The market reaction to the RBNZ’s dovish pivot was a thing of pure beauty. Wholesale interest rates dropped and the Kiwi plunged as the RBNZ delivered a track more than what was priced.

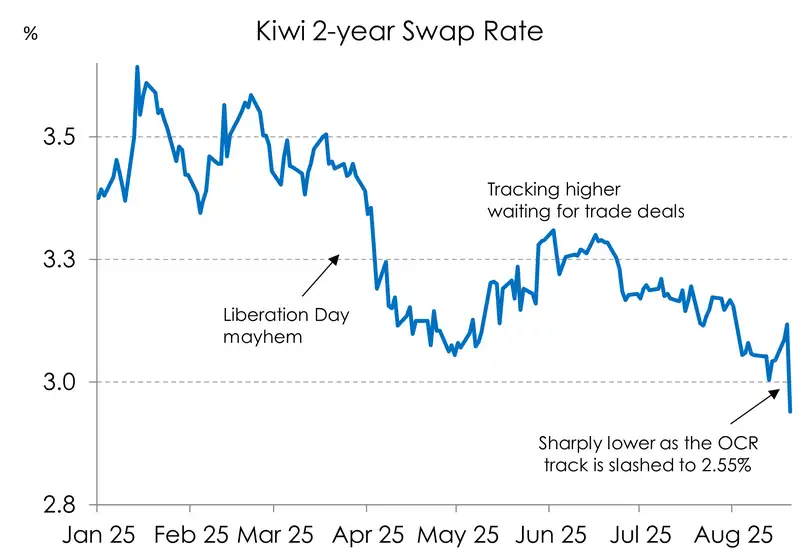

Kiwi rates swooped like a majestic kingfisher into water, with the 2-year swap rate dropping 16bps and splashing below 3% to 2.94% (from 3.1% prior to the announcement). And today, the two-year opens at a new cycle low of 2.90%. This is good news for indebted businesses and homeowning households. An eventual drop in the cash rate to 2.5% should see the 2-year swap rate on a glide-path to 2.8%, taking retail rates lower with it.

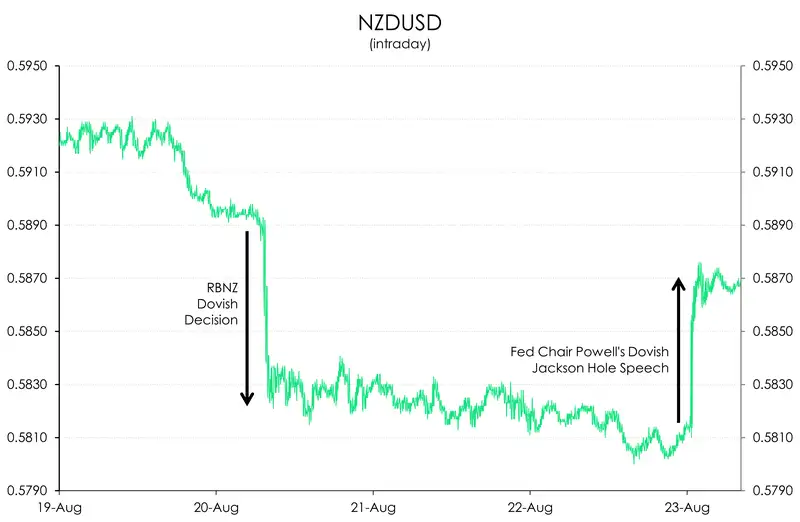

Looking at currencies, the Kiwi dollar dropped to a low of 58.21 on the day, breaking through key support levels (around 58.50) against the big dollar. We quickly moved to the lower end of our expected trading range with the Kiwi getting as low as 58.01 by the end of the week. We liked it. It was a good move for our exporters facing a 15% tariff into the US, albeit being somewhat short lived. Dovish messaging from Fed Chair Jay Powell over the weekend saw the USD weaken against the Kiwi. The result, were not too far off from where we were pre-MPS.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.