NZ is now predicted to start accumulating a surplus of housing over the coming years as projected building activity outstrips rising demand.

However, there is a cloud hanging over future building activity. The current housing market is not conducive to property development.

In addition, some indicators, such as net new residential electricity connections, point to the potential for downward revisions to already published supply data.

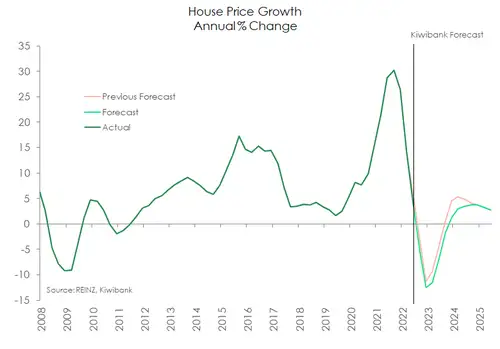

All else equal, the rapid turnaround in NZ’s housing shortage means that house price growth will be held back over the medium term. We are forecasting house prices to be 13% lower by year end, followed by a modest recovery.

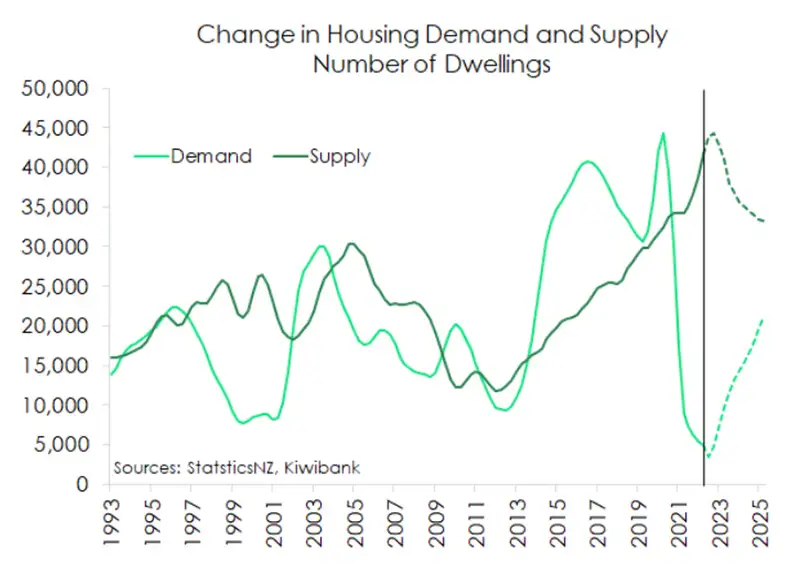

Since our last housing market note a year ago the building industry has been busy. Really busy! Despite all the disruption from covid, despite the lack of materials, and despite the difficulty finding staff, StatsNZ estimates a total of over 41,000 homes were built in the year to June 2022. That is by far the largest addition to Aotearoa’s housing stock in the data going back to 1991. At the same time, new housing demand has slowed to a trickle as population growth has hit the lowest rate since the 1980s. The seismic shifts we’ve seen in housing supply and demand drove down New Zealand’s housing shortage to an estimated 23,000 homes, still large but massively down from a revised 57,000 shortage estimated last year.

The current yawning gap between supply and demand points to New Zealand’s cumulative housing shortage disappearing over the next 12 months. However, forward indicators suggest that the covid-era trends in housing supply and demand are about to change. The outlook for house building has dimmed. And with our border fully reopened, positive net-migration next year should see demand lift off lows. Importantly, there is significant uncertainty around our demand and supply analysis at present. Some indicators, such as net new residential electricity connections, point to the potential for downward revisions to already published supply data.

A growing surplus of houses ahead is likely to weigh on New Zealand’s housing market and generate a slow recovery in house prices. After the post-covid boom of 2021, the housing market is clearly in retreat. Credit conditions have tightened dramatically, in large part due to the RBNZ embarking on aggressive interest rate hiking to tame multi-decade high inflation. And the RBNZ isn’t done yet. We see the cash rate reaching 4% by year end. Across the motu, sales activity this year is down by around a third compared to a year ago. House prices have recorded falls in every month in 2022 so far. We have downgraded our house price forecast and now see house prices fall by 13% by the end of the year. Our forecast would take house prices back to where they were at the start of 2021. Our projected recovery in house prices is weaker too.

Shifting foundations

Since our last detailed housing note, StatsNZ has revised both population and housing estimates based on new information to hand. It turns out New Zealand had more homes and fewer people back in early 2021 than we had thought. This means that rather than 67k shortage of homes last year our revised estimates suggest it was 10k less at 57k.

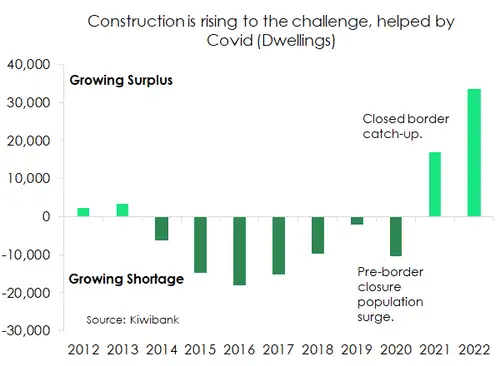

Despite the well documented material and labour shortages, it’s easy to forget just how busy the building industry has been over the last year. An additional 41,700 private dwellings were constructed in the year to June 2022. That is by far the largest annual increase in dwellings in StatsNZ dwelling estimates going back to 1991. To put the gain in homes in context, the peak in construction during the mid-2000s only managed to produce a net 30,000 homes. And looking at the 2018 census data 41,700 dwellings is roughly the same as the number in the whole Southland region.

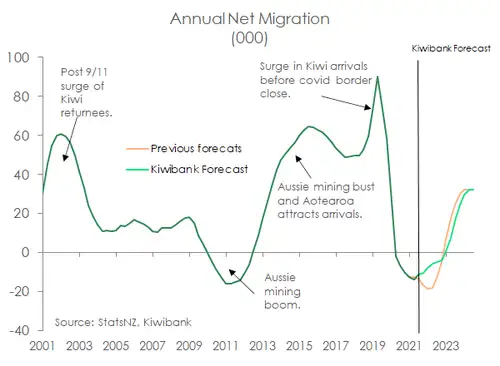

But New Zealand’s population growth over the 2010s was large by historical standards, and home building is only now starting to catch up. Supply is catching up in part because covid restrictions at the border has seen population growth slow to a trickle – a rare positive from covid. Net migration, the main swing-factor in population growth, posted a sizable 11,500 outflow of long-term migrants from New Zealand’s shores in the year to June 2022. And overall population growth slowed to just 0.2%, the lowest rate since 1986. In the year to March 2022, New Zealand managed to produce a surplus of 33,000 homes (see chart above), which has decimated the housing shortage to 23,000 homes. Still an uncomfortably high shortage. But going by current construction rates and low population growth, Aotearoa is likely to start building a housing surplus at some stage over the next 12 months. All else equal, a growing surplus of homes will weigh on the recovery in house price growth over the medium term. However, the recent housing supply data we are using in our analysis is subject to change. We may well see downward revisions to supply. New Zealand’s housing shortage may in fact take longer to remedy.

Suspect supply?

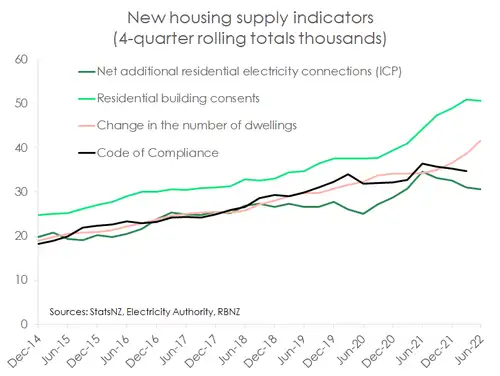

There is evidence to suggest that dwelling estimates may be revised down by StatsNZ in future releases. Dwelling estimates produced by StatsNZ use residential building consents as a key indicator. However, just because there is a building consent, it doesn’t guarantee a house will materialise, or it will lead to a net addition to total housing stock. The possible consequence is another downward revision in already published household estimates – i.e. a lower starting point than we have in our model at present.

Major shortages of both materials and labour, in addition to covid absenteeism, in the construction sector are pushing out the build time of many projects. Data on the net increase in residential electricity connections provides another source of evidence of the change in dwellings. Since the middle of 2021, there has been a divergence between the net increase in dwelling estimates and electricity connections. In its recent Monetary Policy Statement, the RBNZ showed that code of compliance signoff numbers are failing to keep up with dwelling estimates too.

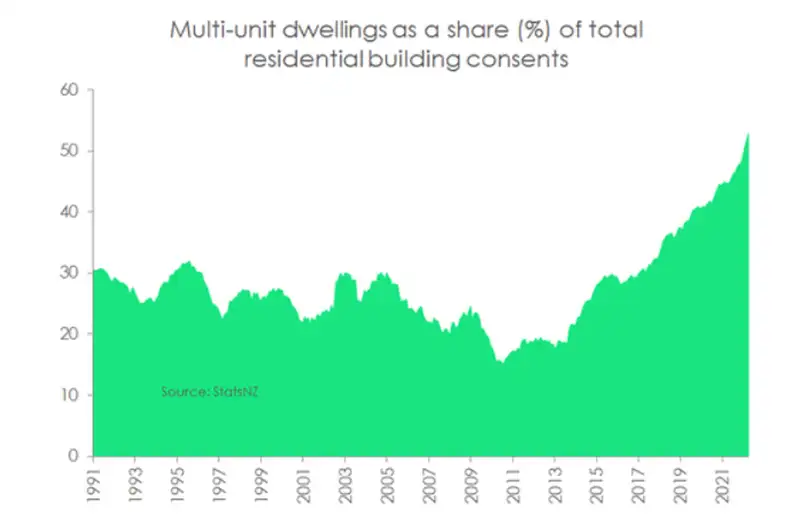

We believe that another reason for the divergence of dwelling indicators and consents is due to the significant infill housing that has been added in our largest cities. That is, building in existing suburbs rather than brand new subdivisions. Infill housing often requires the demolition of older housing stock and can have a potentially smaller net impact on overall housing stock than consenting data project.

Unlike the building boom of the mid-2000s there has been a massive increase in the share of building consents issued for multi-unit housing (see chart below). Multi-unit developments, such as apartments, are more common closer to city centres, rather than city fringes.

The concern now is that with a housing market in decline, and a lack of prospective buyers, some developers may further delay or even cancel planned construction work. Residential building intentions data in recent business confidence surveys do indicate a sharp fall in residential investment growth is just around the corner.

Housing demand has turned a corner

Housing demand looks set to recover from recent covid-induced lows. Additional demand has been artificially held down by covid. And population growth has slowed dramatically. Now the border has fully reopened, we’re seeing what appears is the start of a turnaround in net migration.

We had previously predicted a near 20,00 net-migration outflow by the end of the year based on the timing of the border reopening and the growing desire of Kiwi to take flight. Yes, the number of Kiwi citizen departures has risen rapidly this year. However, what has been surprising since the last forecast is the pace of recovery in the number of long-term arrivals – particularly non-New Zealand arrivals. And looking ahead, it will become easier to move to New Zealand long-term. For instance, the Government is moving to alleviate labour supply shortages and temporarily ease requirements on some work-related visas. Such as allowing for 12,000 more working holiday visas over the next year.

We now expect the current net migration outflow to diminish over the next 12 months. The good news is that labour shortages should ameliorate as a result. Further out the long-term flow of people across our border should normalise. And we continue to forecast annual net migration will recover to around 30,000 over the next few years. That level is around half of the pre-covid trend.

House price growth outlook lowered

Following the excesses of the post-covid property boom, 2022 has been a tough year for the housing market. Sales activity has been around a third lower than last year. And the REINZ house price index (HPI) has recorded falls so far in every month this year. In the month of July, the HPI recorded its first annual fall (2.9%) since 2011 and has further to fall. The supply of listed property has shot up as property is taking far longer to sell. At 44 days, the median number of days to sell are now clearly sitting above the long-run average of 39 days. The sluggish market data adds more weight to our view that house prices have much further to fall in 2022.

The rate of house price growth – peaking at just over 30% last November – was not sustainable. Credit conditions have tightened in large part due to rising mortgage rates. But other policy changes have had a hand in turning many away from housing. Policy changes such as new tax rules for investors, CCCFA changes to bank due diligence requirements, and tighter deposit requirements. The pace of house price falls in recent months has been a bit faster than we had forecast back in June. We have also revised our outlook on the RBNZ’s policy tightening. We now expect the RBNZ to hike the cash rate to 4% by the end of this year. All told we now forecast that house prices will be 13% lower by year end, compared to a 10% fall previously forecast. Beyond 2022, an expected recovery in house prices is expected to be more muted.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.