- Kiwi inflation lifted to 2.7%yoy from 2.5%yoy over the June quarter. But context is key. A reacceleration in imported inflation is driving the move higher. It was food and electricity that continues to bite at our back pockets. Domestic price pressures are cooling.

- This is the first test for an August cash rate cut. Inflation will likely push further from here. But more important to policy is underlying inflation, which remains within the RBNZ’s target band. Spare capacity within the Kiwi economy is keeping downward pressure on domestically generated inflation.

- Downside risks to medium-term inflation remain. Whether that’s a consequence of a slowdown in global economic growth, or a diversion of trade marked at a discount. There is still a case for more accommodative interest rate settings.

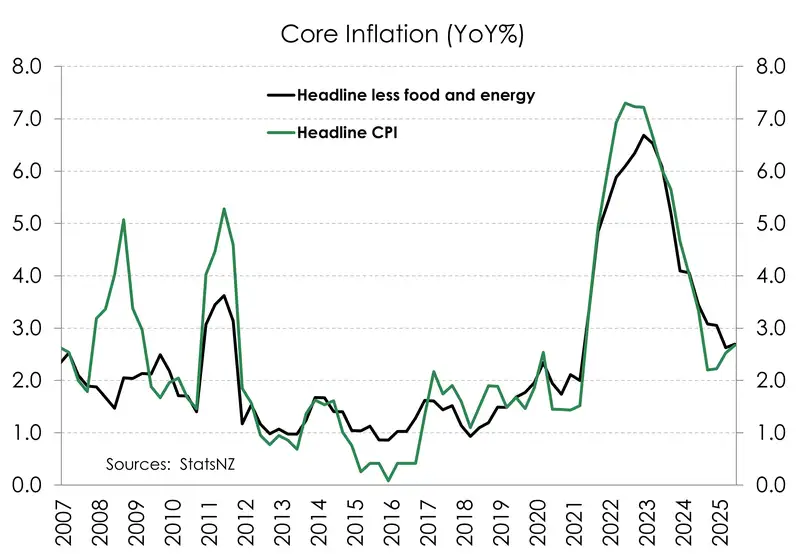

Kiwi inflation accelerated over the June quarter. Annual headline rose to 2.7% from 2.5%. It’s a move in the wrong direction. But context is key. A strengthening in imported inflation is driving headline higher. But domestic price pressures, on balance, continue to cool. And most importantly, the underlying trend in consumer prices is weak. Excluding the volatile movements in food and fuel, annual core inflation lifted to 2.7% from 2.6%. A move that was better than many had feared, and one that will improve into next year. For now, there’s little risk this bout of high inflation will persist. Especially given that there’s still significant spare capacity in the Kiwi economy.

Today’s report showed that price increases are becoming less extreme. The proportion of goods and services that increased in price was little changed at 54%. However, the June quarter saw a greater share of the basket record a decline in price, from 30% (185 items) to 35% (210 items). A larger proportion of items either remained flat or increased in price by less than 3 percent in the 12 months to June 2025.

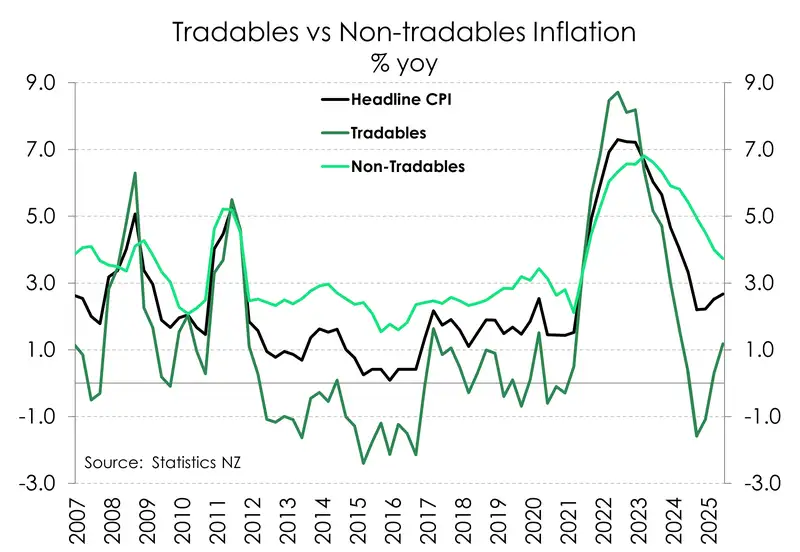

The rapid deceleration in imported inflation, which helped to pull down headline, is reversing course. We’re no longer importing deflation. Annual tradables inflation lifted from 0.3% to 1.2%. The 4.2% increase in food prices accounted for 28.5% of the lift in headline inflation.

Domestic inflation, in contrast, continues its (slow) move south. Annual non-tradables inflation pierced below 4% for the first time in four years to 3.7%. Domestic inflation has fallen some way from its 6.8% peak in 2023, but it is still sitting high above the long-term average (~3%). And that’s despite such a weak domestic economy. Such persistence is due to the lingering strength in administered prices. Council rates and insurance costs are running well above historic averages, up 12.2%yoy and 6%yoy, respectively. And households are now contending with high electricity charges, climbing to 9.1%yoy. If we exclude housing-related inflation, domestic inflation prints at 3.5% - the lowest since December 2021. Given excess capacity still sloshing in the economy, domestic inflation should continue to head lower. But the pace of easing is being dictated by factors largely outside of the RBNZ’s control. That’s a frustration.

Inflation will likely push higher in the coming quarter. But like any spike, it will come back down. The economic undercurrents are weak. For monetary policy, the underlying trend in inflation is what matters most. Monetary policy settings today, are set for an economy 12-to-24 months down the track. It takes a long time for movements in the cash rate, and other lending rates, to influence the economy. So, a knee-jerk reaction to a couple of internationally charged price shocks is not on the cards.

The RBNZ’s job is to look through volatile movements, and set policy for late next year. And in late 2026, inflation is set to slow below the mid-point of the target band (2%). It’s why we focus more on core. Core measures of inflation strip out the volatile price movements. Encouragingly, core inflation has been trending south since hitting the 6.7% peak at the end of 2022. At 2.7% (in the year to June 2025), core inflation remains within the RBNZ’s target band. Our forecast stirps out the spikes and looks at slack in the economy. And there’s a lot of slack, especially in the labour market. Our best guess, incorporating the damage inflicted through the recession we’re still crawling out of, has inflation falling to 1.8% next year. If realised, the RBNZ continues to overcook. And we continue to advocate a stimulatory setting of 2.5%.

Basket breakdown

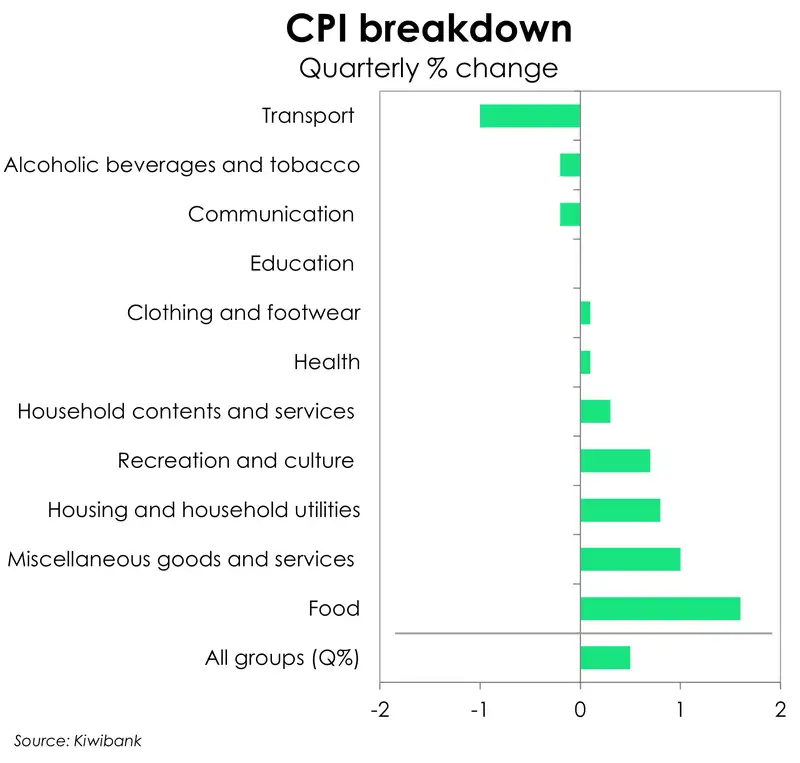

A 9.5% increase in cultural services, driven by an subscriptions to streaming services, led the overall quarterly increase in consumer prices. The 1.6% increase in food and 4.9% lift in electricity prices we also key drivers over the quarter.

Strong growth in food prices has dominated domestic headlines. Because it’s dominating household wallets. Food prices increased 1.6% over the quarter. In part, it is a reflection of a seasonal lift in prices for fresh produce. Vegetables alone are up 10%. There have also been large increases in meat and dairy products.

Going the other way, transport-related prices fell a chunky 1% over the quarter. And that’s despite the escalation in the Israel-Iran conflict that took place within the quarter. The consequences of which were relatively limited. Global oil prices went up, but then went back down. Petrol prices at the pump were largely unaffected. In fact, over the quarter, petrol prices fell 4.8%. Domestic airfares also cheapened up, with a 9.2% decline over the quarter. Meanwhile international airfares were up slightly. Similarly, prices for domestic accommodation fell 9.5%, while prepaid overseas accommodation lifted 4.2%. It’s seasonality in play. Kiwi fled the winter chill for the warm Bali breeze.

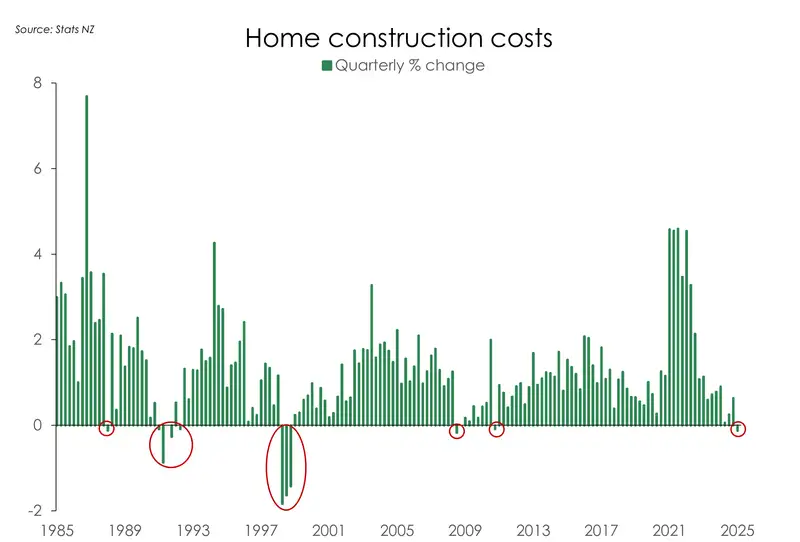

There’s good news for housing related stuff. Building costs fell 0.1%qoq – the first decline since March 2011. And over the year, costs are up just 0.8% - that’s the lowest we’ve seen since the GFC (Dec 2009). Those in the industry cited competitor price-matching as well as lower component and fitting costs as reasons for price weakness. Falling materials costs, like steel, match the anecdotes were hearing from developers. And wages within the industry have softened also. There’s less work. Such pricing weakness was flagged in the latest NZIER QSBO report, where the building sector reported the biggest fall in pricing – from a net 3% raising their prices to a net 35% decreasing their prices.

Renters face weaker rent rises as well. More good news. Rents rose 0.8%qoq and 3.2% over the year… down from 3.7% last quarter. So whilst we’re being hit with hefty food, electricity, insurance, and council rates… at least our rents aren’t rising as much… or if you own a property, interest rates are less painful (but at these levels, they still hurt, not help).

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.