Signs that wage growth has peaked continue. But wages pressures remain firm. Wages lifted 1% over the quarter and 3.9% over the year.

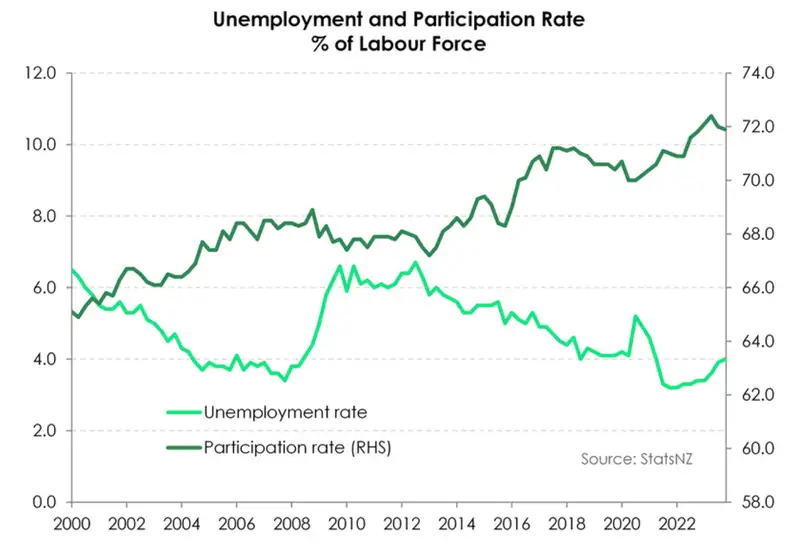

Amid the slowing economic landscape, the labour market is expected to continue cooling in the coming quarters. We are forecasting the unemployment rate to continue lifting from 4% today, to a 5-5.5% peak later this year.

Labour market report

As the last major data point ahead of the RBNZ’s February meeting, today’s labour market report was a big one to watch. With a slowing economy, and a rapid growing population (thanks to migration), we expected a loosening in the labour market. And we got that. Though not as much as we had expected. And the deeper you look, the stronger the data becomes.

The unemployment rate lifted from 3.9% to 4.0%. It breaks 9-straight quarters below 4% (just) and marks the highest rate since early 2021.Jarrod Kerr, Mary Jo Vergara & Sabrina Delgado, Kiwibank Economists

But it was still less than we, and the RBNZ, had expected (Kiwibank 4.2%, consensus 4.3%).

The uptick in the underutilisation rate – a better measure of slack in the market – to the highest since March 2021 at 10.7% is proof of what’s to come. More people need more hours. But employers are not as keen.

At the same time, employment expanded 0.4% over the quarter, slightly stronger than forecast. The annual rate was unchanged at 2.4%. Similar themes to the last couple of quarters are in play. That is, the loosening in labour market conditions continues to be a story of a migration driven recovery in labour supply. But cracks are emerging. There is a VERY strong migration impact. The working age population rose by 3% - the strongest ever recorded (back to 1986). But jobs growth of just 2.4%, employment can’t keep up. That alone should see unemployment lift further in the coming year as participation in the labour market remains near record high (71.9%). And then, there’s our slowing economy. Firms are no longer hiring with the same gusto as demand wanes under the weight of high interest rates. There’s more pain to come.

There are clear signs that the RBNZ’s heavy handed hikes are inhibiting household demand, and hurting business. The labour market stats lag activity in the economy, as employers hold onto employees for as long as they can, before downsizing. And we are hearing of businesses downsizing as the economy cools. The data will soften from here.

Indeed, it's not just about today's old data, that lags the economy. It's about momentum, and the outlook for employment into 2025. The economy is smaller than the RBNZ had forecast in November, and employment growth is likely to stall. The unemployment rate is forecast to break above 5% this year, as employers 'rightsize' their businesses. It is by RBNZ design. And we're likely to see a softening in wage pressure (and inflation).

At face value, the report today reduces the chances of a near-term rate cut by the RBNZ. Thoughts of cuts in May and August will likely push out to November. We're sticking with our call for cuts commencing in November.

Slowing wage growth

In another sign that heat is leaving the labour market, wage inflation continued to soften over Q4. The private labour cost index – a measure of pure wage inflation – lifted 1% over the quarter. Annual wage inflation cooled to 3.9% from 4.3%, and further away from the 4.5% peak recorded early in 2023. The annual distributions were little changed, with around 63% surveyed receiving a pay rise from last year’s levels. In contrast, public sector wage growth continues to climb, up 5.7%yoy from 5.4%. The recent lift in public sector pay follows the April 2020 to May 2023 period when wages within the sector were put on ice in response to covid. The Quarterly Employment Survey offers greater insight. Average total hourly earnings within education and health care sectors rose by double digits (14% and 10%, respectively), as pay agreements took effect.

Rising inflation expectations and labour shortages have bolstered wage demands. However, expectations are normalising as headline inflation continues to move south. And due to strong migration inflows, employers are now facing an expanding pool of talent. Weaker wage inflation will help drive an easing in domestic inflation. Currently, the pace of consumer prices is running faster than wage growth. The good news is, we see the current cost-of-living pressures easing soon. We expect wage growth will soon exceed consumer price inflation. It’s been a long time coming.

Recruitment slowdown

For now, growing labour supply is driving a loosening in labour market conditions. We expect the narrative to shift later this year. The forecast recession should see slack grow in the market. Labour demand is breaking down. Firms simply don’t need workers with the same desperation as years past. According to MBIE data, the number of job vacancies advertised online declined around 7.5% over the quarter, and over 25% from last year’s levels. There are clear signs that the RBNZ’s heavy handed hikes are inhibiting household demand, and hurting business. If firms expect to pump out less output, then an extra pair of hands may prove too costly. There’s been a mindset shift among businesses, and employment intentions are weakening. There’s a strong correlation between employment intentions and actual employment growth. It’s only a matter of time before those weaker intentions translate into weaker growth. We expect employment growth to weaken further in the coming quarters.

The labour market tends to lag the broader economy. And in an economic downturn, it’s often the last shoe to drop. Firms tend to cut hours first, before headcount. But a forecast slowdown in activity will eventually hit the labour market and see employment return to more sustainable levels. It must, in keeping with the RBNZ dual mandate. We expect to see the unemployment rate reach a peak of 5-5.5% late in 2024.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.