- The RBNZ kept the cash rate on hold at 2.25%. And the messaging was crystal clear. Let the economy recovery. Keep settings accommodative. And if all goes well look to rate hikes at the end of this year, or early next. It’s a big if. But overall, it’s a message that we can get behind.

- The Kiwi economic recovery is in the “early stages”. There’s a lot left to do. There’s a lot of time that’s needed to heal. And there’s a lot market participants can do to ease the pressure. Wholesale rates are lower and the currency unmoved. That’s exactly the reaction we were hoping for. And the RBNZ will be happy with that (let’s forget about the last MPS in Nov which was a shambles).

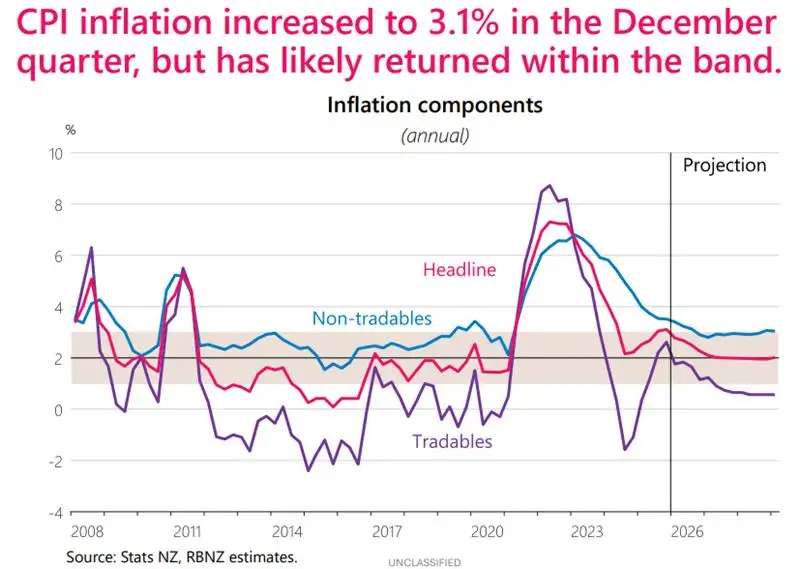

- Inflation will fall back to 2%. It remains their forecast, and ours.

- Ultimately, though we still think that the kiwi economy will need a little more time to be fully mended. And as such retain our view of rate hikes kicking off in 2027.

Don’t you just love fresh beginnings? Meeting for the first time in 2026, the RBNZ felt like a whole new central bank today. New leadership can do that. As expected, the cash rate was left unchanged at 2.25% under a unanimous decision. New Governor, Anna Breman, made her mark with an exceptionally simple, well delivered, statement and OCR track. Something which in the past, as recently as November, has not been well executed.

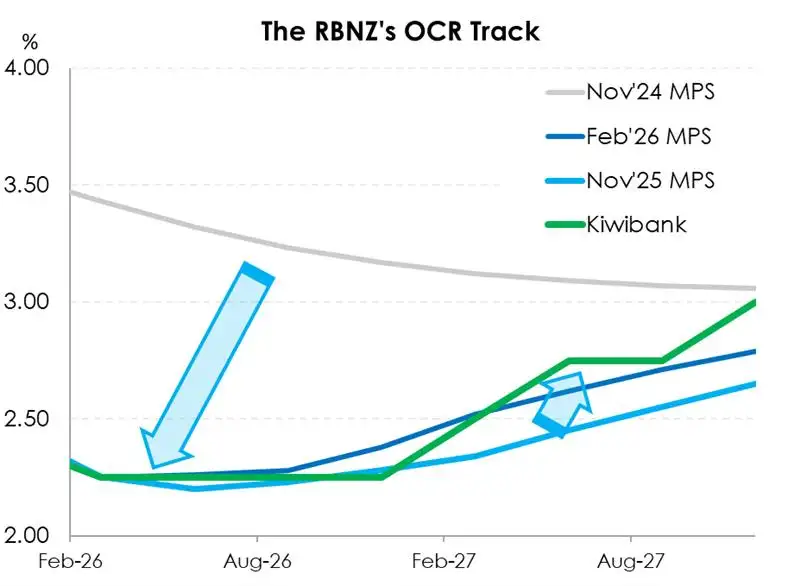

The RBNZ confirmed time on the easing cycle with a lifting of the OCR track. The next move in monetary policy is up. And the timing of that move has been brought forward. Now ending the year at 2.38%, the OCR track implies a good chance of the first hike happening at the end of this year. However, as Governor Breman herself said in the press conference, such a move is not entirely priced in their own view either. And for us we’re still on the side that rate hikes are an early 2027 story.

In our view there are a few key lines that sum everything up nicely.

- “The economy is at an early stage in its recovery.” Talk of imminent rate hikes are premature. It’s simply too soon to call for hikes with much weighting. That said, if all goes according to plan, the RBNZ sees a “possibility of a rate hike by year end… but it’s not fully priced” or expected by the MPC. So cool your jets, and wait for the recovery.

- The outlook for global growth, and our trading partner growth, is “highly uncertain” with “weak domestic demand in China”.

- “The Committee is confident that inflation will fall to the 2 percent midpoint over the next 12 months due to spare capacity in the economy, modest wage growth, and core inflation within the target band.” Our sentiments exactly.

An expected improvement in the RBNZ’s forecasts

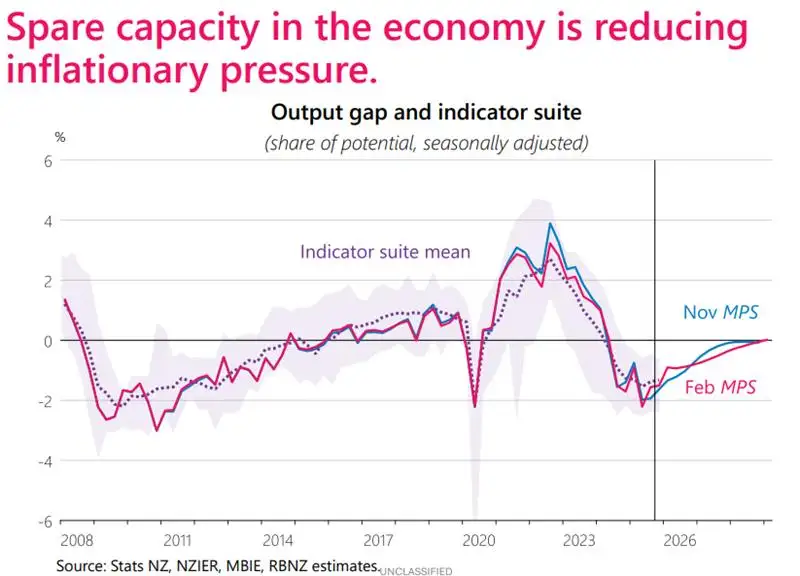

The RBNZ’s revised forecasts were broadly in line with our expectations. Reflecting stronger‑than‑anticipated activity and stickier inflation since the last meeting the RBNZ’s growth and inflation forecasts are higher relative to the November MPS. Central to forming these forecasts though is the RBNZ’s assessment of the output gap. That’s the difference between actual output and the economy’s potential.

Given the recent pickup in activity and the faster pace of recovery, the RBNZ now estimates the output gap to be slightly less negative than it was in November. However, the key point is that despite the stronger data, the output gap is still expected to remain negative throughout almost the entire forecast horizon, right out to the end of 2028. Meaning the economy is expected to operate with a meaningful amount of spare capacity over the next few years. And it is this spare capacity that underpins the RBNZ confidence that inflation will continue to moderate and ultimately return toward the 2% midpoint of its target range.

So accordingly, despite the recent lift in inflation above the RBNZ’s target band, their forecasts show inflation falling back within the band in the current March quarter. And later reaching the 2% midpoint in the second half of 2027. Spare capacity is expected to help ease domestic inflation further, alongside gradual declines in the stubborn administered components of the CPI basket that have remained elevated. Similarly tradable inflation, which has risen at a more elevated pace than expected, was largely attributed to the weaker currency of the past year. And a recovered currency is set to help ease further imported inflation alongside easing global inflation. However, the RBNZ also noted ongoing uncertainty over the global outlook.

Overall, the RBNZ expect to see a period of growth in the economy with limited inflationary pressure. The RBNZ now expects the economy to grow annual average of 2.9% this year compared to 2.3% estimate in November.

Market reaction

What a great start. Anna Breman’s MPC managed to deliver a commentary that was easily absorbed by market traders, and economists. The reaction in wholesale rates and FX was textbook. Why? Because markets didn’t move much… and the moves that did occur, were in the right direction. Breman’s take on the world and Kiwi economy failed to meet overzealous calls for rate hikes (just because the Aussies are doing it). Leading into today’s decision, wholesale rates had glided lower. Positioning was unwound, and the market better balanced. Overeager calls for rate hikes were tempered today. And that got wholesale rates lower, by ~5-9bps. That’s a win. And thoughts of a stronger spike in the Kiwi dollar vanished, at least for now.

The pivotal 2-year swap rate had eased to 3.03% leading into today’s decision, from a recent high of 3.17%, as traders took off paid positions and squared up. Immediately following the statement, the 2-year fell to 2.95%. The RBNZ’s forecast OCR trajectory gave a strong probability of a hike by the end of the year… but not much more thereafter. A stitch in time. By Dec’27, the RBNZ’s OCR is around 2.79% whereas the market was around 3.50% (a few weeks back) and 3.10% now.

RBNZ statement

“Annual consumers price inflation was slightly above the Monetary Policy Committee’s 1 to 3 percent target band at the end of 2025. Increases in food and electricity prices and local council rates were the biggest contributors to above-target inflation.

The economy is at an early stage in its recovery. With ongoing strength in commodity prices, economic activity in the agricultural sector and regional New Zealand remains strong. Although residential and business investment is increasing, households remain cautious in their spending. The labour market is stabilising, but unemployment remains elevated. House price growth remains weak, dampening household wealth and inclination to spend.

In response to previous cuts in the OCR, economic growth is broadening across sectors of the economy, such as manufacturing, construction and some retail. Economic growth is expected to increase over 2026.

Inflation is most likely returning to within the Committee’s 1 to 3 percent target band in the current quarter. The Committee is confident that inflation will fall to the 2 percent midpoint over the next 12 months due to spare capacity in the economy, modest wage growth, and core inflation within the target band.

Risks to the inflation outlook are balanced. The global environment remains highly uncertain. Domestically, greater caution by households in their spending decisions could slow the pace of New Zealand’s economic recovery, risking inflation falling below the target midpoint. But with demand increasing in the economy, businesses could try to increase prices faster than expected, leaving inflation above the target midpoint.

The Committee agreed to hold the OCR at 2.25 percent. If the economy evolves as expected, monetary policy is likely to remain accommodative for some time. The Committee will continue to assess incoming data carefully. As the recovery strengthens and inflation falls sustainably towards the target midpoint, monetary policy settings will gradually normalise.”

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.