy is in a far weaker state than the Goldilocks economy the US is becoming. Fundamentals are shouting for a Kiwi well below 60c. And yet, the Kiwi has rallied. The strength in the Kiwi Aussie cross also has us puzzled for the same reasons. Mieneke talks us through how she’s navigating currency markets.

Listen to our podcast on Spotify

Watch our podcast on the Kiwibank YouTube Channel

Modal to play video

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.