- The Reserve Bank cut the cash rate a further 25bps to 3%. And today’s decision came down to a vote, 4-2 (a first in RBNZ history), with 2 favouring a 50bps cut.

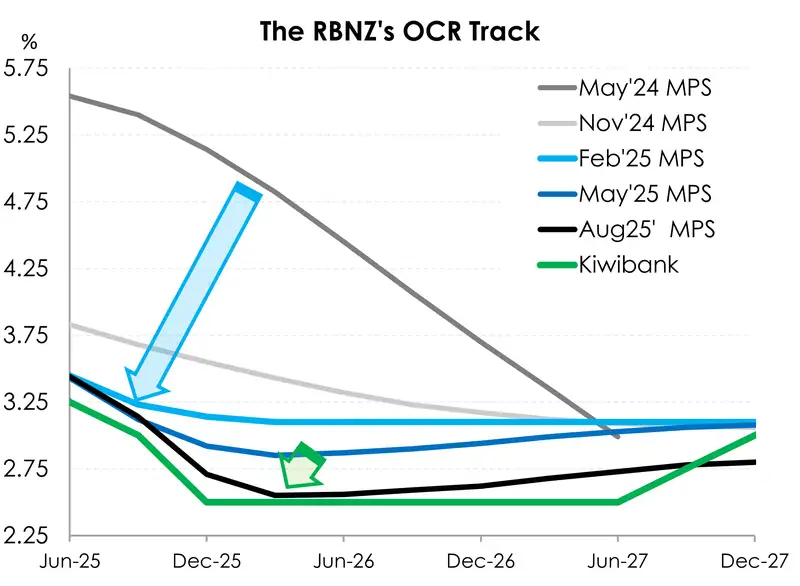

- More importantly, the RBNZ clearly signalled further rate cuts from here. The OCR track was massively lowered, now signalling an 80% chance of a move to 2.5%. We love to see it. This is great news for households and businesses.

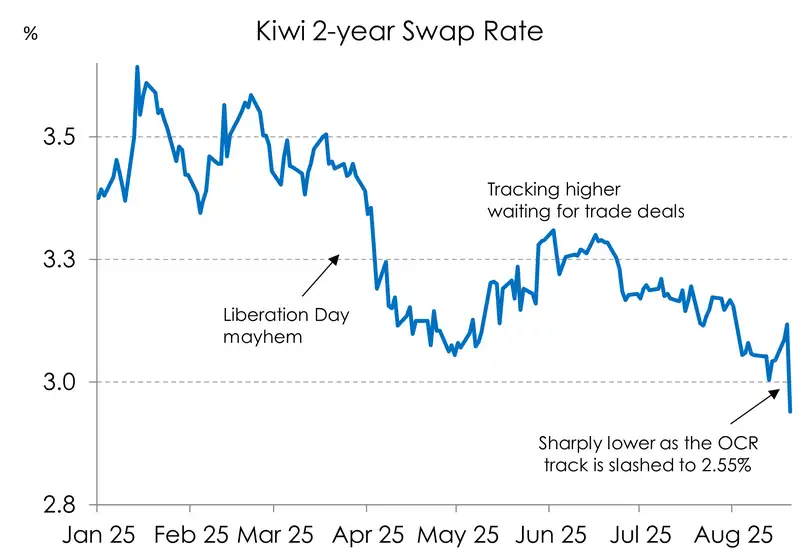

- Market reaction to today’s uber-dovish decision was swift. Wholesale interest rates dropped and the Kiwi plunged as the RBNZ delivered a track more than what was priced.

- Our call for a 2.5% cash rate by year end remains as it always has – unchanged.

The RBNZ are back in the game! After pausing in July, the RBNZ have cut the cash rate a further 25bps to 3% today. But more importantly, the RBNZ has signalled further cuts to come. The central bank we saw today was one almost completely different from the one we saw in May. The OCR track was lowered a massive 30 points from a bottom of 2.85% to 2.55% in March 2026.

What does that mean? This is important. The Reserve Bank has gone from signalling a 60% chance of one last 25bps move to 2.75% at the May MPS, to now an 80% chance of a cut to 2.50%. Going into today’s meeting, only 4 of the 30 forecasters surveyed by Reuters were calling for a 2.5% low in the cash rate. It was an out-of-consensus move, and a bold one for the RBNZ. We have been forecasting, praying and rain dancing for a 2.5% since late 2023. We still are, with another two 25bps cuts to be delivered at each of the RBNZ’s remaining meetings this year.

Like the May meeting, today’s decision came down to a vote. But unlike the May meeting, there was a 4-2 vote (first time in history), with 2 favouring a 50bps cut. The statement, the vote, the forecasts were clearly (appropriately) dovish.

Although it’s great to see the RBNZ move towards a stimulatory interest rate setting, … it would have been better delivered three months ago. Around a third of the mortgage book has repriced over the last 3 months onto rates that should have been lower. The transmission is slower than it should have been.

The first box in the RBNZ statement highlighted the RBNZ’s liaisons with Kiwi business leaders. Clear in the anecdotes were the frustrations, uncertainty and squeezed profitability across many industries. We’ve heard this before. We have been flagging these struggles in our research. One example being our Travelling Economist note titled “Things Just Got Real”. We get great insights ahead of the official data and it shows the power of Kiwibank’s customer relationships.

We think the RBNZ’s research into the likely impacts of US tariffs on global trade and inflation, solidified the bank’s view on inflation risks to the downside (not upside as other commentators have suggested). Chief Economist’s Paul Conway’s speech, titled “Tariffs, turbulence, and monetary policy”, noted: “For New Zealand, our assessment is that these developments mostly represent a negative demand shock that is reducing medium-term inflation pressures. This contrasts with the situation in the US, where tariffs are expected to add to inflation pressures”.

Of course, the uncertain global environment continues to be front of mind for the RBNZ. As outlined in their May MPS, the Reserve Bank continue to view the US imposed tariffs as an overall negative demand shock – meaning less economic activity, less inflationary pressures, and the need for lower rates as reflected in today’s meeting. Indeed, trade uncertainty has fallen since the original implementation of tariffs in April. And a global front loading of activity ahead of tariffs supported trade and growth over the first half of the year. But activity is expected to weaken over the second half of this year with consensus forecasts still weaker than they were prior to tariff announcements in April.

Summer strength subsides

The need for stimulus is clear. The strength in economic activity over the summer looks to have faded. More timely economic data show that the Kiwi economy stalled in the middle of this year. The RBNZ points the finger at Liberation Day. Rules on the global playground were being re-written, and businesses faced heightened uncertainty. While the August revisions to tariffs avoid the baddest of bad scenarios, today’s global trading environment is still more restrictive than before Liberation Day. Uncertainty remains high and has led to more cautious activity from both businesses and consumers.

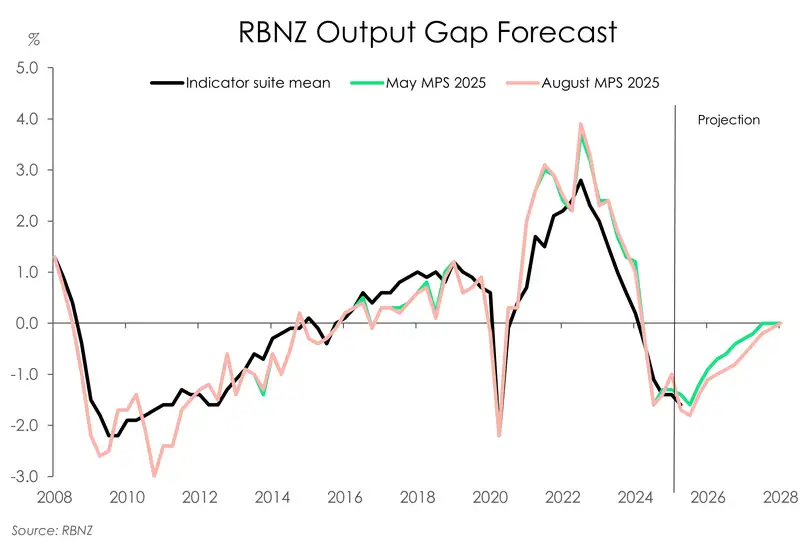

Alongside uncertainty on the global stage, the underperformance of the housing market has also weighed on economic activity. The lack of the wealth effect has hurt other interest-rate sensitive sectors of the economy like residential construction and retail, which have yet to gain momentum. All in all, the RBNZ expect activity to contract 0.3% in the current quarter, followed by another quarter of weak growth. It’s been a year since the RBNZ has commenced the cutting cycle. But this isn’t the economy we were expecting to see. The Kiwi economy is operating with significant spare capacity. The output gap – the difference between actual output and potential output – was modelled to be slightly more negative than in May. All in all, the expected recovery in economic activity is forecast to be slower than projected in the May MPS. The RBNZ now projects the NZ economy to grow just 0.6% this year – well below trend. It’s not until the end of next year that the economy returns to more normal levels of growth.

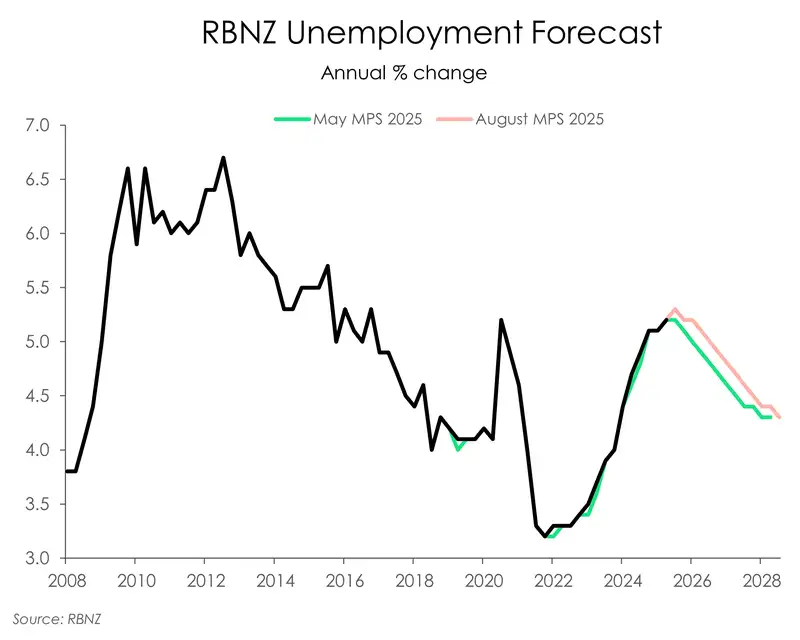

With greater than expected slack in the economy, the unemployment track was shunted slightly higher. As the RBNZ notes: “most measures of labour market tightness are below their average levels since 2000”. The labour market is expected to remain softer than previously thought over the medium-term. The RBNZ’s forecast for the peak in the unemployment rate has edged slightly higher to 5.3% and remains higher over the forecast period. Also symptomatic of a weaker labour market was the downgrade in the RBNZ’s wage inflation forecasts.

The good news is that inflation over the forecast horizon remains reasonably well-contained. Headline inflation will likely hit 3% in the current (Sep) quarter. But it’s a short-lived blip, as inflation is forecast to travel back down to the 2% target midpoint in early 2026. Together weaker global growth, elevated global uncertainty, and declining inflation across most of our trading partners are expected to reduce inflationary pressure here at home. And the RBNZ’s move today in signalling towards a stimulatory 2.5% cash rate rightly reflects as such. The RBNZ’s 1-3% target band is respected. And the inflation beast has been tamed.

Market reaction

The market’s reaction was a thing of pure beauty. Kiwi rates swooped like a majestic kingfisher into water, with the 2-year swap rate splashing below 3% to 2.94% (from 3.1% prior to the announcement). This is good news for indebted businesses and homeowning households. A drop in the cash rate to 2.5% should see the 2-year swap rate on a glide-path to 2.8%. We like it!

The Kiwi currency dropped to a low of 58.21... there were support levels around 58.5 against the big dollar. And we have broken said resistance. We have moved to the lower end of our expected trading range. Again, we like it. A lower currency helps our exporters facing a 15% tariff into the US.

RBNZ statement

“The Monetary Policy Committee today voted to lower the OCR by 25 basis points to 3 percent.

Annual consumers price index inflation is currently around the top of the Monetary Policy Committee’s 1 to 3 percent target band. However, with spare capacity in the economy and declining domestic inflation pressure, headline inflation is expected to return to around the 2 percent target midpoint by mid-2026.

New Zealand’s economic recovery stalled in the second quarter of this year. Spending by households and businesses has been constrained by global economic policy uncertainty, falling employment, higher prices for some essentials, and declining house prices.

There are upside and downside risks to the economic outlook. Cautious behaviour by households and businesses could further dampen economic growth. Alternatively, the economic recovery could accelerate as the full effects of interest rate reductions flow through the economy.

The Monetary Policy Committee today voted to decrease the Official Cash Rate (OCR) by 25 basis points to 3 percent. Further data on the speed of New Zealand’s economic recovery will influence the future path of the OCR. If medium-term inflation pressures continue to ease as expected, there is scope to lower the OCR further.”

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.