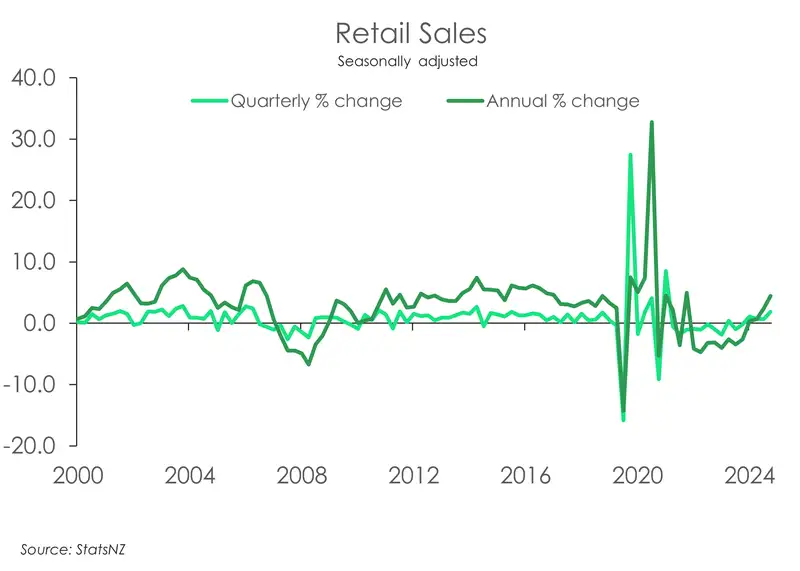

Just in time for Black Friday, last Thursday StatsNZ released some good news on retail sales data for the September quarter. Up 1.9% over the quarter, the lift in total retail sales was over three times the expected increase and marked the largest uptick in volumes since late 2021. Meanwhile over the year retail volumes were up 4.5%. And removing the volatility caused by motor vehicles and fuel, core retail volumes were up a solid 1.2% over the quarter.

Just over half of the measured industries recorded higher sales volumes compared to last quarter. The most notable lifts came from electronic goods up, 9.8%, and motor vehicles, up 7.2%. Heavy discounting is clearly doing the trick in getting electronic goods into shoppers’ baskets with the price deflator falling a further 1.5% and posting its third consecutive quarterly decline.

Retail spending was also more evenly spread across the regions in the September quarter. In the June quarter, most of the lift in retail values came from the South Island, while much of the North Island saw declines. That trend has now balanced out. Retail values were up 1.4% across the North Island. Sales in the South Island remains strong with values up 1.7%.

All up, it’s a pretty encouraging read for an industry that’s been among the hardest hit by the RBNZ’s engineered recession. The lift in retail sales reflects lower interest rates filtering through the economy. And with around 30% of households set to roll onto lower rates in the next six months, the outlook for retail points to continued gains heading into 2026. Hopefully giving retailers an extra spring in their step as they move into the busy festive season.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.