The search for labour has improved markedly with rising net migration. Labour is no longer the top constraint, and cost pressures are easing. That’s good news for inflation. But demand is what’s top of mind for businesses. And they’re wary of the outlook.

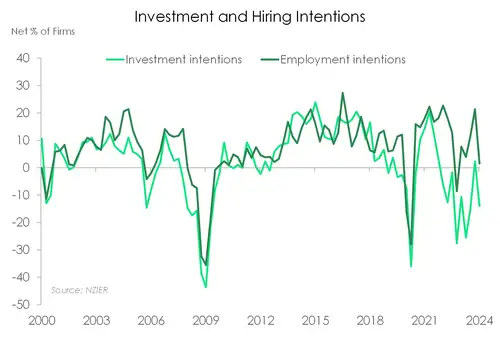

Amidst an environment of softening demand, firms are remaining cautious about investment and hiring.

The bounce in business confidence following the election proved to be temporary. NZIER’s latest Quarterly Survey of Business Opinion (QSBO) showed a deterioration in confidence. Not the best start to the new year. In the March quarter, a (seasonally adjusted) net 24% of businesses expect economic conditions to deteriorate in the coming months – a much greater proportion than the net 10% in the prior quarter.

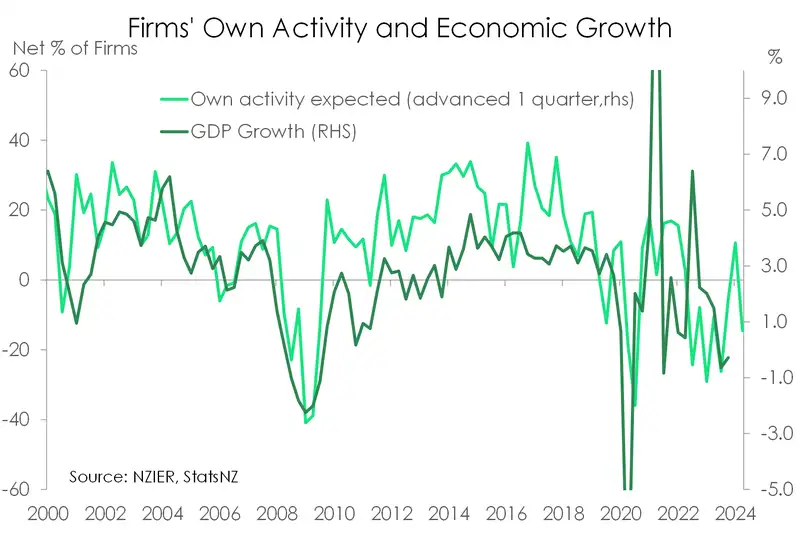

According to Kiwi businesses, navigating the current economic environment is still a challenge. The mood among firms remains downbeat as activity indicators deteriorated in the quarter. A net 23% of firms reported a decline in trading activity, a sharp turnaround from the net 7% that reported an increase in activity in Q4. And in terms of the period ahead, more firms are feeling downbeat. A net 11% of firms see a weakening in trading activity in the coming quarter, again a starkly different response to the net 7% expecting an increase in activity last quarter. There’s a clear correlation between firms’ trading activity and economic growth. And with activity still running below the QSBO’s long-run average, a period of below trend growth lies ahead for the Kiwi economy.

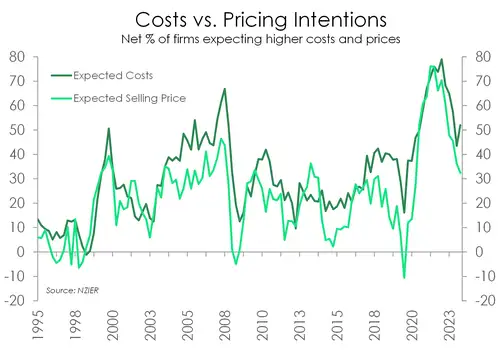

The most important read in the report, involves pricing. And cost pressures and pricing intentions are (slowly) improving. Fewer firms reported increased costs and raised prices over the quarter. A net 53% of firms experienced higher costs, slightly fewer than the 55% last quarter. Interestingly, more firms expect costs to rise in the coming quarter. Nonetheless, the improvement is feeding through to an easing in pricing. A net 35% of firms raised prices over the quarter – down from the last print of 39%. That’s the lowest since June 2021. And it’s great news for the inflation outlook. What’s even better is the shrinking proportion of firms looking to increase prices over the coming quarter – from a net 36% to a net 32%).

It's a day out before the RBNZ announces its latest policy decision. From their perspective, this report is what they want to see. There’s further evidence that demand is cooling and economic activity is softening. The easing in cost and pricing intentions also point to continued disinflation. And a weakening in hiring intentions points to growing slack in the labour market. Heat is leaving the economy. Monetary policy is clearly working. Next up? Rate cuts. Soon, but not tomorrow. And most likely, not until November. Tomorrow’s RBNZ announcement should be a non-event. We are not expecting a change in policy or stance. The April “review” is simply a steppingstone to the more detailed “statement” in May.

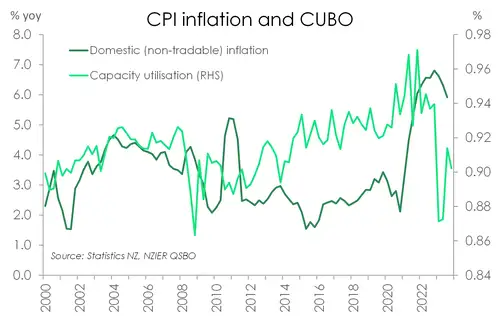

Capacity utilisation improves

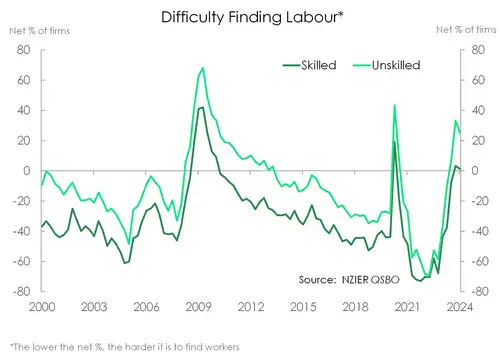

NZIER’s latest survey also noted that capacity pressures continue to ease. Capacity utilisation – a measure of the intensity with which firms are using their resources – amongst builders and manufacturers has markedly declined over the past year after reaching heart-palpitatingly high levels. More firms are also reporting the ease in finding labour. Whether it's unskilled or skilled labour, firms are no longer having to look under rocks. A net 27% of firms are reporting that it is easy to find unskilled labour. And finally, it’s the same case for skilled labour (from a net 0.4% to a net 2% - the highest 2020). We’ve seen a strong and rapid return of migrants, and their impact on the economy is clearly felt. Today’s report is further evidence demonstrating the much-needed boost to the supply side of the economy.

Both the improvement in capacity utilisation and labour availability point to a considerable easing in capacity pressures in the economy. That’s good news for domestic inflation. A capacity-constrained economy for the last three years created a breeding ground for inflation. But the narrative is shifting. And as capacity pressures ease, downside risks to domestic inflation are building.

An easing in capacity pressures is also being driven by a weakening in demand. The steep rise in interest rates is squeezing household incomes, and demand is slowing. Since the beginning of 2023, sales have eclipsed labour as the main constraint for businesses. And a year later, even more firms are experiencing the same. Of the firms surveyed, a clear majority (59%) reported sales as their top constraint.

Caution reigns

The sugar rush of a new government is over. And with weakening demand, firms are back to being cautious around investment and hiring. A near net 11% of firms already reduced staff numbers in the first quarter of 2024. And going forward, just a net 1.5% of firms are looking to expand their workforce in the coming quarter. It makes sense. We’re in a recession after all. And with output continuing to decline it seems an extra pair of hands is proving too costly.

What we were really on the lookout today, was investment intentions. Last quarter, we saw investment intentions lift into positive territory for the first time since the end of 2021. Though we cautioned the move was largely influenced by the news of a new government and a promise for change. We wondered whether investment intentions would be able to hold their ground or fall back into negative territory. And today we’ve seen the later. Investment intentions have retreated back into negative territory with a net 14% of firms paring back on investments across plant and machinery. As well as a net 8% paring back on investments in buildings. Unsurprisingly, given that they are most pessimistic on the outlook moving forward, it was builders who are paring back the most on investment. Not something we want to see with our ongoing housing shortage, growing population and climbing rent prices as a result.

One central theme is clear in today’s report: The honeymoon phase for the new government is over. Uncertainty over the governments incoming actions, from spending plans to cutbacks, is clouding an already foggy investment environment as high interest rates remain. For now, firms will likely be putting investments and expansion plans on hold until the details of the Government’s upcoming Budget are revealed in May.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.