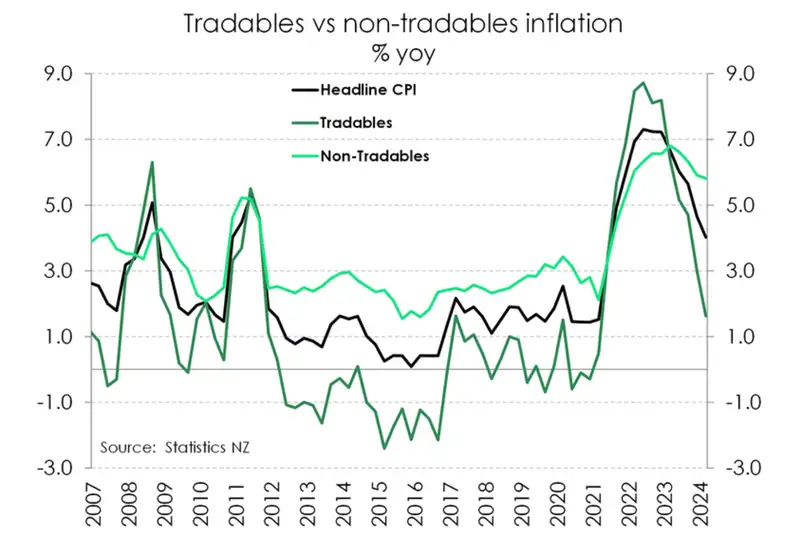

The details were not as good as the headline suggests. The decline in price pressure came from offshore. Tradables inflation fell to 1.6% (well below our forecast of 2.2%). That’s great, we’ll take it. But domestically generated inflation surprised on the upside. Non-tradables fell just 0.1%pt to 5.8%. It’s not enough. The stuff the RBNZ is trying to restrain, is proving to be even more frustrating.

Going forward, the path for policy is the path for inflation. We expect inflation to return to within the RBNZ’s 1-3% target by the September (third) quarter. But it’s not until mid-October that we receive the data, and (hopefully) confirmation. That leaves November as the earliest kick-off date for rate cuts.

The details are dicier the deeper we dive into the data

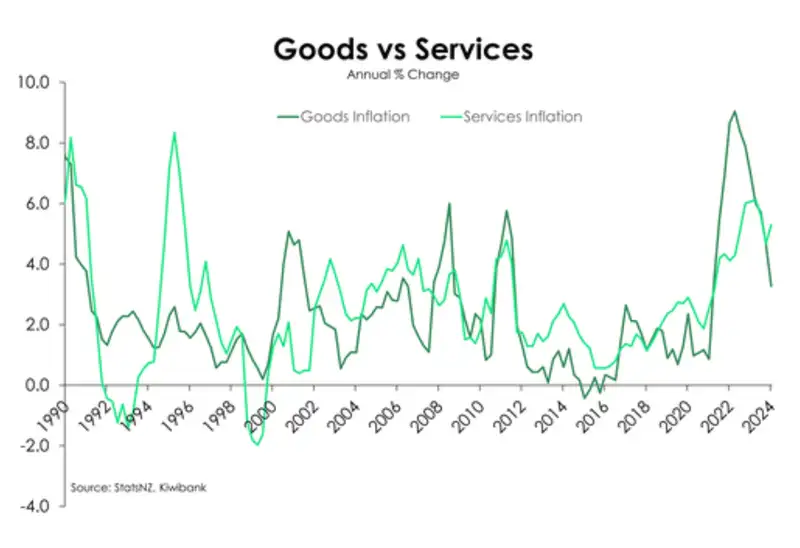

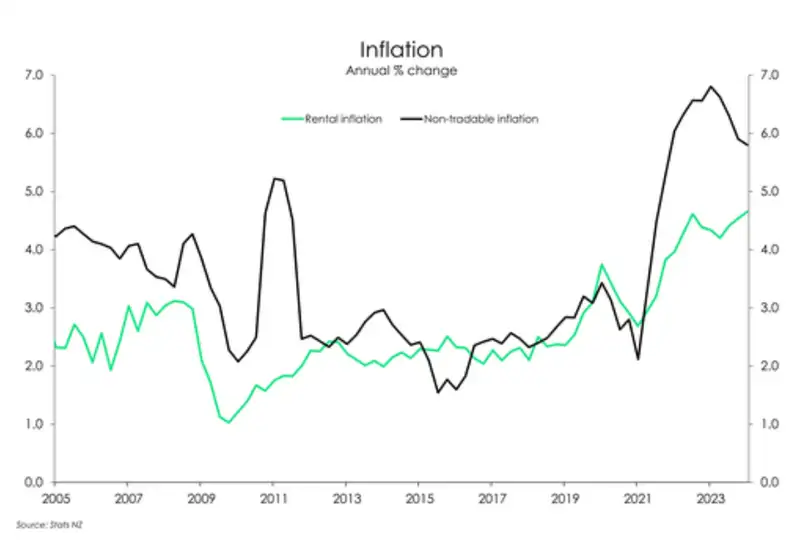

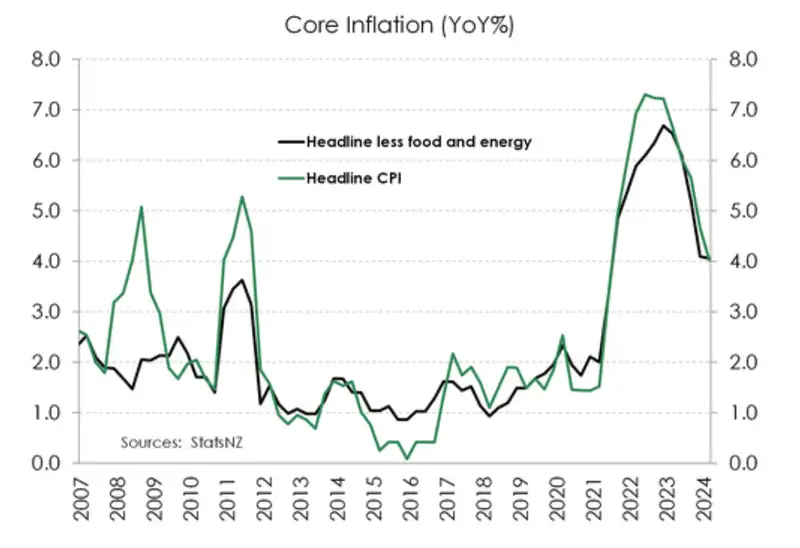

While construction costs continue to cool, the migration boom is keeping rents elevated. Rental inflation is currently running at the fastest pace since 1999 (when StatsNZ began the series). Services inflation also ticked up from 4.7% to 5.3% - after trending south for much of 2023. And core inflation – removing the volatile movements in food and energy prices – was unchanged at 4.1%. It’s frustrating to not see a move lower, but it’s still better than the 6.7% recorded in late 2022.

Imported deflation continues to do most of the heavy work in bringing down the headline rate. But the stubbornness in domestic inflation extends the journey back to the midpoint of the RBNZ’s 1-3% target band. Nonetheless, we still think inflation is on track to fall below 3% by the second half of the year. But like the RBNZ, we want to see more progress on core inflation.

Domestic inflation is barely budging

The RBNZ won’t be too cheery about non-tradable inflation coming in stronger than expected. Domestic inflation eased to just 5.8% from 5.9%, against the RBNZ’s forecast of 5.3%. It’s a miss, and a miss in the wrong direction. The ripple effects of migration are adding upside pressure, especially when it comes to housing. Solid lifts in rents and insurance remain the leading drivers. Rents are the running at the fasted pace since 2021, while dwelling insurance is up 24.6% from a year ago. Domestic price pressures need to cool. Otherwise, the risk of overall inflation remaining above stuck above the RBNZ’s 1-3% target band grows.

Tradable (imported) inflation was much softer than expected. Over the year, imported inflation has fallen from 3% to 1.6%, and further away from the dizzying heights of 8-9%. Weakening imported inflation continues to do most of the leg work in bringing down the headline rate. That’s great. But momentum can be easily disrupted. We’re keeping an eye on the what’s happening abroad. Houthis attacks on ships in the Red Sea are causing shipping rates to spike, and delivery times to lengthen. We are unlikely to see the same sort of spike cause by the covid crisis. But any spike in costs is unwelcome.

Basket breakdown

In 2023, price gains appeared to be becoming less broad-based. Fewer items were recording increases in price, while more were falling in prices. But progress reversed course at the start of this year. Over the March quarter, the proportion of all items that lifted in price expanded to 55% from 53.3%, while fewer items were discounted (from 34.8% of all items to 30.8%). That’s not something we want to see.

Driving the 0.6% rise in quarterly inflation was the 3.4% lift in alcohol and tobacco prices which is typical this time of the year. The increase however was partly offset by the chunky 2.5% decline in transport prices. Petrol prices fell 2.3% over the quarter as global commodity prices continue to cool. Airfares also continue to correct, helped by growing airline capacity. Both international and domestic airfares declined over the quarter (-10.3% and -1%, respectively).

Accommodation

The lift in accommodation prices was another key driver over the quarter. Overseas accommodation, in particular, rose 6.8% over the quarter alone. And we have a few guesses as to why. While Taylor Swift sadly left out Aotearoa on her world ‘Eras’ Tour, her presence was still felt by Kiwi… wallets.

Food prices

Food prices rebounded over the quarter, up 0.5% following the 1.2% decline last quarter. Prices for fresh produce fell 2% while meat prices fell 0.4%, softer than usual during this time of year. Both moves however were offset by the 1.2% rise in grocery prices. Over the year, food prices are up just 2.4%. That’s a big shift down from the double-digit highs of 2023 – pushed up by Cyclone Gabrielle – and the smallest increase since the June 2021 quarter. Food inflation has (finally) peaked, and prices appear to be normalising.

Insurance

While the price impact of the Cyclone and weather events on food prices has normalised, the impact on insurance continues. Premiums accelerated over the quarter, with home insurance up 5.8% over the quarter. Higher risk areas were hit harder, with even higher premiums. We expect to see this re-pricing of insurance (esp. in high risk areas) continue, and become even more targeted. Some houses may become uninsurable. That’s a discussion for another day. But it’s inflationary and will remove housing stock.

Housing inflation

The slowing in annual housing inflation was also evident in today’s report. Helped primarily by cooling construction costs, housing inflation decelerated from 4.8%yoy to 4.5%. Annually, construction costs have plunged to 3.3% from the 18% peak recorded late in 2021. The ripple effects of the migration boom however adds upside pressure, when it comes to housing. Rental inflation continues to creep higher, and is yet to turn. Over the quarter, rents accelerated 1.2%. And on an annual basis rents are running at around 4.7% (the highest since 1999) - well above the circa 3% pre-covid rates.

Costs faced by firms

Cost pressures faced by firms also continue to ease, but only gradually. According to NZIER’s March quarter business confidence survey fewer firms reported increased costs. And this improvement is feeding through to an easing in pricing. A net 35% of firms raised prices over the quarter – down from the last print of a net 39%. That’s the lowest since June 2021. Retail prices have also come under pressure due to high inventory levels. Retailers built up their stock during the pandemic. Today, warehouses are full, and shelves are well-stocked. But this oversupply needs clearing. Clothing and footwear recorded just a 0.1% gain over the quarter, while prices for household contents and furnishing decline 1.4 %.

Core matters most

Frustratingly, underlying price pressures were also stubborn to budge this time around. Core measures of inflation – stripping out the volatile food and energy prices – remain unchanged from last quarter’s 4.1%. It’s annoying to not see a move lower but it’s still far better than the 6.7% peak recorded in late 2022.

We’re also keeping a close eye on housing related inflation Construction costs have come a long way. Rents however continue to run at an above-average pace, and make up about 10% of inflation. Unfortunately, the current migration continues to place upward pressure. Council rates too have recorded double-digit increases, which accounts for 3% of inflation. Altogether housing-related inflation accounts for about a third of inflation. So taming housing inflation is the battle that must first be won, for us to claim victory in the war against inflation.

Getting close, but still no cigar

Today’s print reinforces the downward momentum in inflation we’ve seen to date. We’ve seen the headline rate fall from the 7s into the 6s, 5s and now, into the 4% range. The RBNZ’s target band is within arm’s reach. Unfortunately, progress in core inflation stalled, with the rate unchanged at 4.1%. Nonetheless, we still believe inflation is on track to return to within the RBNZ’s 1-3% target band in the second half of this year. That’s important because the path for inflation from here is the path for policy. We expect inflation to fall below 3% by the September quarter. But it’s not until mid-October that we see that in writing. That leaves the RBNZ’s November meeting as the earliest date to kick off the next, and long-awaited, phase in monetary policy: rate cuts.

Overpriced wholesale markets are adjusting higher, for now

But there’s not enough, by way of cuts, priced over the medium term.

Market pricing, in wholesale swap rates, has pushed higher in recent weeks, with the realisation that the US Fed may not cut for longer. And therefore, other central banks may also postpone thoughts of rate cuts. These views are being translated Down Under. With many traders removing the risk of imminent rate cuts.

Not long ago, the market had a full 25bp rate cut priced into August. That's way too early, and has been pared back to 13bps (50% chance). November is more interesting. We optimistically expect a 25bp cut. The market had a whooping 66bps priced. Way, way too much. Now at 39bps (5.11%), we see rates continuing to push back up towards 5.25%. February is more fairly priced at 58bps (two cuts), and April has three 25bp cuts to 4.75% - this is exactly in line with our expectations. Beyond April, the market doesn’t have enough cuts priced in. The terminal rate is around 4%, whereas we expect the RBNZ to head back to neutral, around 2.5-3%. So there's plenty of room for 2-to-3 year rates to drop. And that means lower fixed rates on mortgages, and term deposits.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.