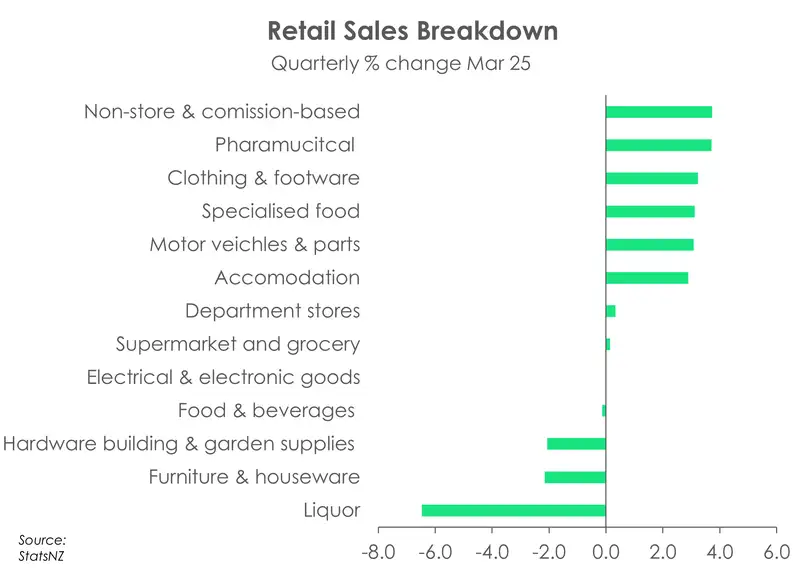

Retail sales for the March 2025 quarter released last Friday were much stronger than expected. Consensus had settled on a flat print over the quarter, and instead we saw retail volumes lift 0.8% over Q1. Compared to last year, volumes were up 0.7%. Overall, the strength in retail sales was fairly broad-based. 10 of the 15 measured industries were up over the quarter, and each of the 16 Kiwi regions posted higher seasonally adjusted values compared to the end of last year.

Some areas of particular strength were evident across pharmaceuticals (up 3.7%), clothing (up 3.2%), motor vehicles and parts (up 3.1%), and accommodation (up 2.9%). However big ticket items, from furniture to electronics, and anything “around the house DIY” continues to lack strength. And shows households are still prioritising essentials. A lower rate environment, is likely adding some support to household spending, but broader headwinds, primarily the soft labour market and continued weakness in housing, are clearly still dampening consumer appetite. Nevertheless, the stronger than expected print adds a bit of upside risk to Q1’s upcoming GDP print. And, like the broader economy, we continue to expect a continual recovery across the retail sector throughout the second half of the year helped by real income growth, lower interest rates, and an eventual recovery in the housing market.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.