Key points

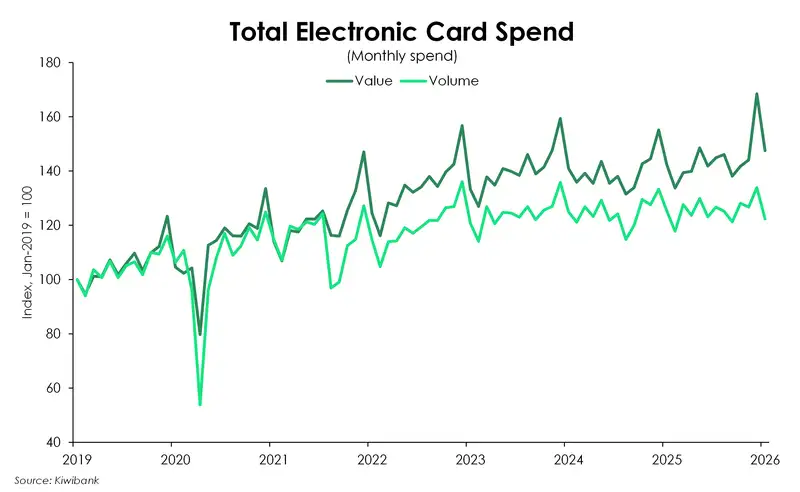

- We typically see spending ramp up into the summer holidays. But our Kiwibank electronic card data showed this effect was less pronounced this time around. The silly season kicked off on a good note with the number of transactions in December up 0.4% on last year’s levels. But it seems consumer spending got hit with a bad new year’s hangover in January. The number of transactions in January dropped 2.7% below the overall 2025 monthly average. And compared to last January, transaction volumes were down 2.3%.

- The total amount of dollars spent however still rose in both December (+8.6%) and January (+3.7%) when compared to last year. So Kiwi are tapping, swiping, and inserting their cards less, but spending more each time. With the lift in transactions over December, the sharp rise in values likely reflects broader spending strength with bigger trolleys and larger Santa sacks this past Christmas. But January tells a different story. The softer value gain, paired with falling volumes, points to the all than more familiar culprit: higher prices. Inflation has picked up over the past year, and many households are still feeling the squeeze after several years of tight budgets, elevated consumer prices, and expensive credit. So, it’s no surprise we’re still seeing fewer shopping trips with more spent per trip.

- Even though interest rates have fallen significantly over the last year, household budgets remain under pressure. Elevated utility costs are continuing to weigh on disposable incomes. And as households have had to spend more on essentials, less has been spent on fun discretionary items. Spending on retail apparel particularly remains in persistent decline. However, there are encouraging signs emerging within housing-related spend. Especially in the home-reno space with Kiwi clearly enjoying a summer of DIY. Farmers too became big spenders in December. However, hospitality services were mixed this summer with Kiwi preferring restaurants over cafés. Meanwhile Kiwi travel demand is still broadly in a downtrend.

- Looking at the early data we have for February, which runs to just after Waitangi weekend, transaction volumes are currently tracking about 4.3% lower than this time last year. That suggests that the same kind of soft consumption we saw through January may be lingering into February. While this may be the case, we’ll flag that it may be too soon to draw firm conclusions for February. There’s still plenty of the month left, and a late-month pickup could shift the final outcome significantly. Time will tell.

- We still believe that the fall in interest rates over the last year should help free up disposable incomes and support a recovery in consumption over 2026. But for now, households are still grappling with a number of challenges. Beyond the elevated costs of essentials, lingering job insecurity and a still soggy housing market continues to weigh on consumer confidence and willingness to spend. We expect such factors however to improve over the course of the year as the broader economic recovery gathers pace, in time feeding through to stronger consumption.

Who takes the knockout? Black Friday vs Boxing Day

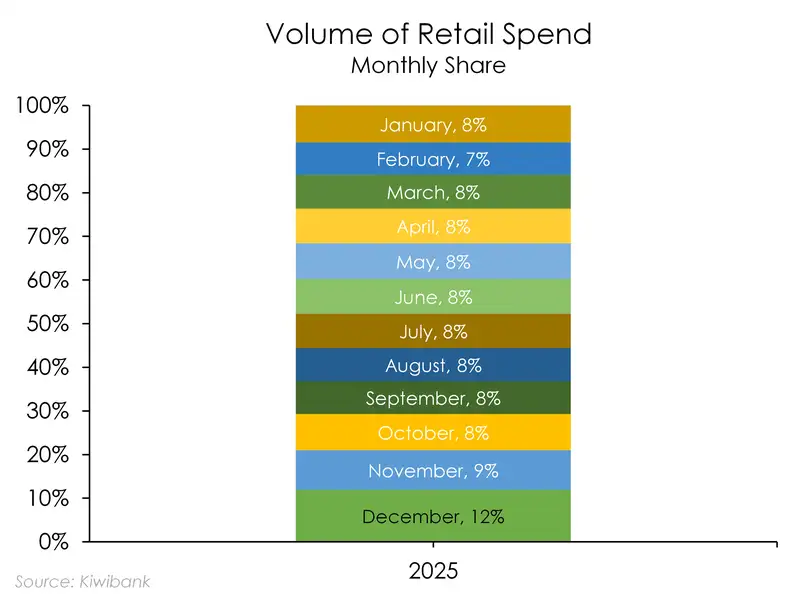

Earlier in the year other sources had reported a disappointing Boxing Day turnout, especially when compared to the Black Friday period. Nowadays, Black Friday and Boxing Day sales seem to start and end well before and after their official days, so it’s a little tricky to identify these exact two periods. But our Kiwibank data shows that at a monthly level, the number of transactions and dollars spent was still higher in December than in October and November – because yes, we did see Black Friday sales start as early as October last year.

When we go glove to glove, comparing Black Friday against Boxing Day (and not the marathon sales around it), the winner in the ring depends on which referee you ask…

Look at overall total spend, and Black Friday comes out as the heavyweight champion on both volumes and values. But narrow the fight to retail spending only, and Boxing Day still holds the title on both fronts.

The likely reason? Black Friday appears to spread its deals far beyond retail and into services. Boxing Day, on the other hand, lands during the great Kiwi shutdown, when a lot of services go on holiday mode, leaving retail to carry most of the spending action.

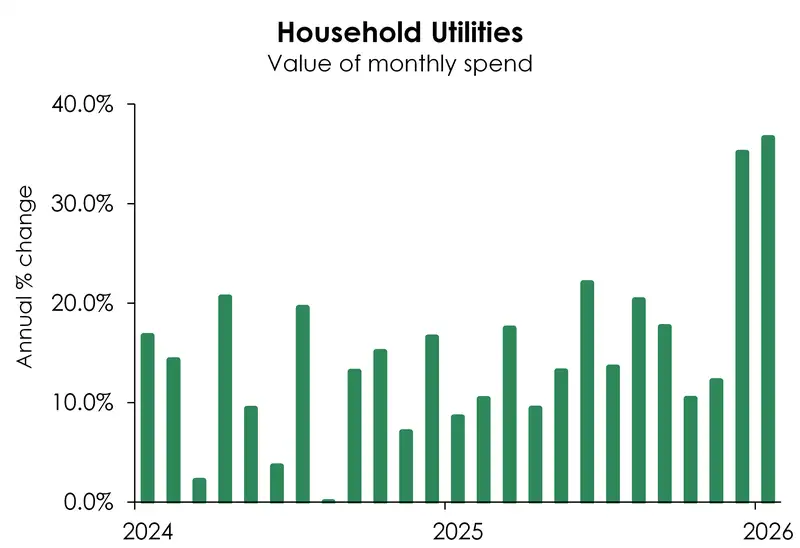

Elevated utilities are a disposable income killer

The ever‑climbing cost of household utilities continues to weigh heavily on discretionary spend. From higher council rates to rising energy bills, elevated utility costs are chewing through household budgets.

Altogether, total dollars spent on household utilities across December and January was around 36% higher than a year ago. That’s an eye‑watering increase. And it’s clearly limiting what households can afford to spend elsewhere. But what can you do? These are essentials. They have to be paid. But it’s leaving less room for spend across the nice‑to‑haves.

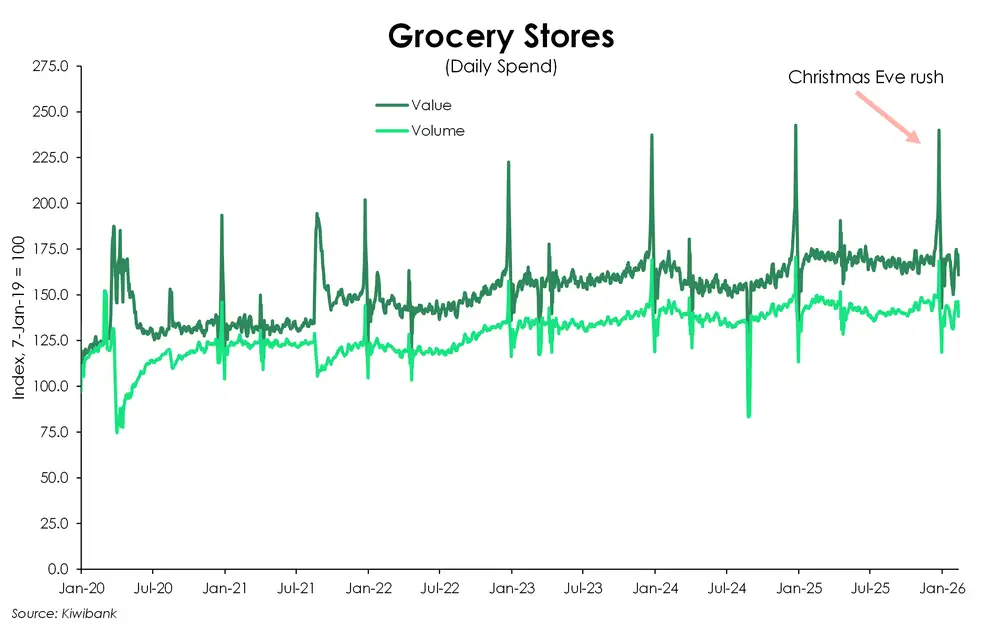

Full trollies in December. Leftovers for January

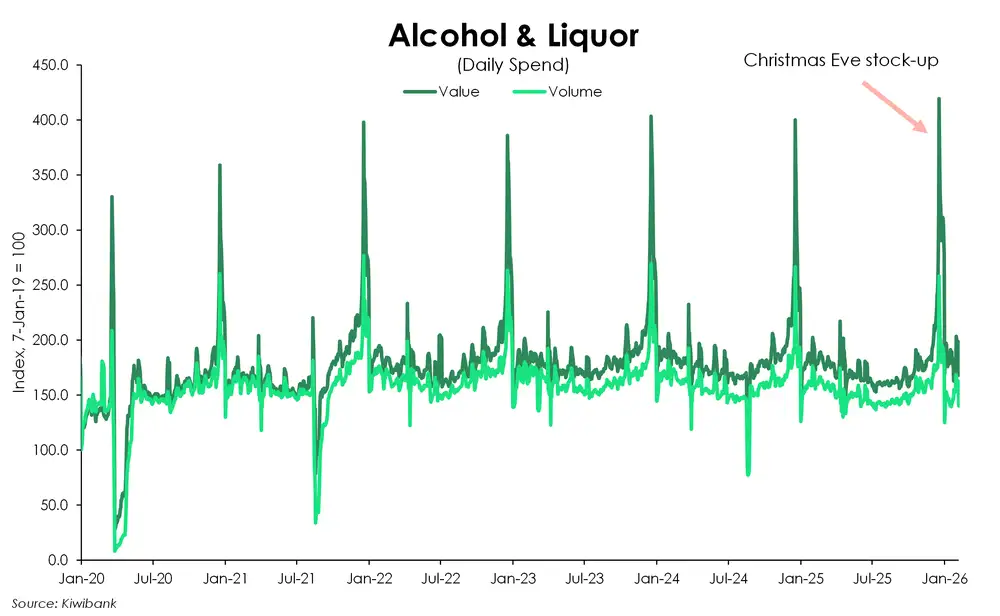

As usual, spending on all things food and drink jumped in the lead‑up to summer, with Christmas feasts to prepare and home bars to replenish. Trips to the grocery store were up 2.1% over the month of December, with the 23rd and 24th alone accounting for just under 10% of the month’s total purchases. The same story played out for alcohol. Visits to the local liquor store surged 22% over the month. And 14% of December’s spend occurred on those same two frantic pre‑Christmas days. I guess we all had to grab those last minute essentials before the mere two-day shutdown.

Thankfully, at a time when we were making more grocery runs, food price pressures had eased compared with earlier in the year. Back in August, dollars spent at the supermarket peaked at 17.5% higher than the previous year. Whereas in December, total spend was up a far gentler 2.3%.

We must have had a lot of leftovers from December because trips to the grocery store in January dropped 2.3% compared to last year. And with fewer supermarket visits in January, total dollars spent also fell 2.7% from a year earlier. It seems leftovers, full cupboards, and well‑stuffed fridges carried many households well into the new year. That, and eating out more….

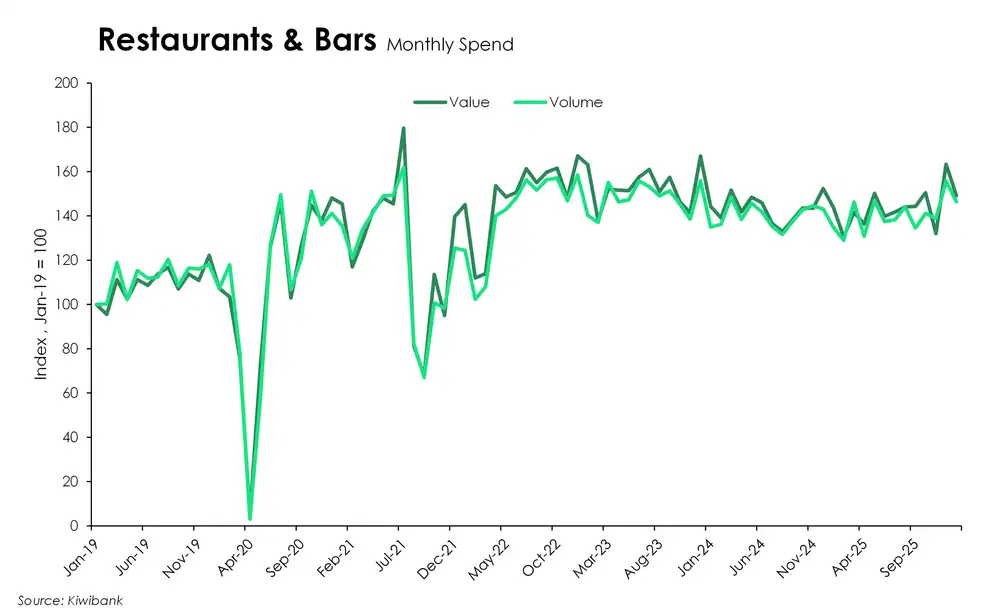

Swapping brunch dates for dinner plates

It seems Kiwi opted for more formal dining and nights out this summer, rather than the usual morning coffees and quick takeaways. Trips to restaurants and bars were up 8.7% over December and January compared with last summer

Cafés, however, didn’t get the same love. We frequented our local coffee and brunch spots less than last year. And higher food prices seem to be hitting here the most. Because while the number of café visits has dropped, the dollars spent have instead risen. Compared with last summer, café spending is up almost 9%, meaning each visit is costing noticeably more. So for now it seems were gritting our teeth through our homemade instant coffees instead.

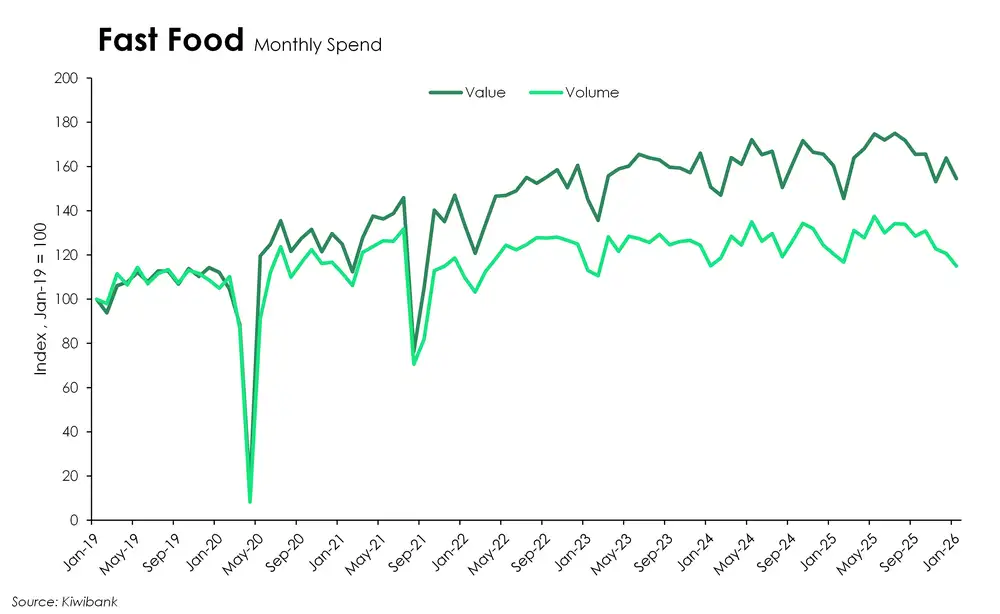

And as for takeaways? Don’t bother asking Mum if we can go to McDonald’s. There’s food at home. Takeaway trips have been on a steady slide since October and are now sitting 4.6% below last year.

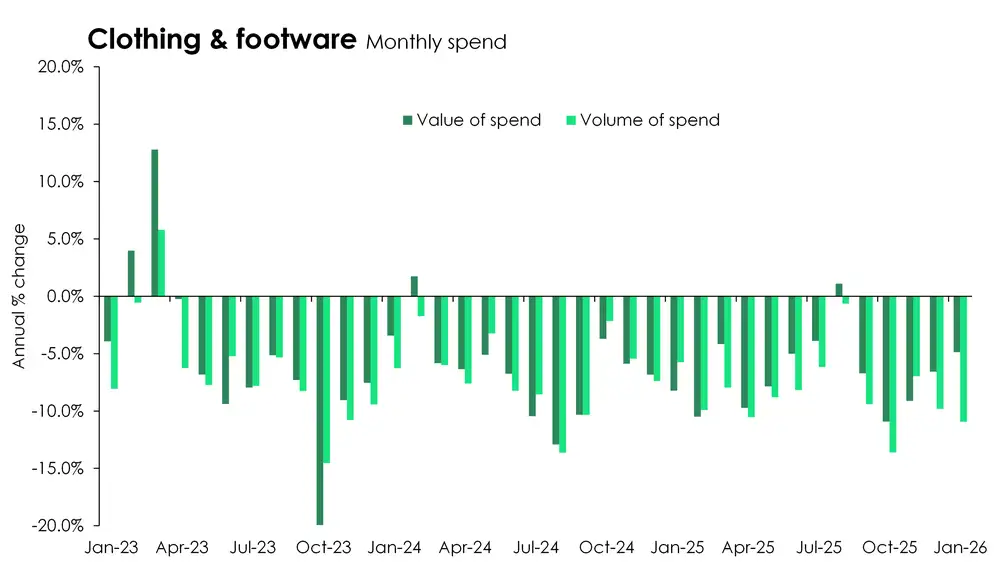

Call the fashion police. The industry is still in crisis

The wasteland for spending across apparel continues. Even with heavy discounting over the past couple of years, the hottest new styles just aren’t hot enough to entice spend. Clothing and footwear spend fell 6.6% and 4.9% in dollar terms over December and January respectively. Meanwhile, the volume of transactions posted even bigger declines of around 10%. It adds to the several years of underperformance for the sector. And is a direct result of squeezed disposable incomes. As household budgets have tightened, discretionary items, particularly across apparel, like that new dress or pair of boots, have been the first cut.

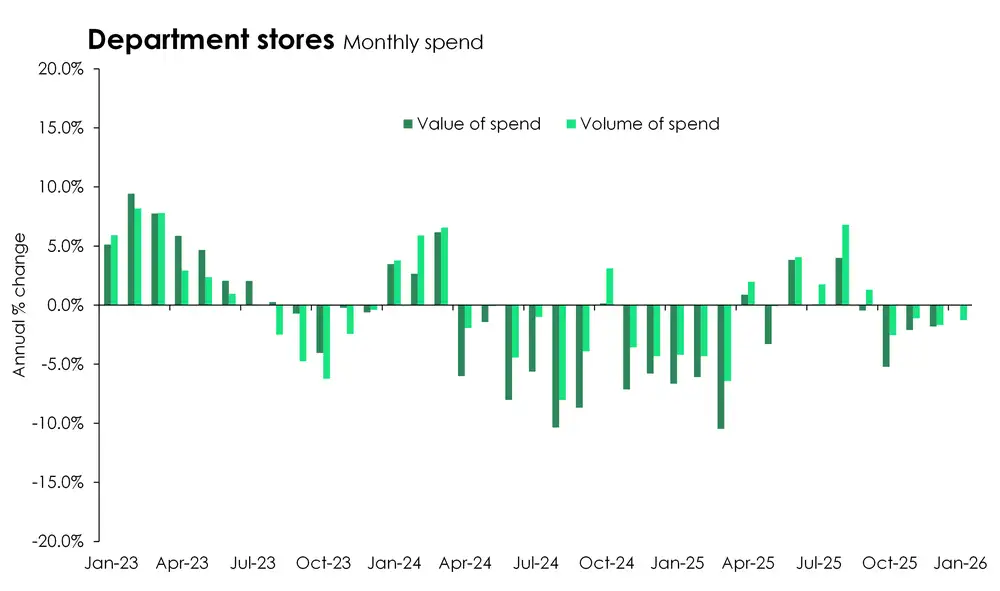

Similarly across department stores the number of transactions over summer remained below last year’s levels, while total dollars spent was broadly flat.

Overall, the number of transactions on retail goods rose just 0.5% over December and January when compared to a year ago. And the small lift we did see was largely driven by spending on all things around the home…

Home is still where the hope is

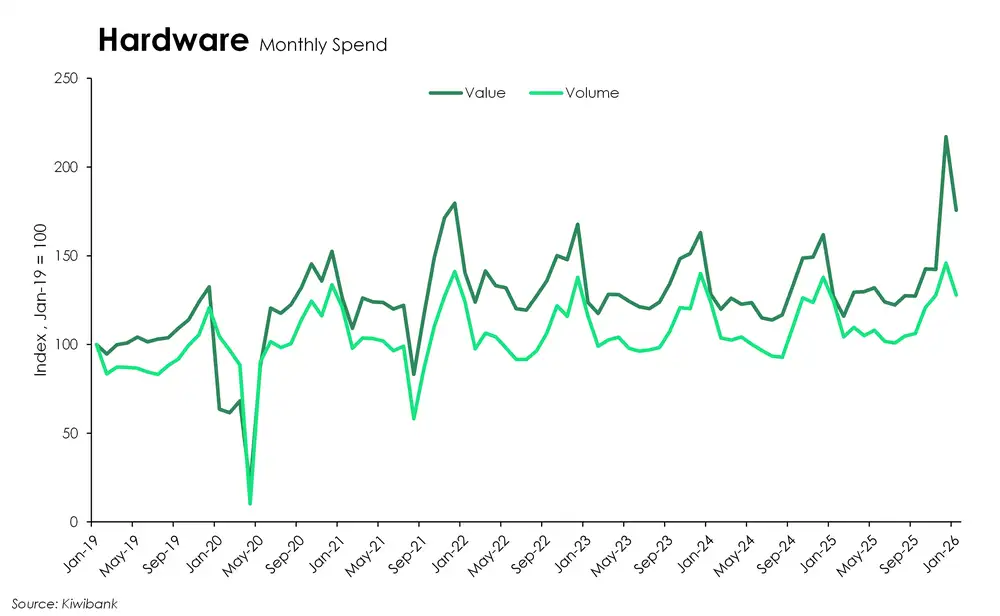

Demand for housing‑related goods continues to strengthen, helped along by what looks like a summer of Kiwi DIY home renos. Trips to the local hardware store were up nearly 6% in December compared with last year. And our trolleys were noticeably fuller, with total dollars spent rising just over 30%. The momentum carried into the new year too, with visits up 2.8% in January and dollars spent running closer to 40% higher than the year prior.

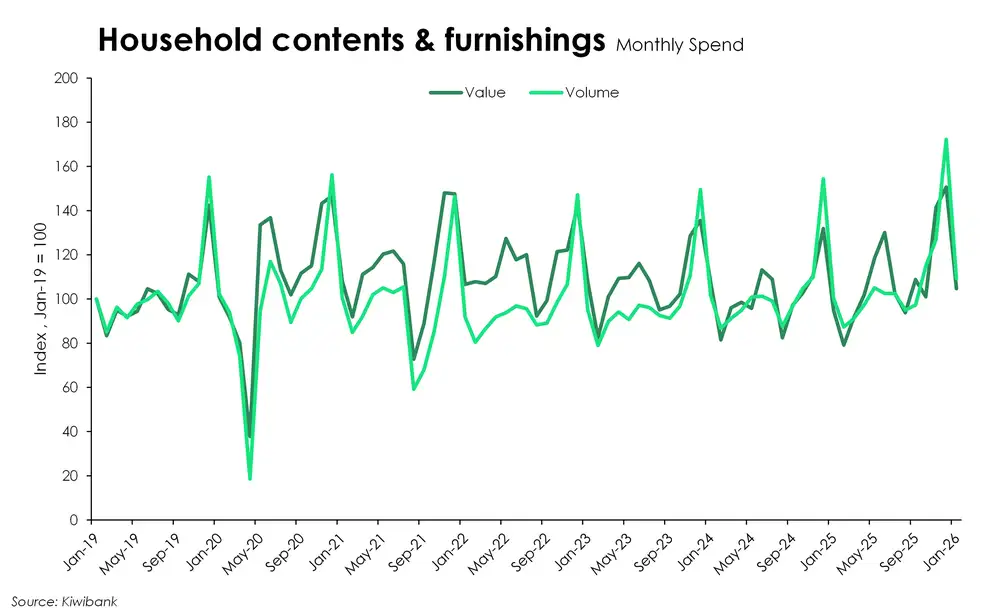

Similarly, the volume of spend on home contents and furnishings was up around 10% over the early summer period compared with last year. And in dollar terms we spent about 12% more on turning our houses into homes. You know, the cushions, the plants, the lamps. That one little thing that somehow becomes five.

Overall, the lift in housing-related spend offers an encouraging sign for the housing market. The need for a fresh lick of paint or new furniture is often suggestive of increased housing market turnover. To us, the data signals that households are getting ready for a better year for the housing market. And we expect it will be with interest rates in their low ranges.

2026: The analogue year?

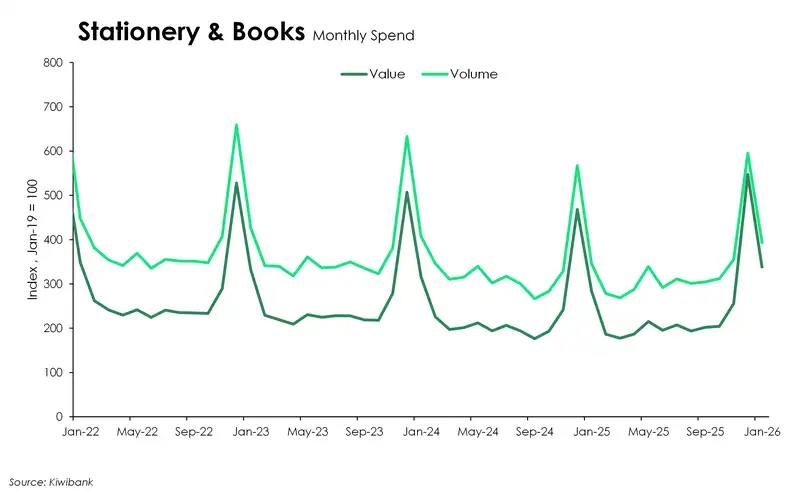

I don’t know about you, but over the end of last year and the start of this one, my social feeds were completely overtaken by the viral “going analogue in 2026” trend. Now you might be wondering, “what on earth is this Gen Z economist is talking about?” So for anyone who hasn’t stumbled across this emerging cultural shift, quick rundown is that it’s all about intentionally shifting our lifestyle and hobbies away from screens and back into the tactile world. Think books, journalling, crafting, board games. Basically anything that doesn’t involve a device. I must admit I’ve even joined the movement myself with my friends having kicked off a monthly craft club. And now the analogue trend is showing up in our Kiwibank spending data too.

The number of transactions at stationery and bookshops climbed almost 5% in December and a whopping 14% in January compared with a year earlier. And even more striking, the total dollars spent jumped an average of 18% across the two months. The timing of the lift in spend across stationery and books does align with the usual seasonal spikes that come with the Christmas and New Year rush. After all, there are presents to wrap, cards to send, and kids to get kitted out for the return to school. But this year’s lift was noticeably stronger than last year’s. And in terms of dollars spent, it even appears to have ever so slightly improved and reversed the gradual downward trend we’d been seeing in spending at stationery and bookstores over the past couple of years.

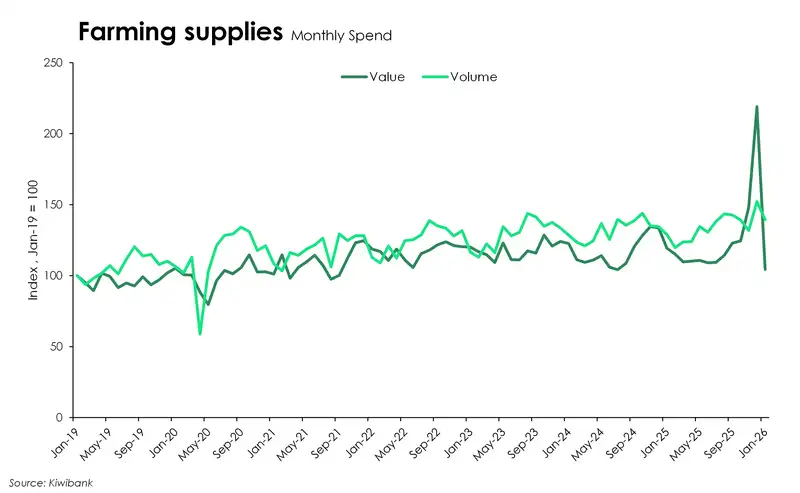

Cash cows on the loose. Farmers open their wallets

We know last year was a much better year for farmers. We saw strong dairy and meat prices at a time when our lower kiwi dollar made our agri exports even more attractive. And then of course, came the announcement of the lofty capital return for farmers with the sale of Mainland Group.

With all of that in mind, it seems farmers were in good spirits and opened their wallets in December. There was a 13% lift in the number of transactions on farming supplies compared to last year. But what really stands out is the dollar value surging nearly 64% on the year. The spike follows a period of softer spending through much of the past year. So, it’s likely farmers used the stronger cashflow and improved sentiment as an opportunity to make some bigger, more investment‑heavy purchases. The kind of spending that typically gets, and has been, deferred during tougher seasons.

Compared to December, farm spend pulled back to more typical levels in January. Though notably remained above levels seen last year for both volumes and values.

Not venturing far…

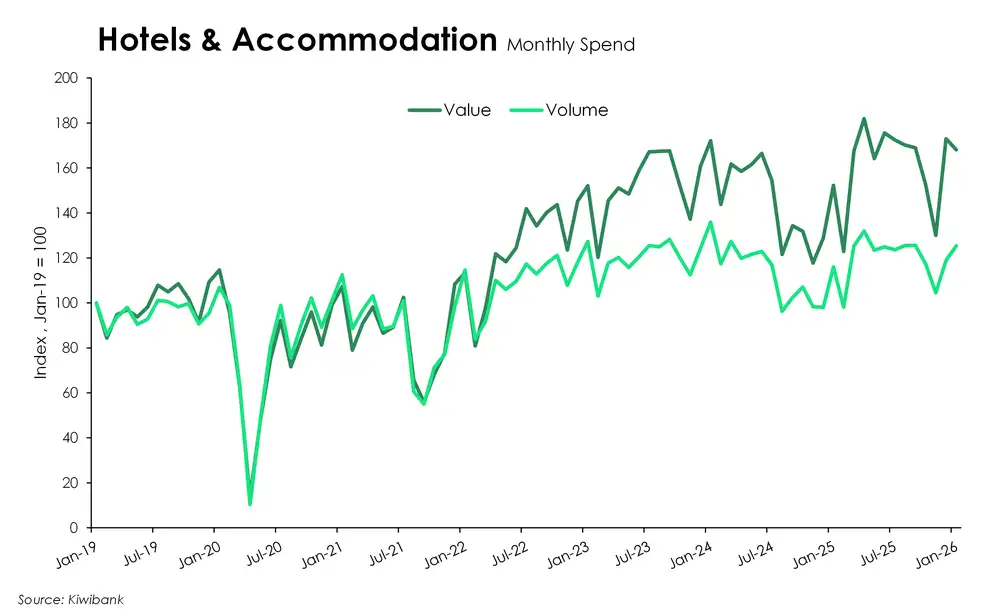

The volume of spend on hotels & accommodation increased 21% in December compared to a year ago. But the large increase is more reflective of the weak state of the economy in 2024 rather than a revival in discretionary travel.

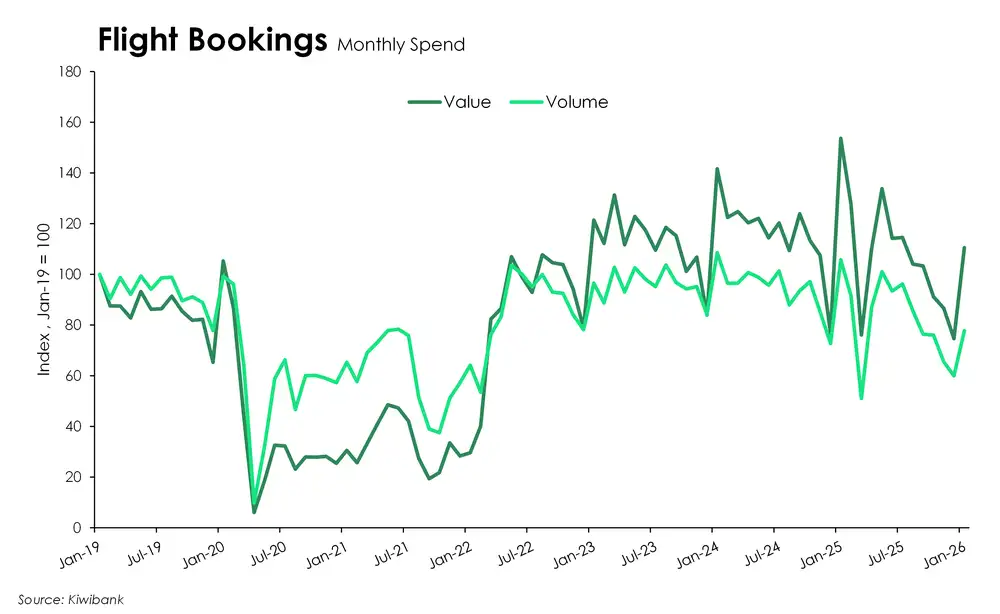

Not even the rainy weather over summer was able to entice Kiwi to book flights to sunnier destinations. Elevated international airfares throughout December likely discouraged booking trips abroad given overall flight‑booking volumes were down 22% over the early summer period when compared to last year.

Indeed, most of 2025 saw a steady decline in flight‑booking volumes and values. Between constrained disposable incomes and a weaker Kiwi dollar throughout the year, travel was just not as attractive nor feasible last year.

On a month‑to‑month basis, January flight booking volumes were up close to 30% from December. But it’s still unclear whether that rise reflects anything more than typical seasonal patterns. Nonetheless travel demand should improve in time as overall consumption recovers in line with the broader economy. Plus an expected strengthening in the Kiwi dollar across certain currency pairs over the year should make international travel a little more appealing.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.