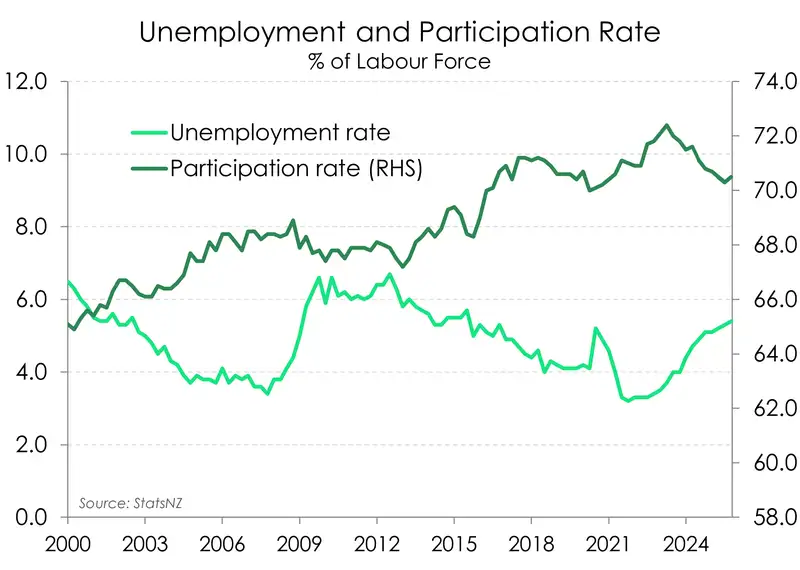

- The unemployment rate lifted from 5.3% to 5.4% in the December quarter. It’s a higher than we expected as more people dusted off their CV’s and returned to the labour force.

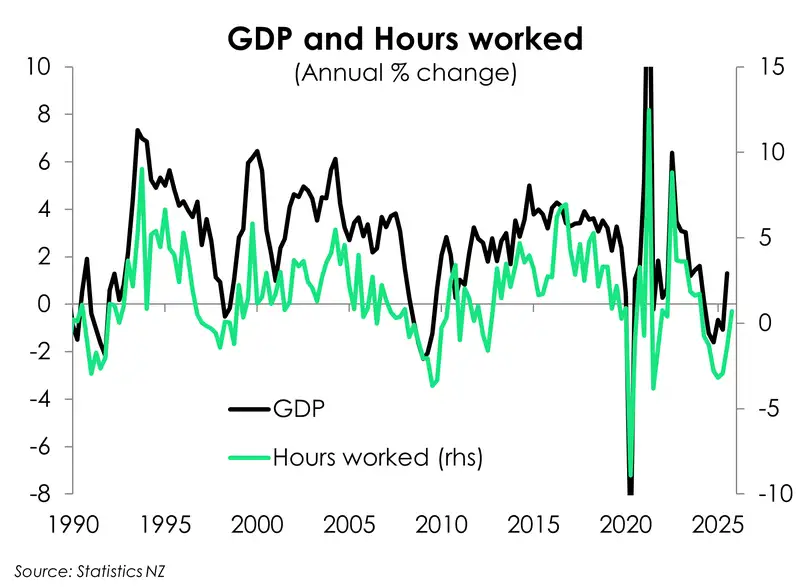

- Though not enough to absorb the growth in labour supply, the 0.5% lift in employment over the quarter shows that the appetite for labour is gradually improving. And overall paired with the lift in total hours worked, today’s jobs report reflected a labour market that is broadly stabilising.

- A high degree of spare capacity remains in the Kiwi economy. And it’s that slack in the market that is seeing further moderations in wage growth. Annual wage growth slowed to 2.0%. That’s the lowest in almost 5 years. That should give the RBNZ some comfort that inflation will return to the 2% target this year with wage growth far from a source of inflationary pressure.

Markets, the RBNZ, and ourselves were expecting the Kiwi unemployment rate to hold steady at 5.3% in the December quarter. Instead, the headline rate rose to 5.4%. At first glance, the move doesn’t look good. But beneath the bonnet, there’s encouraging signs of greater engagement in the labour market.

Employment growth, up 0.5% over the quarter came in stronger than we expected. And over the year, employment was up 0.2%, marking the first annual increase since June 2024. The appetite for labour is slowly improving as the economic recovery gathers pace. And it appears that signs of such a recovery have more people dusting off their CVs to test the market. As labour demand begins to recover, labour supply is responding. The labour force grew 0.6% over the quarter while the participation rate lifted to 70.5% from 70.3%.

The past two years of recession had seen the participation rate in a gradual decline as workers left the labour force discouraged by the lack of prospects in the jobs market. But now, people are putting their names back into the hat. It’s just that labour demand just isn't quite there yet. And as such we’ve seen a lift in the number of people unemployed.

The lift in employment today show that the appetite for labour is gradually improving. And 2026 should show further improvements. But it’s a slow burn with the labour demand typically lagging the broader economy. After economic downturns, employers generally want to see a steady stream of demand before expanding headcount. And we’re only at the start of our economic recovery. So, it’ll take some time before the labour market can absorb new talent entering the market. But we’re at the starting line now.

There was some good news in the number of hours worked. Employers had previously been slashing hours in response to soft economic demand. But this trend started to reverse last September quarter and grew a further 1% at the end of 2025. On an annual basis, total hours worked grew for the first time since March 2024, up 0.7%. Small caveat though, the trend taken from the Household Labour Force Survey, didn’t quite line up with the total weekly paid hours reported in the Quarterly Employment Survey. In the QES, total paid hours fell over the quarter and over the year. Though these two measures are conceptually different in nature, it is a bit of a head scratch to see them move in opposite directions. But the great thing about being an economist, is we get to pick the numbers we like, so we’ll take the lift in hours worked.

There is still a significant degree of spare capacity in the economy. An unchanged underutilisation rate of 13% confirms as much. And such slack continues to weigh on wage growth. The private sector Labour Cost Index (LCI) has dropped to 2% (1.98% if we round to two decimal places) - the lowest rate since March 2021. And the distribution of annual wage growth underscored cooling wage pressures. Of those receiving pay increases, just 9% are pocketing chunky rates of more than 5%. Back in 2023, that proportion was more like 40%. Instead, more are receiving increases of 2-3% today.

Overall, despite the higher headline unemployment rate, today’s jobs report still showed signs of a labour market that is stabilising. But the economy still clearly carries a meaningful degree of spare capacity. Spare capacity which will take time to be fully absorbed. We need to see the labour market really turn, not just stabilise, to have confidence in the recovery. We don’t think we’ll see that until the tail end of this year, maybe even early next year. And the degree of slack still in the market should provide the RBNZ with comfort that inflation will return to the 2% target this year with wage growth far from a source of inflationary pressure. So overall, we remain of the view that rate hikes remain a story for 2027.

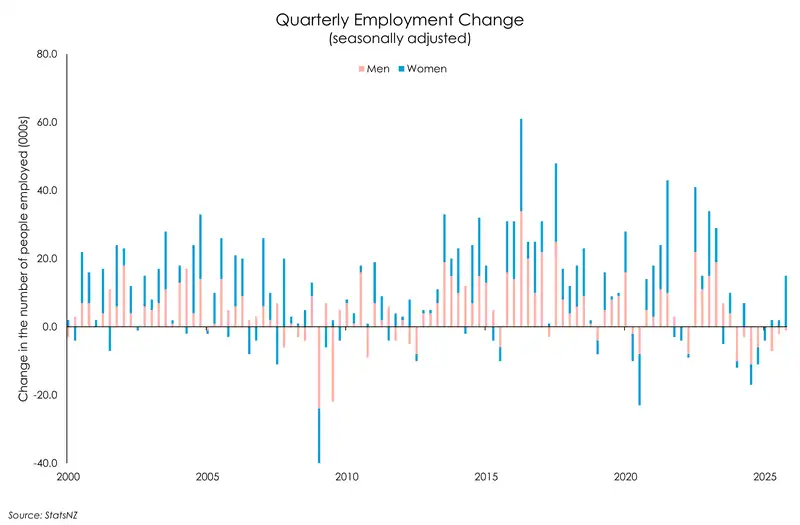

The Kiwi labour force expanded a strong 0.6% in the December quarter. It’s the strongest increase in two and a half years. Annually, the labour force has grown for the first time in a year, being 0.5% bigger than December 2024 labour force. All this growth was led by women. The 14k lift in the number of people employed over the quarter was entirely driven by growth in female employment. And Stats NZ shows more women moving into managerial and professional roles. It’s a trend long in the making, and one we like to see.

The 4k increase in the number of people unemployed was also driven by women. With more women active in the labour market, the female participation rate rose to 66.9%, the highest since September 2024.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.