It feels like the housing market is stuck in an endless winter. The fact that we’re actually in winter certainly doesn’t help. The housing market always performs better over the warmer months. But even beyond the winter blues, after 225bps of rate relief, the housing market continues to show hardly any signs of recovery.

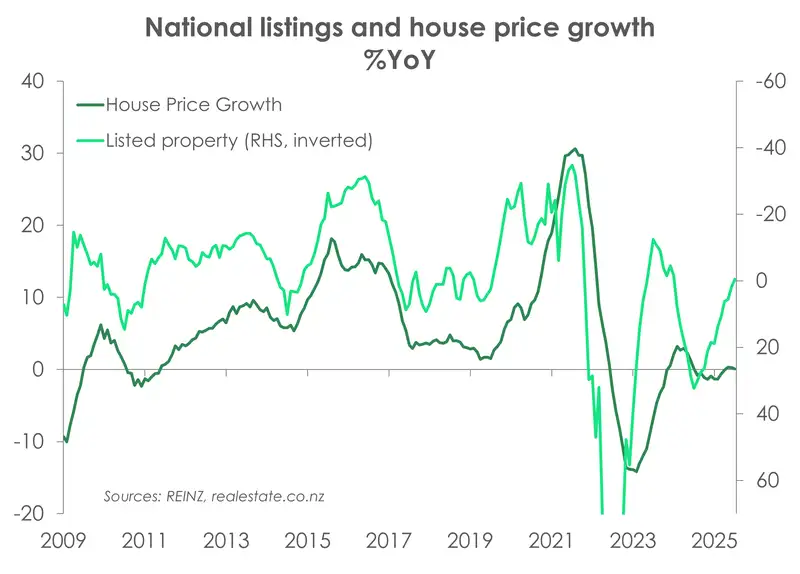

The latest REINZ data for July showed house prices fell a further 0.6% (seasonally adjusted) following last month’s decline. While on an annual basis house prices have remained virtually flat (up just 0.1%). The median days to sell, one of the best real-time indicators of housing dynamics, continues to yo-yo above the long-term average of 40, most recently settling at 48. So, it’s quite clearly still a buyer’s market out there. And the longer it takes to sell, the weaker the market.

To us, the laterally locked state of the housing market reflects one simple truth: The RBNZ has more work to do. Rate cuts to date have not kicked in. Rate cuts to date have not enticed investors. And rate cuts to date are not enough.

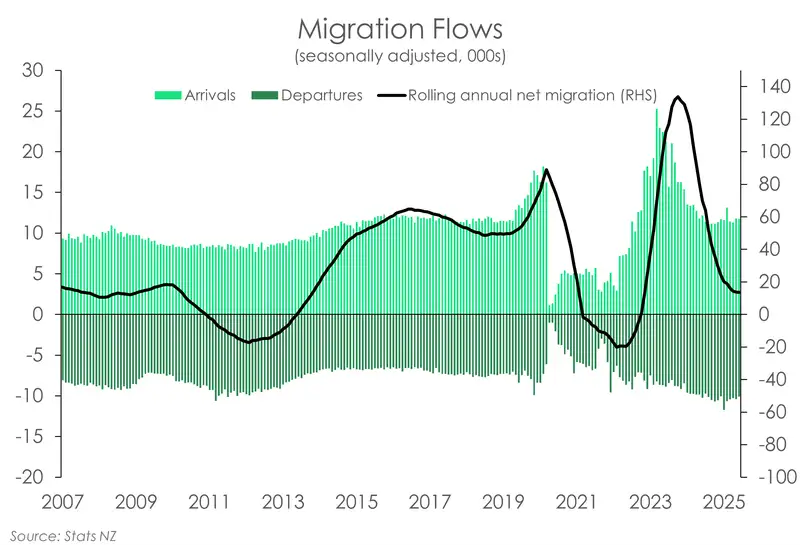

Sure, record breaking departures and slowing net migration have also kept price growth subdued through reduced demand and a growing housing stock. In the year to June 2025, our net migration gain slowed to just 13,700 – well below the long-term average of ~25k. Non-NZ citizen migrant arrivals have dropped nearly 30% from a year ago. Meanwhile, NZ citizen migrant departures at 71,800 are sitting just below the all-time high of 72,400 in 2012.

Of course though, the slowdown in net migration is being driven by a lack of opportunity as our labour market continues to weaken. So put together it’s just another sign of an economy in need of stimulus.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.