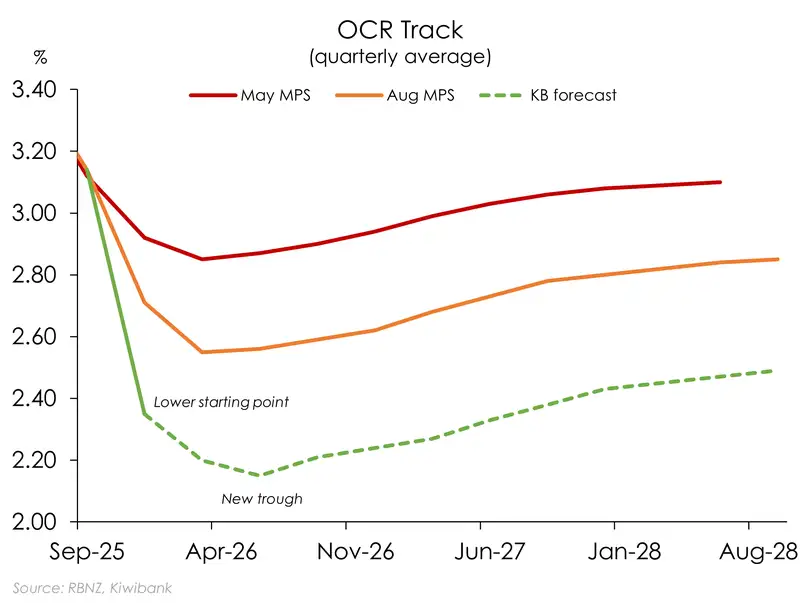

Accompanying this week's decision will be a fresh OCR track – the RBNZ’s forecast of the cash rate. We expect the track to be lowered (again) for two key reasons. First, the track must be lowered simply because of the October 50bps cut. The previous track troughed at 2.55%. The October cut took the cash rate below that to 2.5%. And this week’s cut would take it even lower. So naturally, the new track begins with a lower starting point. Secondly, let’s not forget the RBNZ’s forward guidance at the last meeting – “The Committee remains open to further reductions in the OCR”. The key word here being “reductions” – plural. With this grammatical nugget in mind, we’d expect the RBNZ to keep the door open to further rate cuts in 2026. We expect the terminal rate to drop to about 2.15%, implying a modest easing bias. Anything below that would signal firm intention to cut below 2.25%.

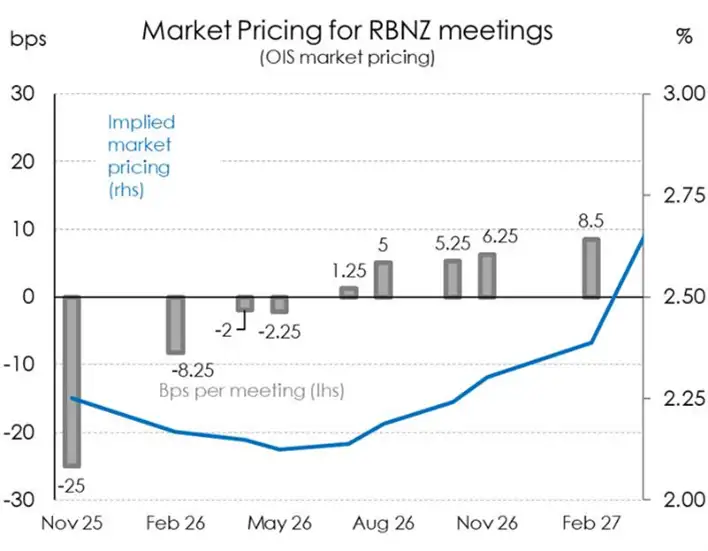

A track that troughs at 2.15% would largely be delivering on current market pricing. The OCR endpoint priced into the OIS strip currently sits at 2.12%. So 2.15% is not too different. The overall reaction in financial markets should be fairly muted.

But if the RBNZ’s statement still highlights the need for optionality, and possible cuts (plural), then swap rates can fall back a bit. The 2yr swap rate has recently climbed to above 2.60%, unwinding the post-October MPR fall to be 15pts above the cycle-low. A dovish tone from the RBNZ could send rates back to those October lows. And arguably, that’s the right (needed) reaction to anchor retail rates at current levels, or even pull them lower. A track that signals a more aggressive easing bias in 2026 would certainly trigger a 10-20pt rally in wholesale interest rates, and the Kiwi dollar’s wings would be clipped as the RBNZ pulls even further away from its peers.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.